muhammet sager

We spend a lot of time discussing master limited partnerships and other energy infrastructure companies here at Energy Profits in Dividends for a very good reason. These companies tend to enjoy incredibly stable cash flows and high yields. However, there can be some problems associated with putting them into a tax-advantaged account, such as an IRA. This is due to the fact that in certain situations, you may face some tax penalties depending on the source of the income that they distribute.

Fortunately, there are some ways around this. One option that we have available to us is to purchase shares in a closed-end fund that specializes in the sector. In addition to providing a way around the tax problems, these funds can also frequently pay out a yield that is above that of any of the underlying companies.

In this article, we will discuss one of these funds, the Cushing MLP & Infrastructure Total Return Fund (NYSE:SRV). This closed-end fund (“CEF”) sports a jaw-dropping 15.90% yield at the current price, which admittedly is approaching the levels that could indicate a general fear of a distribution cut. With that said, the price is very attractive today so let us investigate and see if this fund could be a worthy addition to an income portfolio.

About The Fund

According to the fund’s webpage, the Cushing MLP & Infrastructure Total Return Fund has the stated objective of providing its investors with a high level of total return. This is hardly surprising considering that the name of the fund directly states this. It is also a fairly typical objective for a fund that invests primarily in equities. After all, equities are by their nature a total return vehicle since investors want to obtain both capital gains and income in the form of dividends and distributions. In fact, the fund directly states that it wants to provide its total return in the form of both capital appreciation and current income. Unfortunately, master limited partnerships have not historically been the best investments in the world for capital gains. This is because these companies pay out the majority of their cash flows in the form of distributions to their investors. While they have delivered growth, due in part to the shale boom that the country experienced over the past decade, this growth was somewhat diluted by the equity issuance that was used to finance this growth. With that said, the Alerian MLP Index (AMLP) currently has a 7.81% yield so we do not really need much in the way of capital gains to get a satisfactory return from these companies.

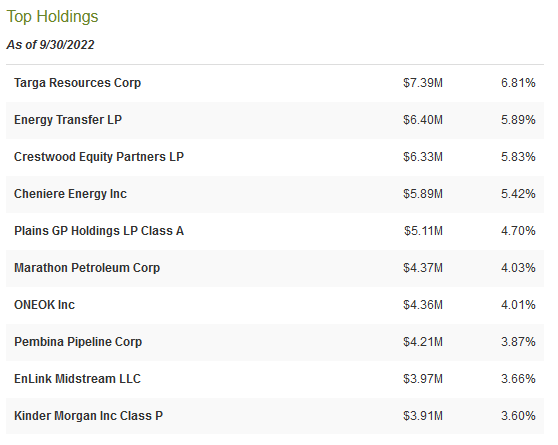

As my regular readers are certainly no doubt aware, I have devoted a considerable amount of time and effort discussing master limited partnerships and other energy infrastructure companies over more than ten years here at Seeking Alpha. As such, the largest positions in the fund will undoubtedly be familiar to most readers. Here they are:

CEF Connect

I have discussed all of the companies except for Marathon Petroleum (MPC) at least once here at Seeking Alpha. However, most are companies that I have discussed many different times over time so regular readers are likely to be familiar with all of them. It is also very difficult to find fault with this portfolio as these are generally among the best midstream companies in the industry. With that said, many of these are not actually structured as master limited partnerships. In fact, only Energy Transfer (ET), Crestwood Equity Partners (CEQP), and Plains GP Holdings (PAGP) are partnerships. The remainder is all taxed as corporations. Despite the business structure though, all of the midstream companies here largely operate the same way.

Midstream companies are one of the safest ways to invest in the energy sector because their business model provides an incredible amount of stability regardless of the conditions in the industry or the economic environment. In short, these companies operate by entering into long-term contracts with their customers under which the customer sends resources through the midstream company’s infrastructure and compensates it based on the volume of resources handled, not on their value. This provides a great deal of insulation against fluctuations in energy prices. However, there is still the possibility that a decline in energy prices will still cause customers to reduce their production. We saw this situation happen back in 2020 when energy prices fell in response to the pandemic-induced lockdowns.

Fortunately, the midstream companies have a way around this, too. The contracts that the midstream companies have with their customers include minimum volume commitments. These clauses specify a certain minimum volume of resources that the company must send through the midstream company’s infrastructure or pay for anyway. Thus, these clauses essentially provide a floor below which cash flow cannot really decline. This provides a great deal of support for the distributions that these companies pay out and are one reason why they tend to be very good vehicles for income-focused investors.

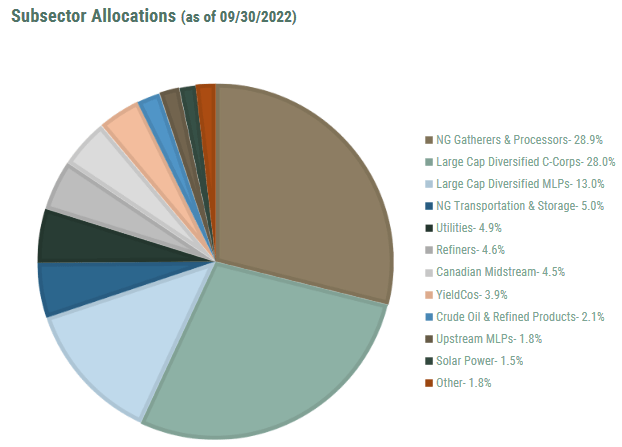

The name of the Cushing MLP & Infrastructure Total Return Fund implies that it invests in more than just midstream companies. This is true, although right now these other things only account for a very small percentage of the portfolio. As we can see here, utilities account for 4.9% of assets, refiners account for 4.6% of assets, and yieldcos and solar companies account for 5.4% of the fund’s total assets:

Cushing Funds

Although these companies do not generally transport hydrocarbon resources, they do have many of the same characteristics as midstream companies. In particular, they tend to have remarkably stable cash flows regardless of economic conditions. It is pretty easy to understand how this would be the case with utilities as most people prioritize paying their utility bills above discretionary purchases since heating and electricity in a home or business are pretty important for modern life. In the case of yieldcos, these companies usually have long-term contracts with a power purchaser to buy electricity over a given period. In fact, due to the intermittent nature of renewable power generation, this is the only way to make a wind farm or solar plant economically feasible. Thus, overall, the assets held by this fund should prove very stable over time, although their market prices do certainly vary with energy prices (even though their cash flows do not).

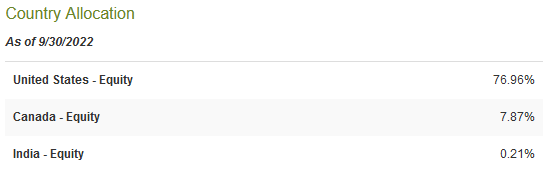

One thing that we can clearly see by looking at the largest positions in the fund above is that it is heavily invested in the United States and, to a lesser extent, Canada. A look at the broader portfolio reveals that this is indeed the case:

CEF Connect

This is not surprising given that nearly all midstream funds are almost exclusively invested in these two companies. One big reason for this is that we do not really find publicly traded midstream companies outside of these countries. As a result of this, a properly diversified portfolio will include foreign assets alongside the midstream assets to ensure sufficient protection against a hostile government or other country-specific problems.

The Future Of Midstream

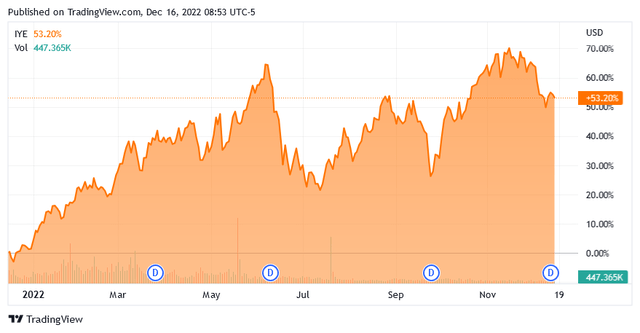

Over the past year, the energy sector is one of the only sectors that delivered a positive return due to the strength in crude oil and natural gas prices. In fact, the iShares U.S. Energy ETF (IYE) is up 53.20% over the past twelve months:

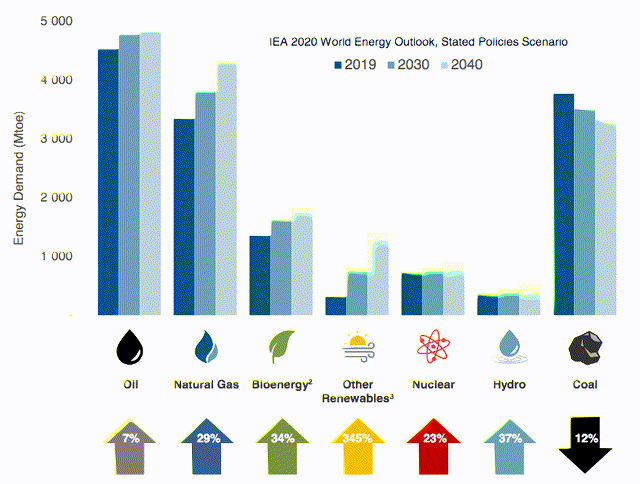

Despite this, the sector remains somewhat underrepresented in many portfolios. One reason for this is that investors have a perception that the days of fossil fuels are numbered. This is a belief that comes from the constant media coverage of politicians and activists making this claim. However, it is a belief that is largely unfounded. In fact, according to the International Energy Agency, the global demand for natural gas will increase by 29% and the global demand for crude oil will increase by 7% over the next twenty years:

Pembina Pipeline/Data from International Energy Agency

Perhaps surprisingly, the growth in natural gas demand will be driven by global concerns about climate change. As everyone reading this is certainly well aware, these concerns have induced governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. The most popular strategy being used to accomplish this is to encourage utilities to retire old coal-fired power plants and replace them with renewables. However, renewable energy generation has a major flaw. This flaw is that it is unreliable. After all, wind power does not work when the air is still and solar panels do not generate electricity at night. We have a very long way to go until battery technology is good enough to compensate for this problem. As such, the usual solution is to supplement renewables with natural gas turbines. This is because natural gas burns cleaner than any other fossil fuel and enjoys the reliability to maintain the electric grid in the way that we are used to.

The demand growth for crude oil may be a bit harder to understand. After all, the governments in many developed nations are actively trying to reduce crude oil consumption. However, it is a very different story if we look at the various emerging nations around the world. These nations are projected to benefit from significant economic growth over the period. This economic growth will have the effect of lifting the citizens of these nations out of poverty and putting them securely into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is much closer to that of their counterparts in the developed nations than what they have today. This will require the growing consumption of energy, including energy derived from crude oil. As the populations of these nations are substantially larger than the populations of the developed nations, the growing demand from these regions will more than offset the stagnant-to-declining demand in the world’s developed economies.

The various midstream companies that this fund invests in will likely benefit from this demand growth despite the fact that they do not actually produce any crude oil or natural gas. This is because the United States and Canada are among the only regions of the world that can actually increase their production of hydrocarbon resources in order to meet this demand. This is due to the enormous resource wealth in the various shale and conventional deposits across the continent. However, it would be pointless for energy companies to increase their production without the means to get incremental resources to the market. That is the task that midstream companies perform. As we have already discussed, midstream companies will see their cash flows increase when volumes do so we should see growth across the midstream sector. That will obviously benefit the fund and its shareholders.

Distribution Analysis

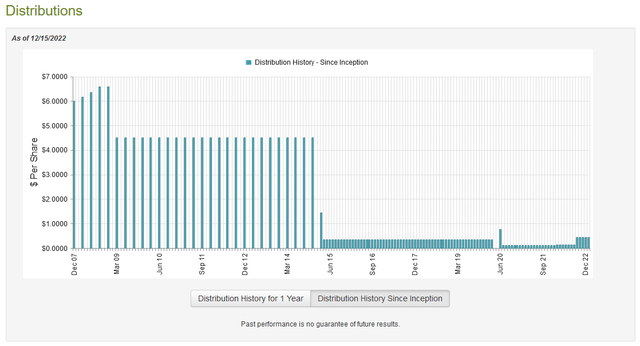

As was mentioned, the Cushing MLP & Infrastructure Total Return Fund aims to provide a high total return to its investors, delivered in the form of current income and capital appreciation. In addition, midstream companies tend to have very high yields, which we can see from the yield of the Alerian MLP Index. As such, we can expect the fund to deliver a very high yield. This is certainly true as the fund currently pays a monthly distribution of $0.45 per share ($5.40 per share annually), which gives it a jaw-dropping 15.90% yield at the current price. Unfortunately, the fund has not been particularly consistent about this distribution over the years as it has generally declined over time. However, the fund did triple its distribution earlier this year:

This distribution history may be somewhat discouraging for those that are seeking a steady and stable source of income but it is important to keep in mind that the fund switched from a quarterly to a monthly distribution back in 2015 so the actual decline over time is somewhat less than the chart above implies. We still see a very significant cut in 2020 but this is not surprising as nearly every midstream fund cut its payout at that time. This is largely due to the crash in energy prices that year, which caused numerous producers to greatly reduce their expectations for production growth. This caused some of the growth projects that midstream firms were working on to no longer be needed. However, the midstream companies generally did not see their cash flows decline for reasons that were already cut. We still saw distribution cuts though as there was some uncertainty about their ability to obtain financing in the market so the companies wanted to strengthen their balance sheets. When combined with the fact that midstream unit prices crashed at that time, the fund’s ability to generate positive returns was curtailed. Those problems have all been largely corrected now and the fund has raised its distribution in response.

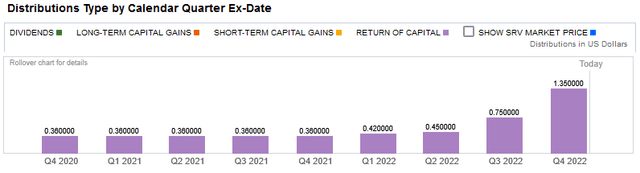

Regardless, anyone purchasing today will get the distribution that is currently being paid and does not have to worry about the fund’s history. While that may be comforting, some investors may still be turned off by the fact that the fund’s distributions are entirely classified as a return of capital:

This may be concerning because a return of capital can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be classified as a return of capital. In fact, the distribution of money received from master limited partnerships would be classified in that way. This is probably what the fund is doing but we should still investigate in order to determine how sustainable these distributions are likely to be.

Unfortunately, we do not have an especially recent document to consult for that purpose. The fund’s most recent financial report corresponds to the six-month period ending May 31, 2022. As such, it will not include any information about the fund’s performance over the past several months but it should still tell us how well the fund performed in the first half of the year, which was a very strong period for the energy sector. During the six-month period, the Cushing MLP & Infrastructure Total Return Fund received a total of $3,098,737 in dividends and distributions along with $6,677 in interest from the assets in its portfolio. However, the money that the fund received from master limited partnerships is not considered to be income so we need to net that out. Once we do that, we get a total income of $969,775 for the fund during the six-month period. It paid its expenses out of this amount, leaving it with a negative $40,446 available for investors. It is immediately obvious that a negative net investment income is not sufficient to pay any distribution, let alone the $1,834,048 that it actually paid out.

However, it is important to note that the fund received $2,135,639 from the master limited partnerships in the portfolio, which is not classified as income. This amount by itself is enough to cover the distributions that the fund paid out. It also had some fairly significant capital gains on top of that figure. In the six-month period, the fund realized net gains of $5,490,845 and had another $10,915,622 net unrealized gains. Overall, the fund’s assets increased by $14,531,973 during the period even after paying out its distribution. This explains the significant distribution increase and tells us that its payout is probably sustainable for the time being.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Cushing MLP & Infrastructure Total Return Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value is the current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can get them for a price that is less than the net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of December 15, 2022 (the most recent date for which data is currently available), the Cushing MLP & Infrastructure Total Return Fund had a net asset value of $39.30 per share but the shares only trade for $33.60 per share. This gives the fund’s shares a 14.50% discount to the net asset value. This is worse than the 17.41% discount that the fund’s shares have traded for on average over the last month but it is still an incredibly large discount that is more than reasonable. Overall, the fund has a very attractive entry price today.

Conclusion

In conclusion, there is a great deal to like about the Cushing MLP & Infrastructure Total Return Fund today. The fund has a very solid portfolio consisting of many of the best master limited partnerships around. The companies in the portfolio enjoy remarkably stable cash flows over time and should have some forward growth potential due to the strong fundamentals of the industry. The Cushing MLP & Infrastructure Total Return Fund’s high sustainable yield and incredibly attractive valuation only add to its appeal. Overall, this one is worth considering today.

Be the first to comment