Marcus Lindstrom

The SuperDividend REIT ETF (NASDAQ:SRET) contains REITs, particularly specialty REITs, which have long-term, rent scaling leases that should have been resilient to duration risks in the current hiking cycle. We think the 22% YTD declines are rather overdone, especially when compared to long-term bond ETFs. The income is resilient, and with our longer-term forecast seeing rates come down, we think SRET hits the spot.

SRET Breakdown

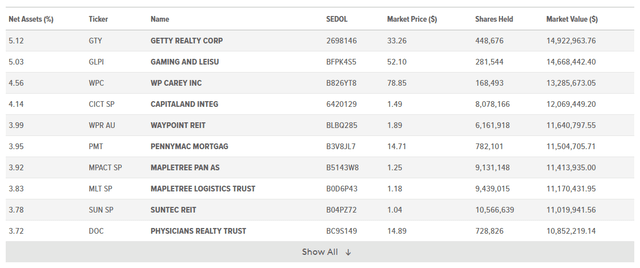

The top holdings are a pretty good sample of what’s in the portfolio.

Top Holdings (globalxetfs.com)

There is a decent amount of retail real estate exposure, regional casinos, and also some office REITs. It’s not quite as well exposed as other specialty REIT ETFs or specialty REITs, since categories like retail and especially office are under quite a bit of flux. Active allocators who are aggressive are considering these asset classes now, but in general there is risk of capital impairment here despite the discounts. Some of the retail exposures like Waypoint REIT in Australia are focused on fuel and convenience retail. These categories should be a lot more resilient within retail, but large scale malls and other such properties are of course under the secular pressure that they have been under the last 15 years from ecommerce.

Office REITs aren’t too prominent in the ETF, at about 10%. Retail at about 25%, capital and mortgage REITs at about 30%, and the rest are in highly resilient categories like healthcare, government, industrial, logistics or other specialty.

Bottom Line

There’s not too much direct multifamily or residential exposure, except through mortgages. These are the only assets that would have lease terms that are shorter term, and more likely to be in decline with broader declines in rents that we are seeing sequentially as leases roll over.

Office, retail, industrial, government, healthcare and all these other exposures usually work on longer-term leases, sometimes triple net leases, that are going to have automatic rent-scaling agreements in place to reduce exposure to duration risks. Mortgage and capital REITs likewise have variable regimes that should be in lockstep with the current phase of the rate cycle. In the case of the real estate leases, most of these have purposes that have seen sustained growth in market over the last couple of years, and their ability to extract rents should hold better than residential. Therefore, even at rollover, income should be protected and incomes should keep up with rates.

This insulation from duration risks goes in contrast with the 22% YTD declines in the ETF which would be consistent with that of a long duration fixed income ETF. Moreover, SRET already took a substantial hit in 2020, which can be partially attributed to a revaluation of office real estate.

The real assets are the leases, not the properties and what they trade at in the private markets, which are on total standby for now. Those leases are better positioned with respect to duration than most fixed income assets, since their income isn’t really fixed, it’s primed to grow.

Moreover, we think that rates are going to go lower. Advantage geopolitical and natural resource situation in the US, coupled with a recession already underway in Europe taking the pedal off cost-push pressures, as well as recessions in China and the impact on basic materials and commodities, should see inflation start coming below expectations, and therefore the yield curve start shifting down. While REITs were hit hard this economic cycle due to the involvement of interest rates, everything goes in cycles and a 22% discount on quality real estate assets looks attractive to us. A 7.2% yield net of expense ratios means you’re paid to wait as well.

Be the first to comment