grinvalds

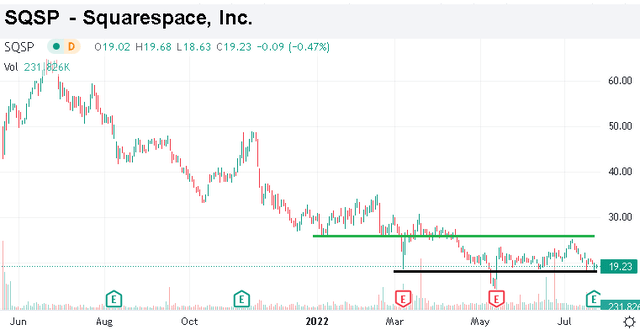

Squarespace, Inc. (NYSE:SQSP) is a leading platform to build websites supporting everything from e-commerce, digital content, business marketing, and social media management. The company leveraged its strong growth over the last several years into its 2021 IPO which took advantage of momentum in internet software names and lofty valuations. Fast forward, shares are off by nearly 70% from their high last year amid the broader market selloff.

The setup here is an otherwise mixed picture. Squarespace just reported its latest quarterly results highlighted by overall solid financials. On the other hand, growth has slowed while shares still command a high premium. Furthermore, the challenging macro environment particularly towards consumer-facing names and online retailers represents ongoing headwinds. We expect volatility in the stock to continue.

Squarespace Q2 Earnings Recap

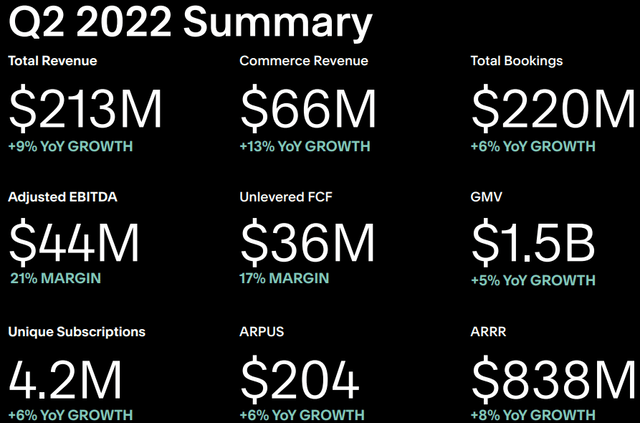

Squarespace Q2 GAAP EPS of $0.45 was $0.36 ahead of the consensus estimate. Revenue of $212 million was in-line with estimates and increased by 8.2% year-over-year. The context for the large earnings beat considers a one-off tax benefit of $53 million based on an accounting method change. Nevertheless, adjusted EBITDA which excludes stock-based compensation reached $43.6 million, climbing from $42.6 million in the period last year. Squarespace was also able to generate $36.4 million in unlevered free cash flow, up from $10.2 million in Q2 2021.

source: company IR

Operationally, Squarespace now counts on 4.2 million unique subscribers, up 6% from Q2 2021 which follows a 15% increase during the quarter last year. The average revenue per unique subscription (ARPUS) at $204, up 6% y/y, suggests the cohort of users on the platform is adding services over time. Total bookings up 8% y/y at $220 million indicate some growth runway.

A strong point has been the momentum in “commerce” where Squarespace takes a fee for each transaction generated on a hosted website. Commerce revenue reached $66 million, up 13% y/y while the gross merchandise volume processed on the platform at $1.5 billion climbed by 5%.

In terms of guidance, management expects full-year revenue growth between 9% and 11%. The focus has been on driving profitability with the target to reach free cash flow between $156.5 million and $166.5 million, which compares to $122.4 million in 2021 and $152 million in 2020.

Notably, the company has been active with buybacks, repurchasing about $35 million in stock year to date. Squarespace ended the quarter with $247 million in cash, equivalents, and marketable securities against $520 million in total debt. Considering the adjusted EBITDA annual run rate, a leverage ratio under 1.5x is representative of a solid balance sheet.

SQSP Stock Price Forecast

The challenge we see with Squarespace is that this segment of website design and building tools is highly competitive and faces some industry-specific headwinds. Compared to the pandemic boom between 2020 and 2021 for online businesses and e-commerce, the sense is that it’s a poor time for new startups amid weaker trends in consumer spending. Simply put, the operating environment for this segment is more sluggish with risks tilted to the downside in terms of Squarespace reaching growth targets.

We don’t see a scenario where the company is going to suddenly capture incremental market share from larger players like Wix.com Ltd. (WIX), GoDaddy Inc. (GDDY), and even Shopify Inc. (SHOP) among others are targeting the same types of potential customers. As it stands, it’s a race to roll out new features which end up becoming increasingly commoditized.

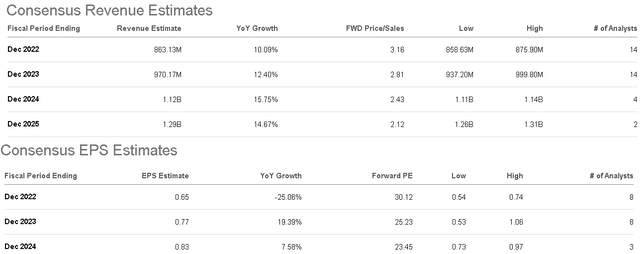

According to consensus, the forecast is for 10% revenue growth this year in line with the current management guidance. The market is also forecasting EPS of $0.65 for the full year 2022, a decline of -25% from $0.86 in 2021. The downside here is based on an expectation for higher spending on R&D and marketing which is necessary for an attempt to maintain growth. The outlook is that EPS only rebounds towards its 2021 peak level in 2024.

Seeking Alpha

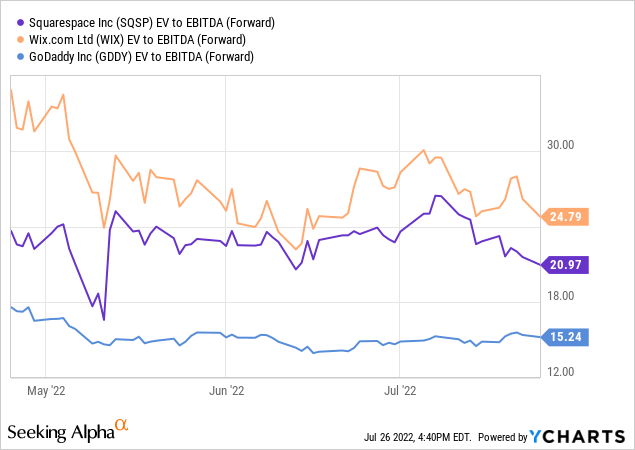

We argue that SQSP trading at a forward P/E of 30x has a demanding valuation against significant earnings uncertainty over the next couple of years. It’s hard to justify such an earnings premium in the current economic backdrop and the near-term financial trends which are hardly at a level to get excited about.

WIX, for example, is generating stronger growth this year with a consensus estimate of 12% higher revenues in 2022. With GoDaddy, the company is on track to deliver 9% revenue growth this year but generates higher profitability. This is important as SQSP trading at an EV to forward EBITDA multiple of 21x sits between WIX at 25x and GDDY closer to 15x. The point here is to say that Squarespace doesn’t necessarily stand out as exceptionally undervalued at the current level.

As it relates to the stock, we mentioned the performance has been a disaster down more than 66% over the past year. The setup here is delicate because that 30x forward P/E multiple or 21x EBITDA leaves little room for error. The risk is that a weaker-than-expected quarterly report later this year opens the door for further revisions lower to long-term earnings estimates, pushing shares even lower. In our view, the risks are tilted to the downside that Squarespace can underperform consensus estimates as part of the bear case.

Seeking Alpha

Final Thoughts

In our opinion, the Q2 results were fine but not strong enough to jumpstart a sustained bullish rally. To the upside, we’d like to see stronger operating metrics between subscription growth and the ARPUS over the next few quarters. A breakout above $25.00 is necessary to confirm more positive momentum. Valuation is still pricey and the more challenging operating environment adds to long-term earnings uncertainties. Our call here is to maintain a neutral view with a hold rating with an expectation for continued volatility.

Be the first to comment