Source: Square.com

Investment Thesis

About two months ago, I introduced a two-part series, in which I examined the businesses of Square (NYSE:SQ) and Shopify (NYSE:SHOP). In the original piece, I recommended investors purchase Square in the low $60s. Since then, Square rocketed into the low $80s, despite a 15% decline in the S&P 500 (NYSEARCA:SPY). Of course, the recent virus fear has decimated those gains, along with the rest of the market. This has created a fantastic entry point of investors who have been hoping to get long Square. I am here today to reiterate that bullish narrative and to justify it mathematically.

Firstly, I will start by juxtaposing Shopify’s valuation with Square’s valuation so as to illustrate the irrationality of the market at present. Then, I will discuss why Square remains indispensable to a wide swath of businesses in the world. And lastly, I will demonstrate mathematically why buying Square at today’s price remains a great buy for long-term investors.

Square’s Valuation In Light Of Shopify’s Valuation

I will construct this section’s argument in a series of charts. Hopefully, by the end of this “slideshow”, you will see my point.

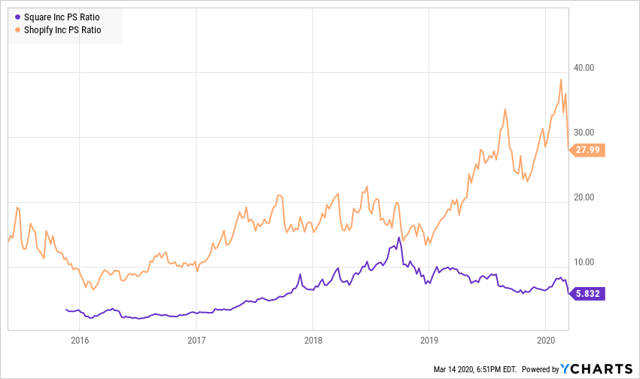

To start, I will share a chart depicting Square’s price to sales versus Shopify’s price to sales.

Source: YCharts

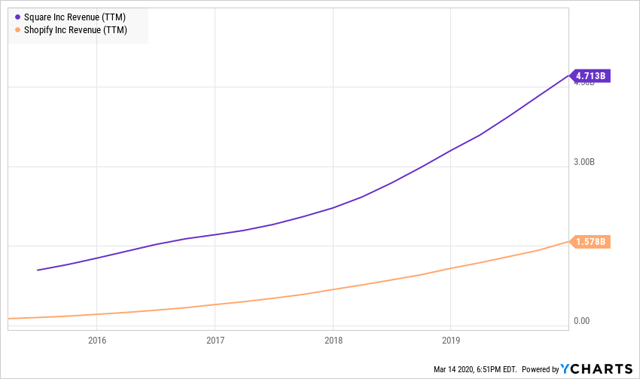

Now, let’s look at which company generates more in the way of sales.

Source: YCharts

And interestingly, Shopify was founded in 2004; whereas, Square was founded in 2009. So, Square has accomplished these revenues at a substantially faster rate than Shopify.

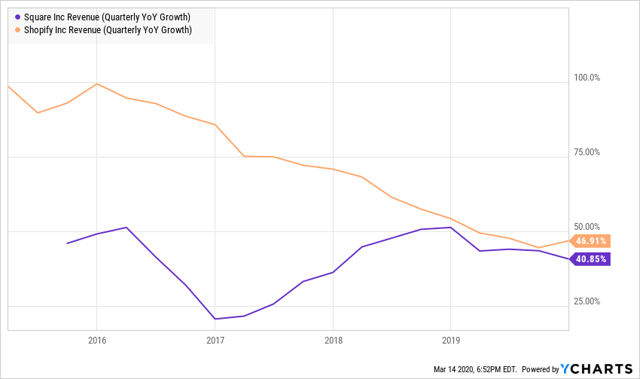

Now, let’s check out the rate at which these companies grew last quarter.

Source: YCharts

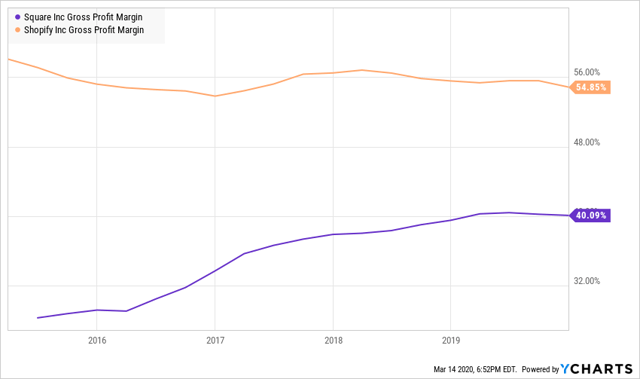

Next, let’s look at gross margins.

Source: YCharts

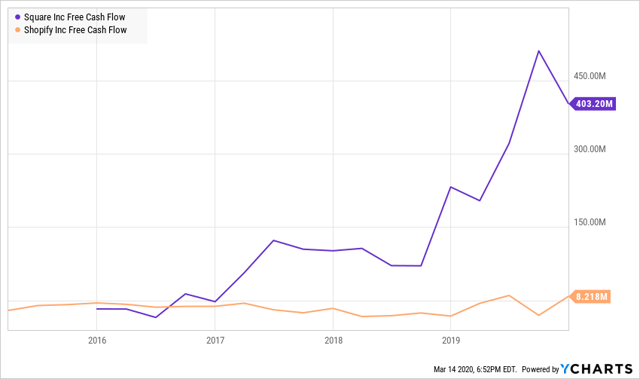

And lastly, let’s look at free cash flow.

Source: YCharts

So, as you can see, Square has grown faster, now grows just as fast, and generates exponentially more free cash flow than Shopify. Nevertheless, the market places a 27x price to sales on Shopify and a 5.5x price to sales on Square. Something has to give here: either Shopify will meaningfully re-rate lower, or, as I expect, Square will meaningfully re-rate higher.

To be fair, Shopify’s gross margins are about 25% higher than those of Square, but for Shopify’s price to sales to be almost 300% higher than Square’s price to sales, there would need to be a much larger difference in gross margins.

But it’s all about growth, right? And as I expect to hear: “Shopify’s target market is not only growing faster, but it’s also substantially larger!”

I strongly agree with that standpoint, and hence, Shopify will likely not re-rate substantially lower. Instead, Square will continue to re-rate substantially higher.

But before we get into Square’s valuation mathematically speaking, let’s check out why Square’s business is not going to be decimated by Shopify or other competitors as many speculate.

Not All Businesses Are E-Commerce Businesses

Shopify has received its rating because e-commerce is supposed to grow massively over the coming decades, and while that’s true, it ignores that there are tens of thousands if not hundreds of thousands or millions of brick and mortar businesses that need highly functional POS’s for their specific realities.

Examples include:

- Restaurants

- Barbershops and beauty salons

- Gas stations

- Auto-repair shops

- Doctor’s offices

And the list goes on and on, and within those lists are hundreds of thousands of businesses. Additionally, Square has barely begun its expansion into international markets.

I write this to highlight the fact that Square has a massive runway for growth ahead of it, and it has not been firmly concluded that Shopify will control 100% of the e-commerce space. Square will also take a bite of it, though it must innovate quickly so as to maintain its position as a competitor with Shopify.

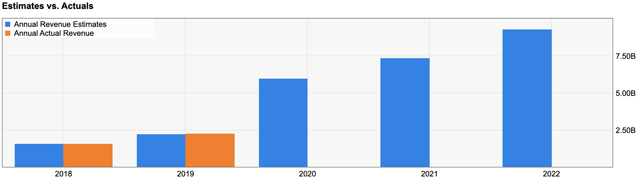

As can be seen below, estimates remain very rosy for Square’s growth, and these estimates will inform our valuation later in this article.

Source: YCharts

As can be seen above, Square’s revenues are projected to grow steadily. Also, of note, they have done away with adjusted EBITDA as directed by the SEC. I’m not sure who in the organization thought that creating their own metrics would be a good idea, as they also don’t report cash from operations, which is incredibly annoying (instead choosing to report adjusted EBITDA). However, Square should leave those innovative streaks to their core business and just report its financials as 99% of all other companies report their financials.

Square: Where Should Its Valuation Lie?

In order to determine this, I will value Square from two perspectives:

- A standard discounted cash flow model

- A valuation method by which we arrive at a target share price predicated on growth of free cash flow per share

This is a slightly modified version of my typical L.A. Stevens Valuation Model, and you can witness the full version of it here. So, let’s get started!

Step 1

In light of the coronavirus impact, we must reduce our expectations for this year, which, I must note, ultimately, will only serve to create higher growth rates in the future. But for the sake of those that will surely exclaim the extent to which Square’s sales will decline as a result of the virus, I will account for the very near-term decline.

I project a conservative decline in sales for Q1 and Q2 would be 30%.

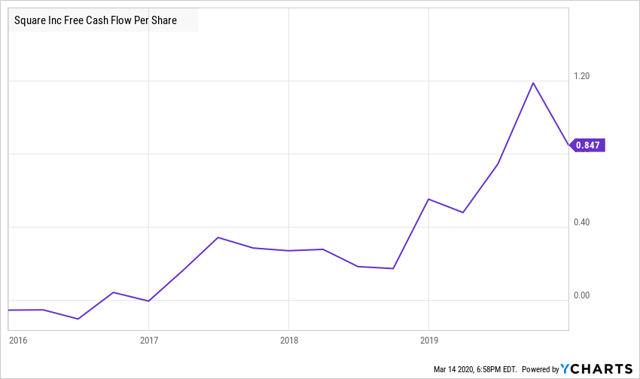

Source: YCharts

So, let’s reduce its current free cash flow per share potential of $1.20 by 30%. This results in a starting free cash flow per share of $.84. Let’s model this below:

Discounted Cash Flow Model

| Assumptions | Values |

| FCF To Equity Growth Rate (10yr) | 25% |

| Terminal Growth Rate | 1% |

| Discount Rate (90yr Annualized Return S&P 500) | 9.8% |

| Initial Free Cash Flow To Equity Per Share | $.84 |

| Fair Value | $58.40 |

Source: Data compiled from YCharts

Therefore, at a price of $55, Square is technically undervalued by 6%. Of course, this assumes that Square’s sales will actually decline by 30% over the next 2-3 months. This may or may not transpire, and nobody in good faith can determine whether it will actually happen.

Additionally, an average free cash flow per share growth of 25% actually becomes conservative in light of the fact that Square just grew by 40+%, and its growth rate from a 30% depressed starting point will ensure that, on average, Square will achieve a 25% annualized growth rate in free cash flow over the coming decade. That is, it only takes 3 or 4 years of 30-40% growth and 6 or 7 years of 20% and below growth to average 25% over ten years. For example, 3 years of 40% growth from this point, then 7 years of 15% growth equates to an average annualized growth rate of 22.5%.

What’s more, Square’s domestic and international expansion opportunities create a growth runway that could easily accommodate the above growth rate scenario.

Now, let’s move on to step 2.

Step 2

Next, we will arrive at a 2030 price target, by which we will determine our expected annualized return.

| Assumptions | Values |

| Fair Value (Present Value of All Future Free Cash Flow to Equity) | $58.40 |

| Current Price to Free Cash Flow to Equity | 68x |

| Implied Price to Free Cash Flow to Equity at 10-yr End | 7.46x |

| Conservative Price to Free Cash Flow to Equity at 10-yr End | 30x |

| Fair Value At 10yr End | $234.70 |

Source: Data compiled from YCharts

Therefore, one can expect an annualized rate of return of 15.62% if one were to purchase Square at $55. Such a return will almost certainly decimate market returns over the coming decade.

Risks

The greatest risk factors Square faces are the following:

- Square does not innovate such that it continues to delight its loyal merchants who have allowed Square to have a retention rate hovering around 100%.

- Jack Dorsey does not steer the company in the proper strategic direction.

- Amazon’s (NASDAQ:AMZN) new checkout technology comes to dominate the POS landscape.

In reference to number 1, Square seems to have the “Apple (NASDAQ:AAPL) Formula” down pat. In that, its sleek, simple-to-use design has delighted its merchants for the last 5 to 10 years. However, this competitive moat could erode if its innovative streak wanes in light of its enormous success.

With respect to number 2, I actually believe Jack is truly a genius and will go down as one of America’s best CEOs of all time. With that being said, I get the sense that he’s a wild card, and I know I am not alone in feeling that way about it. To be sure, this is inexcusable. As the CEO of a company, one should be aggressive, innovative, and a thought leader, but not at the expense of investors’ sense of trust in you.

And lastly, the third threat is very real, as such technology could come to dominate the POS landscape. Square could certainly create a competing product; although, at present, Amazon seems to be the leader within the space, which is something that must be monitored. In all scenarios such as this, I respond by “hedging all of my positions” by simply continuing to own Amazon.

Concluding Remarks

Square and Shopify, for that matter, have become fantastic buys in light of the coronavirus’s impact on the U.S. economy. Of course, the market may fall another 10%. It may fall another 25%. I don’t really know, nor do I really care. I can say, however, with a high degree of certainty, that buying Square at $55 will yield fantastic returns over the coming decade. Once again, I don’t know what the market will do, nor does anyone with 100% certainty, and Square could fall another 15% or even 30%. I’m not ruling that out.

But I bought more at $54. I don’t plan to add anymore, simply because the position is already about 4% of my L.A. Stevens Investment Fund portfolio.

As always, thanks for reading; please remember to follow for more, and happy investing!

Disclosure: I am/we are long SQ, SHOP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment