The SPDR Portfolio S&P 500 High Dividend ETF (SPYD) provides exposure to the top 80 high-yielding stocks in the S&P 500 Index. The fund is a good option to invest passively in a relatively diversified high-yielding portfolio, which includes several industry-leading companies. The current yield at 7.9% has climbed significantly over the past few weeks amid the ongoing market selloff and volatile conditions since the emergence of the global coronavirus pandemic. Recognizing some of the underlying stocks in the fund may be forced to cut its dividend, we think the declines have largely incorporated these expectations. While significant macro uncertainties continue to represent a downside risk for stocks in general, the current price of SPYD begins to approach an attractive risk-reward setup, highlighting our cautiously bullish view.

(Source: Finviz)

SPYD Background

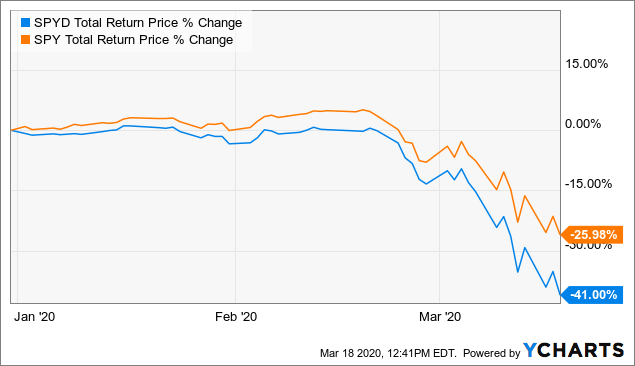

SPYD features an equal weighting methodology with all 80 holdings set at 1.25% of the fund’s composition during each semi-annual rebalancing in January and July. This is important in the context of SPYD’s decline of 41% year to date in 2020, significantly lagging the broader market compared to the 26% decline in the S&P 500 Index (SPY). Effectively, catastrophic declines among smaller and more leveraged high-yield stocks have dragged lower the fund’s performance.

Data by YCharts

Data by YCharts

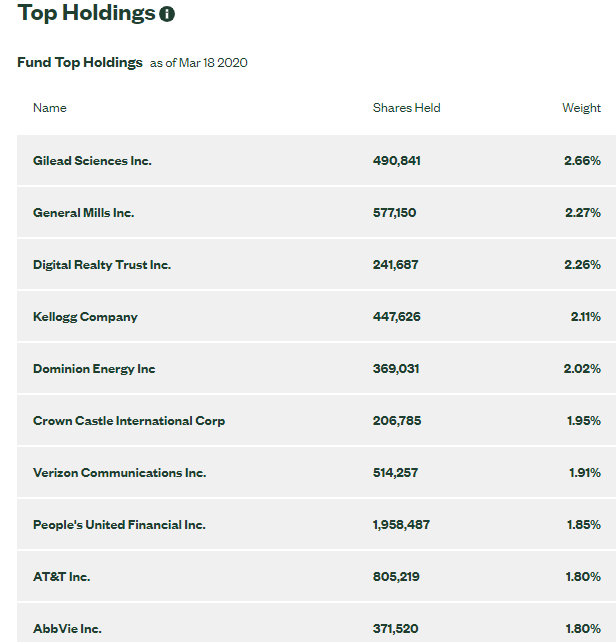

Given what has been extreme moves in the underlying stocks, the weightings of holdings have now diverged from what was the equal-weight balancing last performed in January. A stock that fell by 50% or more lost its importance in Gilead Sciences Inc. (GILD), which is up 30% in 2020 is the largest holding in the fund now with a 2.7% weighting. Some consumer staples sector stocks in the fund like General Mills Inc. (GIS) and Kellogg Co. (K) have also outperformed. At the other end, Apache Corp. (APA), which has suffered a catastrophic decline of 82% in 2020, now represents just 0.25% of the fund as the smallest holding. The result is that SPYD in its current form is now tilted towards some higher-quality stocks among the top holdings.

(Source: State Street)

Typically, highly leveraged companies face the highest risk and volatility during periods of concerns over a cyclical slowdown. An expectation for depressed economic activity is only part of the explanation for the major declines in the market and particularly among high-yielding stocks.

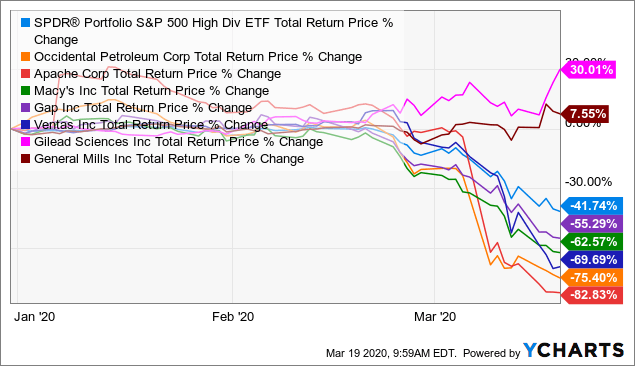

The setup here amid the ongoing coronavirus pandemic has been the deeply negative impact on consumer spending dynamics with people practicing social distancing and generally avoiding public settings. While the weakness is widespread, companies exposed to trends in brick-and-mortar consumer spending have tended to underperform. Separately, the collapse in the price of oil also related to lower demand expectations has been catastrophic for energy sector stocks.

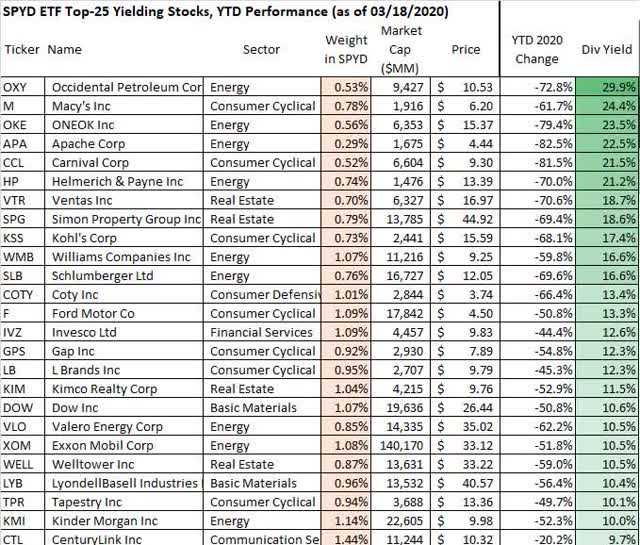

Among the worst-performing stocks in SPYD, Occidental Petroleum (OXY), ONEOK Inc. (OKE), Helmerich & Payne (HP) and Apache Corp. are each down by over 70% this year. Retail names like Macy’s Inc. (M), Kohl’s Corp. (KSS) and Gap Inc. (GAP) are all down over 50% in 2020. Real estate companies with exposure to the retail properties are also facing the same pressures highlighted by Ventas Inc. (VTR), and Simon Property Group (SPG) has declined by 60%.

Data by YCharts

Data by YCharts

Dividend Considerations

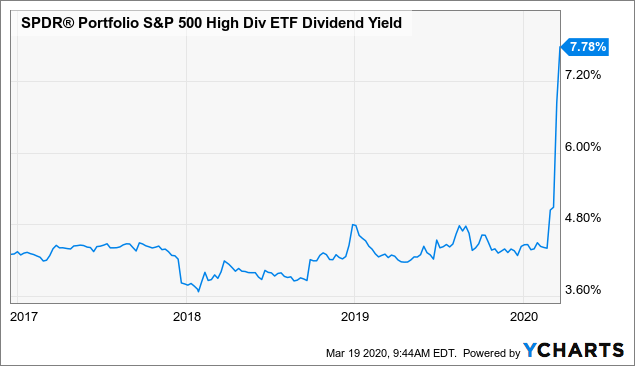

The table above sorted by the highest dividend yields in the SPYD portfolio as of March 17th. The large percentage declines in the stock prices have subsequently driven up the stated yields for most stocks and the overall ETF. The point we want to highlight is that there is significant going concern as to the outlook for dividend sustainability among some of these companies.

(Source: Data by YCharts / table by author)

OXY from the list above with a stated yield of 27.8% has already cut its dividend to a new quarterly rate of 11 cents per share from 79 cents. By this measure, the forward yield on the stock is more down to earth 4.8%. Ford Motor Co. (F) also announced it was suspending its dividend to conserve its balance sheet cash position. The stated dividend yield for F reached 13.3%.

There are other examples within the ETF of companies that have either already cut or suspended their dividend, while there are strong indications that others may soon be forced to. Carnival Corp. (CCL), with a stated 15.7% dividend yield, is facing a complete worldwide shutdown of its cruise operation but has yet to give any indication of a dividend cut. On the other hand, Kohl’s increased its dividend by 5% just a few weeks ago to a new quarterly rate of $0.704.

The point is that the stated yield on the ETF at 7.8% is backward-looking, while the actual forward yield an investor would achieve over the next year is unknown. We are generally skeptical of the sustainability of any dividend yield above 9-10%. Financial databases often just annualize the last quarterly payment for each stock to display a forward yield, and any measure may not consider potential pending dividend cuts. For SPYD, we estimate a forward yield closer to 7.0% from the current level considering still-unannounced dividend cuts and suspensions. Further share price downside or inversely a move higher would change the yield level for any new investment into SPYD.

Data by YCharts

Data by YCharts

Analysis and Forward-Looking Commentary

Recognizing the deeply bearish environment for the economy and stocks, we expect the majority of the holdings in the fund to survive and eventually recover. Energy is a weak point, but keep in mind that in the fund’s current composition, the sector represents less than 10% of all holdings. The weakest stocks within SPYD that potentially face the risk of bankruptcy are only a small percentage, signifying the fund can absorb such a loss.

As a passive ETF, when the rebalancing occurs in July, companies that have cut the dividend will be removed and replaced with other stocks from the S&P 500 ranked within the new top 80 in terms of yield. This supports a measure of quality and keeps the fund balanced with a long-term outlook.

As for the coronavirus pandemic, the key monitoring point we are watching is the number of daily new cases as a measure for the severity of the situation with an expectation that increased testing will push the number of confirmations in the U.S. higher. The silver lining is that if we can get past the next couple of weeks with controlled mortalities that avoid the experience of countries like Italy and Spain, a sense of relief could support sentiment in risk assets.

Verdict

Investors interested in the SPYD ETF could consider taking a small position and averaging into an allocation over days and weeks to capture a lower cost basis in the event the fund moves lower. As a diversified basket of S&P 500 stocks, we like SPYD for its relative quality and compelling income component. We think the fund, at its current level, represents a compelling value buying opportunity for long-term investors. The selloff may have already captured downside for a “worst-case” scenario, and as a group, the ETF can climb higher as conditions normalize.

Build a Stronger Portfolio With The Core-Satellite Dossier

Are you interested to learn how this idea can fit within a diversified portfolio?

With the Core-Satellite Dossier, we sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks / ADRs to find the best trade ideas.

Get access to all our exclusive features including:

- Model portfolios built around different strategies.

- A tracked watchlist of our top picks.

- A weekly “dossier” with an updated market outlook.

- Access to analysts with a live chat

- Exclusive research covering all asset classes and market segments.

Click here for a two-week free trial and explore our content.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment