guvendemir/E+ via Getty Images

What Happened?

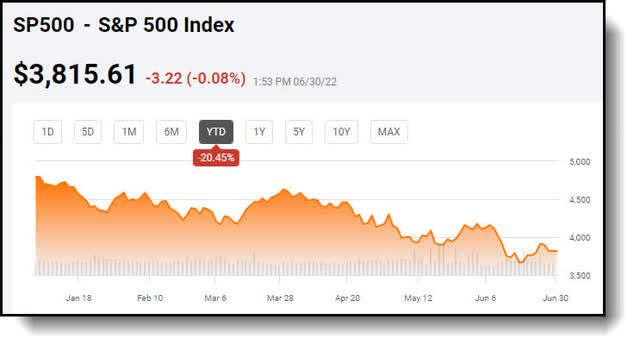

A cacophony of catastrophes colluded, giving rise to the market’s worse first-half since 1970, with inflation being the primary culprit! Besides the damage done to the major market averages, there has been a brutal bloodbath far and wide.

Even so, some see hope ahead. When the S&P 500 (SPY) plunged 21% in the first half of 1970, it promptly reversed those losses to gain 26.5% in the second half, proving the point that pain does purify! Let me explain.

Pain Purifies

There are times to make money in the markets and times to not lose money. We’re now in a time to not lose money. The market selloff has been a complete liquidation. This has reminded me of a lesson learned from my time during “Winter Warrior” mountain infantry training in Ft. Drum, New York as part of the famed U.S. Army’s 10th Mountain Division.

10th Mountain

The mantra “pain purifies” was instilled in us during this time. The instructors explained that the extreme conditions and hard training was painful, but would harden us and prepare us for what actual combat may be like. Many soldiers didn’t make it for one reason or another. For some, it was a physical issue. For others, it was a mental dilemma of just not being able to cope with the bone chilling cold.

This is similar to what happens to market participants during time of severe duress in the market. Some participants have employed leverage and are wiped out in short order by margin calls, having their positions forcibly liquidated, the physical. While others fold under the pressure and sell out at the lows, not being able to take the pressure of the losses any longer, the mental. It all leads to steep selloffs, the likes of the one occurring now.

Nonetheless, it is important to remember at times such as this to take a contrarian stance in the midst of the madness. It is how all the greatest investors throughout time have made their millions, and billions for that matter. Let me explain.

Buy When There Is Blood In The Streets

Look, all the greatest long-term investors say pretty much the same thing when it comes to buying opportunities, only in differing terminology. Nathan Rothschild, a 19th-century British financier, is credited with saying probably the most famous buying opportunity quote:

“The time to buy is when there’s blood in the streets.”

Other famous lines include Warren Buffett’s:

“Be fearful when others are greedy, and greedy when others are fearful.”

And Sir John Templeton’s:

“Buy at the point of maximum pessimism.”

You get the idea. Our innate instincts encourage us to depart a sinking ship. This survival tactic impacts the way we invest. A major market selloff based on macro factors often creates opportunities to buy stock in solid companies with sound prospects. I submit this is the case we have now for many stocks.

Hopefully you have powder dry and take advantage. I just happen to have some fresh dry powder by taking profits at the end of last year during tax loss harvesting season. Knowing when to take the profits on winners and cut your losses on losers are two of the hardest decisions for investors to make. It’s more often than not counterintuitive. At the exact time you are feeling the pain and about to sell out is often the precise time you should be doubling down. Conversely, instead of patting yourself on the back for the amazing profits you’ve made, it’s probably the time to take some chips off the table. What’s more, I feel the current recession fears are overblown. Here is why.

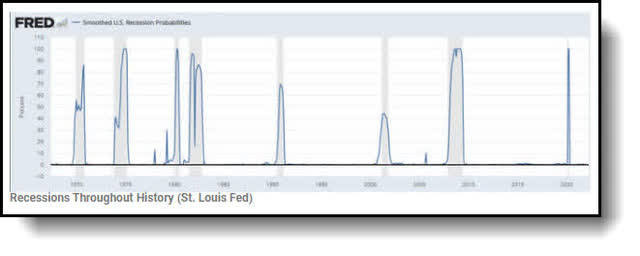

Recession Fears Overblown

First of all, let me start by saying, after doing my due diligence on past recessionary cycles and the respective effects on the markets in general, I surmise the potential coming recession will be a short and shallow one, even with a hard landing, for several reasons. Firstly, the average drop in the S&P 500 during the past 12 recessions since World War ll was 30%.

We’re currently down 20% already, so about two thirds of the recession’s potential downside effect on the market is already priced in by historical standards.

Plus, the market always overshoots to the upside and the downside. It’s starting to feel like the fear factor is getting overblown. In fact, the current negative sentiment in the market equals that of the market when it was trading at the very low in March of 2009. The S&P 500 traded at that time for $666, known as the devil’s low or Mark Haines bottom, as it were. The negativity is way out of whack as far as I’m concerned. Now let’s discuss what separates the wheat from the chaff, as it were.

What Separates The Wheat From The Chaff

I was born in Omaha, Nebraska. My father was an Air Force intelligence officer who worked at Strategic Air Command and then became a stockbroker. We are cut from the same cloth as Warren Buffett. We look for stocks that meet our three pillars that comprise outstanding investment opportunities which are; a strong long-term growth stories, adequate organic cash flow, and solid fundamentals. Moreover, I see the current sell off as the buying opportunity I have been waiting for.

Never Look A Gift Horse In The Mouth

The current state of affairs reminds me of the old saying, “Never look a Gift Horse in the Mouth.” What this means to me is when presented with the opportunity to buy stocks selling at a discount during a market downturn, take advantage. Fortune favors the bold, but you must have courage in your convictions. Nevertheless, we still have a rocky road ahead. Here is why.

Prepare For A Wild Second Half Ride

As we head into the second half of the year, I feel it will be very important to pick your spots carefully when picking up shares. There are several problems that still lie ahead. The following is my list of potential trouble points.

- We’ve had multiple compression, now it’s time for earnings compression due to cost inflation and disappointing demand, effectively shrinking margins.

- Not much visibility regarding what lies ahead for the economy, uncertainty abounds.

- PCE came in lower at 4.7%, yet still way above Fed target of 2%.

- The ISM number came in as expansionary, yet new orders contracted, which is forward-looking and related to future capital spending.

- Fed has to tighten into slowing economy due to inflation

- Still have non-farm payrolls to get through next week and work through supply chain issues.

Now let’s wrap this piece up.

The Wrap Up

Let me start by saying no one can predict the future. The best we can do is assess the current state of affairs and use our experience and intuition to make the best decision for ourselves. The market is at a point where this could still just be the end of a “run-of-the-mill” 20% correction, or the beginning of a major bear market.

Even so, there’s plenty of dry tinder at this point, and the market may be in for a bounce after earning expectations are reset lower. If you do decide to dip your toe in the pool, here is my parting thought.

Final Note

There’s a fine art to investing during highly volatile markets such as these. It entails layering into new positions over time to reduce risk. You will want to have plenty of dry powder if the stock you’re interested in continues lower. As a Veteran Winter Warrior of the US Army’s 10th Mountain Division, the attributes of patience and perseverance were instilled in me, hence my investing motto “patience equals profits.”

Take your time and build new positions slowly, dollar cost averaging in. Moreover, use articles such as these as a starting point for your own due diligence before putting your hard-earned money at risk. Those are my thoughts on the matter, I look forward to reading yours.

Your Input Is Required!

The true value of my articles is provided by the prescient remarks from Seeking Alpha members in the comments section below. Do you think we will end the year in the red or black? Why or why not? Thank you in advance for your participation.

Be the first to comment