shaunl

Introduction

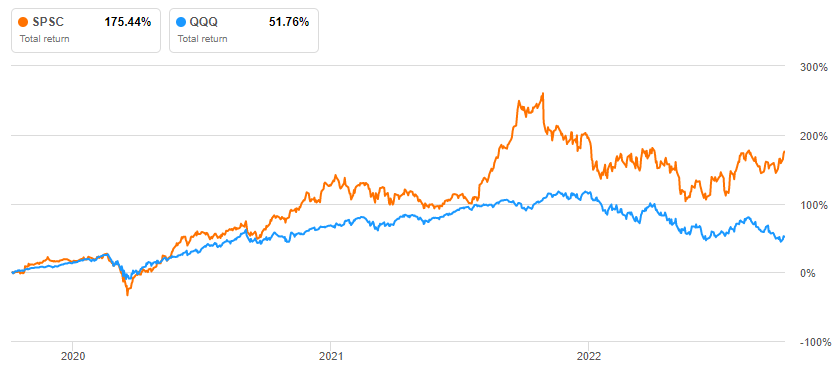

SPS Commerce (NASDAQ:SPSC) has performed well over the past three years (and the last decade), thanks to investments in optimizing global supply chains. Due to the pace of growth, profitable operations, and favorable outlook, the share price of the company has failed to decline as far as most other high growth technology assets. However, if considering an initial purchase or continuation of recurring investments, one must consider the risk of the current valuation. In this article, I will reflect on the company’s performance and determine whether the current valuation is worth the strong performance of the past few years.

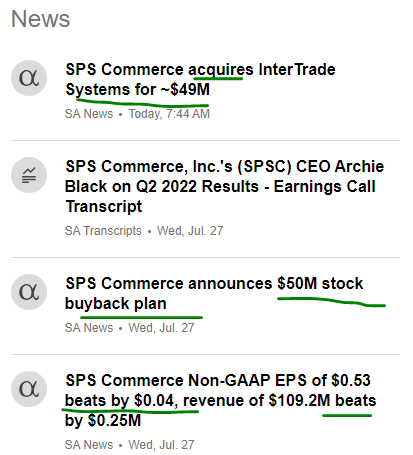

SeekingAlpha

Qualitative Benefits

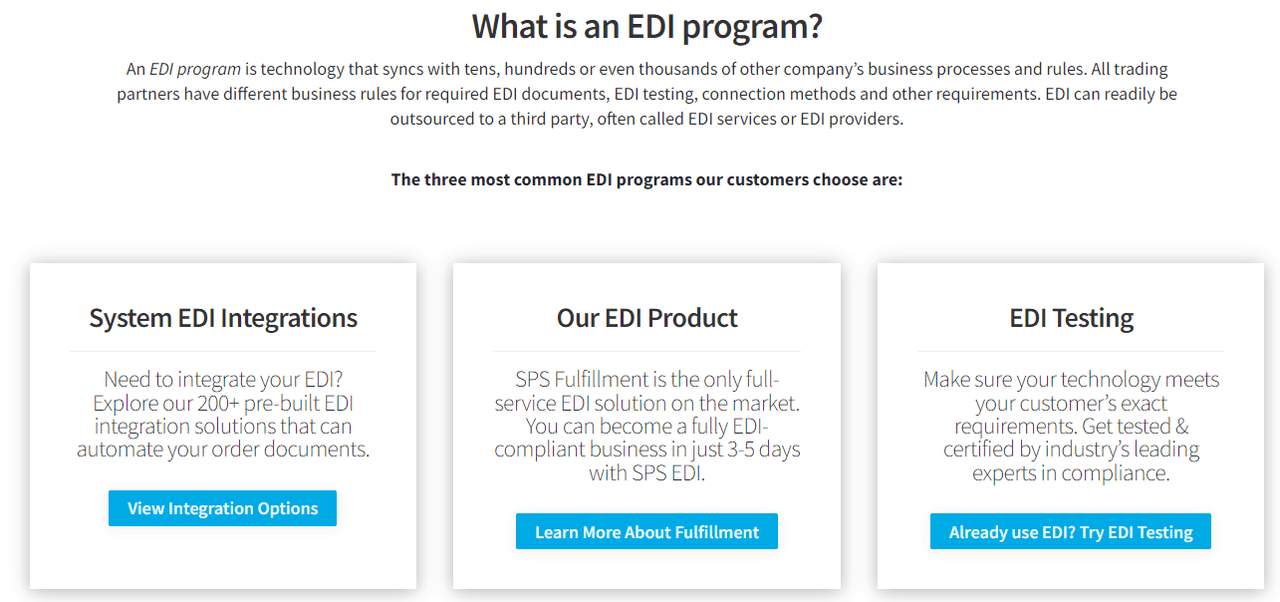

One of the key reasons for the success of SPS Commerce is via their leading software platform, now cloud-integrated. As an electronic data integrator, or EDI, SPSC is one of the primary electronic data processors for retail logistics and has over 100,000 partner companies. Essentially, SPSC processes all the buy and sell orders, takes all paperwork online, and even has value-added services attached such as automation and analysis. As more and more retailers and suppliers integrate into the SPSC EDI program, the usability increases, allowing for more value to be gained from clients who want to access the system.

As such, the company works with nearly all big retailers such as Amazon (AMZN), Walmart (WMT), Walgreens (WBA), and Costco (COST). Major suppliers include Del Monte (FDP), Moet Hennessy (OTCPK:LVMHF), and Under Armour (UA). Lastly, the SPSC platform has many tech partnerships for integration including Microsoft (MSFT), Oracle (ORCL), and Shopify (SHOP) in order to expand the usability and interconnectedness of the system. Therefore, investors have little worry about whether the system will go out of vogue, such as is possibly the case with niche technology platforms. However, the key is finding subscribing customers, as there is a difference between allowing supply chain components to be trackable (as an EDI) vs subscribers accessing the data.

SPS Commerce Website SPS Commerce Investor Presentation

Revenues

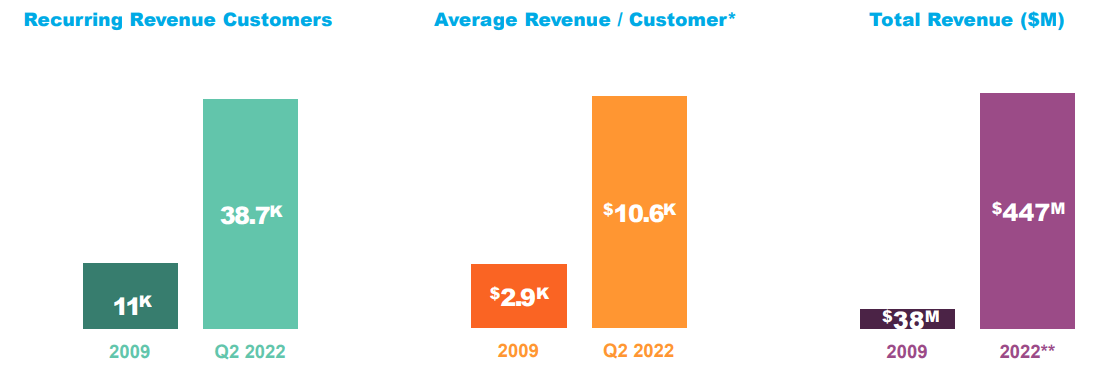

While SPS Commerce is the largest retail EDI, they only have ~40,000 paying subscribers. For 2022, this is set to account for over $400 million in revenues, or an average of ~$10k per customer (see chart below). While user growth has been swift over the past decade and more, the company aims to increase both subscribers and average revenue. At the moment, the current goal is for 200,000 subscription customers at an average of $25,000 revenue per year, or ~$5 billion in revenues. It is certainly a lofty and long-term goal, but highlights the opportunity for investors looking for a long-term bet.

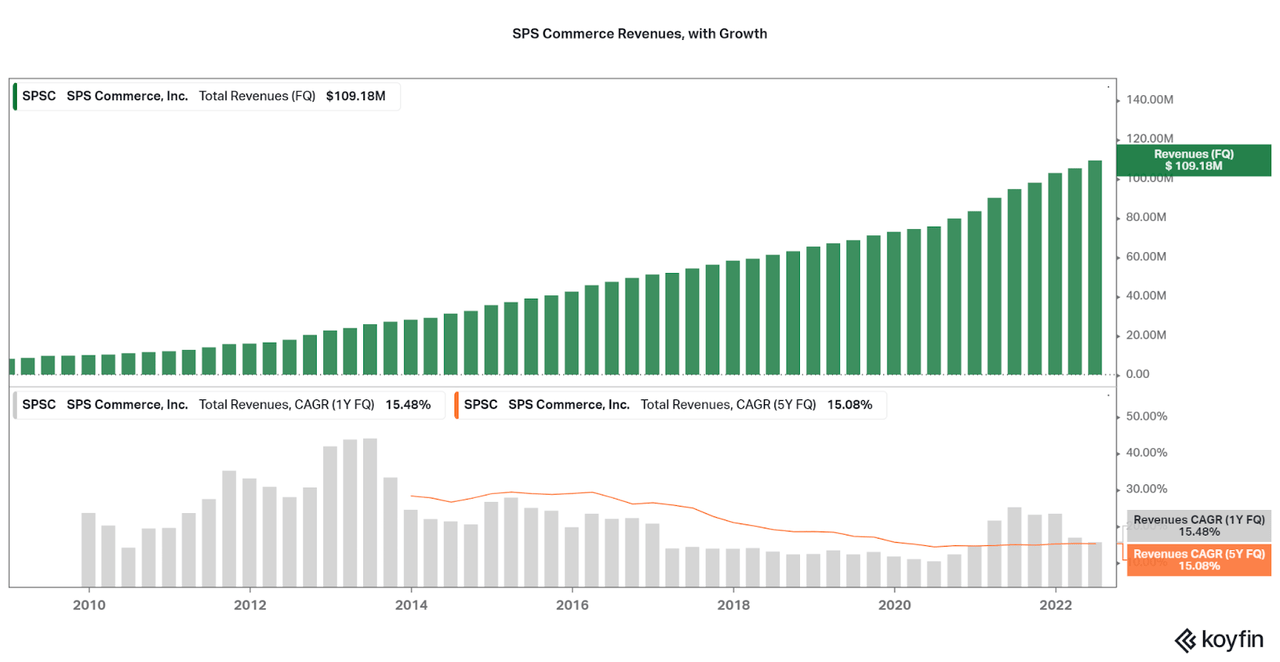

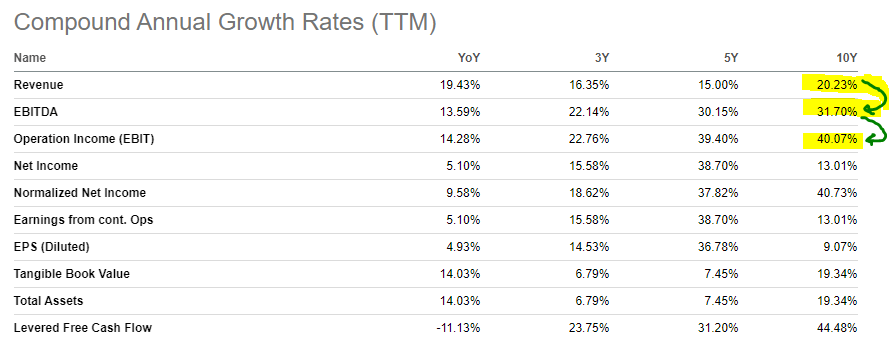

Just be aware that growth is slowly falling, even as the pandemic led to a large increase in growth. The question for investors here in 2022 is what the growth rate after this bullish period will be. The longer your outlook, the less you have to worry about the current cycles, especially with five year CAGR growth remaining above 15% per year (and profits growing even faster). Even in the slower growth period between 2015 and 2020, revenue growth averaged around 10% per year, a sustainable rate.

I personally expect revenue growth to slowly return to that position, but with pricing increases and continued industry investments into supply chain management, the chance for high growth (over 15% per year) remains possible. We can already see that growth is currently at 15% YoY, even when compared to a prior quarter is a tough comparable. While certainly not explosive growth that may be expected with cloud-SaaS providers, when considering profitability I think investors won’t mind.

SPS Commerce Investor Presentation Koyfin

Profitability

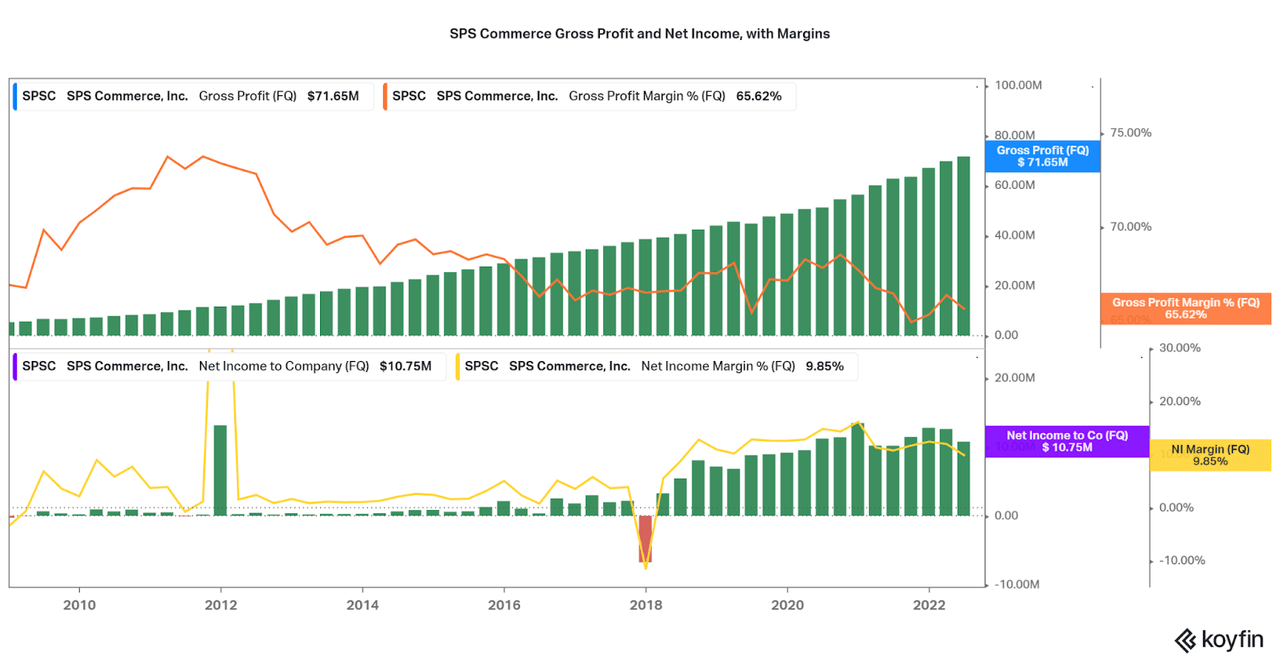

One of the primary reasons why SPS Commerce has performed so well while other technology stocks plummet is due to the fact that they offer strong profitability, and not just due to pandemic era tailwinds. In fact, the company has a history of positive net income since 2010 (apart from just one quarter of an acquisition). This is truly an outlier in the world of cloud-software and I find that this quality is likely to continue indefinitely.

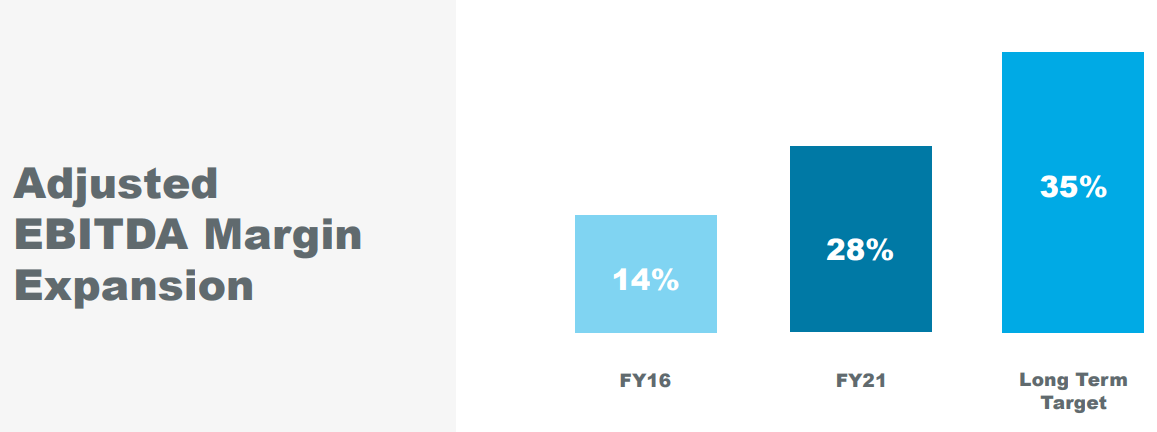

Current net income is averaging close to 10% per year since 2019, but do not worry if it falls as the company invests during this bear market. In fact, the company has been busy this past summer thanks to their strong profitability, but I will circle back on the topic later. For now, just appreciate the strong profit growth that is up to twice current average yearly revenue growth! In terms of outlook, SPSC expects EBITDA margins to move from the current 28% to approximately 35%, further allowing earnings growth to outpace revenue growth. This is a great sign for the longevity of the company, and will favor investors as earnings growth is a great way to reduce the risk of high valuation.

Koyfin Seeking Alpha SPS Commerce Investor Presentation

Balance Sheet

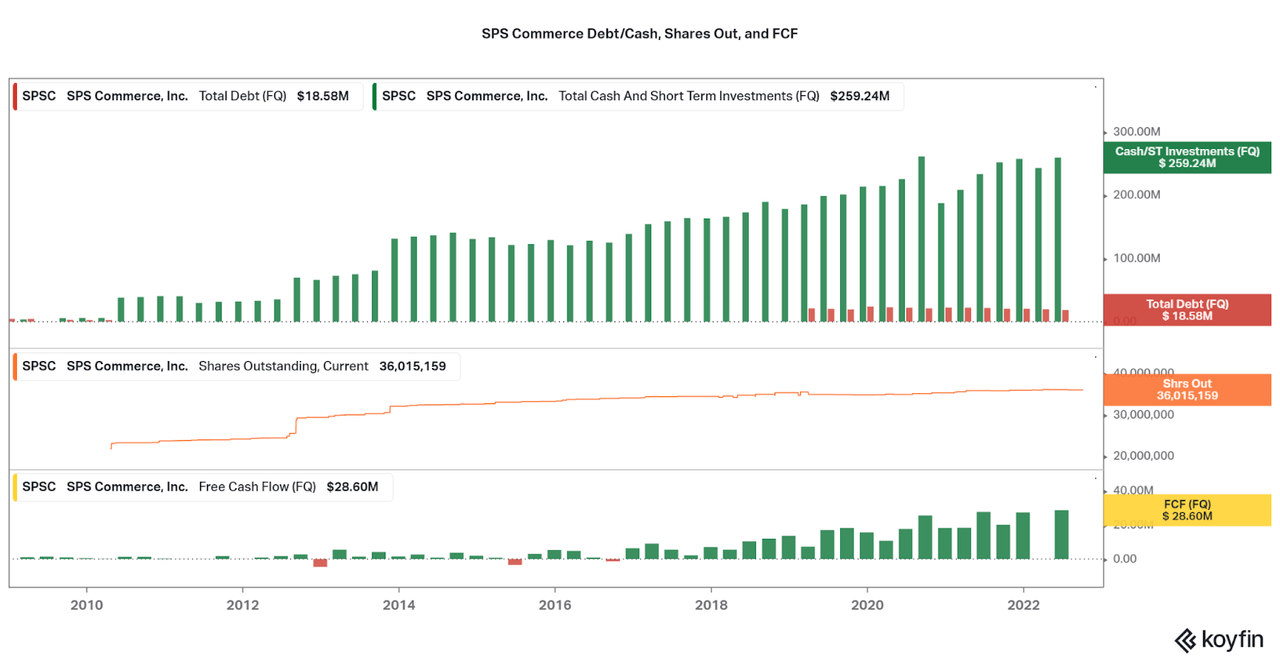

The strong profitability has allowed SPS to maintain an incredibly strong balance sheet. Current cash is around $250 million, and debt is negligible at $20 million. At the same time, dilution has not been a major issue, but shares out continue to increase with compensation. As is similar with net income, quarterly free cash flow has a history of being positive. The balance sheet is well managed, and is even in-line with larger supply chain software peers Manhattan Associates (MANH) and Descartes Systems (DSGX).

Last quarter’s beating of expectations was a great signal (remember the tough comparables), and in fact, the excess profitability is now being leveraged in favor of investors. First, the company announced a $50 million buyback plan. Measured for now, but will surely increase in pace moving forward. Second, SPSC also used $50 million in cash to acquire InterTrade Systems to further expand the partner network. Strong profitability and a healthy balance sheet is always the best way to survive a weak economy.

Koyfin Seeking Alpha

Valuation

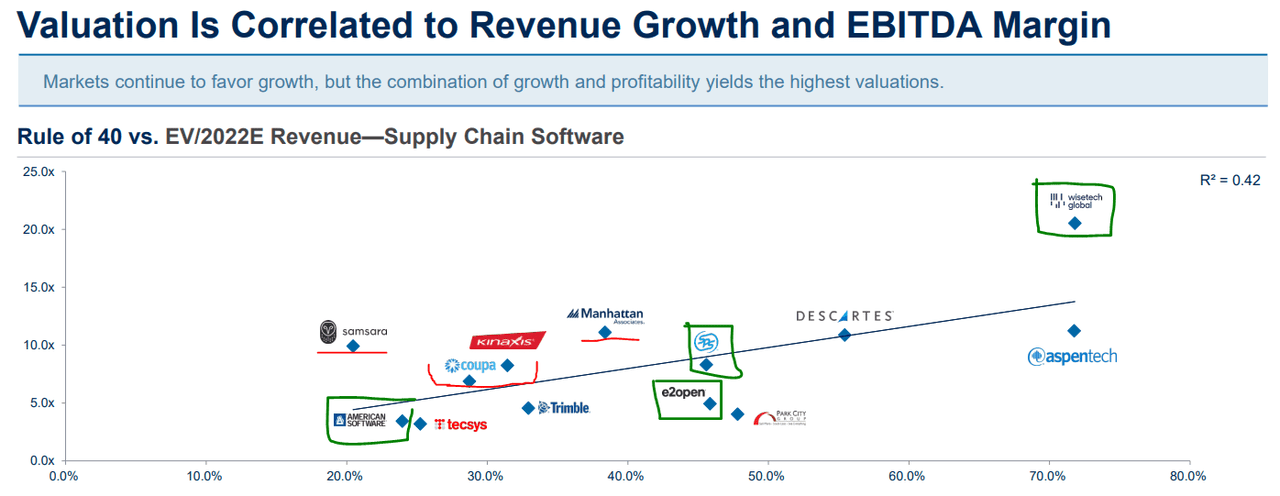

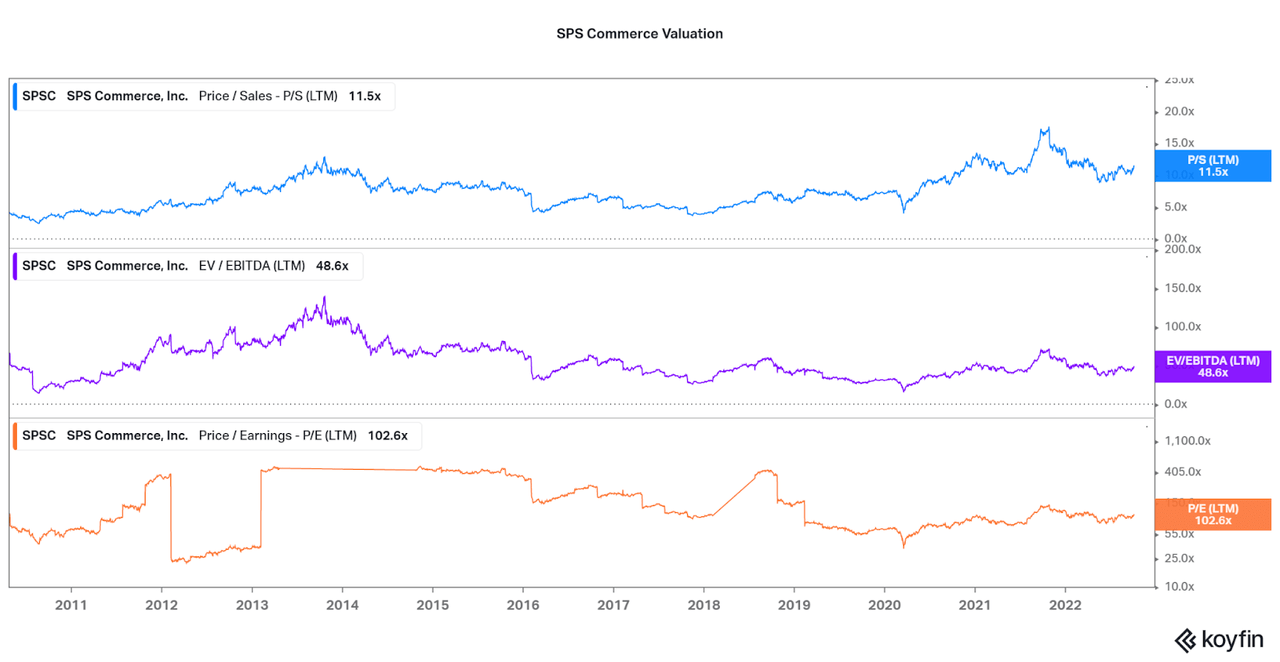

Now, we must move on to valuation. After the strong metrics in growth and profitability, I am sure I have made many readers interested in SPSC. However, the current valuation is the one bad point we must prepare for. No matter how you look at it, SPSC is now well above the historical average trading range and is almost back to late 2021 levels. The bear market has yet to hit. While the company certainly deserves the current valuation from a performance standpoint, I do not expect the valuation to hold at the current levels. Although, when compared to peers, SPSC is in that perfect sweet spot between fast rule of 40 growth and valuation (see chart below).

For me, I would expect a P/E less than 50x, EV/EBITDA less than 30x, and a P/S less than 10x. However, recurring investments until those levels are met may still provide upside, depending on how long it takes the valuation to fall. Watch how earnings performance is over the next few quarters and take advantage of any weakness. As an extremely long-oriented company, I am sure investors will look back to the current prices in a decade and be quite happy. It is just the next three years that may lead to better buying opportunities from a valuation standpoint. It is time in the market vs timing the market, as usual.

Houlihan Lokey Report on Industrial Software Summer 2022 Koyfin

Conclusion

SPS Commerce is in a strong qualitative position, and the quantitative data backs that up. The issue remains valuation. I would take advantage of any major selloff, but be wary of weakening growth if supply chains normalize. However, I believe organic growth will surpass any issues with the economy, especially as most major businesses remain strong even through inflation. As always, don’t be caught flat footed and adjust expectations regularly. In the meantime, I will be looking at some competitors to see if other opportunities exist, but I may stick with SPSC if none are found (as a hint, I am looking at WiseTech (OTCPK:WTCHF)). I will also be sure to update if necessary.

Thanks for reading.

Be the first to comment