Liens/iStock via Getty Images

Thesis

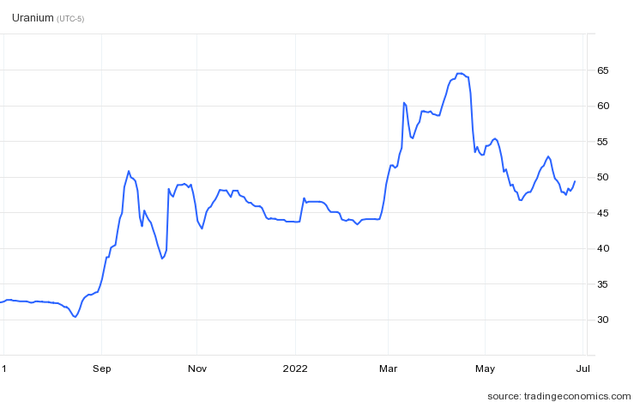

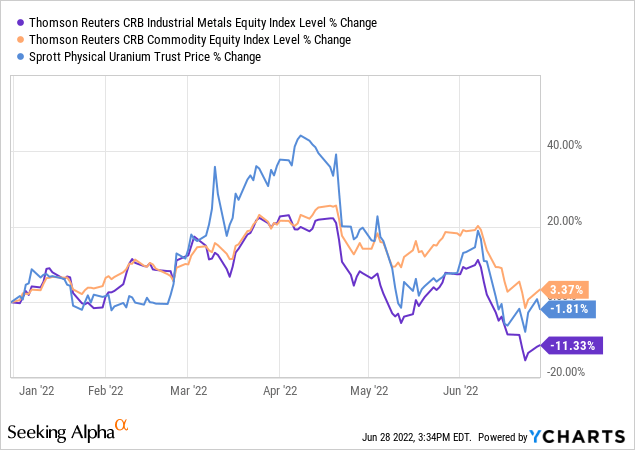

With the notable exception of crude oil and natural gas, the Federal Reserve’s tight monetary policy has caused the price of many commodities to fall over recent months. And spot uranium has been no exception, as it tumbled from the mid-$60 range in mid-April to the high-$40 range today. The impact that this has had on the Sprott Physical Uranium Trust’s (OTCPK:SRUUF) unit price has been even more exaggerated, as the trust, which often traded at a slight premium when uranium prices were climbing, has now plummeted in value and often trades at a 10%+ discount. Therefore, given that the sector weakness is not due to any uranium industry-specific factors, the Trust’s current low price provides a good opportunity for any investors wanting to initiate or add to a uranium position.

SRUUF Market Price vs. Net Asset Value Since Inception (Sprott.com)

Reduced Risk

Earlier this year, I wrote an article outlining the bullish case for uranium, and in the process gave the Trust a buy recommendation. In it, I discussed the environmental and geopolitical factors that were leading to changes in uranium’s narrative, and how nuclear energy is perceived by the general population. I’m bullish on the fact that this is leading to an increased willingness by governments to consider nuclear as a viable energy source for the replacement of fossil fuel power plants.

However, I also talked about the downside risk that another disaster such as those at Three Mile Island, Chernobyl, or Fukushima would have on nuclear energy and uranium demand. So, when a few days later Russian forces began shelling the Zaporizhzhia reactor in Ukraine and news reports were released describing how the reactor was on fire, I decided to heed my own advice and get out of the trade. There’s not much upside to the shelling of a nuclear reactor, and I certainly didn’t need to stick around for that.

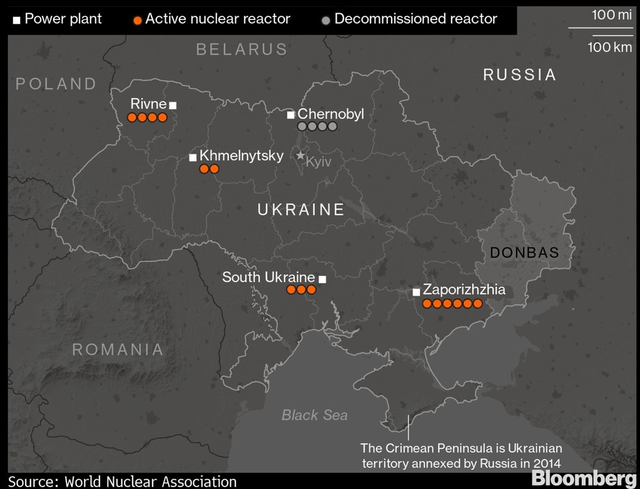

Luckily, however, the shelling was brief, and the fire occurred in a building not connected to the main power plant. But, as I discussed in a subsequent article, I decided to stay out of the trade given the added risk brought on by a war being fought in the European country with the greatest number of nuclear power installations. An accident on par with Chernobyl would probably sour public perception towards nuclear power and result in many active facilities being shut down, not to mention prevent new ones from being planned.

But much has occurred in the months since then. Fighting rages on, but the scope of the war has been greatly reduced, as Putin is now focused almost exclusively on the southeastern part of the country. Doing so reduces the probability of an accident significantly, given that fewer reactors are in the line of fire.

Whereas previously all five of Ukraine’s reactor sites were in an active war zone, that number has now been reduced to two, with only South Ukraine and Zaporizhzhia being near active fighting. Russian forces have also refrained from pursuing any additional attacks on nuclear facilities.

Map of Ukrainian Reactors (Bloomberg.com)

Greater Potential Return

However, those facts alone were not the only thing that served to reignite my interest in the spot uranium trade. While the improved situation on the ground helps reduce the risk side of the equation, what really brought uranium back to my attention was the deep pullback in price. After peaking at just under $65 in April, the price of uranium fell back and is now rangebound between the mid-40s and the low-50s.

Uranium Price (tradingeconomics.com)

However, uranium’s long-term outlook has not changed substantially since my original article that recommended it as a potential investment. If anything, the energy pressures being exerted on Europe and North America due to the Ukrainian conflict have only served to improve nuclear energy’s long-term prospects.

The war has prompted China to expand its already sizeable nuclear program. In April, the UK unveiled an ambitious energy program with a strong nuclear component and the Biden administration has turned decidedly more pro-nuclear as it tries to prevent the shutdown of the Diablo Canyon reactor in California.

It should also be remembered that uranium’s price decline didn’t occur in isolation. The price drop occurred simultaneously with a broader pullback in the commodity complex brought about by rate increases from a Federal Reserve intent on slowing the economy.

The simultaneous occurrence of these two factors, impacting both the risk and price/reward sides of the trade make uranium, and by extension the Sprott Trust, a compelling buy at these levels. For those reasons, I have repurchased units in the Trust and will look to add to my position on any future dips.

Risk

As discussed, the risk to this trade would be another nuclear disaster. Such a scenario would result in nuclear energy becoming a harder sell to the general public and either slow down or even stop its widespread adoption. And while that risk has come down since early March, it has certainly not disappeared and that risk needs to be kept in mind by any potential investors.

Be the first to comment