Cindy Ord

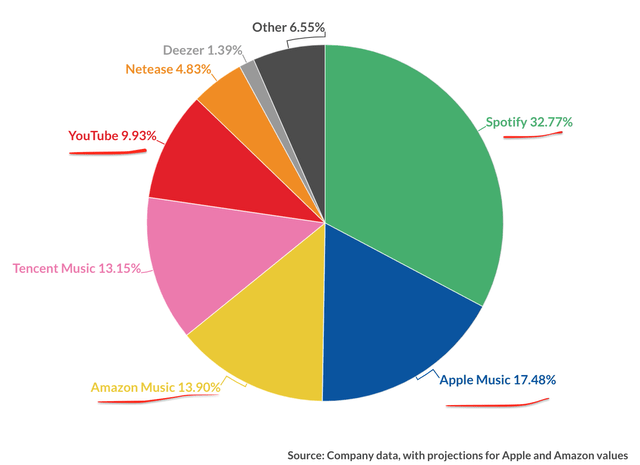

Spotify (NYSE:SPOT) is world’s most popular music streaming application with approximately a 33% market share. It’s main rivals include tech giant Apple which has a ~17% market share, Amazon Music which has a ~14% market share and even YouTube at ~10%. Despite this heavy competition, the company has grown its monthly active users substantially year over year. Management has even announced bold plans to double its monthly Active users and 4X its Average Revenue per user by 2030.

Music Streaming Market share (Business of Apps)

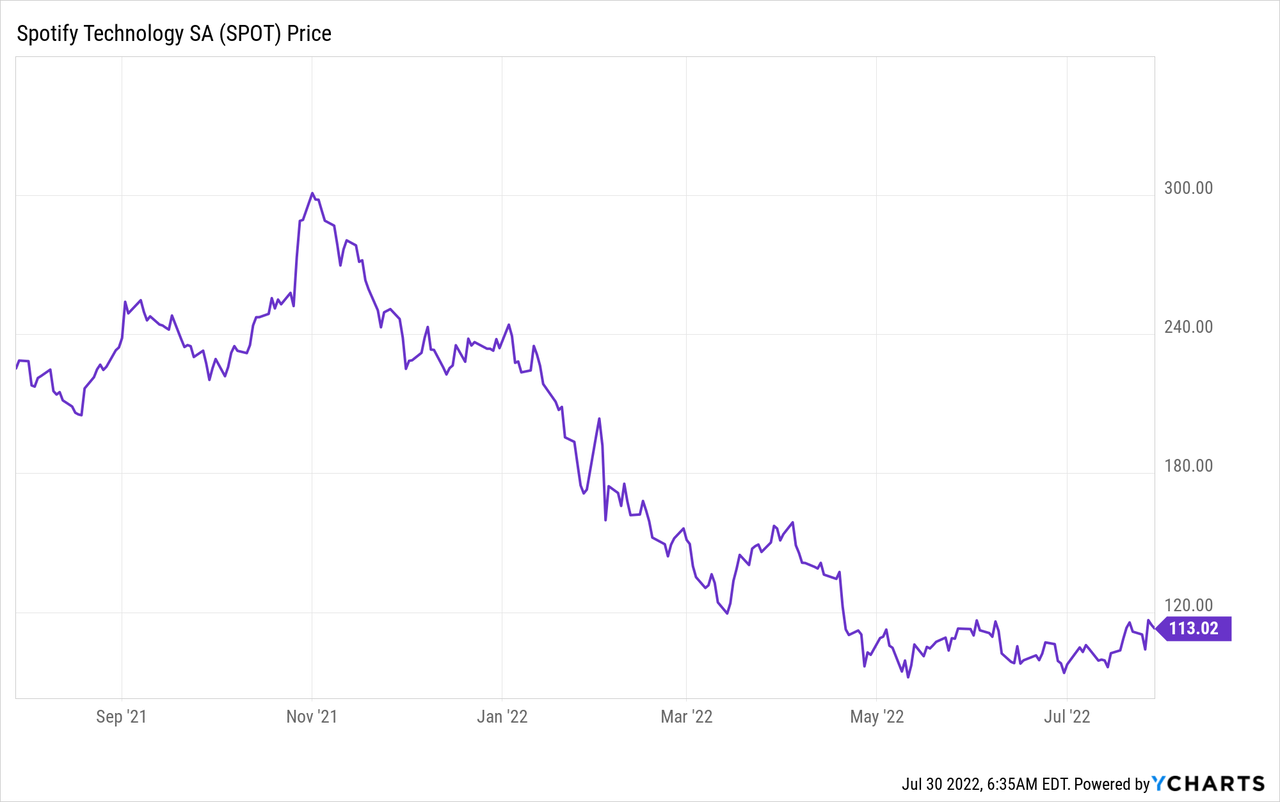

Spotify’s stock price has been decimated since the high inflation numbers were released in December 2021 and is now down 55% from these highs. According to my valuation model, the stock is undervalued intrinsically and has many tailwinds ahead, let’s dive into the second quarter earnings and business strategy for the juicy details.

2nd Quarter is Music to my Ears

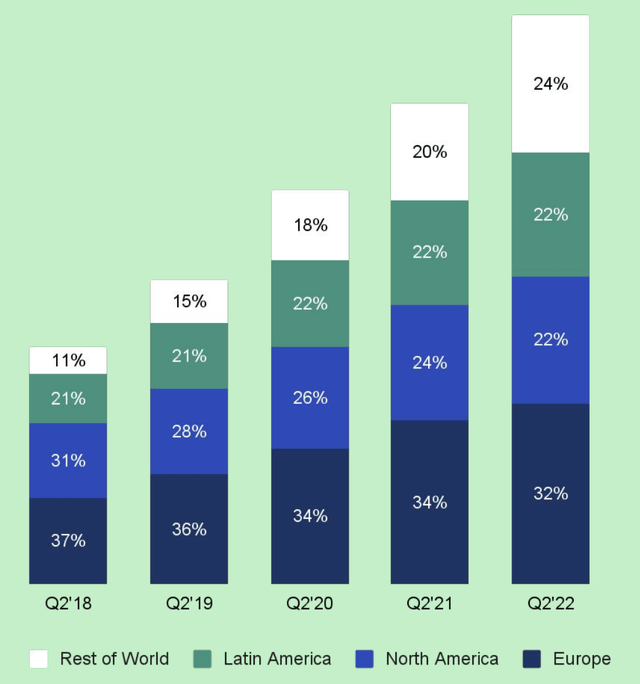

Spotify generated tremendous results for the second quarter of 2022, with almost all metrics surpassing guidance. Total Monthly active users grew by a rapid 19% year over year to 433 million, which was 11 million higher than the last quarter and 5 million above managements guidance.

This was driven by strong user growth in India, The Philippines and Indonesia as a result of a series of marketing campaigns. There was also strong growth in Latin America, driven by higher uptake in the Gen Z audience.

Spotify Monthly Active Users (Q2 Presentation)

Premium Subscribers increased by a healthy 14% Year over year to 188 million, up from 182 million in the last quarter. Premium paid subscribers now make up approximately 43% of the company’s subscribers. This was driven by strong performance across all regions including Europe, in addition to the increased adoption of multi-user plans.

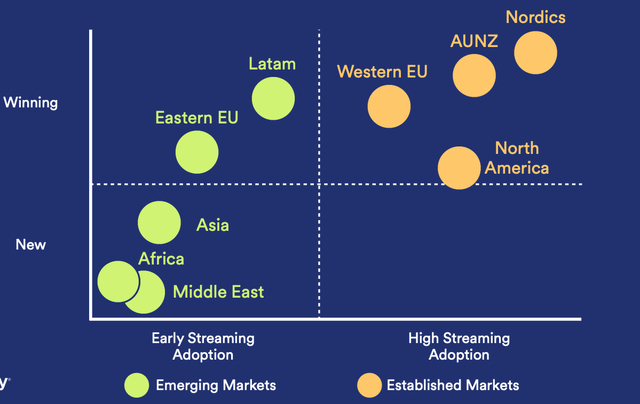

As you can see from the chart below, Spotify is “Winning” the Established markets such as Western Europe, North America, Nordics, and Australia. However, they are also “Winning” markets with long growth runway’s ahead such as Eastern Europe and Latin America. Emerging Markets are represent a strong growth area for the company and the TAM is 5x bigger, according to Spotify’s investor presentation.

Spotify Market Position (Investor presentation)

Total Revenue popped to €2.9 billion ($2.97B), up a rapid 23% year over year. This was boosted by favorable exchange rates from the strengthening of the US dollar and thus would be 15% on a constant currency basis.

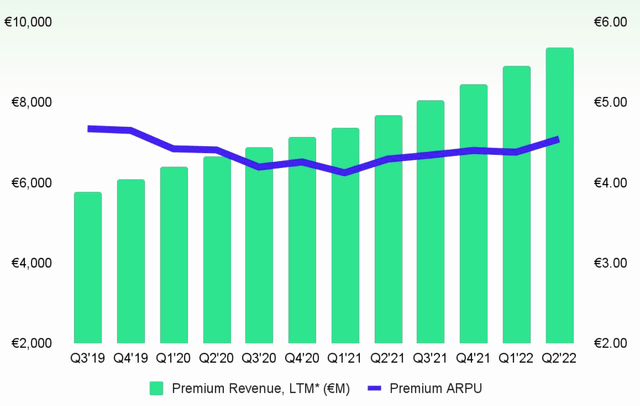

Premium Revenue was up 22% year over year (14% CC) and Average Revenue per user popped by 6% YoY to €4.54 as the price increases implemented in the prior year boosted numbers. However, it should be noted this was flat on a constant currency basis.

Premium Revenue (Q2 Earnings)

Ad supported revenue saw a major boost and popped by 31% year over year (17% on a constant currency basis). This was driven by a boost in music and podcasting growth from the Spotify Audience Network, which is their advertising platform.

Spotify’s Gross Margin was 24.6% in the second quarter, which got sliced by 386 bps year over year. This came in below managements guidance and was mainly driven by a decision to stop manufacturing “Car Thing”, which is Spotify’s in car hands free music device. This decision resulted in the company taking a €31 million hit. However, I believe this was the right decision long term as the company had “tested a number of price points” but “haven’t seen the volume at the higher prices” according to management. Therefore, given the lack of sales and the rising inflation of component prices, coupled with long lead times, it makes sense to halt the product. Decisions like these are why I like Spotify’s management; they are not afraid to “fail fast” which is a key characteristic of founder led companies. The Founder and CEO Daniel Elk owns ~7% of the company and only pays himself a measly salary of €92,000 per year. A former Hedge Fund Manager Nick Sleep, who was widely successful (~20% annualised returns) highlights the characteristic of founders paying themselves a low salary, a key success trait.

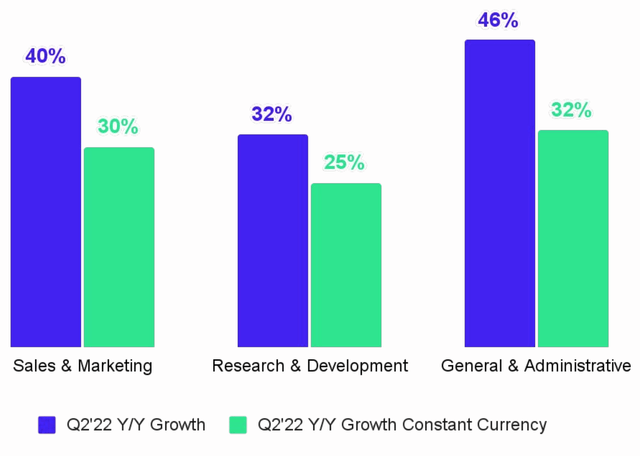

Excluding the Car Thing charge, Spotify reported an Adjusted Gross margin of 25.3%, which was down 123 bps year over year. Operating Expenses increased by a substantial 38% year over year (28% constant currency), which was due to a growth in headcount, as the company invested into a global ad sales team expansion plus acquisitions. Sales and Marketing spend increased by 40% (30% cc) year over year which is substantial. However, management did note that the decisions to aggressively increase investment into Sales and Marketing was “primarily made at the end of 2021” and thus moving forward they plan to slow headcount growth by 25%. This follows the tech giants such as Google and Amazon, which announced hiring slowdowns in their second earnings reports.

Operating Expenses (Q2 Earnings Presentation)

Overall Operating Loss for the second quarter was €194 million ($198m) due to the aforementioned reasons. The company is guiding for a slightly worse Operating loss of -€218 million (-$223m) next quarter due to a forecasted €78 million impact from “unfavorable” exchange rates, mainly due to foreign employees such as those in the US, as Spotify is headquartered in Sweden.

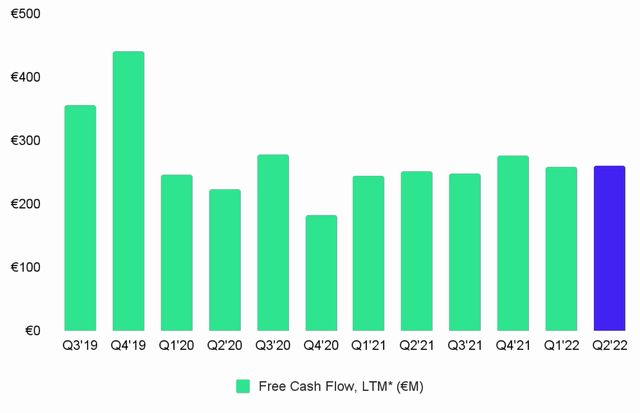

Despite the high expenses, Free Cash flow actually showed a slight increase to €37 million ($38m) in the second quarter, due to a net working capital boost. The company’s free cash flow varies based on seasonality but has averaged €200 million in the trailing 12 months over the past three years.

Spotify Free Cash Flow (Q2 earnings report)

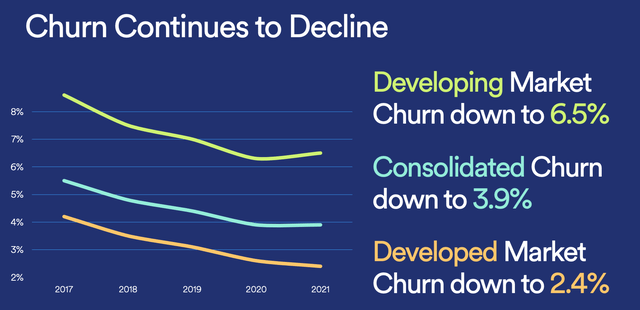

The beautiful thing about the Spotify platform is it’s “sticky” due to high user retention and low churn. Churn is the percentage of users who are cancelling subscriptions, lower is better. In Spotify’s case we see Churn in developing markets has declined to 6.5% and Developed Market Churn has declined to 2.4%.

I also noticed from personal experience that real music lovers who have created personal playlists may be reluctant to switch platforms to Apple Music for example, because they will lose their personal curated playlist.

Churn (Spotify Investor presentation)

Spotify has a strong balance sheet with €3.568 billion ($3.649) in cash equivalents and short-term investments. In addition, to approximately €1.3 billion ($1.33b) in debt via Exchangeable Notes, as per the company’s balance sheet. Seeking Alpha has the Total debt at $1.86 billion, but either way this is well covered by the liquidity position, given the majority is long term debt.

Spotify Social Network Prediction?

In Spotify’s investor presentation management outlined bold plans to double the number of monthly active users to a staggering 1 billion by 2030. To put things into perspective Instagram has 1.4 billion Monthly active users (MAU) and TikTok has 1 billion MAU. Thus, I actually see potential for Spotify to become a Social Network, which would be a game changer. This is not something the company has announced, but I believe it would be smart way to leverage the nearly half a billion users (you heard it here first). Meta which owns Facebook and Instagram have announced continually declining user growth in the last couple of quarters. Thus, I believe if Spotify added more social elements where users could interact with each other based on favorite music or podcasts, they could gain a foothold in the vast social media market. I also recently discovered Spotify had introduced Video Podcasts and I even tested this feature on my own Investing Podcast (Motivation 2 Invest), where I interview Hedge Fund Managers. I believe this is another game changing feature and could allow the company to rival YouTube assuming they make it a strategic priority and execute well, so far there have been no signs of this from management, but I believe this could be huge.

Acquisitions

Spotify recently closed the acquisition of Findaway which works across the entire audiobook ecosystem. Audiobooks are an area the company highlighted as a key driver of expansion and increasing lifetime value of the customer.

Spotify also announced the acquisition of Sonantic, a dynamic AI voice platform that creates voices from text. This platform is amazingly realistic and was even used in the New Top Gun Maverick Movie to recreate Val Kilmer’s voice (as he has throat cancer). Spotify plans provide new experiences for users. I also see Spotify Live, the live audio streaming app as having major potential due to the popularity of Clubhouse over the pandemic. Although when I tested the platform, I found limited content and functionality.

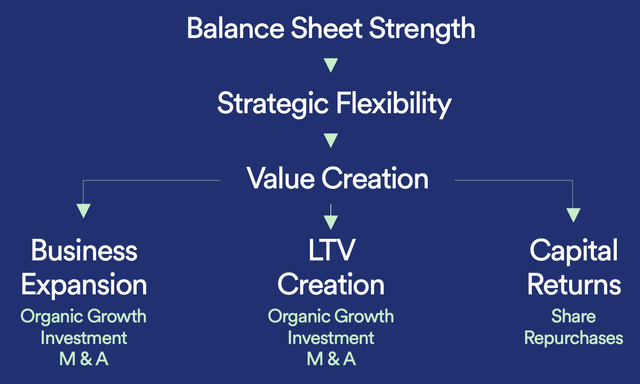

Management had also implemented a strategy to increase Lifetime Value (LTV) of customers through Podcast and new content testing. In addition, they are targeting a 4X increase in Average Revenue Per User (ARPU) by 2030.

Value model (Investor Presentation June 2022)

Advanced Valuation

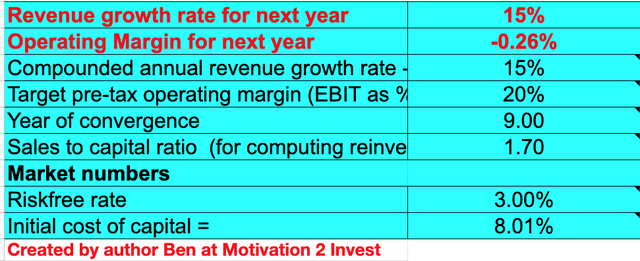

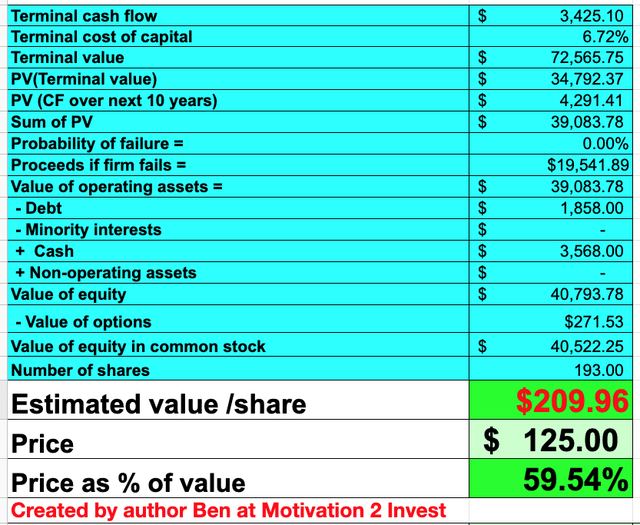

In order to value Spotify, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 15% growth for next year which is fairly conservative given the past years growth of 23% (15% CC). In addition, I have forecasted 15% growth for the next two to five years, which assumes the company can approach it’s bold targets of 1 billion users by 2030 (doubling) and increase Average Revenue Per User (ARPU).

Spotify Stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted it’s operating margin to increase to 20% over the next 9 years which is very conservative, given the average operating margin for the software industry is 24%. In addition, the company experiencing positive results on its customer Average lifetime value (ALV) experiments. I have also capitalized Spotify’s R&D expenses which adjusts the operation margin in a positive manner.

Spotify Stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $210/share, the stock is currently trading at ~$125 and thus is ~40% undervalued.

Note: Spotify was founded and is headquartered in Sweden, thus you will likely see the share price in the Euro currency. At the time of writing the fair value would be €204 euros, per share with a current share price of €113/share.

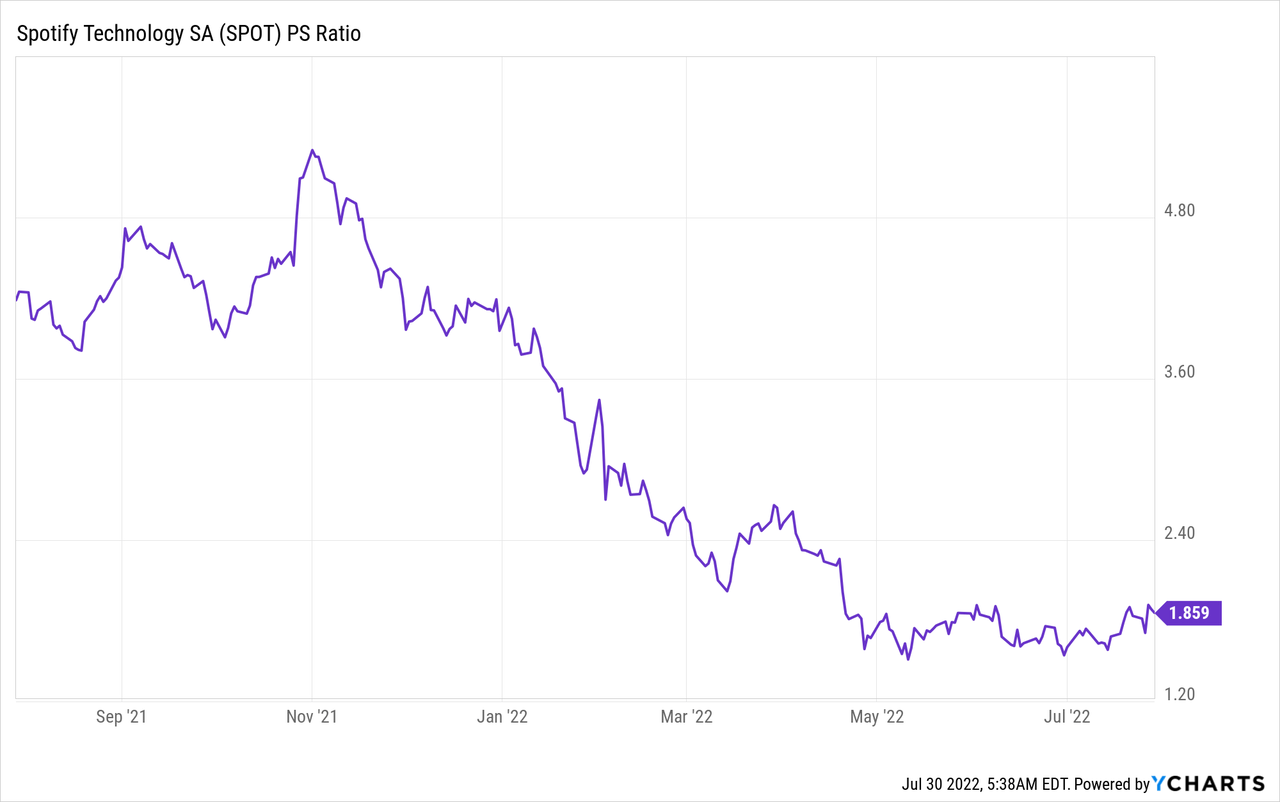

As an extra datapoint Spotify trades at a Price to Sales (FWD) ratio = 1.82, which is approximately 50% cheaper than its 5-year average.

Risks

Competition

The Music streaming industry is becoming increasingly competitive and a commodity service. Tech giants such as Apple, Amazon and even YouTube are investing aggressively into the space and leveraging their platforms to cross sell users to music. This could slow Spotify’s growth longer term and eat into its market share.

Recession/Inflation

As Warren Buffett stated at his last annual meeting, “inflation swindles almost everybody”. From rising input costs to tepid consumer demand the high inflation and forecasted recession is not good for any business. The good news is I imagine most people will still want to listen to music although a few may switch to the ad supported packages. Spotify’s negative operating income could be an issue as Wall Street is extra sensitive to companies “burning cash” in the current climate.

Final Thoughts

Spotify is a tremendous company which is still the market leader in music streaming. The company has generated relatively strong financial results for the second quarter when many tech companies have been reporting substantial declines. The stock is undervalued at the time of writing and thus could be a great investment for the long term.

Be the first to comment