Avid Photographer. Travel the world to capture moments and beautiful photos. Sony Alpha User

Introduction

My thesis is that these are challenging times for Spotify (NYSE:SPOT) because the overall gross margin hasn’t improved and investors don’t like the uncertainty that comes with margin-lowering investments.

At the time of this writing, €1 is about the same as $1.

The Numbers

We saw this slide regarding a 40% gross margin at the June 2022 Investor Day presentation:

Spotify Gross Margin (2022 Investor Day presentation from CEO Ek)

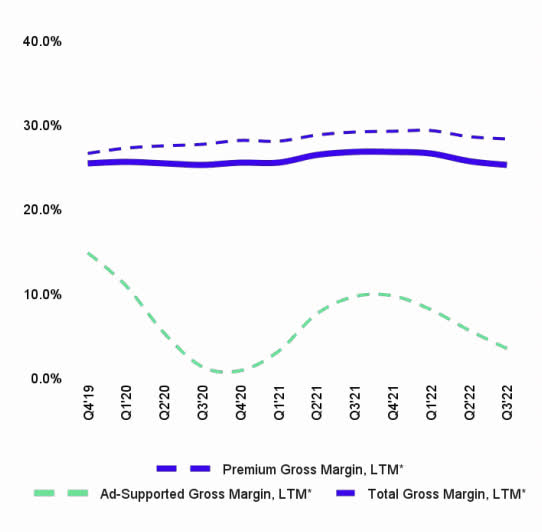

This solid purple line is the total gross margin we’re seeing now in the 3Q22 presentation:

Spotify Margins (3Q22 presentation)

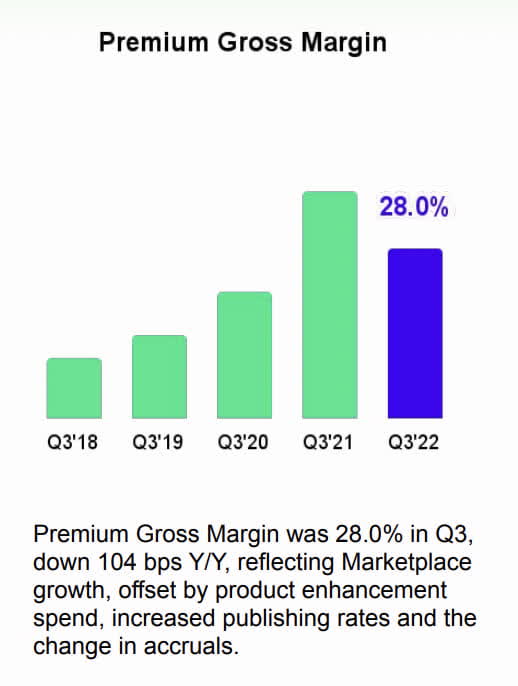

That solid purple gross margin line has a long way to go before it hits 40% and investors are losing confidence. In the 3Q22 presentation, management notes that the premium gross margin is 28%, reflecting Marketplace growth, offset by product spend and an accrual change:

Spotify Premium Margin (3Q22 presentation)

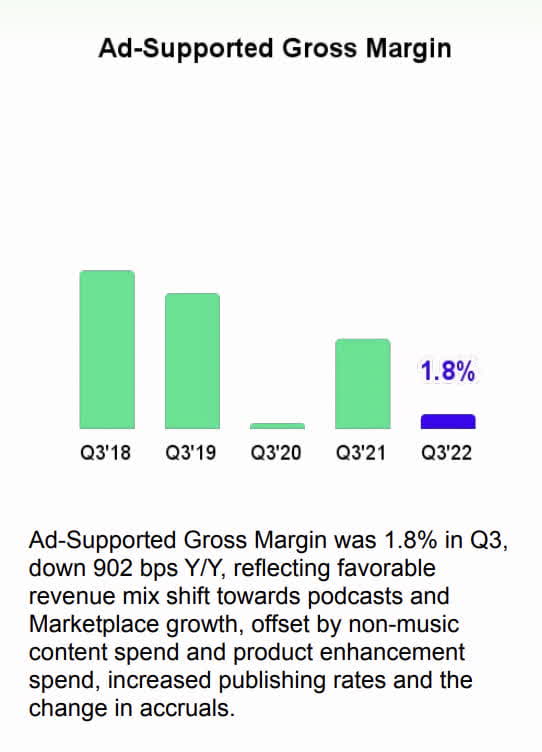

We know that advertising revenue continues to climb as a percentage of overall revenue and this segment has a low gross margin at the present time such that it meaningfully lowers the overall margin:

Spotify Ad Margin (3Q22 presentation)

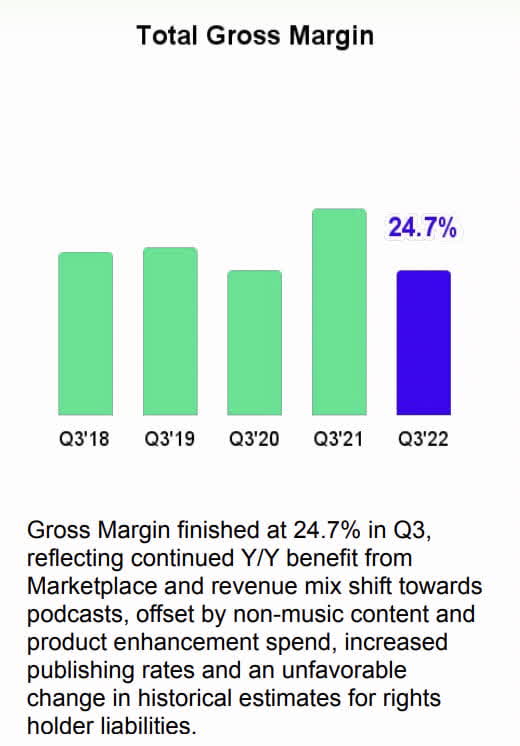

The 3Q22 presentation shows that all of this comes together such that the overall gross margin is less than 25% which is disappointing:

Spotify Total Margin (3Q22 presentation)

In the 3Q22 call, CFO Paul Vogel said the overall gross margin above was 50 basis points less than guidance due to an accrual adjustment, an advertising growth hit from a macro slowdown and currency fluctuations. CFO Vogel went on to say that the outlook for the fourth quarter is a 24.5% gross margin which is lower than the expectation of 25%. He said that the softening macro environment reflected in the advertising slowdown is a factor. Negative currency exposure was cited as a second factor. Finally, the last quarter of the year includes a restructuring charge at the podcasting business. These three factors are said to lower the overall gross margin by 70 basis points cumulatively. CFO Vogel went on to say that he feels good about the future:

So I’d say at a high level, we still remain very confident with the margin profile and margin guidance we gave at the Investor Day. We said a number of times that 2022 is going to be an investment year. You’ve seen it show up in both gross margin and on the operating expense line, and we expect to see improvements as we move into 2023. We’ve talked about particularly things like podcasting that has been a drag, and that should turn into less of a drag and then eventually a benefit moving forward. And nothing has changed at all in terms of our expectations there. Obviously, there’s some macro uncertainty. So the speed of that turnaround could always be impacted by a quarter or 2 or at least the slope of that turnaround.

CEO Ek chimed in saying the podcast margins should eventually be much better than the music margins:

And as Paul said, on the structural side, on podcasting, we believe that to long term be a much higher gross margin business than the one we’re currently in the music, simply because the way to mimic that would be to look at platform type of businesses that usually end up having a higher gross margin than normal services.

Later in the call, a question was asked about the 2 or 3 levers that can increase the gross profit margin 300 to 500 basis points over the next few years. Again, we’re at 24.5% now so these levers could push it to a range of 27.5% to 29.5%. CEO Ek encouraged the person asking the question to take a look at the June 2022 Investor Day presentation again, stating that investments in non music content have been substantial over the past few years and that these podcasting investments have suppressed the overall gross margin. CEO Ek repeated that the heavy podcasting investments are going to reverse in 2023. He stressed that eventually the revenue mix will shift more towards podcasting and audiobooks where the long-term gross margins will be significantly higher than the ones in music. CEO Ek repeated this theme even later in the call, saying the real negative drag on the overall margin has been the podcasting side because of all the heavy investments. I think there were a large number of margin questions in the call because management hasn’t built a cogent case with respect to the benefits investors will see from podcast and audiobook investments; we understand that long-term margins should rise but the details can be a bit nebulous.

The Apple Tax

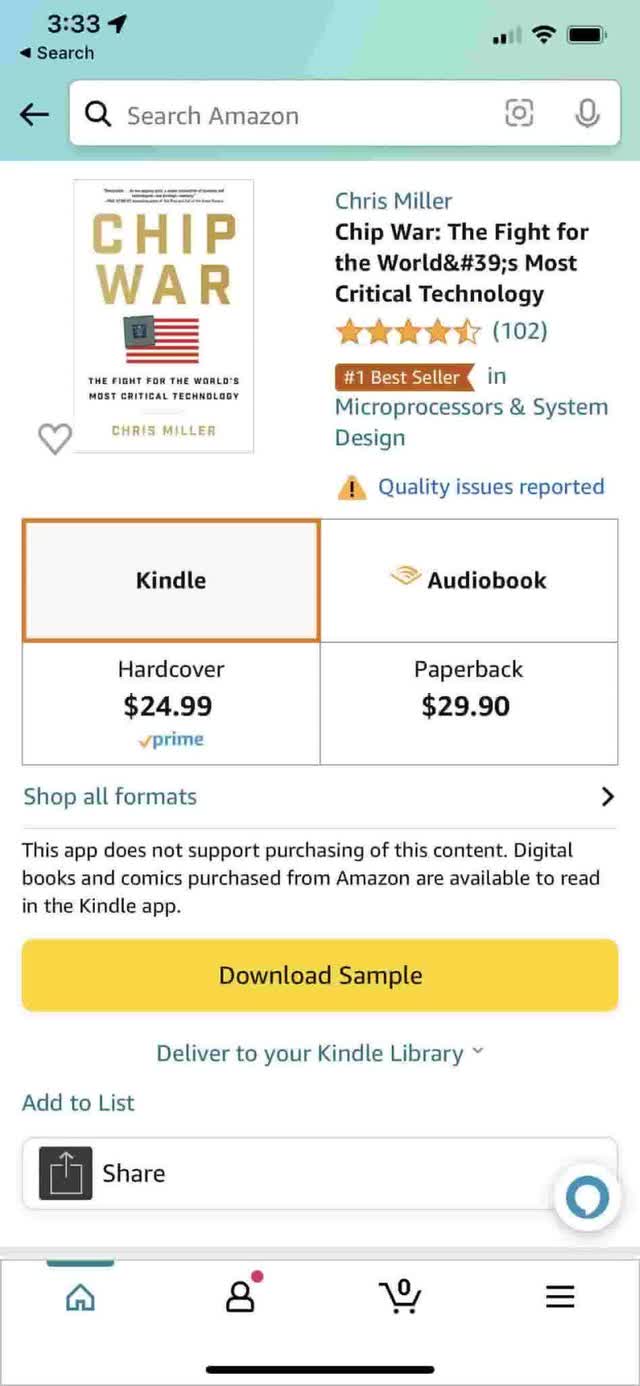

Eventually Spotify wants to have audiobooks as a large part of the revenue mix and they feel the long-term gross margins in this area will be substantially higher than what we’ve seen with music. Apple (AAPL) is also in the audiobooks business and they apply the Apple tax to competitors. One of the best ways to understand the Apple tax is to look at what has been happening to Amazon (AMZN) over the years. MUO reports that Amazon has been dealing with the Apple tax for Kindle purchases since 2011. This concerns me; Spotify is up against a formidable opponent with their audiobook aspirations. We can have a deeper understanding of the purchase restrictions/shenanigans involved with the Apple tax by using an example. I should be able to buy the Kindle edition of books whether I’m shopping from my MacBook or from my iPhone. However, that’s not how the world works and this is tied to the Apple tax. Here is what I see when looking at the Kindle edition of Chip War from my iPhone:

Note the text above that says Amazon’s iPhone app does not support purchasing of this content. Digital books and comics purchased from Amazon are available to read in the Kindle app.

Again, the inconvenient “this app does not support purchasing” message above happens because Amazon doesn’t want to pay the Apple tax for Kindle purchases from iPhones. When going to the amazon.com website on my MacBook, I can purchase the Kindle edition of this book for $14.99 just fine:

Apple Tax Workaround (Author’s screenshot)

This is very discouraging. Amazon is a large company but they’ve been forced to make things inconvenient for iPhone customers because of this Apple tax since 2011. I worry that Spotify will continue to have the same challenges with their audiobook ambitions. A question about this came up in the 3Q22 call and CEO Ek replied that he has been making the same platform net-neutrality points for 4 years:

And the key part that we want to do at Spotify is we want to have the ability to communicate with our customers the way we choose to do that and the way our customers are accepting to have that line of communication. We do not want a gatekeeper or a monopoly in the way to dictate how we communicate with our customers. The second part of that is we think that there ought to be payment method choice by this. So really allow us to use whatever payment method we think is the optimal one and that the customer wants to use. And that’s important. And the last part is having the same access. If you are a platform that offers a competing service on that platform, we want to have access to the same level of APIs that you would offer your own service. Those are the 3 big things.

Later in the 3Q22 call, CEO Ek went on to recommend an October 25th New York Times article on this subject. It talks about the fact that Apple is an obstacle Spotify must navigate in order to become the premier outlet of audio. It notes that Spotify’s app was rejected 3 times over the past month because of the purchase framework for the new audiobooks offering. Selling audiobooks themselves, Apple is incentivized to make things difficult for Spotify and it is telling that there were no issues with the Android version of Spotify’s audiobook app. CEO Ek summed up his thoughts on the article:

Apple keeps putting up roadblocks of just stopping us more and more and more. I think the app was rejected 3 or 4 times at [the] present moment, really despite us having lawyers in the room to make sure we were compliant with this. So they keep moving goalposts, which is exactly what we’ve said all along. And if you contrast that to trying the same experience now on an Android device and on Google, it is a beautiful experience. So this just showcases that we can build an amazing audiobook experience. However, on iOS, the purchasing flow is inherently broken because Apple decidedly wanted it to be broken.

Valuation

On October 24th, Apple reported to CNN Business that they increased prices for streaming music:

An Apple Music subscription for individuals will now cost $10.99 per month, up from $9.99, and a family plan supporting up to five people is now $16.99 per month, up from $14.99. The price of Apple TV+ will increase to $6.99 per month, a 40% increase from the $4.99 it cost previously.

It was mentioned in the 3Q22 call that YouTube Music has also raised prices and these developments are obviously good for Spotify’s potential with respect to monetization which raises their valuation. In other words, Spotify is more valuable now that we see there is some pricing power on the music side.

Per his comments in the 3Q22 call, CEO Daniel Ek wants us to focus on top line revenue as opposed to gross margin:

I’ve said it before, but it can’t be understated: top line growth in the platform is the leading indicator for future success on all other financial metrics.

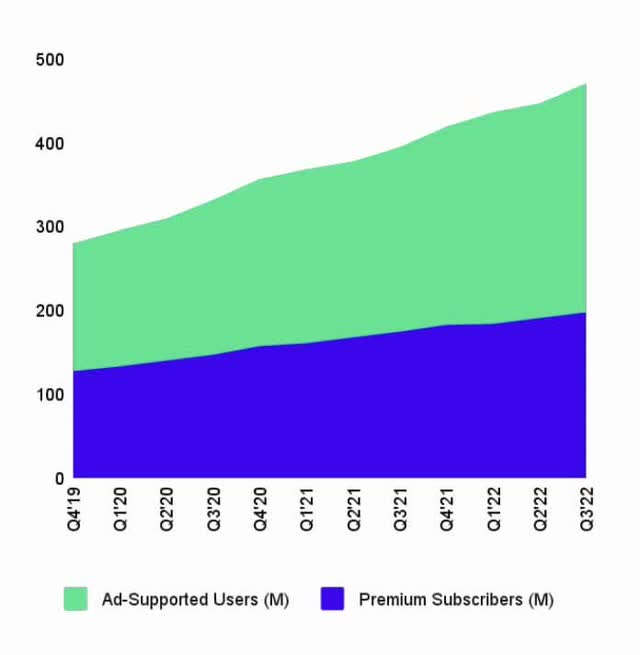

The 3Q22 presentation shows that Spotify didn’t have the subscriber pull-forward from Covid that we saw from other companies. Total Monthly Active Users (“MAUs”) increased 20% year-over-year (“Y/Y”) from 381 million in 3Q21 to 456 million in 3Q22. Premium Subscribers increased 13% Y/Y from 172 million in 3Q21 to 195 million in 3Q22:

Spotify Users (3Q22 presentation)

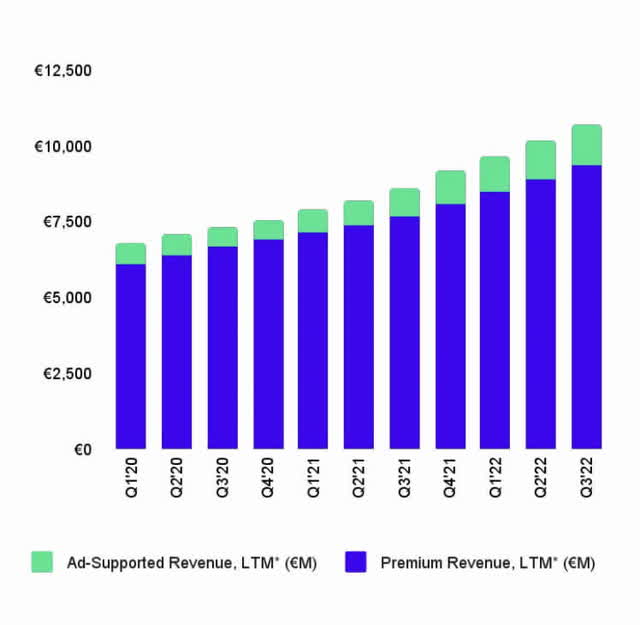

Quarterly ad-supported revenue continued to grow in importance as it climbed 19% Y/Y from €323 million in 3Q21 to €385 million in 3Q22 and it accounted for 12.7% of the total 3Q22 quarterly revenue of €3,036 million. Looking at the trailing-twelve-months (“TTM”), ad-supported revenue was €1,421 million which was 12.7% of the total revenue of €11,250 million:

Spotify Revenue (3Q22 presentation)

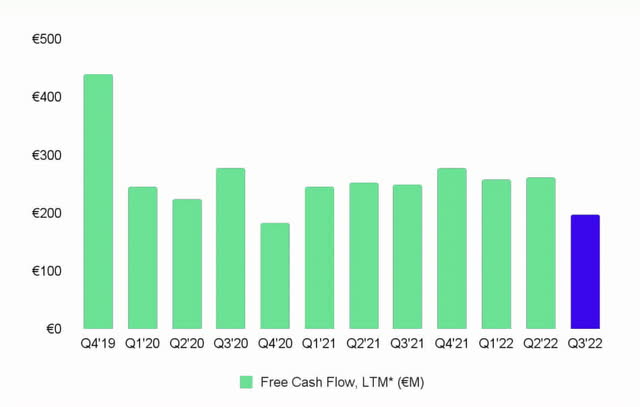

The 3Q22 presentation notes that FCF has been positive for 10 quarters in a row:

This was the 10th quarter in a row of positive Free Cash Flow. While the magnitude of Free Cash Flow can fluctuate from quarter to quarter based on seasonality and timing, we have averaged over €200 million of positive Free Cash Flow on a trailing 12 month basis for the past three years.

Management shows these FCF accomplishments in a graph:

Spotify FCF (3Q22 presentation)

One issue with the unadjusted FCF touted by management is that it doesn’t include stock-based compensation (“SBC”). I treat SBC as a cash expense such that TTM adjusted FCF is negative. In other words, unadjusted TTM FCF is €199 million or 9M22 + FY21 – 9M21 or €96 million + €276 million – €173 million. Note that the FY21 figure comes from the 2021 20-F. TTM SBC is €331 million such that TTM adjusted FCF comes in at the negative value of €(132) million.

Management wants to have an operating margin of 20% in a decade but what really matters is the adjusted FCF margin. I’m hoping this can get to 10% including the impact of SBC. If it were 10% today then adjusted FCF on the TTM revenue of €11,250 million would be about €1,125 million. It’s hard to say what such a business should be worth in this time of rising interest rates. The market cap is $16.1 billion based on the October 28th share price of $83.36 and the 193,077,334 basic weighted-average ordinary shares outstanding from the 3Q22 6-K. As such, Mr. Market seems to be saying that Spotify is worth 14x to 15x the €1,125 million figure mentioned above.

Forward-looking investors should pay close attention to Spotify’s podcasting and audiobook businesses in 2023 to see if they can be as successful as management hopes.

Be the first to comment