turk_stock_photographer

Experienced value investors have been there and seen that. That’s why they will tell you to wait for stocks to come to you versus the other way around. The current market downturn has created many bargain opportunities, especially in the high yield arena. This brings me to Spirit Realty Capital (NYSE:SRC), which is likely the highest-yielding internally managed net lease REIT. This article highlights the merits of investing in SRC at the current price point, so let’s get started.

Why SRC?

Spirit Realty Capital is a self-managed net lease REIT that owns a large number of properties spread across the U.S. It’s made great strides in improving its risk profile since its current CEO came on board in 2017, spinning off its lower quality properties and improving its balance sheet profile.

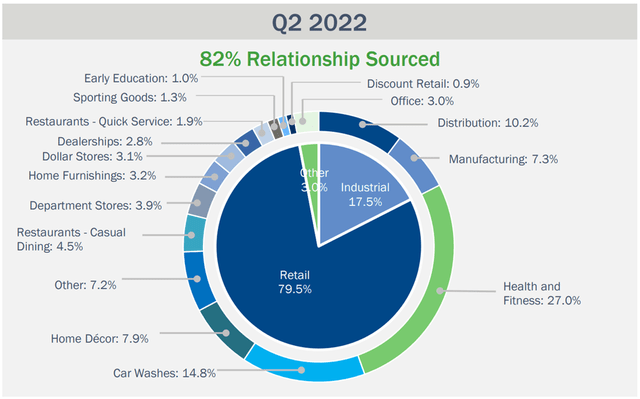

At present, SRC enjoys a high occupancy rate of 99.8%, and carries a diverse portfolio of 2,078 retail, industrial, and other properties across 49 states, and leased to 342 tenants in 35 industries. SRC earns a solid reputation with its tenant base, as 82% of its recent deals were relationship sourced. Also, while SRC generates the majority (79.5%) of its annual base rent from retail tenants, they mostly fit into e-commerce resistant categories such as health clubs, car washes, home furnishing, restaurants, dollar stores, and auto dealerships, as shown below.

SRC Portfolio Mix (Investor Presentation)

Meanwhile, SRC is showing no signs of slowing down, as it invested an impressive $417 million during the second quarter at an attractive cash capitalization of 6.4%. This includes 56 properties across 38 transactions with a long-weighted average lease term of 14.4 years. This was funded in part by active portfolio recycling with $103 million of proceeds from the disposition of 17 properties at a much lower cap rate of 4.4%, and by the issuance of two million shares when SRC’s share price was much higher than where it’s at now.

Headwinds to SRC are fairly obvious, as higher interest rates raise the cost of debt, and the lower share price makes equity issuances unattractive. As such, SRC could see slower growth in the current environment. However, it’s worth noting that SRC maintains a strong BBB rated balance sheet from S&P and that while its cost of capital is higher, cap rates have also trended higher as well. Management also sees opportunities in the deal pipeline, as mentioned during the Q&A session of the last conference call:

Q: I think you had mentioned that you were expecting higher cap rates in the back half of the year. And maybe as part of that, can you share some thoughts on the pipeline and what some of the pricing there looks like?

A: I can tell you in our acquisition pipeline meetings, we’re seeing really interesting opportunities that are really at meaningful spreads where we think versus, say, earlier in the year or last year. And what that translates into is I’d say generally like in the retail assets that we’re looking at evaluating, cap rates have increased 25 to 50 basis points if you compare it to say, late last year.

You didn’t ask, but I’m going to tell you like one of the reasons why I think this is happening is this concept of is gone. People that need to close transactions once certainty of close versus price, I think it’s really critical. And one of the reasons why we are so consistent on this disposition program going forward is it’s super informative, gives us a lot of visibility real-time as to how bidders are responding in the marketplace, and that gives us better information on how to lean in and lean out.

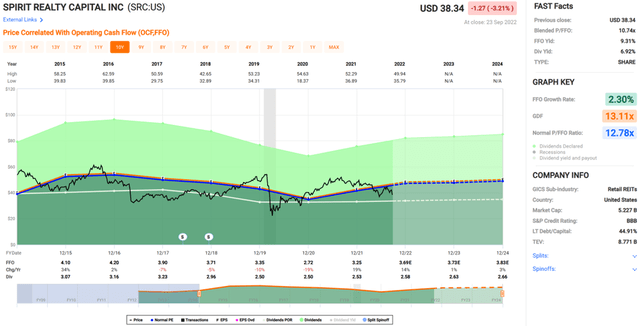

Meanwhile, I see a lot of negativity as having been baked into the share price, pushing the dividend yield now to 6.9%. The dividend was recently raised by 4% and is well protected by a 72% payout ratio, based on Q2 FFO per share of $0.92. As such, I see solid value in SRC at the current price of $38.34 with a forward P/FFO of just 10.4, sitting well below its normal P/FFO of 12.8 over the past eight years. Sell side analysts have a consensus Buy rating on SRC with an average price target of $48.54, equating to a potential one-year 34% total return including dividends.

SRC Valuation (FAST Graphs)

Investor Takeaway

SRC is a well-managed net lease retail and industrial REIT that has demonstrated an ability to weather both good times and bad, with its dividend record being intact in its current form since 2018. It has a high occupancy rate, a well diversified portfolio, and an active capital recycling program with a healthy investment spread.

While the current environment presents some challenges, I believe those concerns are more than baked into the share price. Meanwhile, investors layering in capital today get to enjoy a near 7% dividend yield. As such, I view SRC as being a good buy for high income and potentially rewarding long-term returns from here.

Be the first to comment