RichVintage/E+ via Getty Images

This article was co-produced with Nicholas Ward.

Since the Fed announced its plans to begin normalizing rates again several weeks ago, we’ve seen a broad market rally occur. The Fed increased rates by 25 basis points, its first increase in 3 years.

Furthermore, Fed officials updated their dot plot, which now points towards another 6 increases during 2022 alone. While this may seem drastic, it was less than the 50-basis point increase that many investors feared in the near-term.

Overall, it appears that the Fed did a great job of threading the needle with regard to the extent and the pace of its proposed rate increases – as well as the more recently announced plans to reduce the size of its balance sheet – because we’ve seen stocks from a wide variety of industries and sectors move higher since the Fed’s big announcement in mid-March… REITs included.

Something that stands out when looking at the bullish momentum in the markets these days is the rally that is happening in the defensive space.

We’re looking at healthcare stocks experiencing their time in the sun, with many names that have lagged in recent years making all-time highs (names like AbbVie (ABBV) and Bristol Myers Squibb (BMY) come to mind here).

The utility sector has performed extremely well in recent weeks, with the Utilities Select Sector SPDR (XLU) up 8.9% during the last month alone. The consumer staples space has performed well too. The Consumer Staples Select Sector SPDR (XLP) is up 7.43% during the last 30 days.

And, of course, we’ve seen the real estate space, known for its relatively high yields, post outperformance as well. The Real Estate Select Sector SPDR (XLRE) is up 7.19% during the last month.

All of these areas of the market have outperformed the S&P 500 (SPY) which is up 5.81% during the last 30 days and the Nasdaq 100 (QQQ) which is up 7.02% during the last 30 days.

In short, while the broad markets have headed higher, we’re looking at a rally that favors lower risk assets, which has allowed some of our favorite blue-chip REITs to post even larger alpha.

In general, when we think about reliable passive income in the REIT space, our minds head towards the net lease space.

Why?

Well, because the triple net lease business model produces some of the highest margins in the entire market and historically, the leaders in this industry have produced incredibly safe dividends and steady dividend growth.

For instance, shares of Realty Income (O) have risen by 9.16% during the past 30 days. O has been a top pick of ours in the net lease space for years (in terms of quality) and up until recently, O’s valuation metrics were quite impressive as well.

However, after its recent rally, O shares are trading with a ~1% margin of safety relative to our “Buy Up To” threshold of $72/share. Therefore, while we continue to love the quality that O presents, we’re looking elsewhere for better bargains.

We obviously love focusing on blue chip stocks – especially during uncertain times like these, with potential headwinds on the horizon in the form of geopolitical and monetary policy threats to growth) – however, the fact of the matter is, when looking at the highest quality net lease REITs that we track at iREIT, we’re seeing diminished margins of safety.

We’re currently looking at single digit margins of safety on other high quality net lease stocks such as Agree Realty (ADC), which currently trades with a 6% margin of safety, and National Retail Properties (NNN), which currently trades with a 7% margin of safety.

Furthermore, W. P. Carey (WPC), which is now trading above our fair value estimate of $80/share and therefore, trades with a negative margin of safety.

One name that really stands out to us in the current market conditions is Spirit Realty (NYSE:SRC).

SRC shares are actually down 1.61% during the last 30 days, pushing the stock’s year-to-date performance down to -4.43%.

Spirit doesn’t score as highly as the other net lease stocks that we’ve highlighted thus far, all of which have 90+ iREIT IQ ratings (which is our 1-100 quality metrics scale); however, at 75/100 on the iREIT IQ scale, SRC is certainly not a low-quality name.

And, in terms of its iREIT IV rating (our 1-100 scale which focuses on value oriented metrics), SRC currently offers the best score in the entire net lease space, with a 91/100 rating (for comparison’s sake, O, ADC, NNN, and WPC are currently rated 57, 60, 65, and 57, respectively, with the iREIT IV system).

What’s most interesting about Spirit right now is the divergence between the direction that the stock’s fundamentals are headed and the direction of the company’s share price.

SRC’s share price is down mid-single digits thus far throughout 2022; however, the company is expected to post high single digit AFFO growth this year.

And, this comes on the heels of a 12% AFFO growth year in 2021, showing that the fundamental strength which helped the stock post ~20% capital gains last year remains in place.

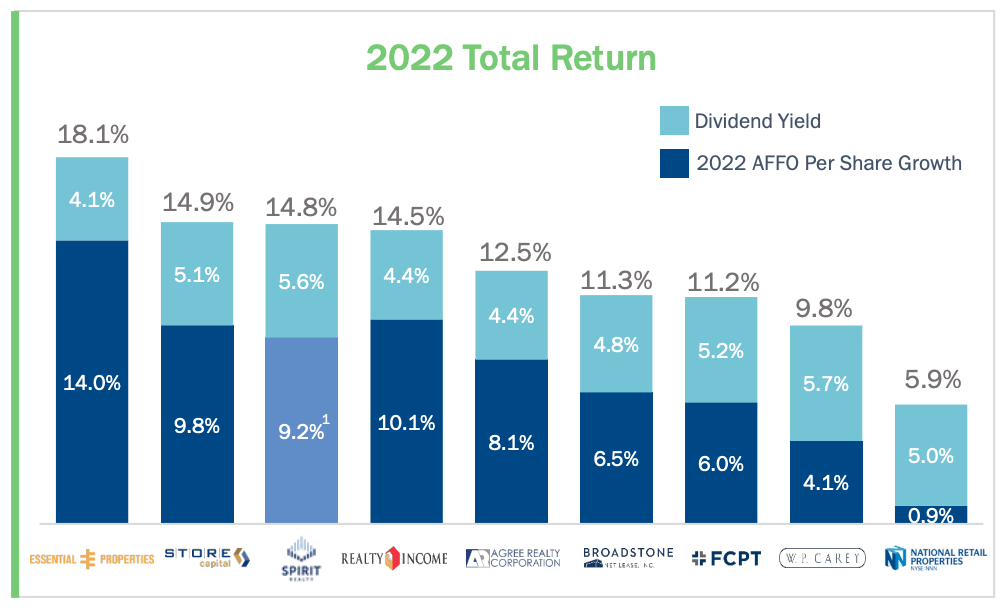

During its Q4 report, SRC management highlighted the relative attractiveness of its shares, highlighting its total return potential in the near-term (looking at AFFO growth estimates + dividend yield).

As you can see, in mid-February, SRC offered attractive total return potential… and since then, this stock has gotten even more attractive, on a relatively basis to its peers, due to the fact that SRC shares have stagnated while the majority of its net lease brethren have moved higher.

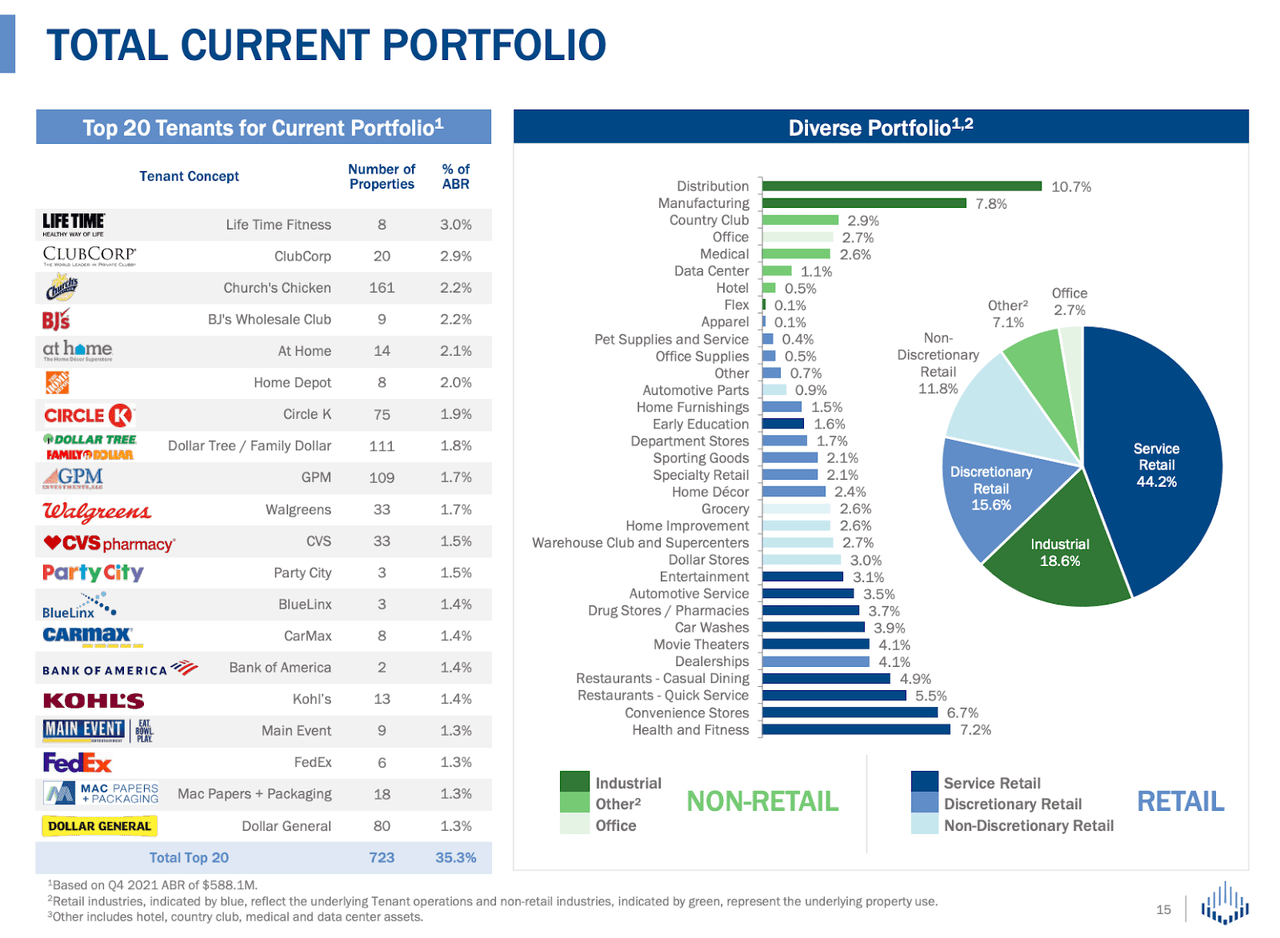

Q4-21 SRC Presentation

Today, SRC yields 5.58%, meaning that its dividend yield is above the net lease average of 5.2%. SRC’s yield is much higher than the yield offered by the aforementioned blue chips; right now, O yields 4.14%, ADC yields 3.94%, NNN yields 4.66%, and WPC yields 5.18%.

And, while it’s true that SRC doesn’t possess the same sort of quality as these names in terms of its portfolio (especially with regard to investment grade tenants), balance sheet metrics, or weighted cost of capital, that ~5.6% dividend appears to be quite safe.

SRC is currently projected to generate AFFO of $3.55 in 2022. The stock’s forward annual dividend is currently just $2.55, representing a forward AFFO payout ratio of 71.8%.

Because SRC is a relatively young company, it doesn’t offer the same sort of dividend growth history that its peers in the net lease space can present. SRC has experienced dividend growth issues in its short history, having cut its dividend several times in its ~10-year history as a public company.

But, in 2021 SRC increased the dividend by approximately 2% and because of its relatively low payout ratio we expect to see annual growth moving forward (analysts agree, with consensus estimates pointing towards low single digit dividend growth in 2022, 2023, and 2024).

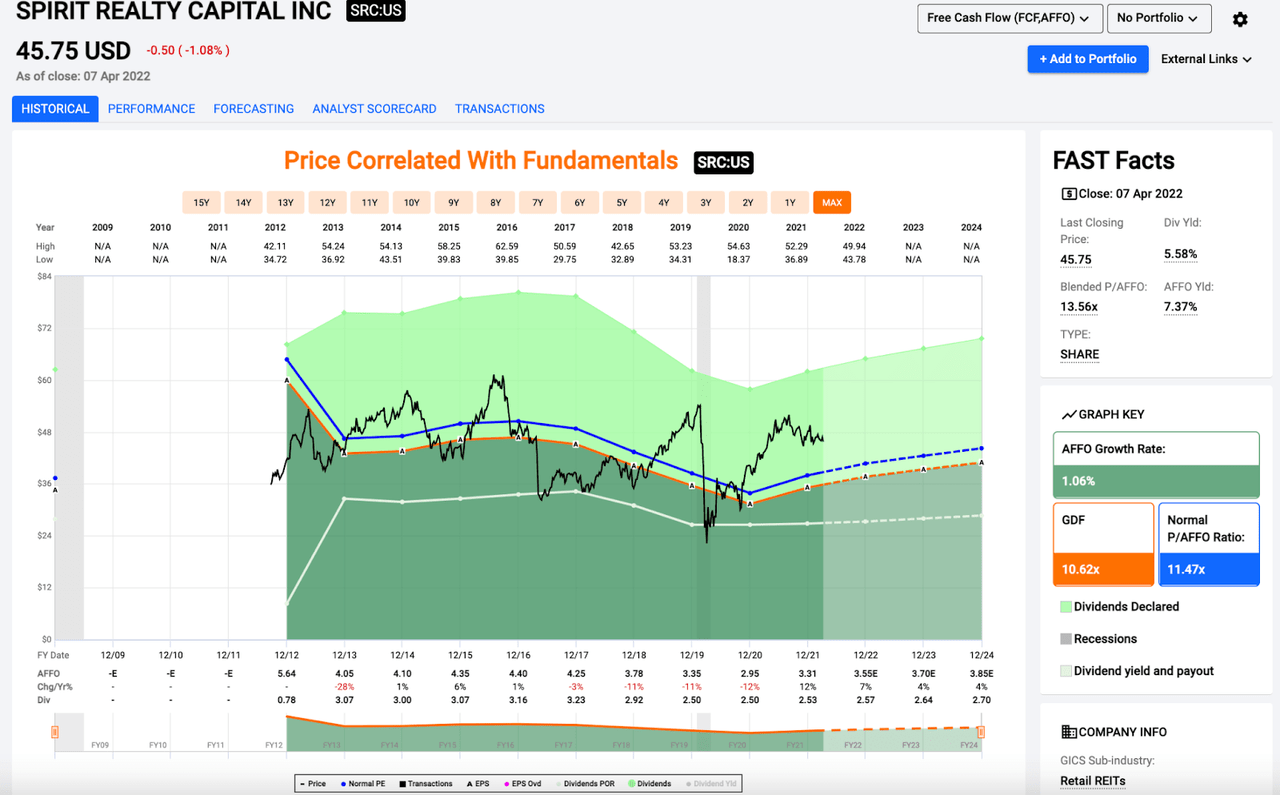

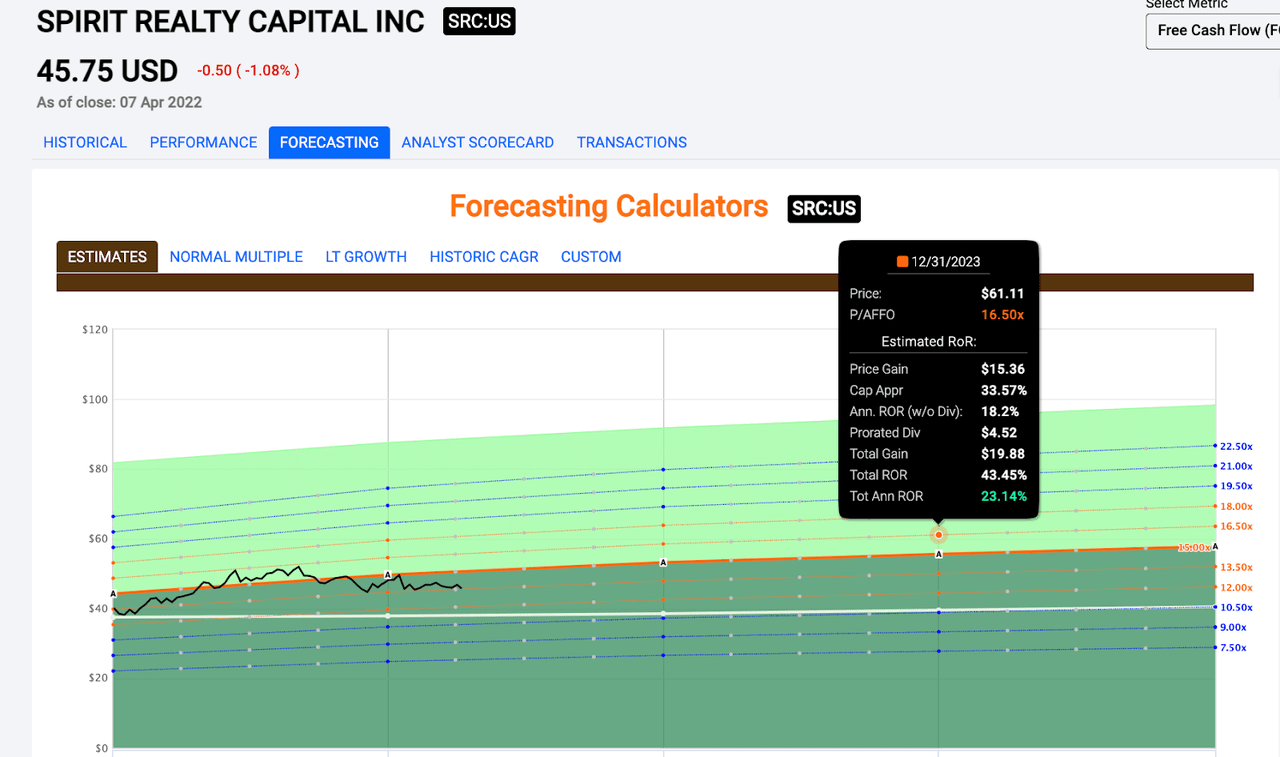

FAST Graphs

As you can see on the F.A.S.T. Graph above, SRC shares have been trended downward for roughly 6 months now. Today, they trade at a 12.4% discount from their 52-week high of $52.29.

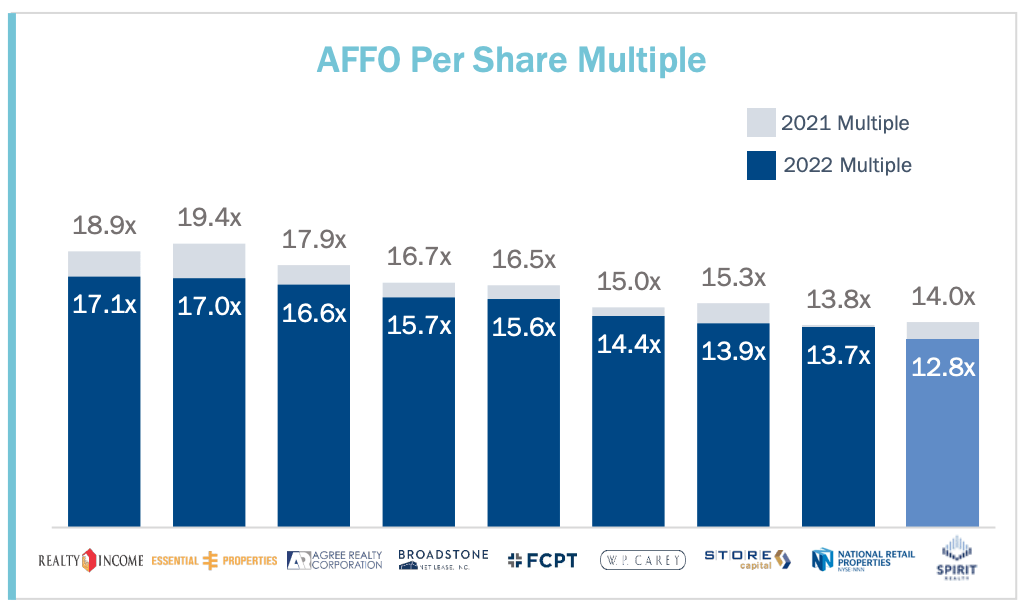

SRC’s current blended P/AFFO ratio is 13.5x. The company’s forward P/AFFO multiple is just 12.9x. Both of these figures are relatively attractive to the multiples that we’re seeing elsewhere throughout the net lease space.

Spirit management highlighted the value that its shares present during its Q4 results and once again, because of the relative underperformance that SRC has generated during the last month or so, today SRC’s relative discount to its peers is even more attractive.

Q4-21 SRC Presentation

It’s rare for companies to offer such strong growth prospects and trade with a relatively low premium like this.

So, what gives?

In short, we believe this company is misunderstood.

SRC began its life as a public company with a property portfolio that looked somewhat similar to the other net lease stocks with a significant focus on retail, restaurants, convenient stores, and drug stores.

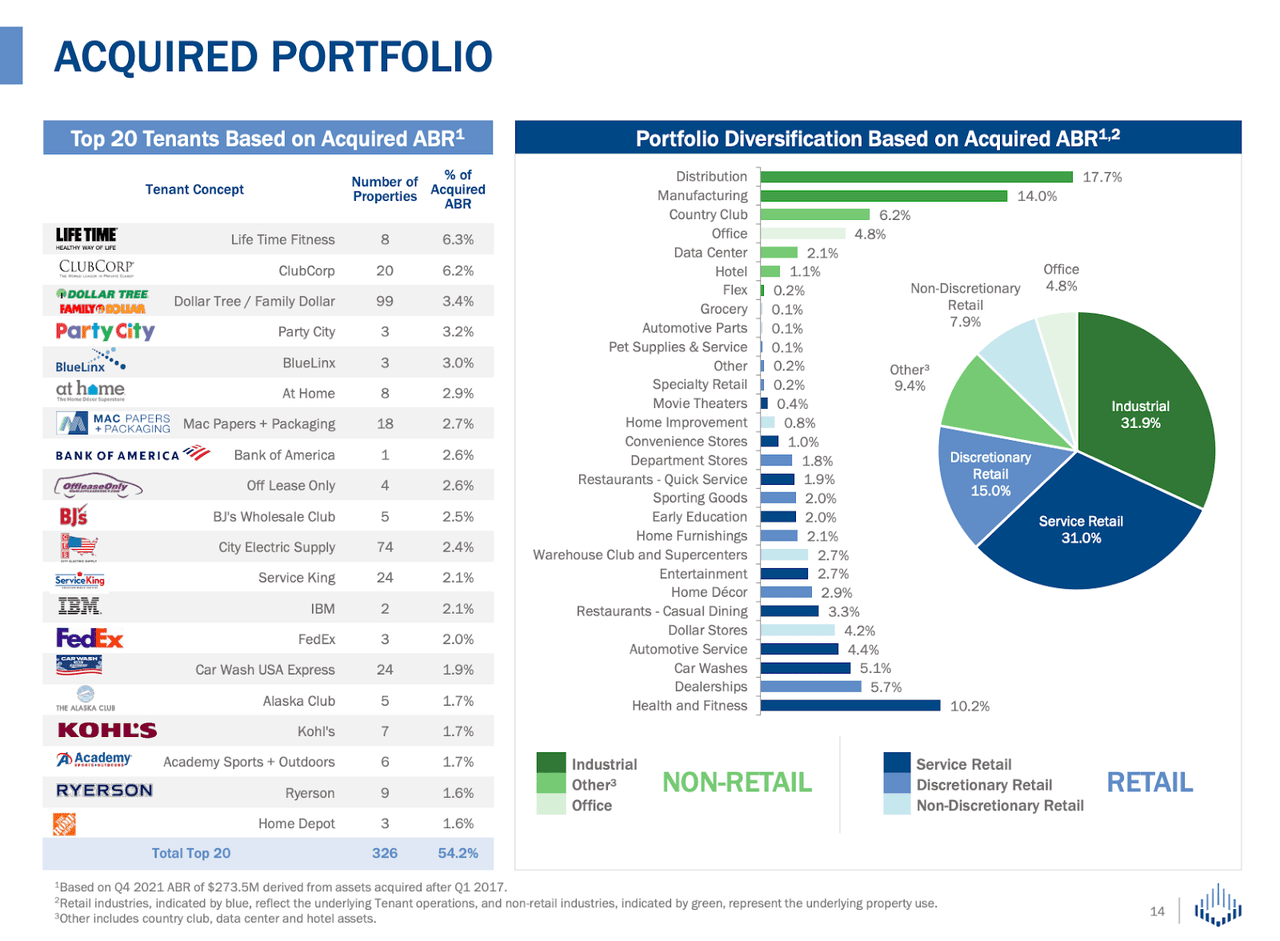

This is the blueprint for success that the best of the best triple net lease stocks have taken advantage of in the past. However, in recent years we’ve seen SRC management pivot towards a much more diversified portfolio and ultimately, we believe that the unique nature of this company’s holdings have caused uncertainty (and ultimately, fear) in the market.

But, fundamentally speaking, we believe this fear is irrational.

It’s true that it’s hard to find relative comps for things like the major country club acquisitions that Spirit has made in recent years. However, coming out of the pandemic period, there is interesting upside potential attached to these leisure/entertainment assets.

But, the major acquisition area that SRC has focused on in recent years is the industrial space. As you can see below, the company has allocated a great deal of capital towards the distribution and manufacturing industries, both of which dwarf the country club investments.

Q4-21 SRC Presentation

We’ve seen others in the net lease space, including Realty Income, allocate capital towards the industrial space because of the strong cash flow multiples that are traditionally placed on the rents collected from these generate.

Spirit’s industrial exposure has more than doubled during the last 5 years, rising from 7.9% of ABR in 2017 to 18.6% in Q4 of 2021.

Therefore, while it’s true that SRC continues to offer exposure to relatively risky industries (theaters, gyms, hotels, and office assets), we believe that the low overall multiple attached to shares here does not fully appreciate the company’s industrial holdings.

Historically, pure plays in the market have been awarded higher multiples than stocks with highly diversified conglomerate structures. This boils down to the unpredictability of more complex holdings; however, there is also something bullish to be said about the ability of a highly diversified portfolio to perform well throughout a wide variety of economic conditions.

And, moving forward, we believe that SRC has what it takes to generate reliable bottom-line growth due to the diversified and well balanced nature of its portfolio.

Q4-21 SRC Presentation

SRC’s focus on diversification has allowed management to acquire buildings with strong rents and reliable tenants. The company’s occupancy ratio was 99.8% at the end of 2021, representing one of the highest results that we see in the entire net lease space.

And, while the company offers exposure to a wide variety of properties/tenants, SRC’s portfolio still offers exposure to the long-term leases (the company’s weighted average lease duration is 10.4 years) and the reliable rent escalation (SRC’s Q4FY21 acquisitions came with an average rent escalator of 1.8%) that net lease REITs are known for.

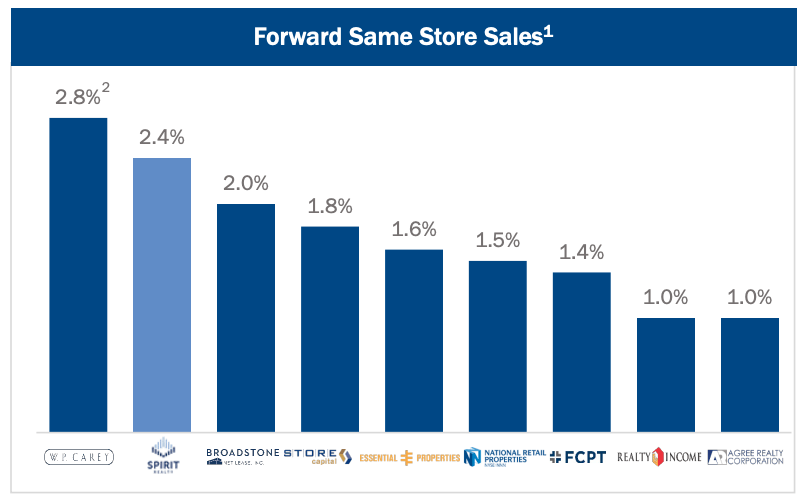

Finally, SRC management points out that its portfolio offers near best-in-class performance, with regard to forward same-store sales estimates. Looking at the chart below, we see that SRC trails only WPC, which is another REIT that offers exposure to a very diversified portfolio, showing that flexibility can offer upside in terms of growth.

Q4-21 SRC Presentation

In short, this company’s unique portfolio, relatively low valuation, and solid growth prospects allows investors to have their cake and eat it too, with regard to the diversification, growth, and total return prospects.

The combination of the stock’s 5.6% dividend yield, the high single digit AFFO growth that it’s expected to produce in 2022, and the potential for multiple expansion up towards its peer average results in immense near-term upside potential.

If the stock were to hit 2022 consensus AFFO estimates and trade with a 16.5x multiple, resulting in a share price which is in-line with our $59/share fair value estimate, we’re looking at a ~46% annualized rate of return by the end of this year.

Moving forward, if these shares were to hit consensus growth targets and maintain this ~16.5x multiple moving forward, investors accumulating shares today with a sub-13x forward multiple attached to them would be setting themselves up to generate ~20% annualized returns over the next several years.

Fast Graphs

In terms of total return prospects, it doesn’t get much better than that in the high yield space. Therefore, after its recent sell-off, iREIT gives SRC shares a “Safe Strong Buy” rating, making it one of the most intriguing opportunities that we see in the REIT space today.

Be the first to comment