dottedhippo/iStock via Getty Images

If you have been paying attention, even a little bit, to the stock markets so far in 2022, you are well aware that so far it has not exactly been a “refrigerator door” year for stocks. This is particularly true for speculative growth names, such as the focus of this article, Spire Global (NYSE:SPIR).

In this article, I would like to dig into market sentiment and why I believe the stock is likely to languish in the near term, even with the recent contract wins, and go over why I still believe this company has a place in a long-term focused speculative growth portfolio.

If this article is your first introduction to the company, I would recommend viewing my prior coverage of Spire here to get a more in-depth view of the business as a whole.

Recent Wins

Spire, frankly, went on a bit of a tear recently ripping off four contract wins in only 8 days from the likes of NOAA, NRO, & NASA. The shares, unfortunately, realized precisely zero gains from the news and in fact, noticeably dropped alongside the markets.

NOAA or the National Oceanographic and Atmospheric Administration, year to date, has awarded Spire four contracts worth $23.6 million. While this would not likely move the needle for most companies, for Spire, who is expecting to do only $81.3 million in revenue during 2022 and sporting a mere $159 million market cap, this is a decent-sized group of contracts.

The most recent wins include $9.9 million for a contract that runs from Jan 18th, 2023 to July 18th, 2023 and focuses on near real-time data used in formulating weather models which are distributed globally. An additional $4 million contract was awarded by NOAA focusing on Spire’s hyperspectral microwave sensing platform to explore its value in improving model forecasts.

In addition, the NRO or National Reconnaissance Office awarded Spire a study contract to evaluate the company’s ability to geolocate GPS jamming attacks as well as the ability to track and monitor aircraft. The NRO is basically a military spy agency integrated with the Pentagon which focuses on space-based observation assets.

As Spire operates what it claims is the largest commercial radio occultation-based satellite constellation, one can easily imagine how the NRO could utilize all of the vast amounts of data collected by the company and I do not believe that this is the last we will hear about Spire and the NRO or other military agencies.

The Profitability Hurdle

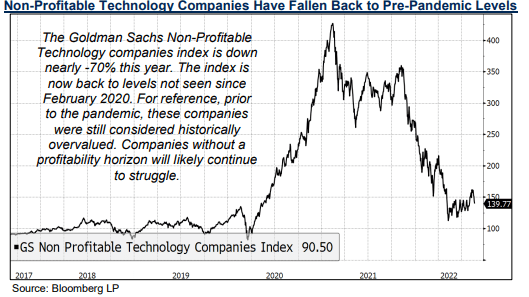

It has become abundantly clear that the market simply refuses to award any meaningful value to companies that do not produce a profit. Unfortunately, Spire firmly falls into this group.

Bloomberg LP

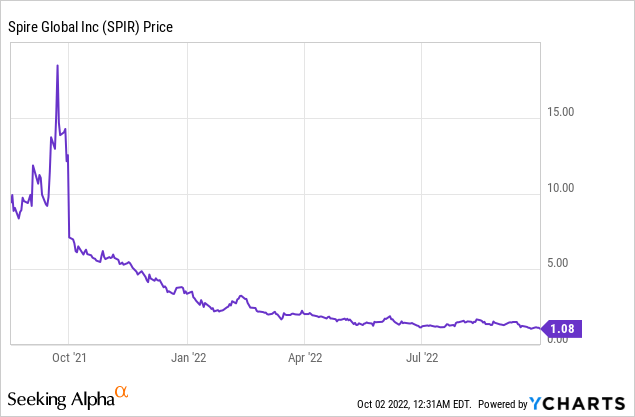

Spire had the terrible luck of going public via SPAC literally right before the bottom fell out in mid-2021, so the company was unable to benefit from the rather extreme rise in valuations during the 2020 time frame, yet seemingly realized nearly all of the pain from the decline thereafter.

This pain does not look to be anywhere near an end given the Federal Reserve appears to be somewhat locked in on continued rate increases to fight inflation along with the subsequent economic pain to come.

Spire does not have many near-term options in accelerating its quest to become a profitable enterprise as it continues to build out its infrastructure and sales team, along with investing in the end product that the company provides which is useable and actionable data for corporations and governments around the world.

The company, as of the Q2 call, reiterated its intent and goal to be cash flow positive within 19 to 25 months, placing that date around February to August of 2024. There is no way to sugar coat it, the company is in for a very bumpy ride until they can prove to the markets that they can become a profitable business.

Balance Sheet

Do they have the cash currently to reach profitability? A firm maybe is all that I can muster at this point.

The company, as of Q2’s report, had $93 million in the bank, thanks largely to the funding agreement with Blue Torch, with a further $20 million expected to be released once the company reaches certain conditions that are expected to be met by year’s end.

Upon the closing of the Blue Torch funding agreement, I was fairly confident in the ability of the company to reach profitability without the need for further capital, however, the FX markets have severely impacted the company and they appear to get worse literally by the day.

The company has customers in over 60 countries worldwide and they are exposed, head-on, to the rapid strengthening of the US dollar around the globe. For every dollar in revenue denominated in a foreign currency booked at the beginning of the year, the company can only expect roughly 80 to 85% currently. For a company such as Spire, this is a brutal headwind to face.

Recently, the company filed an $85 million shelf registration with Canaccord Genuity, giving the company the option to sell shares in the open market. This agreement, in my opinion, appears to be a placeholder in case the company is unable to reach profitability before its cash reserves dry up. Utilizing this facility in any significant amount, at the current dreadful market valuation, would indicate to me extreme distress.

Bottom Line

Spire has been completely ripped to shreds by the bear market that has unfolded during late 2021 and so far in 2022. The paltry $179 million enterprise value awarded to the company implies that the market does not expect the company to become profitable and likewise is set to run out of cash.

This is the chart of a failed company. Spire, in my opinion, is not a failed company. Conversely, I view this chart as a massive potential opportunity.

Spire has a product that is difficult to reproduce, relatively expensive, and time-consuming to build, and has a positive and productive relationship with government entities that require the data that the company gathers.

Accurate global weather data, military intelligence data, and real-time logistics data are firmly in need across the globe right now and are likely to be in very high demand for many years to come. Spire produces this data in droves and has the largest commercially available constellation dedicated to precisely this type of data.

The company is currently in a race against time to reach profitability before its cash runs out, the market is clearly not going to do it any favors, and any reasonable equity funding is firmly closed off given the dilution required. The rewards, if the company is able to reach profitability, are potentially massive.

This is a lotto ticket, make no mistake, it is either boom or bust for Spire, no third option is realistically on the table. The company, in my opinion, will either fail spectacularly, run out of cash, and go to zero, or succeed, become profitable, and provide incredible returns from current levels.

I continue to view the latter as a more likely outcome, though more short-term pain may be ahead, I remain bullish and fully invested at current levels.

Let me know your thoughts below in the comment section. Thank you for reading and good luck to all!

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment