Joe Raedle/Getty Images News

Main Thesis & Background

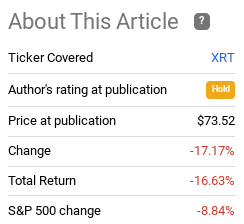

The purpose of this article is to evaluate the SPDR S&P Retail ETF (NYSEARCA:NYSEARCA:XRT) as an investment option at its current market price. The fund’s objective is “to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Retail Select Industry Index”. I covered this fund about four months, when I suggested investors tread cautiously. I was right about that part, although I probably should have recommend outright selling it. This is because XRT is down almost twice what the S&P 500 is since that article:

Fund Performance (Seeking Alpha)

Given this divergence, I wanted to take another look at XRT to see if there was value here. Based on price action alone, it looks like there is, but I have concerns.

Namely, I am not convinced the American (or global) consumer is “out of the woods” yet. Inflation is a persistent problem, and energy prices are not likely to come down materially in the months ahead. The summer vacation season is upon us, and shortly after that households in harsher climates are going to have to contend with rising heating oil and natural gas prices. In addition, personal spending has been weak domestically, driven by both inflation and weakening consumer sentiment about the future. Finally, XRT’s largest sub-sector by weighting is apparel retail. This is an area consumers can easily cut back on if they are trying to limit their overall spend.

What’s The Problem? One Word – Inflation

To begin, let us reflect on the primary driver for why XRT is down so much this year. Clearly, a drop of 17% since early March is a pretty massive blow, so what has been happening to justify such a move?

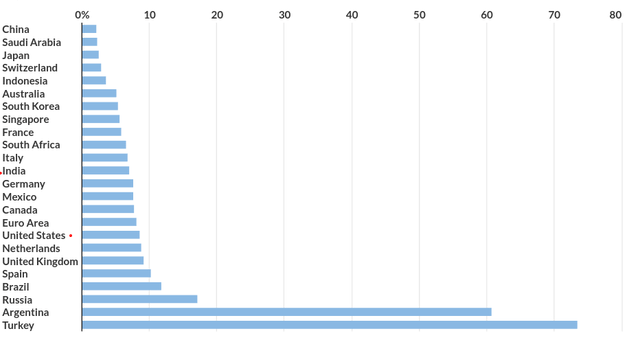

The key is inflation. This is probably not a surprise because it has been the headwind for most of the market in 2022. But this is especially true for cyclical sectors like Consumer Discretionary, extending in to retail. Unfortunately, the major companies that make up this sector are not able to simply “make up” for the challenging U.S. environment overseas. This is because inflation is a global problem, hammering consumers around the globe.

In fact, despite some dubious statements from government officials to the contrary, the U.S. actually sits near the middle of the pack in terms of inflation (by G20 standards). Multiple nations are seeing even worse price increases, suggesting retail companies are going to have a hard time no matter where they try to sell their products:

Inflation Rates (G-20 Countries) (World Bank)

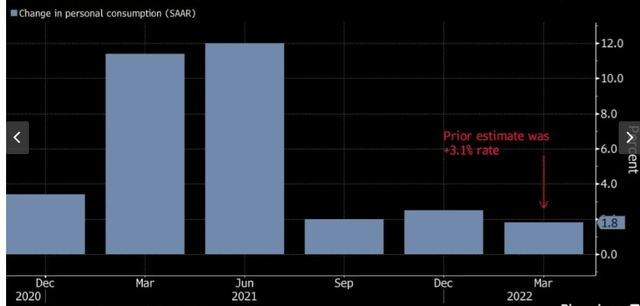

This matters because inflation eats away at spending power. As prices go up, number of goods purchased has to go down if all other variables stay the same. Of course, things like stimulus checks and rising wages can offset the blow somewhat on a household to household basis. But none of the demand-side variables have been great enough to suggest the consumer isn’t in a very difficult spot. The extension of this inflation challenge can be seen in the weak personal consumption (spending) figures that are released in the U.S. on a quarterly basis:

Change In Personal Consumption (Seasonally Adjusted) (Yahoo Finance)

My thought here is there is just too much broad weakness coming out of sales figures, and inflation is a big driver of this reality. If one assumes inflation has peaked and/or is going to decline soon, then perhaps retail is a good play right now. But, in my view, even if inflation has “peaked”, it is still much too high for most American households and I don’t see strong enough catalysts that are going to reverse that trend materially enough in the short-term. The American consumer will likely continue to register weak consumption figures over the second half of the year, and that is a serious headwind for XRT.

The Consumer Is Extremely Pessimistic

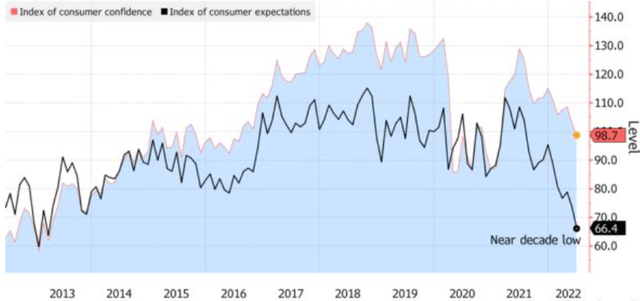

In addition to inflation, there is another factor limiting consumer spending growth at the moment. This is sentiment, which is influential on how willing consumers are to open their wallets right now. Of course, sentiment is fickle, and can change constantly and quickly. Further, a rapid drop in sentiment can often suggest a contrarian buy opportunity, so that is one thing to keep in mind. (The thought being if things can’t get any worse, share prices should rise in the months ahead).

The problem retailers are facing currently is that consumer sentiment is indeed dropping off a cliff. Inflation is one reason why, but there are geo-political headwinds, such as war in Europe, supply-chain issues, and fears over shortages of many goods. This has pushed consumer confident to a multi-year low, and consumer expectations to a near decade low:

Consumer Index Levels (Bloomberg)

These are two important measures impacting consumer-dominated sectors. If consumers don’t feel confident in their current or future prospects they are not going to spend. While I do tend to find myself looking for contrarian plays, I don’t see this as the right idea at this moment. Yes, multi-year lows and decade-lows in sentiment could suggest better days ahead. But I think this will take months, not weeks, to really start to impact consumers in a positive way. This tells me that while downside may not limited, investors do not need to rush in at this juncture. This supports my “neutral” outlook.

Savings Rates Show A Catalyst Is Lacking

Another issue with retail in the immediate term is that consumers are already running on (almost) empty. What I mean is that over the past few years, savings rates had spiked. Consumers hunkered down during the onset of the pandemic and savings went up dramatically. Then, as businesses and countries re-opened, consumers had money to spend. This led a consumer-driven recovery, and helps explain why the economic impact of of the pandemic reversed so quickly.

Fast forward to today, and that story has changed. Inflation has eaten away at paychecks. Stimulus checks and other government programs have begun to dry up. American households are being forced to spend their own money, as well as dip in to savings. In fact, savings rates not only down substantially in the last year, they are below pre-pandemic levels:

Personal Savings Rates (U.S.) (St. Louis Fed)

What this suggests is that consumers can’t keep pace if inflation / prices keep on rising. They can only dip in to a little more savings before credit become the next option. While that can shore up sales temporarily, it is not a sustainable trend. Before retail and consumer discretionary can truly pique my interest, I need to see wages rise and / or inflation cool. Until then, savings rates are a very real signal that the average American isn’t a reason to be bullish just yet.

Apparel Is Challenged

Digging in to XRT specifically, there are other reasons to be cautious. One reason is the top sub-sector in the fund, which is retail apparel:

XRT’s Sectors (State Street)

There are some positives to this. As consumers begin to return to the office, demand for business attire grows. As economies have opened back up to in-person travel, as well as their leisure and entertainment venues, consumers may need new clothes to wear out. So those trends are working in its favor.

Unfortunately, there are some negatives as well. Discretionary spend on apparel is bound to take a hit from both inflation and persistent consumer worries about the future. Most Americans probably already have plenty of clothes, so that is something that is easy to cut back on in the short-run if you need to free up cash for non-discretionary purchases. In addition, many apparel retailers are heavily dependent on supply-chains that are under pressure. Many well-known brands are assembled overseas in places like Central America, Vietnam, China, among other nations. This has made getting goods to final destinations in the U.S. more challenging and expensive. Lead times are rising, and energy costs are making shipment more costly. All of these factors impact profit margins in this space.

Beyond that, there are domestic labor issues that are also making the investment landscape more difficult. In order to bring workers back in to stores, retailers have had to raise compensation and benefits for staff, as well as instill other ways to focus on the employee experience, as well as the customer. I’m not saying this is “bad”, it may even be good for society at large, but it does add to the expense column. Retailers and consumer products companies are spending more for hiring and retention, and that is going to pressure share price multiples going forward. This is true whether the retailer is selling apparel, or any other consumer good.

I Suggest Patience, But I’m Not Overly Pessimistic

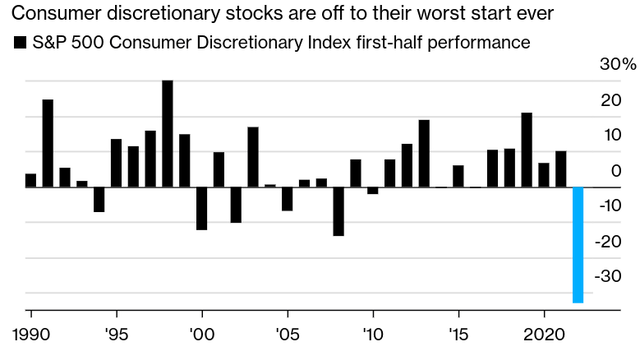

Through this review I have taken a more somber tone. This is largely because I have a position in XRT, have been disappointed with YTD performance, and I’m reluctant to throw good money after bad at this juncture. Yet, I would not consider this an outright sell either. There could be light at the end of the tunnel if wages rise, inflation cools, or consumer sentiment changes – which it is known to do quite often! The retail/consumer discretionary sector has already taken such a beating in 2022 that it really doesn’t make a lot of sense to predict another large drawdown from here:

Sector Performance (Bloomberg)

As you can see, things are very bleak right now. This has been an unusually large sell-off, and one that is bound to turnaround eventually. History supports that notion. I simply am advising investors approach with caution and probably ladder-in because the macro-environment isn’t strong enough to support a rapid turnaround. But if we look back at historical norms, it is hard to see an aggressive bear case at this level.

Bottom-line

Retail is not for the faint hearts. Inflation is a major sore point, and consumers are loudly proclaiming their dissatisfaction with current affairs. Looking ahead to the second half of the year, I would stay cautious on XRT. Value is starting to emerge, but there is no need to rush in at these levels. The backdrop will remain challenged for some time, so pick your spots carefully. As a result, I will be keeping the “hold” rating for this ETF in place, and suggest readers remain patient at this time.

Be the first to comment