CihatDeniz/E+ via Getty Images

Main Thesis and Background

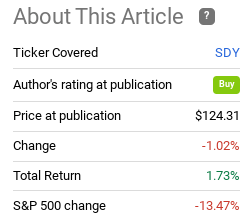

The purpose of this article is to evaluate the SPDR S&P Dividend ETF (NYSEARCA:SDY) as an investment option at its current market price. This is a fund I have written about and owned for a long time. For the most part, it has served me well, and this is why I have emphasized it over the years with my followers. While this has been a long-term, core holding for me, I thought a review now was timely as we begin to focus on the end of 2022 and thus the beginning of 2023. I conducted the same exercise regarding SDY last year on this exact date and its relative performance since then has been impressive. While SDY’s gain is not large by any measure, it compares well with the S&P 500:

Fund Performance (Seeking Alpha)

Clearly, this is strong out-performance. Sometimes just having slight gains and/or lower volatility can be a big win, and the past year has definitely highlighted that. With many of the same concerns floating around at this end of this year as in the beginning – war in Europe, heightened inflation, and aggressive central banks – I don’t see any reason to change things up dramatically at year-end. SDY has been a winner for me in 2022 and this is a story that could likely repeat in 2023. Therefore, I feel a “buy” rating is appropriate, and will explain why in detail below.

The Market Isn’t Cheap – Keep Being Selective

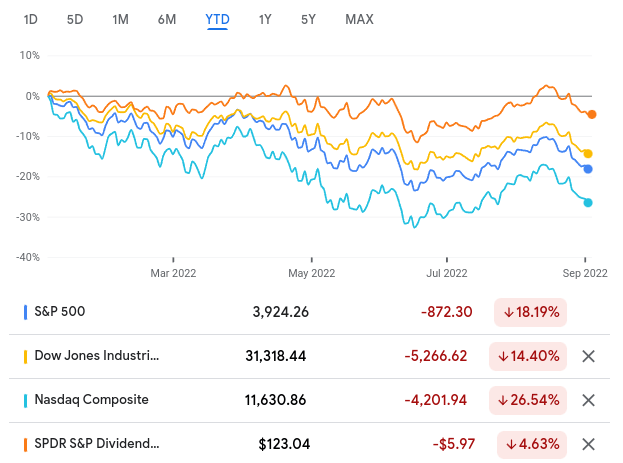

To begin this review, I will take a look at the broader equity picture. This considers where we are, how we got here, and will I continue to believe a more defensive and selective approach to equities is critical to wrap up the year. I would suspect pretty much everyone who follows the stock market knows that 2022 has not been a very good year. All three major U.S. indices are down, and by a wide margin. While SDY is also in the red, we should note the considerable out-performance compared to these indices:

YTD Performance (Google Finance)

This is important because when we consider dividend payouts we can figure that SDY is down about 3% this calendar year. Is this something to really celebrate? It depends on your outlook – but for me it definitely is when I factor in that the Dow, S&P 500, and Nasdaq are all down by double-digits.

There are a couple ways to look at this. One might be that the major indices have fallen too hard and are in “buy” territory. This is probably true with respect to the Nasdaq – a 26% drop can be quite enticing! The S&P 500 is being dragged down by similar headwinds for the Tech sector. Given that it is sitting near bear market territory, this is also a reasonable entry point. So with this outlook it could make sense to buy up this indices instead of a fund like SDY.

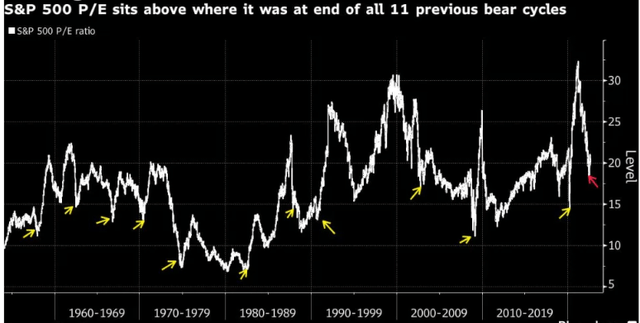

The challenge to that thesis is the other way of looking at it – that the drop in the broader market is not yet over. While buying in during bear markets can be rewarding over the long term, it can also be painful in the short-term if the losses continue. Nobody knows when a bear market will “end”, so any equity investor has to be prepared for more losses in this climate. Furthermore, we have to consider that corporations are facing challenges with rising labor and input costs. This has pressured earnings and has resulted in the S&P 500 being less cheap than one might think when we consider the 18% drop in price. In fact, if we look at prior bear market cycles, we see the S&P 500 often has a P/E ratio much lower than the one it currently has:

Historic P/E Ratios – S&P 500 (Bloomberg)

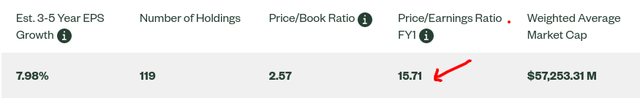

The takeaway here is that I would continue to be cautious in equities despite what looks like a screaming buy opportunity. Markets are down and stocks are cheaper. But they aren’t “cheap”, and plenty of headwinds remain that could pressure valuations further. This leads me to SDY. While this fund is by no means guaranteed to post gains going forward, it has a relative valuation advantage against the S&P 500. This piqued my interest in a big way:

My thought is that SDY has an advantage here that is worth gaining some exposure to. The fund has been a smart place to be since last year, and this type of dynamic convinces me there is plenty of merit to holding it for next year as well.

Uncertainty Abounds, The World Is Not United

I want to shift to a more macro-themed discussion now. This is important because it helps to highlight why I am being more defensive and selective at the moment. As my readers know, I have shifted my portfolio to a less aggressive and discretionary stance over the past few months. This has involved buying up developed markets with limited Euro-zone exposure, raising cash, and, importantly, pumping up my core dividend positions.

This reasons for this are multi-fold. Inflation is a major factor, as well as central bank rate hiking. Both of these factors make me want exposure to dividend paying companies to buffer the impact of inflation to a degree. The other is the relative safety and stability that dividend paying companies provide. This is especially true of SDY’s portfolio, which holds companies that have a strong track record of raising their income streams. This gives me confidence I am owning exposure to management that wants to return capital to shareholders – an attribute I hold near and dear to my heart.

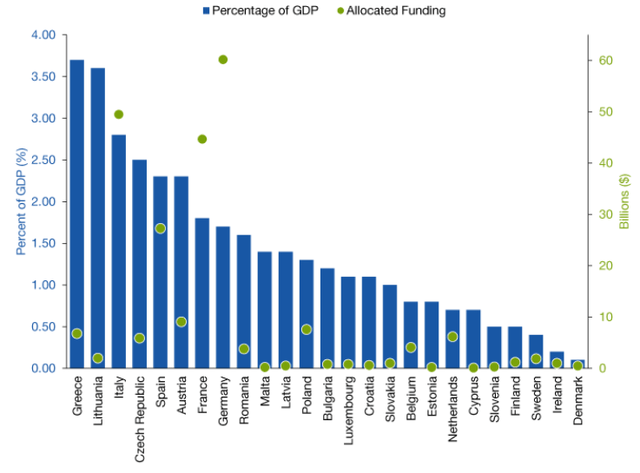

This begs the question – why is this important? For me it just highlights the need for simplicity and stability. The world is in a difficult spot. We have continued supply-chain issues and input shortages, driven by both the pandemic and military conflict. China’s ambitions are growing in the Asia-Pacific region and it is unclear what the West can do (or should do) to counter-balance this effort. Central banks are raising borrowing costs to quell inflation, which is particular untimely for regions that are struggling with escalating food and energy costs. The point being these governments are already spending a larger share of their revenue on coping with these geopolitical challenges at a time when borrowing is now becoming more expensive. This paints a difficult investment backdrop, especially for central and southern Europe:

Government-Allocated Funding To Offset Energy Costs (Lord Abbett)

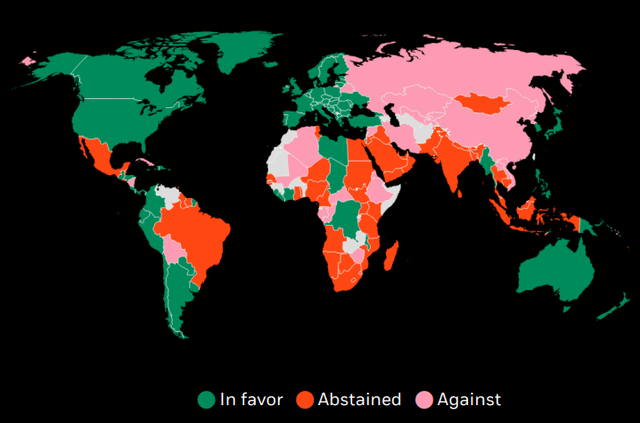

If it sounds like I am critical of the investment landscape right now it is because I am. The implication is that I see a host of macro-challenges with no real resolution in sight. The energy crisis is real and going to get worse come the winter. While some optimists are hoping for the best, I am not, because I am not sure what is going to change between now and November/December that is going to alleviate the supply shortage. Even the world’s response to the Russian invasion of Ukraine has not been a united one. This was one of the primary drivers of rising energy costs and yet many nations did not want to go on record of disapproving of that military action:

Results of the UN Vote to Suspend Russia from Human Rights Council (BlackRock)

All of this adds up to an environment where I want quality companies that have more stable revenues. This relates to SDY because those are the types of companies this fund offers. This is a U.S.-centric portfolio dominated by stable dividend streams. With all the uncertainty in the world, I want a portfolio I can count on. SDY is a fundamental part of that make-up.

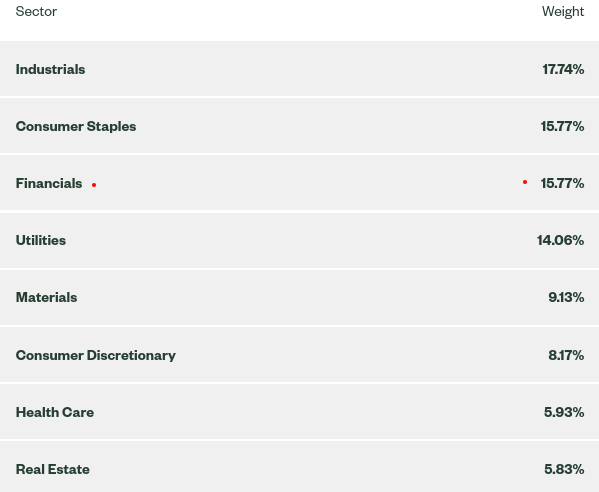

SDY’s Sector Weightings Make An Attractive Portfolio

I will now shift to SDY’s portfolio. This discussion will focus on the sector weightings within the fund, which are key to why I have wanted exposure to this long-term. Fundamentally, I have appreciated SDY’s diversity compared to the S&P 500. While that index is Tech-dominated and also very Consumer-centric, SDY has larger exposure to Industrials, Consumer Staples, Financials, and Utilities. This gives diversification benefits holistically:

SDY’s Sector Weightings (State Street)

For me, the overweight Financials exposure is one that I want in a rising rate environment. While stocks had been rallying in August in the hopes the Fed would shift to a more dovish stance, the last few weeks put that outlook on the back burner. By contrast, recent comments by Fed officials suggest the rate hike cycle is not nearly finished, and the hopes for declining rates in 2023 are a long shot at best. For example, Cleveland Federal Reserve President Loretta Mester threw cold water on dovish predictions in remarks last week:

My current view is that it will be necessary to move the fed funds rate up to above 4 percent by early next year and hold it there. I do not anticipate the Fed cutting the fed funds rate target next year.

The conclusion I draw here is that rising rates are going to be a reality for the next 6-12 months. This is going to challenge equities broadly, especially growth equities. There really is not an easy way to get around this headwind. As yields rise, the income from bonds and savings accounts become more valuable. Further, higher rates can lead to slower economic growth (or negative growth) and can pressure stock valuations across the board. But Financials offer a unique buffer against some of these risks. As borrowing costs rise, Financials pass on higher rates to their customers. The result is higher net income from interest, offsetting declines in other areas that may be more economically sensitive (like trading or loan quality). This suggests to me that Financials remain a reasonable hedge, and SDY gives me that exposure.

Industrials Exposure Will Hurt If Growth Evaporates

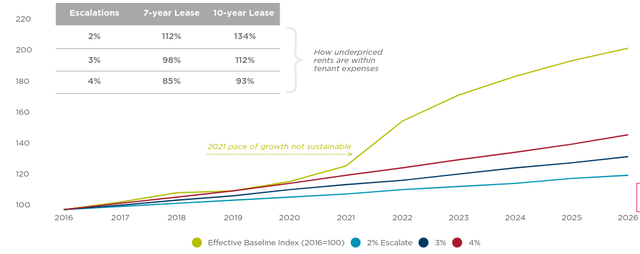

In this review I have mentioned a few key reasons why I think SDY will serve me well in 2023. I think quality, domestic companies are a reasonable way to play volatility and economic uncertainty. But this does not guarantee gains. Any U.S. equity portfolio is going to see its share of challenges if the recession gets worse and/or if global headwinds impact investors across the board. Industrials are a cyclical sector, so look for these holdings to pressure SDY’s total return if the U.S. recession drags on or gets worse.

In addition, we should not be blind to the difficulties manufacturers and producers are facing right now. These include work shortages, rising input costs, and higher rents. All of these factors pressure net profit and income. So far, U.S. companies have been able to pass through a good deal of their inflationary pressures to their customers. But not all of these costs can be passed on, especially if cost pressures keep escalating. For example, higher rents on office and plant space are squeezing companies in the Industrials sector, as shown below:

Rising Industrial Rents (Cushman and Wakefield)

Ultimately these companies are earning more in nominal terms because of inflation. So rising nominal costs via rent and labor are offset to some degree. I am not saying to flee this type of investment as a result. But it does project a risk that investors need to be aware of. While I am bullish on SDY, I want to manage expectations that this is not a risk-free play.

Bottom-line

The last 52 weeks haven’t been all that rosy. But looking back we see that SDY has managed a slight gain while the broader market dropped by quite a bit. This is really the whole point of this type of fund – to offer defensive and more reliable exposure when the climate is difficult. Looking ahead, this is the type of climate I expect in Q4 and early 2023. This means my outlook for SDY remains unchanged. I want this exposure, and will keep on adding through the end of the year. As a result, I am reiterating a “buy” rating on this fund, and suggest readers give this fund some consideration at this time.

Be the first to comment