chonticha wat/iStock via Getty Images

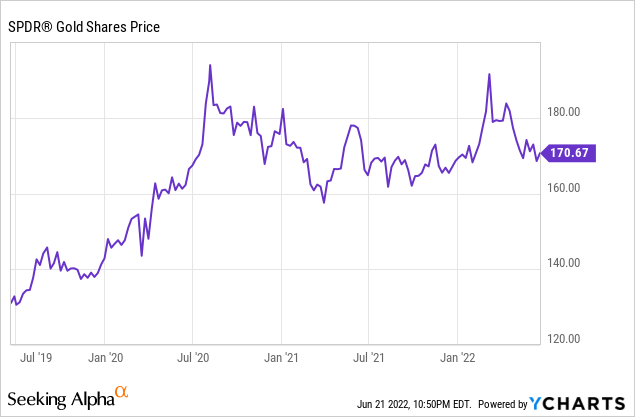

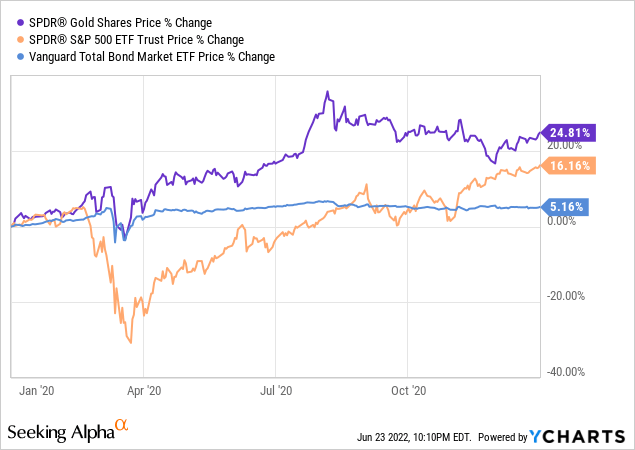

The SPDR Gold Trust ETF (NYSEARCA:GLD) looks poised to generate very attractive risk-adjusted returns from current levels. After serving as a valuable portfolio diversifier and stabilizing force in the midst of incredible market and economic volatility and uncertainty in 2020 – even hitting a new all-time high in August of that year – GLD turned in a disappointing performance in 2021:

The reasons for this primarily included:

- An increasingly bullish outlook on the global economy as COVID-19 deaths and cases were finally tamed and economic behavior began normalizing.

- Profit-taking from gold gains to reallocate into other opportunities

- Rising bond yields

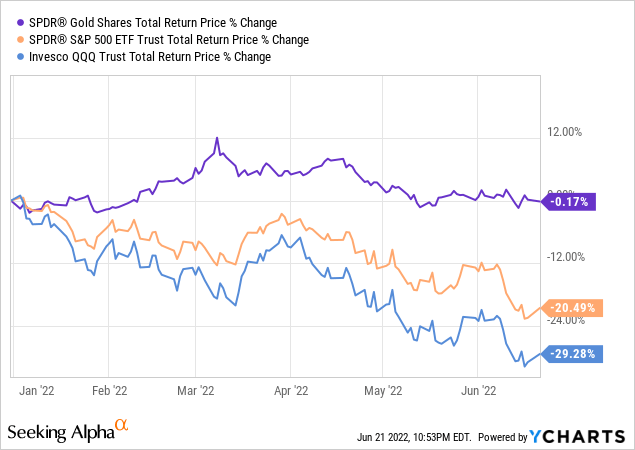

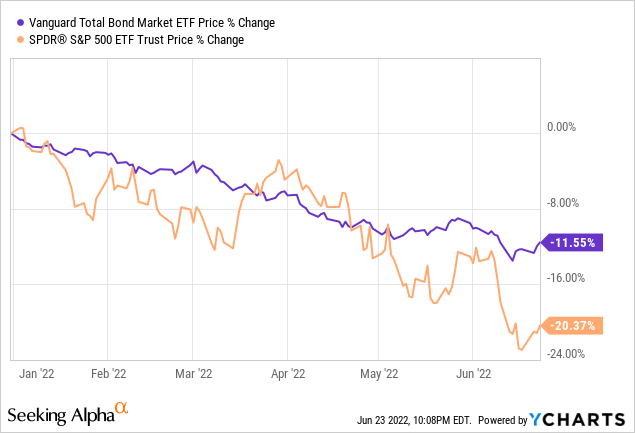

Despite this tough year where GLD badly lagged market indexes like the S&P 500 (SPY) and Nasdaq (QQQ), GLD has once again taken the lead relative to the market indexes in 2022, holding up admirably well in the face of rapidly rising interest rates while the equity markets have tanked:

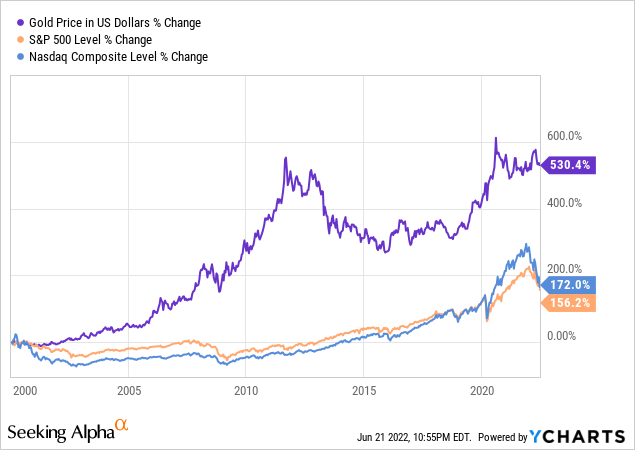

In the process, it has further padded its massive lead as the best performing investment of the 21st century compared to market indexes and virtually any other mainstream long-term investment asset class:

After consolidating its strong run from 2019 through 2020, GLD looks ready to resume its long-term uptrend in the near future. In addition, there are several catalysts to accelerate price increases which we will look at in the remainder of this article.

#1. The U.S. Dollar’s Days As The Global Reserve Currency Are Nearing Their End

Perhaps the biggest reason why we are bullish on GLD right now is that the U.S. Dollar’s days as the global reserve currency are nearing their end.

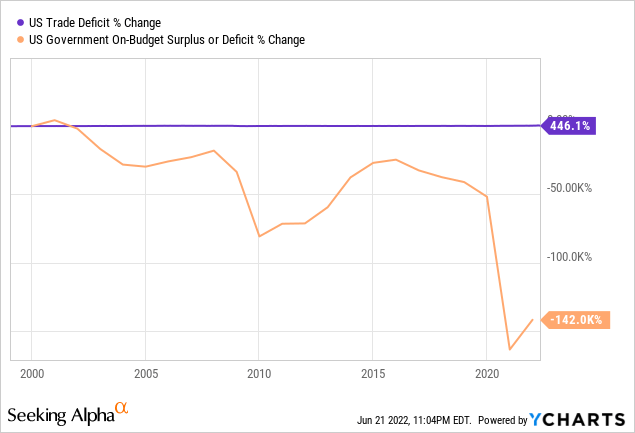

While the U.S. government’s abuses of its enviable status as the issuer of the world’s reserve currency is evident in the persistently massive and yawning trade and budgetary deficits that the country has run, it appears the chickens might be finally coming home to roost.

For example, back on February 26th, the G7 and European Union decided to freeze the U.S. Dollar and Euro currency reserves of the Russian Central Bank. Given that 60% of Russia’s international currency reserves are in these two currencies, and it is such a major nation (a leading nuclear power, veto power member of the U.N. Security Council, a major oil exporter, and major power broker in the Middle East). While this may have been an effective and relatively painless way to punish Putin in the short term, it could have enormous long term consequences for the U.S. Dollar in particular.

While countries all across the globe (in particular China) have aggressively built up their U.S. Dollar and Euro reserves in exchange for exporting hundreds of billions of dollars of goods and raw materials into the Euro zone and United States, this new development could change all of that. Essentially, the United States and Europe have told these countries that at any moment they could pull the plug on access to their foreign reserves and effectively default on their promise to accept their own currencies from foreign nations in exchange for reciprocal goods and services. This is a huge deal, as central banks around the world hold over $7 trillion in U.S. Dollars.

Russia has responded to this effort by establishing a gold price floor on its currency, and also is no longer accepting Euros as payment for its exports. As Russian Duma energy committee chairman Pavel Zavalny said:

Let them pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency.

With Asia rapidly growing in economic prominence, the United States’ repeated abuses of its own currency, and the West’s most recent actions towards Russian Dollar reserves, the U.S. Dollar monopoly as the global reserve currency is in greater trouble than ever before. If/when China goes to war with Taiwan and if the U.S. decides to follow a similar tactic in sanctioning China, things could go downhill very quickly for the U.S. Dollar as the global reserve currency. Russia has already rejected it, and China could be very close behind.

#2. GLD Remains An Excellent Portfolio Diversification Tool

While traditional portfolio theory (as well as Ray Dalio’s All Weather Portfolio) has viewed bonds as a sufficient diversification tool relative to stocks (bonds and stocks have only had four years out of the past 90 where both declined), that system of checks and balances seems to have broken in 2022:

Meanwhile, GLD has served as a stabilizing force, with flattish returns year-to-date. A similar pattern emerged in 2020 during the COVID-19 volatility. While the stock market crashed in the wake of the COVID-19 outbreak, GLD held its value remarkably well and significantly outperformed bonds (BND) through the initial mayhem and over the course of the full year.

With significant uncertainty about the path ahead for the economy – and much of that uncertainty surrounding geopolitical risks and inflation – there is arguably no better portfolio diversifier than GLD, especially given the liquidity that GLD offers along with the ability to trade options against it with considerable liquidity.

#3. Nominal Interest Rates Are Unlikely To Remain Elevated For Long

A third major catalyst that we see emerging for GLD in the coming years is that nominal interest rates are unlikely to remain elevated for long. The reasons for this are simply:

(1) Sovereign debt and deficits across the world – especially in the United States – cannot service higher interest rates for an extended period of time without some extremely unpopular policy decisions having to be made. On top of that, with a major geopolitical contest underway with China, the U.S. Government will need continued access to cheap debt in order to fund necessary defense, technological, and diplomatic investments to remain competitive.

(2) The economy is going to have a hard time handling higher interest rates, especially given how addicted corporations and individuals have become to debt. With the cost of capital going so high, growth will likely come to a screeching halt, pushing us into a recession. This will only further exacerbate point one and – with the extremely pivotal 2024 election right around the corner – there will be immense political pressure on policymakers to reduce interest rates before then in an effort to prop up the flagging economy.

(3) Related to point 1 as well is the fact that inflation makes the massive U.S. deficit and debt less significant, whereas raising interest rates and increasing the value of the Dollar makes the debt and deficit seem more daunting. It is therefore highly likely that policymakers will err on the side of more inflation rather than higher interest rates.

(4) There are massive technological forces at play right now such as artificial intelligence and machine learning, robotics, and other advances that will be very deflationary in nature. If/when these manifest themselves more fully over the next few years, inflation rates should come down substantially, freeing up policymakers to cut interest rates substantially while also reducing market pressures that also push interest rates higher.

As the chart below illustrates, with the exception of last year (for the reasons we have already listed), there is a strong correlation between negative real interest rates and higher gold prices.

| Year | Real Interest Rate | Gold Performance |

| 2010 | Clearly Positive | Up Significantly |

| 2011 | Clearly Negative | Up Significantly |

| 2012 | Clearly Negative | Up Significantly |

| 2013 | Clearly Positive | Down Sharply |

| 2014 | Slightly Positive | Down Slightly |

| 2015 | Clearly Positive | Down Sharply |

| 2016 | Clearly Positive | Up Slightly |

| 2017 | Roughly Zero | Up Slightly |

| 2018 | Slightly Positive | Flattish |

| 2019 | Slightly Negative | Up Significantly |

| 2020 | Roughly Zero | Up Significantly |

| 2021 | Clearly Negative | Down Slightly |

source: Author’s calculations comparing CPI, Long-term U.S. Interest rates, and Gold Price movements

As a result, given our belief that interest rates are unlikely to move higher over the long-term, the odds lie heavily in favor of gold prices moving higher.

Investor Takeaway

GLD offers investors an exceptionally attractive risk-reward profile right now thanks to the severe international and geopolitical headwinds facing the U.S. Dollar in the coming years and decades, its ability to serve as an effective portfolio diversifier, and the likelihood that nominal interest rates are likely to remain in a lowish band over the long-term.

As a result, we believe it is a good time for investors to ensure that their portfolio maintains a healthy allocation to the yellow metal, and GLD is arguably the easiest and most liquid way to do so.

Be the first to comment