jetcityimage

Dear readers,

In my last article on SpartanNash (NASDAQ:SPTN), I called it an interesting company to look at. I still do not own a stake in SpartanNash, but I think now that we have some clarity with regard to the future, it might be time to look at what the company could give us.

In this article, we’ll review if it’s a good time to get into SpartanNash, or when you could consider this company a decent “BUY” – specifically the valuation.

SpartanNash – An update

SpartanNash is in the attractive and recession-resistant segment of food solutions and services. That means the company delivers ingredients for food services for several customers. By ingredients, I don’t mean things like flour exclusively – but everything from grocery products to related stock to a combination of chain retailers and independent retailers, retail stores, government (military) commissaries and similar end markets/customers.

That description alone should be enough for you to at least theoretically understand why this company is attractive as an investment. Geographically speaking, SpartanNash serves customers across all states in the USA, as well as Columbia, Europe, Cuba, Puerto Rico, Honduras, Iraq, Kuwait, Bahrain, Qatar, and Djibouti – an interesting mix of geographies and markets based on where it services the US army and similar customers.

The business history goes back to 1917 (not SPTN, that goes back to 2013), in the form of the Grand Rapids Wholesale Grocery Company, which assumed the name Spartan Stores in 1957. For most of its history, the company was, surprisingly enough given its US location, a cooperative.

It changed to a profit-making company in 1970 and was listed on NAS in 2000. A number of accretive M&As and growth initiatives later, the company merged with Nash Finch, with Nash Finch and Spartan stores creating SpartanNash.

The company reports its operations in the following segments:

- Food Distribution focuses on the distribution of 65,000 SKUs (grocery products) to end consumers, but also to the company’s own retail stores. SpartanNash is by far one of the largest wholesale grocery distributors in the nation and is in the Top 5 in terms of annual revenue.

- Retail holds the aforementioned company-owned retail operations of 145 corporate-owned stores and 36 fuel centers in 9 states in the midwestern part of the USA. The brands here include Family Fare, Martin’s Super Markets, D&W Fresh Market, VG’s Grocery, and Dan’s Supermarket, ranging from 14,000 sqft up to 90,000 sqft on a per-store basis.

- Military focuses on contracts with brokers and manufacturers to distribute dry groceries, frozen foods, beverages, and meats to U.S military commissaries and exchanges. This is somewhat unique, as the company’s segment, with the third-party partner Coastal Pacific Food Distributors, is the only delivery solution to service the Defense Commissary Agency to this degree in the entire world.

So, again – plenty of available appeal here as a business. It’s neither seasonal nor especially volatile overall in its natural state – it all depends on the company making scaling work. We’ve seen some inflation, wage and fuel risks since we last wrote on the company, and these impacts have been clear here.

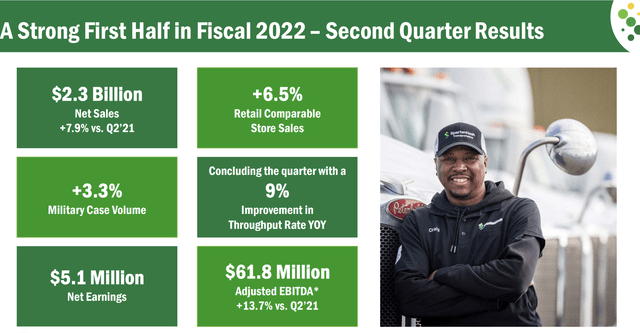

Despite this, the company has been able to perform solidly, with good half-year and 2Q22 results, reported in August of 2022. Sales, comp store sales, military volumes, EBIT, and earnings – all of it is up. The company has, therefore, so far, successfully navigated the increased cost environment they’ve been forced to work in since early 2022.

Moreover, SPTN has reiterated its guidance for the next 3 years. It targets over $10B in net sales and earns a 3% adjusted EBITDA from those net sales, which would be an improvement over the historical results. Remember, this is a low-margin business segment. Grocery players typically have a 1-4% operating income margin.

The company continues to work on its strategic, high-level priorities. SPTN is currently working on replacing its existing transport systems, including rationalization and standardization of several systems into a single larger system, or “stack”. SPTN has also implemented automated timekeeping, scheduling, and payroll across its entire network to make things more effective. All of this has been massive automation on a huge scale. SPTN has also implemented AI to help with inventory management and shrink process sizes across its organization.

As I mentioned in my initial article – the question I got was if this is a good investment. And based on its operations and where it works, I would say that the company can be a good investment. It’s been able to deliver good EPS growth for the past 10 years, and earnings continue to go up.

The company has clear shortfalls and risks. It still doesn’t have a credit rating. Its yield is relatively low on a sector comparison, and it does have debt above 40% of capital. This makes the case for the company difficult because, to be frank, there are plenty of opportunities out there that are much better than SpartanNash.

By “better”, I mean better credit rating, better fundamentals, better yield, and a technically better upside.

There’s also the not-insignificant fact that the company’s targets, mentioned above, are being challenged by shareholders. The company has confirmed that there is no M&A or buyout ongoing, and despite activists not getting to its targets, the dissidence remains. I frankly agree with management here – I don’t believe that a leaseback deal would be beneficial for the company, as it will erode shareholder value, but I also don’t know what the company should be doing instead, beyond what it currently is doing in trying to increase efficiency and use modern technology to reduce operating expenditures.

Let’s look closer at the potential valuation upside for the company here.

SpartanNash Valuation

The unfortunate fact is that the company trades at a valuation premium to its recent historical, 5-year average results. This always makes things difficult, but this is especially true when the company lacks a credit rating, is under shareholder scrutiny, and has the current host of issues that it has – despite the overall quality and upside being there.

SPTN needs to be valued on its own merit, and this puts the company, unfortunately, in a very different light.

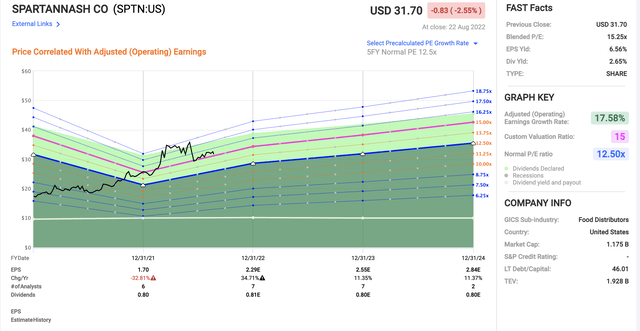

SPTN is still volatile, and this also speaks against investing in SPTN when it’s at a premium. Now, a 15.25x P/E doesn’t sound like much of a premium, but when considering it usually trades at 12.5x, it becomes one. The company is expected to improve EPS by 17.58% CAGR over the next few years until 2024E. Should this materialize, there is a 12.5x P/E upside of 18% to be had here, and a 15x P/E upside of almost 40%. That is impressive, all things considered, and makes it possible even to stomach the 2.65% yield in context to the relatively higher risk we’re seeing here.

However, accuracy for the company remains subpar at best. On a 2-year basis with a 20% MoE, analysts fail to forecast SPTN around 40% of the time negatively, and only hit accurate forecasts 50% of the time. There is plenty of ups and downs baked into the stock here.

SPTN Valuation (F.A.S.T. Graphs)

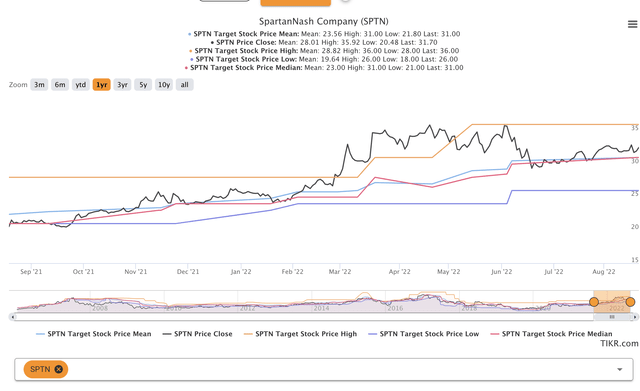

In my previous article, I clarified that some investors consider SPTN worth $50/share in a takeover scenario based on breaking up what the company actually does. I thought this excessive, and so did S&P Global, at least in terms of analyst price targets.

Based on 4 analysts, the average company share price target isn’t higher than $31/share, with the highest price target of $36, making the current $31.7/share above any average given by analysts here.

I am in agreement with these targets here. In the long-term, I would be unwilling to pay any more than 12.5X normalized P/E here – and that’s exactly the issue I have with SPTN. The current share price is well above the normalized P/E.

Even assuming a future 10% EPS growth rate (including the 2021 33% EPS decline) on a forward basis, this implies a share price of no more than $28/share.

SPTN Analysts Targets (TIKR.com/S&P Global)

Unlike many analysts, I do not often change my price targets. The reason is that those price targets are set with what I would actually pay for the company, not a target where I “might maybe reconsider looking at the business.” When I set a “BUY” target, that PT is where I would buy the company at.

I’m not changing my target for SpartanNash here. The takeover/M&A did not go through, and the company has fallen somewhat since my last piece. However, STPN has not fallen enough yet.

This makes the company a “HOLD” with a PT of $28/share.

Thesis

SpartanNash is, despite some of the appeal, a company with the following thesis:

- The company lacks the sort of upside that justifies investing at the current price of $35/share. The takeover offer isn’t in any way concrete or confirmed, meaning there’s a very real downside potential if it does not happen, or if the price does not meet market expectations.

- The company is fundamentally appealing – but I believe at current valuation levels, there are superior investments with better upside.

- I value SPTN to a $28/share PT, with a “HOLD” rating at the current valuation.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment