Boris25/iStock via Getty Images

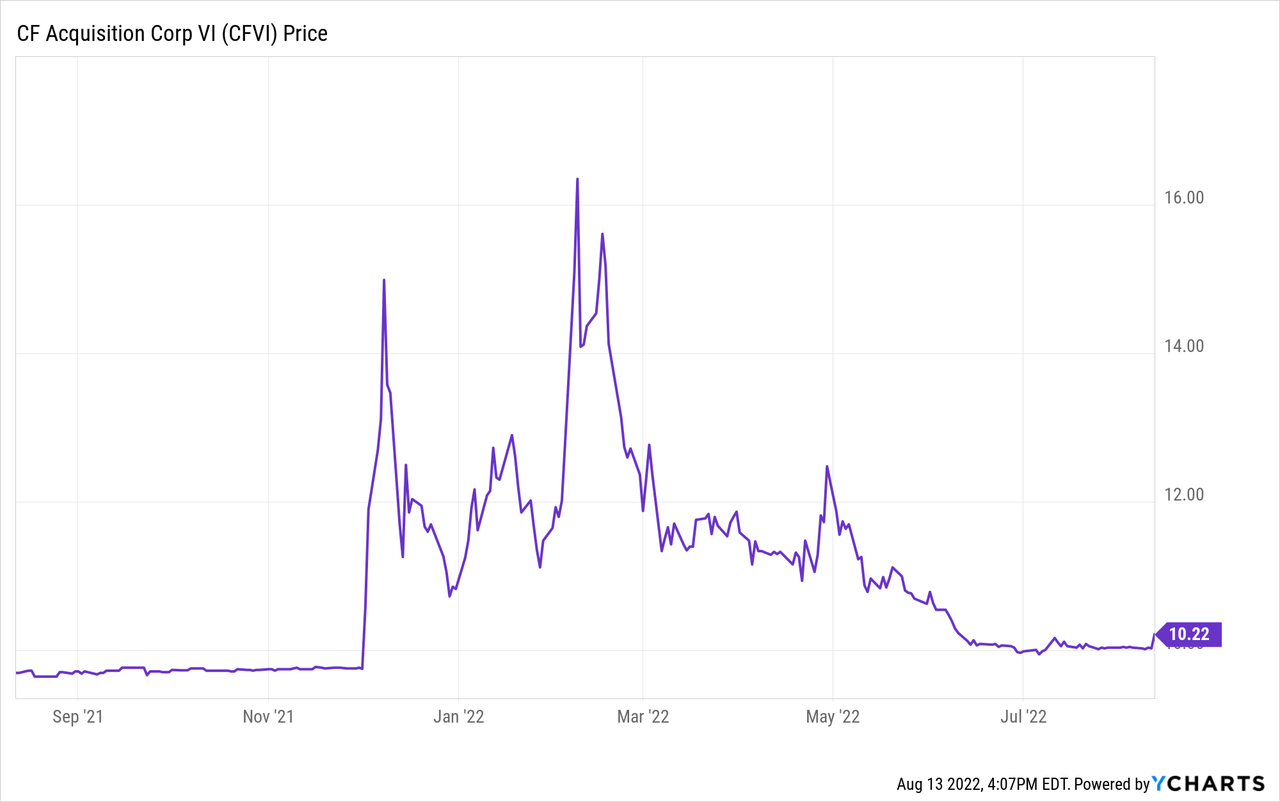

Rumble and CF Acquisition Corp. VI (NASDAQ:CFVI) received two pieces of great news recently. First, on August 11 the SEC declared their S-4 effective that allows the two parties to finally move forward with their merger. Shareholder meetings are now set for September 15. Second, a federal judge on July 27 rejected Google’s/Alphabet’s (GOOG) motion to dismiss the $2 billion lawsuit Rumble filed against Google last year. This litigation by Rumble can now continue to move forward. I covered details of the proposed SPAC merger in a prior article and this article is an update on some important issues.

SEC S-4 Approval-Merger of CFVI and Rumble

The SEC declared their S-4 effective on August 11. This is a major event because now the SPAC CFVI and Rumble can now finally solicit proxies from shareholders to approve their merger and also approve some other items. The S-4 was filed back on February 14 and some investors were worried when it was filed that because of politics it could be a very long wait or even that the SEC would deny approval. Rumble tries to be much more neutral on monetizing their content than Google’s YouTube. Rumble also hosts Trump’s Truth Social, which is also waiting SEC approval of their S-4 merger with SPAC Digital World Acquisition Corp. (DWAC).

The CFVI shareholder meeting is set for September 15. It is expected the merger will be completed soon after the vote. (There is some approval needed by Ontario, Canada that I am not sure how fast/slow they move on these approvals). Because insiders are voting for the merger, only approval by 36% of the public CFVI shareholders is needed. CFVI shareholders can elect not to participate in the merger and instead redeem their stock for about $10 cash.

The merged company will finally get access to CFVI’s cash held in their trust account and cash raised from PIPE financing. The total amount of new cash after various transaction fees is $345.3 million. This much needed cash will enable Rumble to be able to greatly expand and to help it pay for improving a few technical problems they have experienced. It is interesting to note this will all happen after the November elections so Rumble’s expanded/improved platform will not impact the elections. (I guess the SEC waited just enough to approve their S-4.)

Rumble v Google $2 Billion Lawsuit

A very positive development for Rumble was the July 29 decision (text of decision) by federal Judge Haywood Gilliam to deny Google’s motion to dismiss Rumble’s lawsuit against Google. This means this important case will continue to move forward. Some thought this Obama appointed judge might dismiss this case.

On January 11, 2021, Rumble filed a civil case against Google (text of 21-cv-00229-HSG) seeking damages “well in excess of $2,000,000,000” for:

Google’s antitrust violations, and for injunctive relief to prevent Google from continuing unlawfully to maintain its monopoly in the relevant market –online video-sharing platforms –through anticompetitive and exclusionary practices…These practices include Google rigging its search algorithms purposefully and unlawfully to always give preference to Google’s YouTube video-sharing platform over Rumble…”

Google filed a motion to dismiss (text of the dismissal motion) on June 6, 2021, and a hearing was held on September 9, 2021. So, this motion had been up in the air for over a year. The next step is a case management conference on August 30 that should set the tone on this litigation going to move forward in the discovery stage. I assume Google will fight to the maximum against being forced to hand over to Rumble detailed information on their algorithms. To Google this would almost be like having to give up the recipe for Coca-Cola.

Rumble also has their video content on YouTube because often that is the only way it can be found via internet searches under current algorithms. This means, according to their January 2021 filing, that Rumble earns only an average of $0.48 per thousand views on YouTube compared to $10 to $30 per thousand views on Rumble’s own platform. This large difference is what their $2 billion damages is partially based on.

Besides issues with Google’s algorithms, Rumble also asserted in their filing:

Google has also forced Android-based smartphone manufacturers to include YouTube as a preinstalled app on their phones in order to acquire the right to use the Android operating system, which constitutes an illegal tying arrangement. This also has damaged and continues to damage Rumble by further self-preferencing YouTube over Rumble (and other platforms, which harms competition in addition to Rumble).

Rumble’s case is based on Section 1 (“restraint of trade…declared to be illegal”) and Section 2 (“monopolizes any part of trade or commerce deemed guilty of a felony”) of the Sherman Act; and Section 4 (“injured… by reason of anything forbidden in the antitrust laws may sue and….recover threefold the damages”) and Section 15 (procedure for restraining violations) of the Clayton Act.

It could be a long time before this actually goes to a jury trial and any subsequent appeals. I bet most of the members of any future jury personally have experienced search results that placed YouTube content at the top of the first page when that YouTube video was not really what they were looking for and realized it was just because of Google’s internal operating model. Even if Rumble does not win “equal” footing, it might be able to negotiate a settlement for “better” footing in internet search results for their content. Seeking damages in “excess” of $2 billion is just an added incentive, in my opinion, to force Google to agree to some settlement regarding search results.

The impact from any positive settlement with Google could be extremely significant because not only would Rumble’s video content be placed higher on internet search result’s pages, but video creators/broadcasters who currently use YouTube may move over to Rumble’s platform, if they knew they would get much greater visibility, especially because Rumble has a more neutral content policy. Rumble may also place much less of their video content on YouTube, which earns only a token amount per thousand views, and use their own much more profitable platform. While I can’t place an actual dollar figure on the impact, it could be a major financial game changer for Rumble. If, however, there is no positive settlement, it will just be the status quo, until the DOJ finally takes some action.

I am not sure why there has been just limited news coverage of this case so far, but as the case moves forward, I would expect more coverage by investors. If the case developments are positive for Rumble, I expect investors could begin to factor that into their Rumble valuation models.

Some Dark Clouds

Rumble is highly dependent on ad revenue from clicks and views. Many other companies have reported weak ad revenue in their latest quarterly results. This is a major problem for Rumble, but they are trying to greatly expand their revenues from subscriptions and fees. They bought Locals.com, which enables video creators to offer subscription-based content on Rumble. They also are expanding Rumble Cloud Solutions which earns usage fees and subscription revenue. (Truth Social is on that platform.) The cash from this merger will be partially used to expand these areas outside of ad-based revenue operations.

Another cloud is potential future dilution. While I already covered this in my prior article, investors need to be reminded of this problem. Assuming that there are no redemptions and the newly merged company trades at $10 per share, there will be 262,206,418 shares outstanding, which results in a $2.62 billion equity capitalization. If investors become very bullish and value the new Rumble at $6.6 billion, that means the stock should be trading at $25.18 ($6.6 billion/262,206,4418). Wrong! Because of the impact of large “earnouts” by insiders and warrants, there would be 377,220,168 shares outstanding, and the stock should be trading at $17.50 – not $25.18. This illustrates the impact of dilution.

Conclusion

Before Rumble’s lawsuit against Google actually had any impact on CFVI shareholders, the SEC needed to declare their S-4 effective so shareholders can finally vote on the merger with Rumble. This lawsuit could be a dramatic financial game changer for Rumble. If there is any significant positive settlement for Rumble, the percentage stock price increase, in my opinion, for Rumble would be much greater than the percentage decline of GOOG/GOOGL because Alphabet is a very diversified company.

While the lawsuit might be great for Rumble, the company needs to improve its operations. It needs to expand its revenue base further into subscriptions/fees and improve some technical issues of their platform operations. CFVI, which will soon be Rumble, faces many challenges, but I am keeping my buy recommendation. Depending upon what I hear at the August 30 litigation case management conference, I could change this to a strong buy.

Be the first to comment