Pabscal/iStock via Getty Images

Mobility is an incredibly important thing in the modern era. In such a globalized economy and at a time when populations are so large, ensuring proper mobility can be a challenge. One company dedicated to this task is SP Plus (NASDAQ:SP). Unfortunately, the COVID-19 pandemic really hurt the enterprise. But the firm is showing signs of a turnaround following that. Add on top of that the fact that shares of the business are trading at levels that look fundamentally appealing, both on an absolute basis and relative to other firms, and I cannot help but think that this could be an attractive opportunity for value-oriented investors to consider.

A niche mobility play

As I mentioned already, SP Plus is a play on mobility. But naturally, this is a rather vague statement that we need to provide more details on. To do this, we should dig into the company’s different operating segments and explain how each of these works. The first segment to pay attention to is what management calls the commercial segment. Through this segment, the company offers an online and mobile application called Parking.com. It provides on-street parking meter collection and other forms of parking enforcement services. The company also provides remote monitoring services using different technologies, as well as provides shuttle bus services and the drivers to operate them. Through this segment, the company also provides valet services, valley tracking technologies, doorman and bellman services, various ground transportation services like taxi and livery dispatch services, and more. The segment is also responsible for compliant facility maintenance services such as power sweeping and washing, painting and general repairs, and cleaning and seasonal services. The company’s comprehensive security services also provides training and hiring activities for security officers and patrol personnel. During the company’s 2021 fiscal year, this segment accounted for 37.3% of the firm’s revenue and for 82.5% of its positive segment profits.

The other segment is the Aviation segment. Through this, the company offers baggage services, including the delivery of delayed luggage and baggage handling. It also provides remote airline check-in services, wheelchair assist services at airports and to airline passengers, package repair and replacement services, shuttle bus vehicles and the drivers necessary for their operation, ground transportation services like taxi and livery dispatch activities, valet services, compliant facility maintenance services for airports, and more. Last year, this segment accounted for 13.8% of the company’s revenue and 17.5% of its segment profits.

Another way to look at the company is through the lens of the types of contracts that it has. At present, there are two different types of contracts the company works with. One of these would be management-type contracts, through which the company offers its services to a client in exchange for a fixed or variable monthly fee. The company also generally charges fees for other miscellaneous services like accounting support, equipment leasing, and consulting. Under these types of agreements, its activities include the hiring, training, and staffing of personnel, as well as everything that goes with that. Usually, these contracts are for between one and three years. 64.2% of its contract revenue was attributable to these types of arrangements last year. Meanwhile, under the lease-type contracts, the company will provide its offerings and, in exchange, pay to its client or to the property owner a fixed base rent or fee, a percentage of the rent that is tied to the performance of the operation, or a combination of the two. This accounted for 35.8% of contract revenue last year. It’s also worth mentioning that a significant portion of the company’s revenue comes from outside of its segments. Management calls this a reimbursement management-type contract revenue. In short, this relates to a reimbursement the company receives under its management-type contracts in exchange for operating expenses that it should not generally be responsible for. This accounted for 48.9% of sales last year.

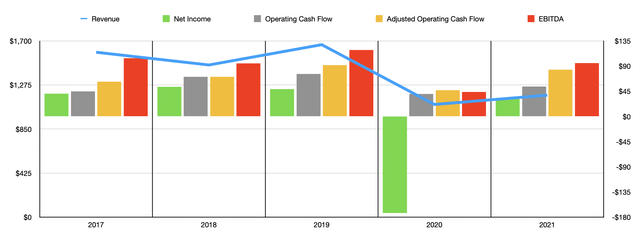

Prior to the COVID-19 pandemic, things had been quite positive for the business. Although revenue was a bit lumpy, the general trend was positive, with sales climbing from $1.59 billion in 2017 to $1.66 billion in 2019. Then, when the pandemic hit, revenue plummeted, dropping to just $1.09 billion for 2020. 2021 saw only a modest recovery, with sales coming in at $1.18 billion. Given the particular services that management provides, and considering how decimated the airline space, as well as other industries that would benefit from the kind of services the firm offers, it should not be all that surprising to see such a persistent and painful drop in revenue.

The drop in sales had a big impact on the company’s bottom line as well. After seeing that income remained in a fairly narrow range of between $41.2 million and $53.2 million in the three years ending in 2019, the company generated a loss of $172.8 million in 2020. The good news for investors is that this decline was short-lived. Last year, despite seeing revenue increase only modestly, net profits came in at $31.7 million. Other profitability metrics have followed suit. Between 2017 and 2019, operating cash flow increased from $45.2 million to $76 million. This metric dropped to $40.2 million in 2020 before climbing to $53.4 million last year. If we had to adjust for changes in working capital, cash flow was actually $83.7 million in 2021. This compares to the $46.8 million generated one year earlier and is not far off from the high point of $91.7 million the company reported for 2019. Again, a similar relationship can be seen when looking at EBITDA which, last year, was $95.2 million. That stacks up against the $43.7 million reported in 2020 and is not far off from 2019’s $119.1 million.

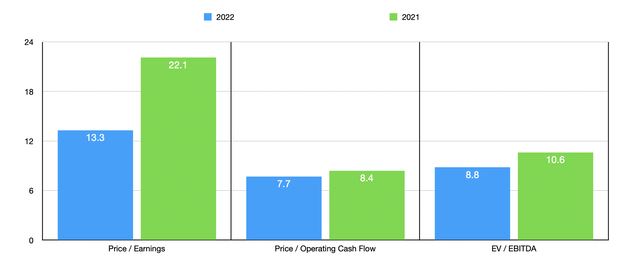

For the company’s 2022 fiscal year, management currently anticipates EBITDA of between $110 million and $120 million. Net income should be between $50 million and $55 million, with adjusted profits of between $56 million and $61 million. Meanwhile, management anticipates operating cash flow of between $83 million and $98 million. Using this data, we can effectively value the business. Using the 2022 estimates, the company is trading at a price-to-earnings multiple of 13.3. This compares to the 22.1 figure we get if we rely on 2021 figures. The price to adjusted operating cash flow multiple of the company should be 7.7. That stacks up against the 8.4 reading that we get if we rely on 2021 results. And the EV to EBITDA multiple for the company should be 8.8. That compares favorably to the 10.6 reading that we get if we use 2021 data.

Truth be told, I could not find any true comparable firms to compare SP Plus to. However, I did find other businesses in the environmental and facilities services market. Taking five of these, I decided to price the company against them. Unfortunately, positive results only existed for four of the five firms. On a price-to-earnings basis, these companies range from a low of 11 to a high of 156.2. Meanwhile, using the price to operating cash flow approach, the range was from 7.4 to 12.5. In both of these cases, only one of the four companies was cheaper than SP Plus. Using the EV to EBITDA approach, the range for the companies was from a low of 6 to a high of 12. In this case, three of the five firms were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| SP Plus (2022 Expectations) | 13.3 | 7.7 | 8.8 |

| Heritage-Crystal Clean (HCCI) | 11.0 | 7.4 | 6.0 |

| Harsco (HSC) | 93.7 | 12.4 | 8.4 |

| CECO Environmental (CECE) | 156.2 | 12.5 | 12.0 |

| BrightView Holdings (BV) | 29.3 | 11.0 | 10.4 |

| Li-Cycle Holdings (LICY) | N/A | N/A | N/A |

Takeaway

At this point in time, SP Plus is still in the turnaround phase following the pandemic. Having said that, the company seems to be doing quite well for itself all things considered. The road to recovery may be a long one still, but the firm’s bottom line is definitely encouraging. Add in just how cheap shares look today, both relative to similar businesses and on an absolute basis, and I cannot help but think that it offers some potential for long-term, value-oriented investors to consider.

Be the first to comment