mixmotive

Editor’s note: Seeking Alpha is proud to welcome Normad Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

I recommend a buy rating on S&P Global (NYSE:SPGI). It has one of the best moats that I have encountered during my research, a moat that is, in my opinion, almost impenetrable. The current macroenvironment is definitely negative for SPGI, but I expect SPGI to lap this weak part of the capital cycle eventually. I believe SPGI can generate for investors a stable long-term IRR of 11% over the coming decades, supported by mid-single-digit sales growth and margin expansion.

Company overview

In late February, SPGI finalized its purchase of IHS Markit. The merged company is now one of the largest providers of financial data to asset managers, investment banks, commercial banks, and others in the finance industry. Following the acquisition, SPGI has the following six business units: Market Intelligence, Ratings, Commodity Insights, Mobility, Indices, and Engineering Solutions. In terms of pro forma FY21 revenue, the two largest contributors are Ratings (33% of total revenue) and Market Intelligence (31% of total revenue). SPGI has an international clientele.

Credit rating business has strong network effect

Before delving into the network effect, it’s worth noting SPGI’s stellar reputation and prominence in the credit rating industry. SPGI is the credit rating agency to approach in order to have newly issued debt “recognized and rated.” In terms of revenue, SPGI is the world’s largest credit rating agency, narrowly beating out Moody’s (MCO), which is the second largest player.

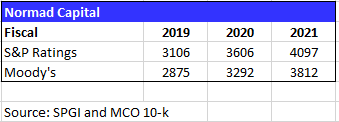

Normad Capital, SPGI and MCO 10-K

Being the largest or among the largest organizations means that a company will benefit greatly from the network effect. Credit ratings are critical to the operation of the entire fixed income investment ecosystem, from the creation and marketing of funds to the types of bonds that regulated companies (such as banks and insurers) and major institutional investors are permitted to hold. SPGI and MCO are widely regarded as the standards against which participants in international credit markets assess the relative creditworthiness of various debts. International bond markets often require issuers to obtain credit ratings from SPGI and MCO. Simply put, as more businesses adopt SPGI, the label gains credibility and trustworthiness in the eyes of debt buyers. As a result, as the SPGI label becomes more widely known, more businesses adopt it.

Other examples can be used to demonstrate SPGI’s position in the credit market. For example, the International Organization for Standardization (ISO) label indicates that the product has met a certain level of safety, and thus consumers or stakeholders have more trust in the company. The “.com” domain is a simpler, though not the best, example – a typical web user would trust “.com” more than “.dkru,” for example.

The network effect is boosted not only by SPGI’s credibility and standing in the industry but also by the sheer volume of information and wisdom the company has amassed over the years. SPGI’s decades-long track record of rating performance allows it to provide accurate default probability estimates, as well as relative default probability estimates and bond rating comparisons. On the surface, this appears straightforward, but debt is not the same as equity. Unlike stocks, which are always stocks, debt can have a variety of legal implications depending on its status as secured or unsecured, covenants, subordination, and other factors. Therefore, SPGI’s ability to provide comparison across various debt issuances is a major benefit.

Lastly, I believe that the company’s long-standing connections with debt issuers and regulators around the world constitute a valuable intangible asset that is difficult for new entrants or smaller players to replicate. Relationships are like that; once you’ve established trust with someone, you tend to go to them first whenever you need to do something. In the case of SPGI, it is when corporates need to issue debt.

Strong pricing power and high incremental margin

The fact that SPGI allows debt issuers to lower their cost of capital just by using the SPGI label gives it tremendous pricing power (as repeatedly mentioned in SPGI earnings calls throughout the years). For instance, if SPGI hasn’t rated a company’s ability to repay debt, that company’s borrowing costs might be 5%, while borrowing costs for a similarly rated company might be 4%. This is because the rated company is seen as less risky because SPGI has already evaluated it.

Given that the total amount of debt issued is in the millions or even hundreds of millions of dollars, these few basis points make a big difference. You might be wondering if SPGI significantly raises its prices if customers won’t simply switch to MCO. Personally, I don’t see that as a problem because SPGI and MCO form a rational duopoly in the market. Both SPGI and MCO have a history of raising prices to make more money instead of lowering prices to get a bigger share of the market.

Having strong pricing power is good, but having a high incremental margin is even better. Since there is very little additional cost involved in implementing a price increase, the SPGI business model is inherently predisposed to a very high drop-through. SPGI’s operations are driven by over a thousand credit analysts located in offices around the world; these analysts are a fixed expense for the company. The operating margin for the Ratings segment has increased from 42% in FY13 to 64% in FY21, and overall operating margin has increased from 31% in FY13 to 47% in FY21, which would support my claim of a high incremental margin if one were to look at the financial statements.

Market Intelligence segment entrenches SPGI into customers’ workflows

Most Marketing Intelligence products are sold on a subscription basis and are integrated into customers’ workflows, resulting in a substantial amount of recurring revenue. SPGI’s Market Intelligence division offers financial information services to end users via a desktop platform and enterprise data feeds. The Market Intelligence division of SPGI is geared primarily toward financial end users and offers a desktop and data feed solution for those industries. There are three distinct parts to the segment: data management (wholesale data feed to third parties like Investing.com), risk services (credit research and analytics), and desktop services like Capital IQ.

The main product in this segment is desktop services (the most widely known product is Capital IQ). When it comes to financial desktops, users tend to stick with them once they’ve built their workflows around them (e.g., charts, news, watchlists, models, etc.) And since Bloomberg sets the price floor for financial desktops, SPGI can increase prices while still being cheaper than Bloomberg – despite the fact that the market for financial desktops is fiercely competitive and end customers are highly price-sensitive. For customers who are looking to save money, Capital IQ is a better option than Bloomberg.

Valuation

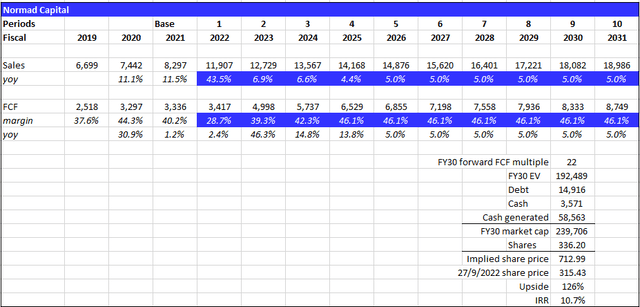

At the current stock price of $315.43 and 336.2 million shares, the market cap is ~$105 billion. I believe the current market price presents a decent entry point for investors to enjoy a stable 11% IRR. I believe SPGI will make $19 billion in sales and $8.8 billion in EBITDA in FY31. This will be driven by sales growth in the mid-single digits and margin expansion, giving it a market cap of $240 billion and a stock price of $713 in FY3.

Here are my assumptions:

- Sales to grow according to consensus estimates over the midterm until FY25, supported by organic pricing power and volume growth. Post-FY25, sales to continue growing at mid-single-digit rates, slightly lower than pre-COVID levels as the business is now bigger.

- FCF to follow consensus estimates until FY25, which suggests margin expansion due to fixed cost leverage and high incremental margin from an organic increase in price. I believe the margin could expand higher, but I modeled it to be flat moving forward in order to be conservative.

- Valuation to be valued using the current FCF multiple of 22x. In light of the rising rates environment, investors would demand a higher FCF yield than in the past.

Normad Capital

Risks

One risk involves private lenders offering cheaper debt. SPGI exists to provide credit ratings to bonds, but as banks are battered by risk aversion and falling asset values, the rise of direct lenders from entities such as private equity firms could potentially intermediate SPGI. This could be appealing because neither lenders nor borrowers must have their loans scrutinized by the public.

Another risk is heavy exposure to capital markets cycle. Global bond issuance has a significant impact on SPGI, with the Ratings segment contributing the most EBITDA. Short-term debt issuance has declined given the significant amount of global debt issuance in recent years, as well as the rapid rise in interest rates. A longer-term sustained increase in interest rates would be detrimental to ongoing debt issuance trends, dampening Ratings’ future growth potential.

Another risk involves the inverse relationship with interest rates. As previously stated, if interest rates do rise and remain at higher levels this will have a negative impact on Ratings. It would almost certainly result in a reduction in the SPGI multiple. Given SPGI’s relatively high multiple and the fact that rising interest rates would hurt demand for the products of its most profitable division, multiple contraction is a risk even if the business does well.

Conclusion

SPGI operates in a duopoly industry and has one of the best businesses in the world, with strong network effect and pricing power and high incremental margins. I accept the fact that there are short-term headwinds stemming from the macro environment. But if one were to take a longer-term view, SPGI is essentially a bet on the long-term health of the capital market, which is directly impacted by the growth of the economy. The current valuation is a decent entry point that should yield investors a stable, long-term IRR of ~11%.

Be the first to comment