lindsay_imagery

This article was originally published for subscribers of Reading The Markets on July 30, 2022

The S&P 500 (SP500) rose dramatically in recent days. Some people have accounted this to the Fed’s “dovish” pivot, which in reality doesn’t exist. But what does exist is the liquidity that moved in the market in recent days, as conditions to obtain margin have eased, and the overnight repo facility usages stalled out.

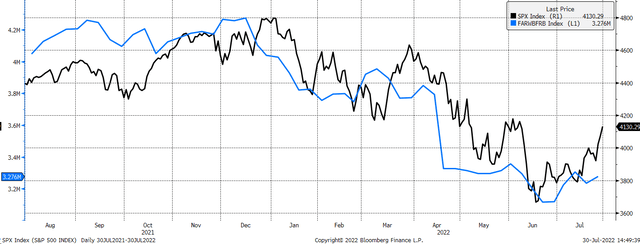

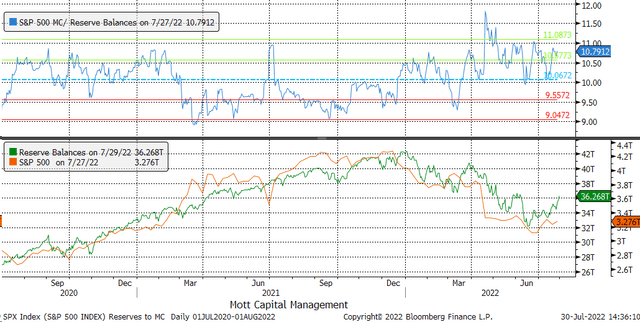

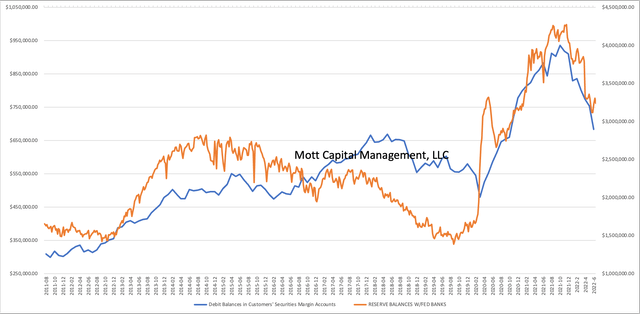

This past week saw reserve balances of depository institutions held at the Federal Reserve increase slightly to $3.276 trillion from $3.235 trillion, not a significant overall change. But for July, reserve balances rose from a low reading of $3.116 trillion in June. The increase for the week and the month added liquidity, helping to push stocks higher after a considerable decline in June.

The ratio of the S&P 500 market cap to reserve balances expanded during July from a June 14 low of 9.94 to 10.75, pushing the market cap to reserve balances ratio to the upper end of the historical range since July 2020.

Typically, when the ratio gets around 10.75, it has marked a top in the market, such as on February 2, 2022, March 29, April 20, May 27, and June 27. It does not mean that the index has to see a new low. Still, it has marked short-term tops and, depending on the overall movement of reserve balances, can mark a turning point such as witnessed during the majority of these peaks in 2022 because reserve balances, generally, have been moving lower.

Leverage

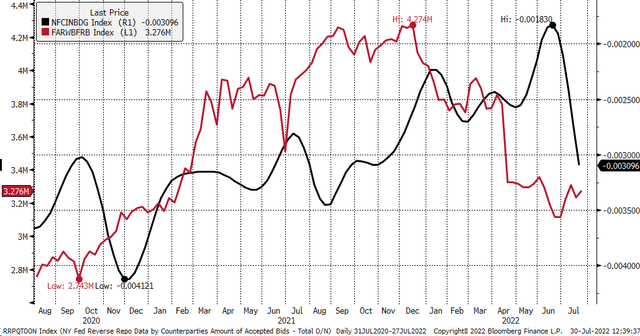

Additionally, the Chicago Fed NFCI weekly financial conditions index reveals that conditions for margin have eased significantly in recent weeks. The NFCI margin index measures how easy or tight conditions are to access margin, with a reading above 0 indicating conditions that are tighter than average and a reading below 0 indicating looser than average conditions. So as the level moves higher, it suggests tightening margin conditions, and as it falls, easing margin conditions.

The access to additional leverage is likely why we saw a big move in the market over the past several weeks, despite a relatively small increase in reserve balance since the end of June. Changes in reserve balances appear to have a positive and negative effect on margin and leverage conditions. Falling reserve balances lead to tightening leverage conditions, while rising reserve balances lead to easier leverage conditions.

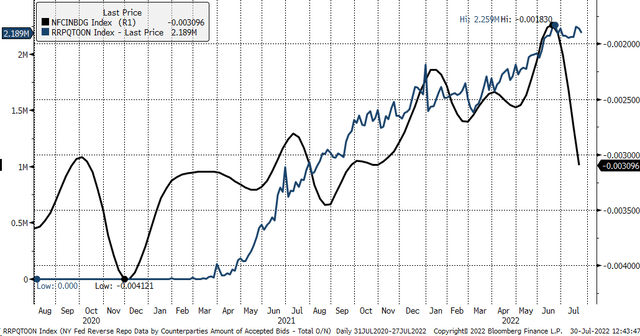

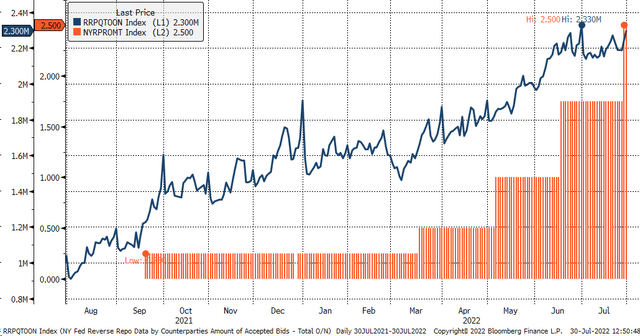

When exploring this more closely, the changes in the leverage conditions appear directly to be tied to the usage of the Fed reserve repo activity. Reserve Repo totals have a direct impact on reserve balances, with higher repo totals reducing reserve balances and lower repo totals raising reserve balances.

Reverse repo activity has been steadily rising since it was introduced in March 2021, and leverage conditions have tightened steadily during that time. When reverse repo usage is actively climbing, margin conditions tighten while easing when reverse repo usage falls. It also appears that when repo usage is stable, conditions for leverage expand as well. Reserve repo activity was flat for most of July, likely leading to easing conditions for margin.

Higher Rates

But that may change soon because reverse repo activity appears to get a boost when the Fed changes interest rates. There was a surge in repo activity after the Fed rate change this past week, but it was also month end, and there tends to be increased activity at month end. There will be a need to monitor this usage of the repo facility. If it increases this week beyond $2.3 trillion, that would likely result in leverage conditions tightening and would work to reduce reserve balances, which is bad for stocks, and indicate a decline is likely over the next couple of weeks.

Based on this information, FINRA margin debit balances should have increased for July. Reserve balances and FINRA margin debit balances have followed each other very closely over several years.

If the higher interest rates from the Fed do serve to attract more money from money market accounts into the overnight reverse repo facility, then it seems likely that access to margin should begin to tighten, and reserve balances should begin to fall, which is negative for asset prices. Remember that most money that goes into reverse repos comes from money market accounts. If that money is being used to get the higher and risk-free rates of the overnight repo facility, then it is not going to the stock market, or any other market for that matter.

Be the first to comment