S&P 500, FTSE 100 Analysis and News

S&P 500 | Chinese Sentiment to Dictate State of Play

After a soft start to the week, turnaround Tuesday and some help from the Chinese Central Bank’s liquidity injection has seen the S&P 500 eke out a marginal gain for the week. However, equity markets are not out of the woods yet, we are still on Evergrande watch amid rising default concerns, thus equity markets will continue to remain sensitive to Evergrande headlines. Alongside this, with central banks gearing towards a reduction in monetary stimulus, the current mini-tantrum in the bond market does not provide much encouragement for risk-taking.

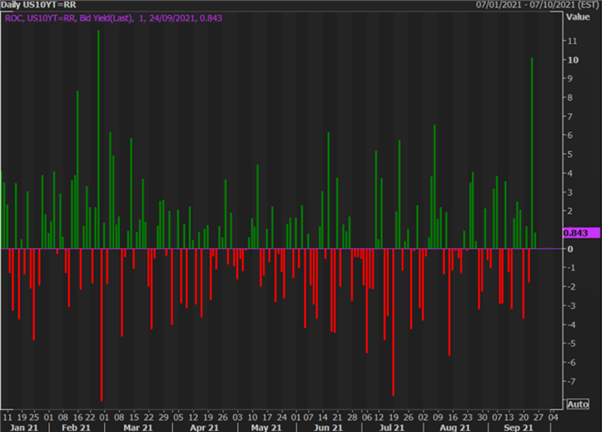

Mini-Tantrum?…. Biggest Increase in US Yields Since February

Source: Refinitiv

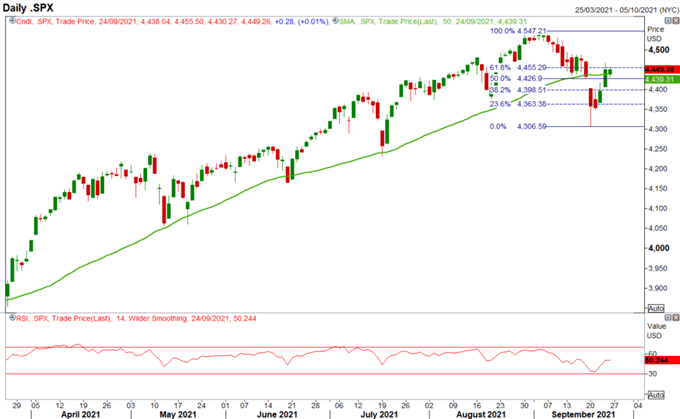

From a technical standpoint, a lot of focus is on the 50DMA and the 61.8% fib, uncertainties remain, which could see short-term traders look to fade the bounce back. Keep in mind, that we are still in the seasonally weak three week period (ending October 9th).

S&P 500 Chart: Daily Time Frame

Source: Refinitiv

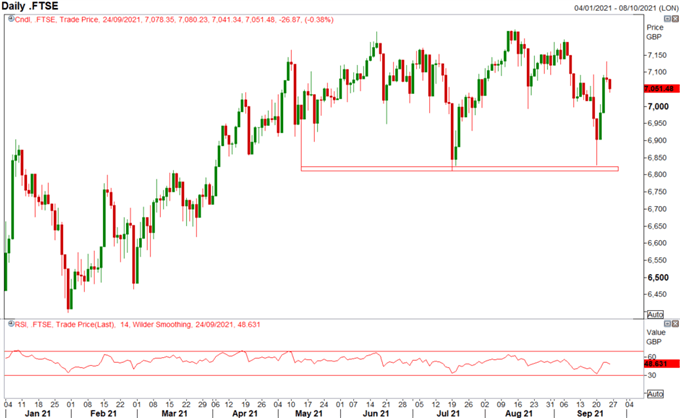

FTSE 100 | Bears Remain in Control

The FTSE 100 is perhaps the most exposed to overseas risks stemming from China, given the heavyweights within the index, such as HSBC, Standard Chartered, as well as commodity-related stocks. Therefore, as mentioned previously, Chinese sentiment will dictate the state of play for the index. Alongside this, a more hawkish than expected BoE, prompting several banks to bring forward rate hike calls to February 2022, which in my view is doubtful, will unlikely inspire much traction for upside. Taking a look at the technicals, with the RSI falling to break back above 50, bears remain in control with pressure likely back on the 7000 handle, below which opens up the door to 6850.

FTSE 100 Price Chart: Daily Time Frame

Source: Refinitiv

RESOURCES FOR TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Be the first to comment