On Monday March 2, 2020, we saw the biggest one-day point surge in the DJIA ever of nearly 1,300, or more than 5%. Likewise, other major indexes had extremely sharp bounce-backs as well. The S&P 500/SPX (SP500) rebounded by 4.6%, and the Nasdaq composite finished the session up by roughly 4.5%.

These are incredible gains after one of the steepest declines in U.S. stock market history. The SPX as well as other major indexes gave up around 16% from peak to trough in just seven trading sessions, something that has happened only a handful of times in recent history, since around 1950. Moreover, such steep declines lead to a recession only once out of these instances and that was in the financial crisis of 2008.

However, despite SPX’s sharp nearly 10% rebound from the correction lows, the most widely watched stock market index is now about 11% off from its all-time highs achieved just 11 sessions ago. Please keep in mind that as I am writing this article, SPX futures are down by roughly 2.5%, putting the market deep in “official” correction territory once again.

Now, due to the Coronavirus’ continuous spread, especially in the U.S., there is likely to be more volatility ahead, and the overall economic impact on the global and the U.S. economy is still very difficult to predict. Nevertheless, it is likely to be significant and should cause a substantial slowdown in GDP growth, consumer spending, YoY corporate sales/earnings growth, and may even tip the U.S. as well as other major economies into recessions.

What to make of the recent Fed move?

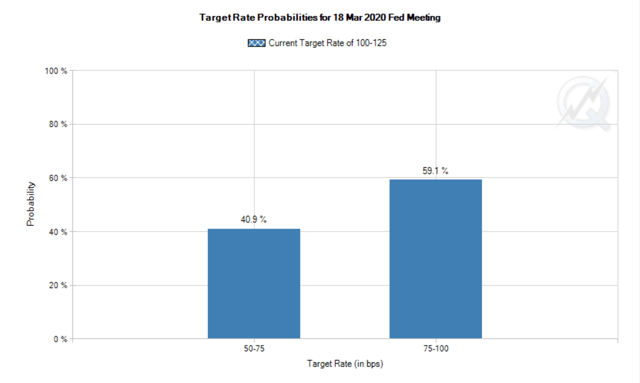

The Fed came out with an emergency 50 basis point rate cut in light of tumbling stock markets due to the Coronavirus panic. It is interesting that just one month ago the probabilities for a 25 basis point cut were only around 15%, and now we are looking at a probability of 100% of an additional 25-50 basis point cut in just around two weeks from now.

Source: CMEGroup.com

Yes, remarkably, the Fed is likely to lower rates by a total of 75-100 basis points this month mostly due to the Coronavirus debacle and the unintended consequences the virus is likely to have on the U.S. and global economies. This is an incredibly stark difference which indicates that the Fed is ready to act swiftly due to the Coronavirus disruption. However, the key question is, will it be enough?

This can be viewed as a positive signal for some risk assets, as it implies that the Fed will likely introduce other forms of easing coupled with rate cuts (likely back down to zero) as the economic impact begins to infect the U.S. economy.

However, not all risk assets are created equal, and the Fed cannot simply fix everything with rate cuts alone. Other monetary measures will likely be needed. The Fed’s return back to easing suggests that rates are headed back towards zero, more Treasury buying is likely to occur down the line, and the Fed may even follow the footsteps of other central banks (ECB, BOJ) and may start to buy corporate bonds coupled with stocks/ETFs if things really begin to look dire in the U.S.

The following actions are likely to lead to higher inflation which is extremely positive for gold and the bulk of the gold, silver, mining/GSM sector. Furthermore, the expansion of the Fed’s balance sheet along with the U.S.’s monetary base should reflect positively on prices of key digital assets as many top decentralised coins are essentially inflation proof.

Bond instruments that increase in value as longer-term rates head lower also appear to be a good bet in the current environment. As far as stocks go, I am not sure that the Fed can prevent a corporate recession from occurring and we could see multiple compression going forward as opposed to the multiple expansion we witnessed last year.

Therefore, the slump in stock prices may continue longer than anticipated, and we may even be entering a Coronavirus-triggered bear market right now. For now, most stocks remain a question mark for me as it is unclear how deep the impact of the virus will be on corporate profits and by how much multiples could contract in a prolonged downturn.

Is the media creating too much panic over the Coronavirus threat?

In my personal view, I believe that the media is creating excess panic over the Coronavirus threat. Yes, it is a troubling disease, it spreads quickly, and unfortunately it claims lives across its path. However, so far there are only around 90,000 cases worldwide (most in mainland China), and the mortality rate is not nearly as high as the SARS virus, which had a mortality rate of roughly 10%, or about 3 times that of the Coronavirus.

Moreover, the mortality rate seems to be much lower in more developed nations that are somewhat prepared to deal with the Coronavirus threat. For example, the global death toll from the virus is around 3% of infected individuals (once again, mostly in Wuhan, Hubei Province, China). However, if we look at statistics coming out of South Korea, the disease has killed only 28 people out of 4,800 infected (roughly 0.58%).

This suggests that more developed nations appear to be much better prepared to battle the illness and the mortality rate in most developed nations should be much lower than in China and other underdeveloped/unprepared areas like Iran.

Another factor to consider is that the Coronavirus is particularly dangerous to older patients and to those with already compromised immune systems. Most patients under 60 with relatively healthy immune systems recover at home or with minimal hospitalisation.

Some Statistics

For patients of 80 years of age and over the fatality rate is reported to be around 15%. For infected patients of 70-79 years of age, the fatality rate is roughly 8%. Also, as of March 4th in Italy, where the death toll stood at 52, all deaths occurred in patients over the age of 60. Even on the infected Diamond Princess cruise ship, where the skew was towards more elderly patients, only 6 died out of the 707 reported cases (0.8%), indicating that access to adequate healthcare plays a huge role in saving lives and keeping fatality rates at a minimum.

What about the “regular flu”?

People are worried about the Coronavirus, but what about the “regular” flu? Did you know that just this year in the U.S. alone up to 45 million have been sick with flu virus, and this is despite vaccines? Moreover, up to 560,000 hospitalisations have been reported along with up to 46,000 deaths.

Furthermore, the flu season is nearly over as spring brings warmer weather and tougher conditions for the virus to be contracted. The Coronavirus outbreak appears to be causing mass panic around the globe even though the influenza virus infects far more people and causes many more deaths.

Yes, it is true that the mortality rate from the influenza virus is only around 0.1%, but it appears that the Coronavirus death toll will also be relatively low (well below 1%) in patients under 60 with adequate access to proper healthcare.

Also, I believe that as the flu season comes to an end, so should the bulk of the panic concerning the Coronavirus. Corporations may simply get back to business as usual after that. However, it is still unclear what the overall hit to corporate earnings and GDP will look like.

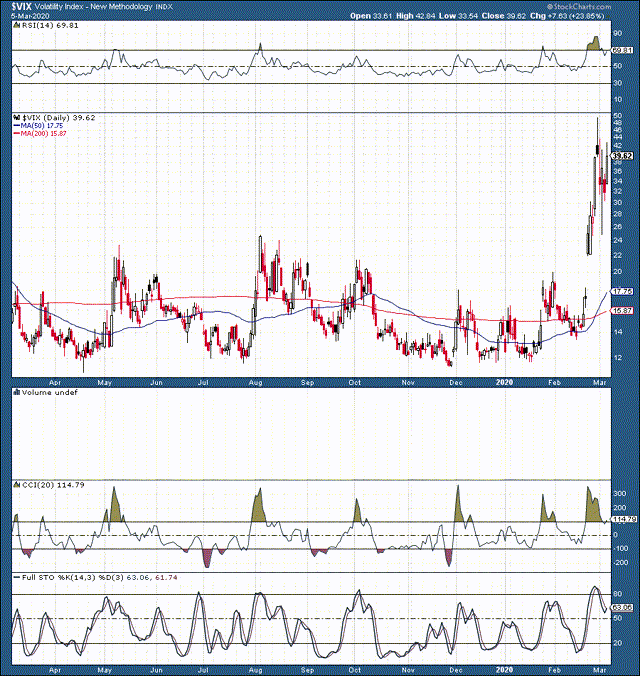

What the VIX is telling us

The VIX is going wild, touching upon the 50 level in recent sessions. Moreover, as the market opens today, we are likely to retest around the 50 level as the stock selloff appears set to continue.

The VIX is going wild, touching upon the 50 level in recent sessions. Moreover, as the market opens today, we are likely to retest around the 50 level as the stock selloff appears set to continue.

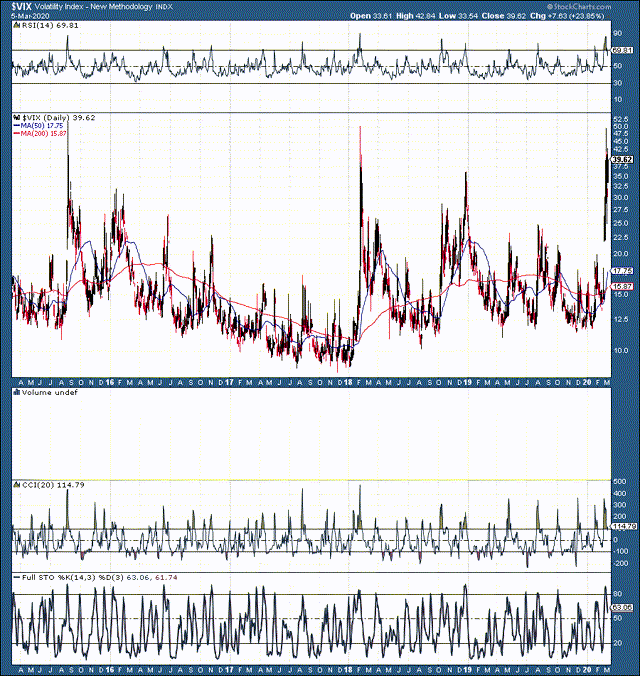

If we look at a longer-term view of the VIX, we see that the current explosion higher is on par with only several instances over the past five years. We saw similar spikes in the August 2015 flash crash, in the early 2018 correction, and in the late 2019 year-end selloff.

If we look at a longer-term view of the VIX, we see that the current explosion higher is on par with only several instances over the past five years. We saw similar spikes in the August 2015 flash crash, in the early 2018 correction, and in the late 2019 year-end selloff.

However, we may still be in the early to mid stages of this correction process, and it would not surprise me to see volatility stay elevated for some time, possibly retesting or even shooting over the 50 level at some point in the next few days/weeks.

As far as markets are concerned

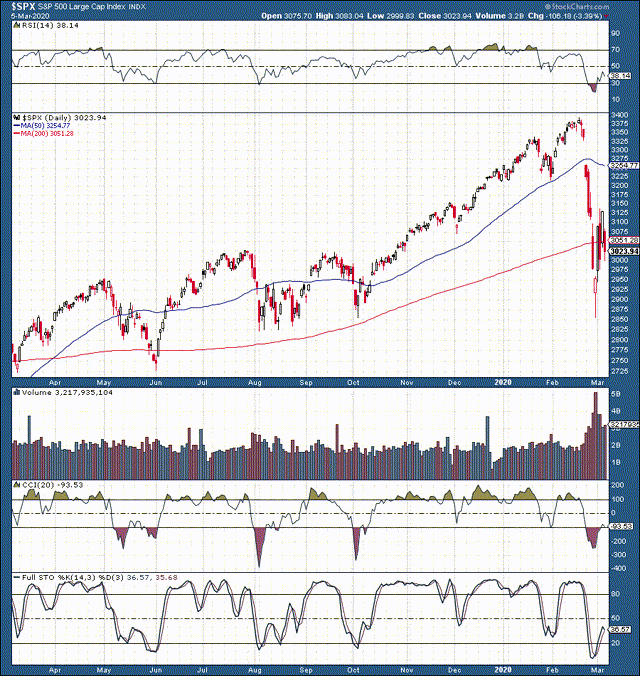

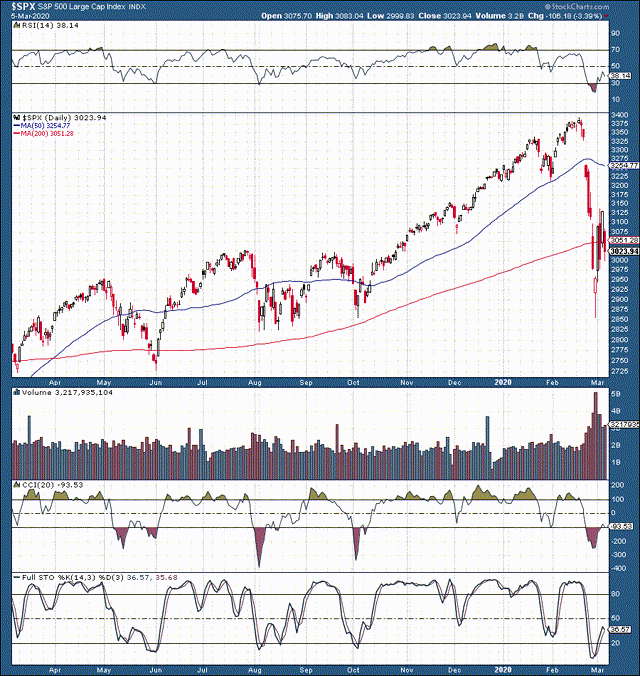

SPX 1-Year

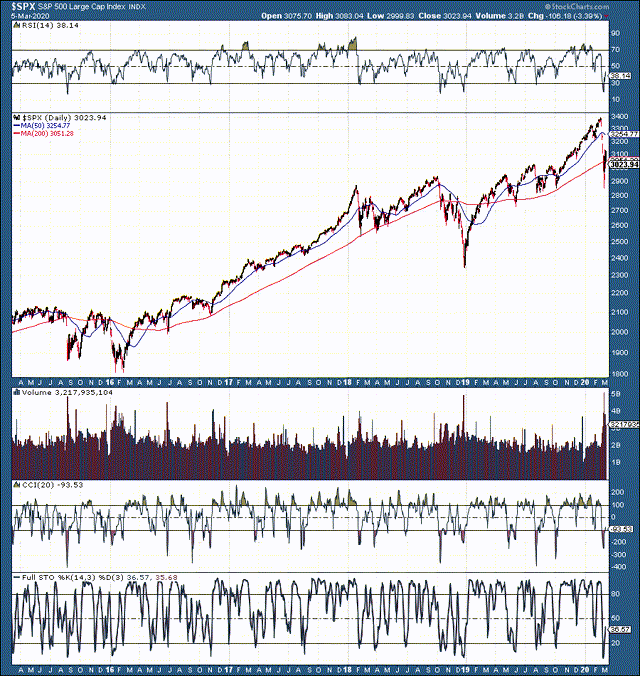

Due to the uncertainty over the economic impact the Coronavirus and its unintended consequences will have on the global economy and U.S. corporate profits as well as U.S. GDP, it is unlikely that we will see a sharp V-shaped rebound from here. In fact, it already looks like we are at least heading for a W-shaped retest of prior lows around the 2,850 level.

Due to the uncertainty over the economic impact the Coronavirus and its unintended consequences will have on the global economy and U.S. corporate profits as well as U.S. GDP, it is unlikely that we will see a sharp V-shaped rebound from here. In fact, it already looks like we are at least heading for a W-shaped retest of prior lows around the 2,850 level.

This will be a crucial retest, and if it fails, SPX can easily fall to around 2,725 (20% correction), or possibly lower even, putting the S&P 500 in “official” bear market territory. We can already see the 50-day MA turning lower, which suggests a shift towards a more negative momentum, implying that markets are not done going down yet.

It is possible that we may witness a similar scenario transpire as we saw back in 2015, early 2016, a very choppy and prolonged correction process. It is also possible that we may break down lower from here, similar to what happened in late 2018. Only this time the SPX may bottom around the 2,725 or possibly lower. This is my base-case scenario for now, roughly a 20-25% correction in total from recent highs. This would drag the SPX down to around the 2,550-2,725 before a real bottom can be established.

In a worst-case scenario, the U.S. may enter a recession. In this case the S&P 500 may decline by a significant amount of around 30% to 40% in my view, putting the market bottom at around the 2,000-2,400 level.

The Bottom Line: A Recession Is Now Possible

The Coronavirus is causing more economic disruption than was previously anticipated. Additionally, the continuous panic coming out of the main stream media is not helping matters. A Coronavirus outbreak in the U.S. may also harm President Trump’s reelection chances, will very likely cause a slowdown in consumer spending, disrupt corporate earnings, and could possibly even tip the U.S. into a recession.

Although a recession is not my base-case scenario for 2020, it is possible, and the probability of a recession occurring in 2020 or in early 2021 has gone up substantially in my view. For now, my base case is that the market (S&P 500) will likely correct further from here. I don’t think that a quick V-shaped recovery is likely anymore given the number of uncertainties brought forth with the Coronavirus.

My base case now is that the market will likely go through a choppy, somewhat prolonged correction process, and will probably fall through recent lows of 2,850. I expect that a “correction” of around 20-25% is very plausible, may take weeks or even months to work its way through system, and could ultimately drag the S&P 500 down to around the 2,550-2,725 level before a real bottom could be put in.

Yes, the Fed is acting, but there is only so much that the Fed can do. Even lowering rates back down to zero may not be enough to adequately stimulate the economy at this point. More QE measures will likely be required along with fiscal stimulus to stimulate markets after the ongoing debacle. However, with trillion-plus-dollar deficits in the U.S. already, significant fiscal stimulus may be more difficult to organise than is anticipated.

Therefore, good safe-haven plays include bond instruments that appreciate as longer-term rates fall, gold, silver, miners/GSMs, certain systemically important digital assets, as well as other assets and trading instruments that will benefit from future monetary base expansion and other inflationary forces.

Want the whole picture? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

Disclosure: I am/we are long VARIOUS STOCKS IN THE S&P 500. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Please always conduct your own research before making any investment decisions.

Be the first to comment