erlucho

General Overview

The sustainability drive sprawling across nation states is good for mining. With Western cheerleading pushing countries big and small to adopt measures to decarbonize economies, electrification of mobility has become a resounding topic.

That’s great for EV manufacturers capitalizing on major shifts in automotive manufacturing. Even better for miner’s developing strategies around the decarbonization theme.

To meet ambitious goals set by policy makers, abundant amounts of nickel, copper, lithium, graphite, and cobalt will be required. The major issue here is how quickly demand has shifted, and the time required for supply to catch up.

Mining projects are extremely capital intensive and take years from exploration, permitting, project design, final investment decision, construction, commissioning to production. The end-result is likely to be industry wide under capacity followed perhaps by large scale over supply 5-10 years down the line when multiple projects come online.

Right now, that provides ideal market conditions for miners strategically transitioning into green metals such as South32 (OTCPK:SOUHY)(OTCPK:SHTLF). Born from a spin-off by BHP (BHP), at the time looking to distance itself from less profitable segments of its portfolio, the new firm has since been on a crusade to transform itself into a decarbonization darling.

So far, results look promising. That is why my outlook for the Perth-based miner is positive moving into 2023.

South32 (+14.96%) has been outpaced by bigger BHP (+38.38%) this year.

Company Introduction

South32 is an Australian Perth-based miner with operations spanning Australia, South Africa, North America, and South America. The company has a portfolio of concentrated legacy aluminum, metallurgical coal, copper, silver, lead, zinc, and nickel assets.

Well suited to a transitioning of its portfolio to assets linked to a low carbon future, the organization is strategically moving into development of a nickel business. A consolidation of aluminum assets is likely to bode well for the future, with electric vehicle manufactures looking for efficiency gains in battery life by making vehicles lighter. Expect the future of vehicle assembly to include more meaningful amounts of aluminum.

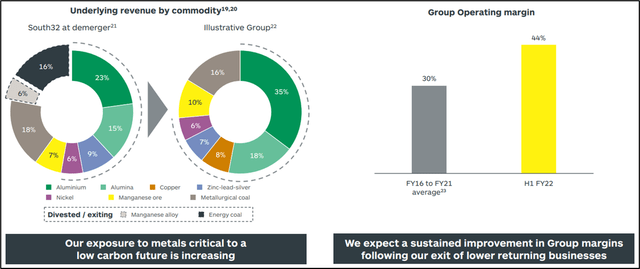

The organization’s revenue profile is expanding to metals critical to low carbon industries.

Key Projects

The company expects to grow share of production to more than 1.1Mt of aluminum and 5Mt of alumina in FY 2023. Its integrated position with operations in Brazil, Mozambique, South Africa, and Australia provides solid operating margins (~25%).

Those margins are set to expand most notably in the aluminum division with Hillside and Mozal smelters producing for both domestic and export markets. These divisions represent the lion’s share of South32’s sales with significant expansion in the aluminum business since the firm’s demerger. Given trends in automotive production, increases

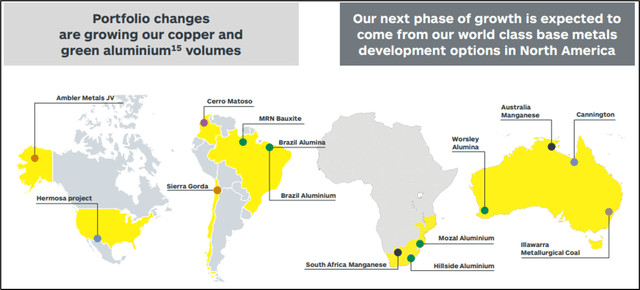

The company’s base metals operations, comprised of zinc-lead-silver, nickel, and copper, are supported by operations in Latin America and Australia. The company holds a joint interest in the Antofagasta region of Chile with an open cut mining and processing facility producing copper and molybdenum concentrates.

South32’s Australian Cannington project is comprised of an underground silver, lead and zinc complex, producing silver-rich lead concentrate and zinc concentrate. Finally, the organization’s Columbian Cerro Matoso project, is an integrated surface nickel mine and integrated ferronickel smelter. A major furnace rebuild at Cerro Matoso will facilitate additional productivity in a product line set to see significant margin expansion.

Steelmaking raw materials such as Manganese ore and metallurgical coal provide diversification benefits to the asset portfolio. The firm’s Samancor JV (60% ownership) makes South32 the world’s largest producer of manganese ore. Additionally, the GEMCO open-cut mine in Australia’s Northern Territory is one of largest low-cost operations in the world.

The company operates several underground metallurgical coal mines in New South Wales, Australia delivering hard coking coal to domestic and international export markets. Booming coal prices have provided strong tailwinds for underlying operating margins.

South32 has supported its strategy to boost copper assets through a 45% acquisition in its Sierra Gorda project. Sierra Gorda appears to be a particularly compelling project, bringing immediate volume and growth potential.

The mine has more than 20 years to run and was acquired at US $1.4B in cash plus a contingent price-linked consideration, underpinning a strategic focus in battery minerals. In Mozambique, the corporation has strengthened its aluminum portfolio by extending its interest, acquiring an additional 16.6% in Mozal Aluminum.

Changes in asset portfolio point to developments in copper, low carbon aluminum and projects in North America.

Financials

The Perth-based miner has a market cap of A $19.8B. 5-year sales growth has been roughly 5% with EBITDA expanding at a faster clip ~12%. The company presents an interesting opportunity for income investors with a ~7% dividend yield and 21% payout ratio. Returns year to date have outpaced the broader market, delivering 27.64% over the past 1 year.

Given the company’s size and profile, it has garnered significant interest from fund managers, with equity being held by 95 different ETF products representing circa ~ A $1.1B. Currently South32 trades at a forward multiple of 8.7x.

Sales have markedly increased with postings of A $13.6B FY 2022 (A $7.4B FY 2021) A lot of this can be explained by eye-watering coal prices and strategic moves into more value accretive battery minerals. EBITDA expansion has been just as impressive (43.70% in FY 2022 v 26.28% FY 2021).

The company has valuable liquidity sources on hand for strategic investments and capital projects (A $3.4B) and manageable debt (A $2.6B). Present current ratio (2.2x) and quick ratios (1.7x) highlight a degree of prudence in capital allocation. Operating income has increased 5x between FY2021 and FY2022. An impressive rate!

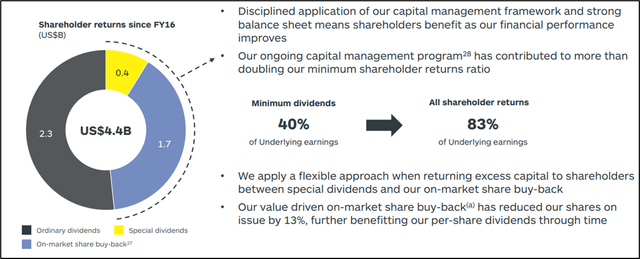

The balance sheet provides little hints of future hardship. Some goodwill has been allocated during asset acquisition (from A $185M to A $201M) but nothing material in perspective. The company is a cash machine, with cash flow from operations posting at $4.4B (A $1.87B one year earlier) Strategic capex continues at a steady pace (A $857M FY 2022) as do strategic investments, particularly related to expanding the company’s copper portfolio.

Debt continues to be paid down and re-issued, with South32 using available cash to pay sizable dividends (A $821M FY 2022) and repurchase stock (A $217M FY2022). It is also worth pointing out South32’s decision to pay A $134M in special dividends during the year.

The company’s prudent approach to capital management provides it flexibility to return funds to shareholders via distributions and support the equity price via share buybacks.

Key Risks & Valuation

The company trades at 8.7x price to earnings over next 12 months, slightly lower than higher capitalized majors such as Rio Tinto (9.3x) and BHP (10.7x). The company has meaningful amounts of cash deployable for future portfolio rightsizing along with adequate access to debt.

Macro-economic risks linked to China’s hampered infrastructure market and a progressive slowing of its economy are likely to impact both coal and aluminum assets. Developments in nickel and copper will possibly offset this to a certain extent.

A softening US dollar into 2023 is likely to stimulate commodity prices providing some upside for firms like South32.

Key Takeaways

South32 makes for a compelling 2023 investment. A cash rich firm, with a strong portfolio of legacy assets, and a strategic ambition to capitalize on shifts towards sustainability over the next years.

Copper and nickel assets are likely to play more meaningful roles in margin generation, while increasing use of aluminum in electric vehicles will support revenues.

Presently, despite a risk-off macro environment, it is hard to see downside here – prudent cash management, a diverse portfolio of assets and a strategic ambition to move to sustainability puts this company firmly on my watchlist.

Be the first to comment