Aja Koska/E+ via Getty Images

If someone tries to steal your watch, by all means fight them off. If someone sues you for your watch, hand it over and be glad you got away so lightly.”― John Mortimer

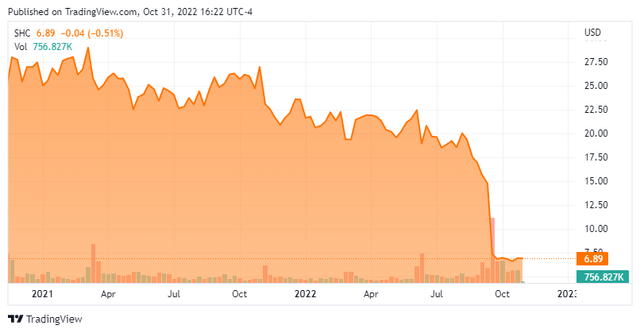

Today, we look at a somewhat unique play in the healthcare space. The company provides services to approximately 80% of the top 50 medical device makers as well as to most large pharma companies. Despite steady revenue growth, the stock has worked its way deep into “Busted IPO” territory since coming public in the fourth quarter of 2020. An analysis follows below.

Company Overview

August Company Presentation

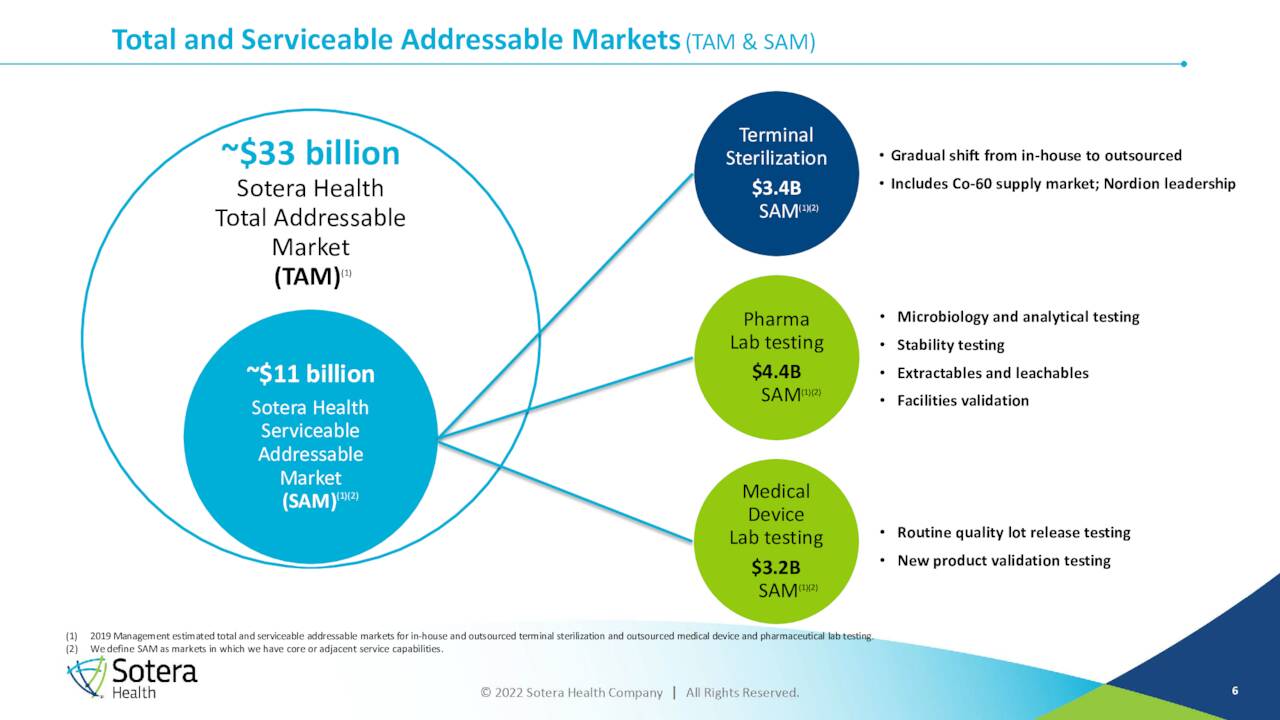

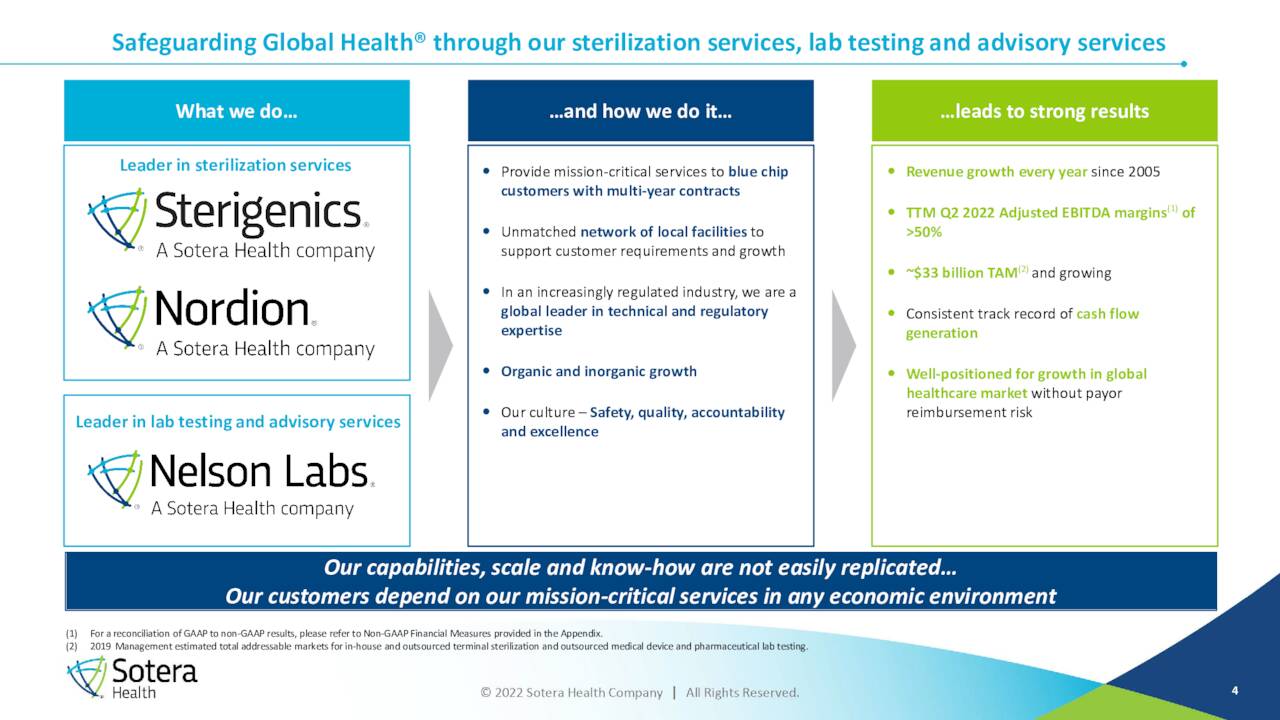

Sotera Health Company (NASDAQ:SHC) is located just outside of Cleveland, Ohio. The company provides sterilization, and lab testing and advisory services both in the United States and globally. The company basically provides sterilization services for a variety of medical products such as procedure kits and trays, implants, and catheters from its Sterigenics and Nordion business lines. Sotera also provides lab services via its Nelson Labs brand and business unit. The stock currently trades at around seven bucks a share and sports an approximate market capitalization of just south of $2 billion.

August Company Presentation

The stock has been hit hard since a Cook County jury in Illinois found Sotera’s Sterigenics sterilization unit was liable for claims that one of its plants may have caused breast cancer in September. Sotera was directed to pay just over $360 million in the first of more than 700 such cases in which Sterigenics faces charges over carcinogenic emissions over the past decades. The company obviously plans to challenge the decision through an appeals process as awards of this size would force Sotera into bankruptcy.

Second Quarter Results

On August 4th, the company reported second quarter numbers. Sotera had a GAAP profit of 11 cents a share, a nickel below the consensus. Revenue growth was nearly six percent on year-over-year basis to just over $266 million. This was approximately $10 million above expectations. Adjusted EBITDA rose just a tad over one percent from 2Q2021 to $136 million.

August Company Presentation

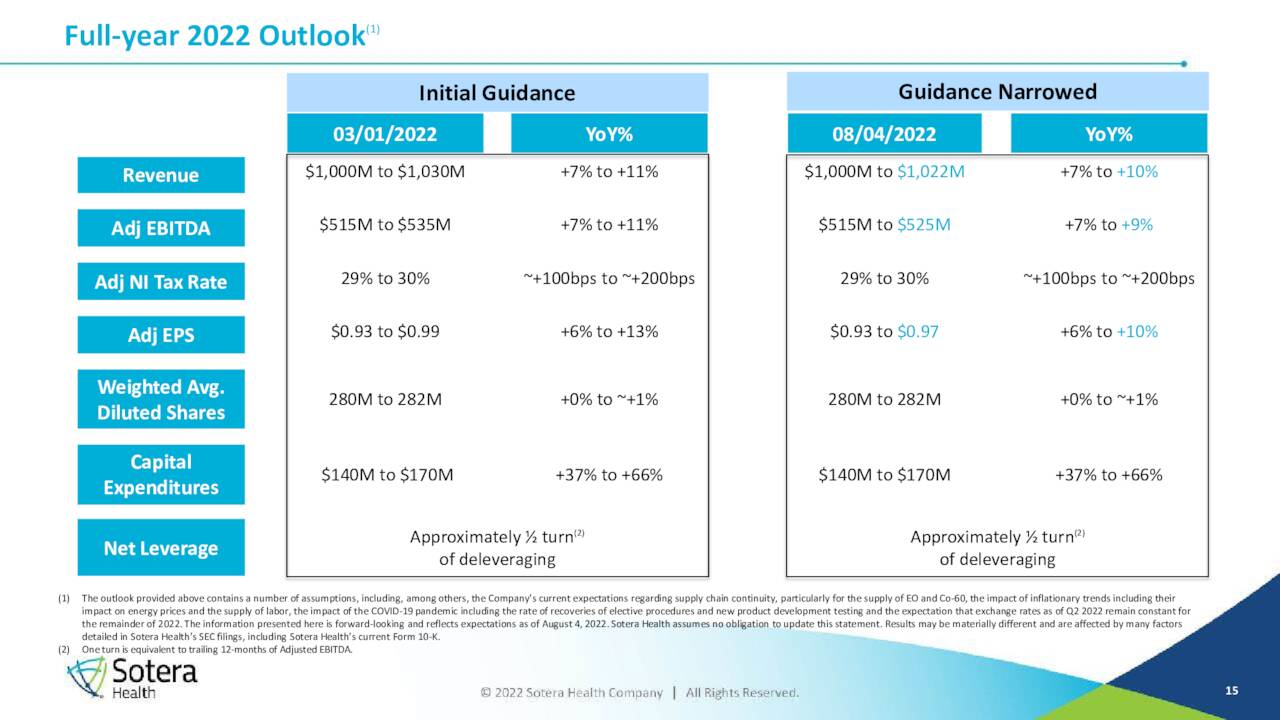

Management provided the following FY2022 guidance.

- Net revenues in the range of $1.0 to $1.022 billion, representing growth of approximately 7% to 10% over FY2021.

- Adjusted EBITDA in the range of $515 to $525 million, representing growth of approximately 7% to 9%, compared to FY2021.

- Adjusted EPS in the range of $0.93 to $0.97, representing growth of 6% to 10% over FY2021.

August Company Presentation

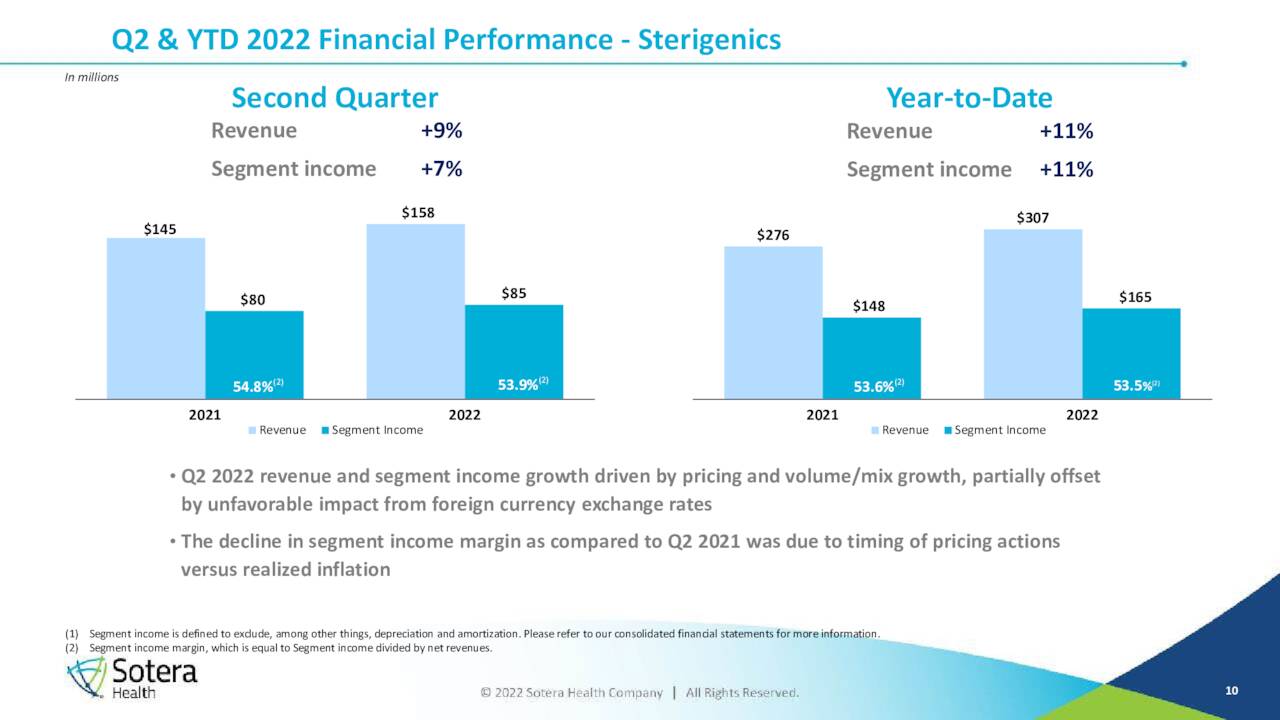

Sotera was impacted by a strong dollar during the quarter and would have had nine percent sales growth on a common currency basis. Revenues rose 8.7% Y/Y at its Sterigenics unit to $158 million. Nordion sales were up 2.8% for the quarter to $50 million and Nelson Labs booked revenues of $58 million, which was up just 1.3% from the same period a year ago.

August Company Presentation

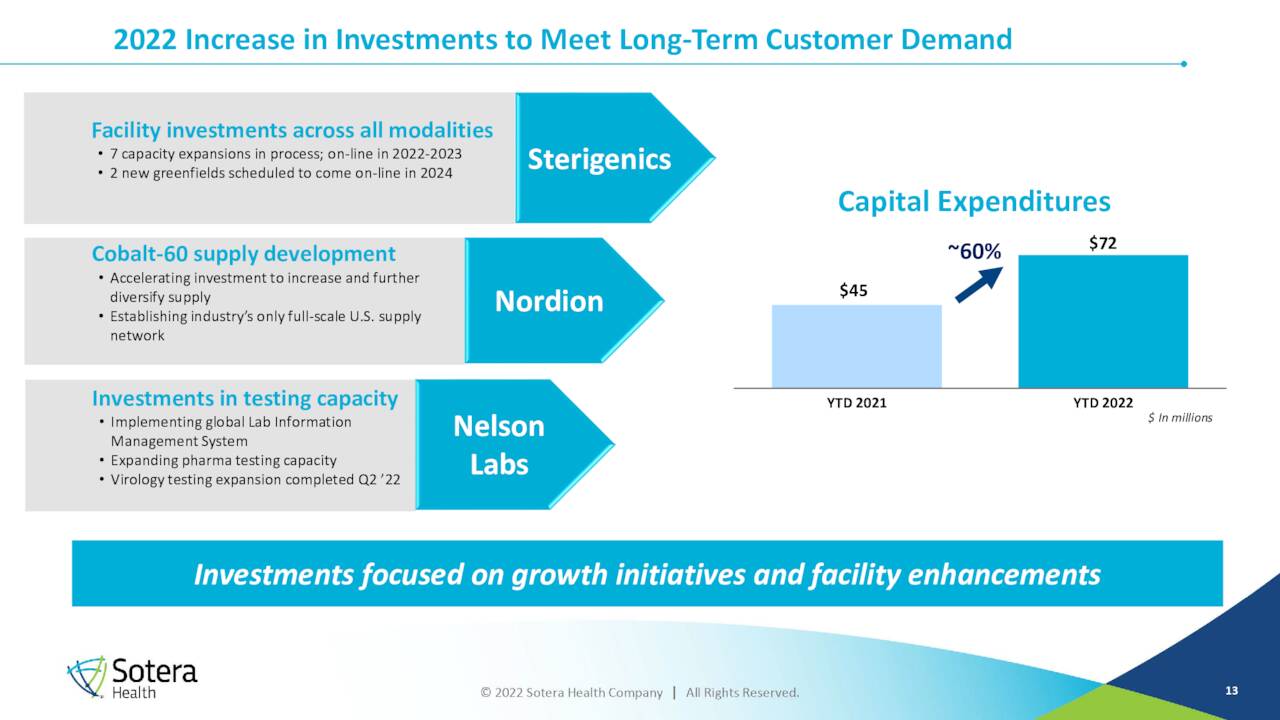

Cap Ex also rose some 60% in the first half of 2022 to $72 million, as the company is building out capacity to meet long-term demand.

August Company Presentation

Analyst Commentary & Balance Sheet

The jury verdict resulted in rash of downgrades from the analyst firm community. Four analyst firms, including Citigroup and JPMorgan, downgraded Sotera Health Company stock to a Hold or a Sell with significant price target revisions. Barclays maintained its Hold rating on the stock. Price targets proffered were in a tight range of $8 to $9 a share.

August Company Presentation

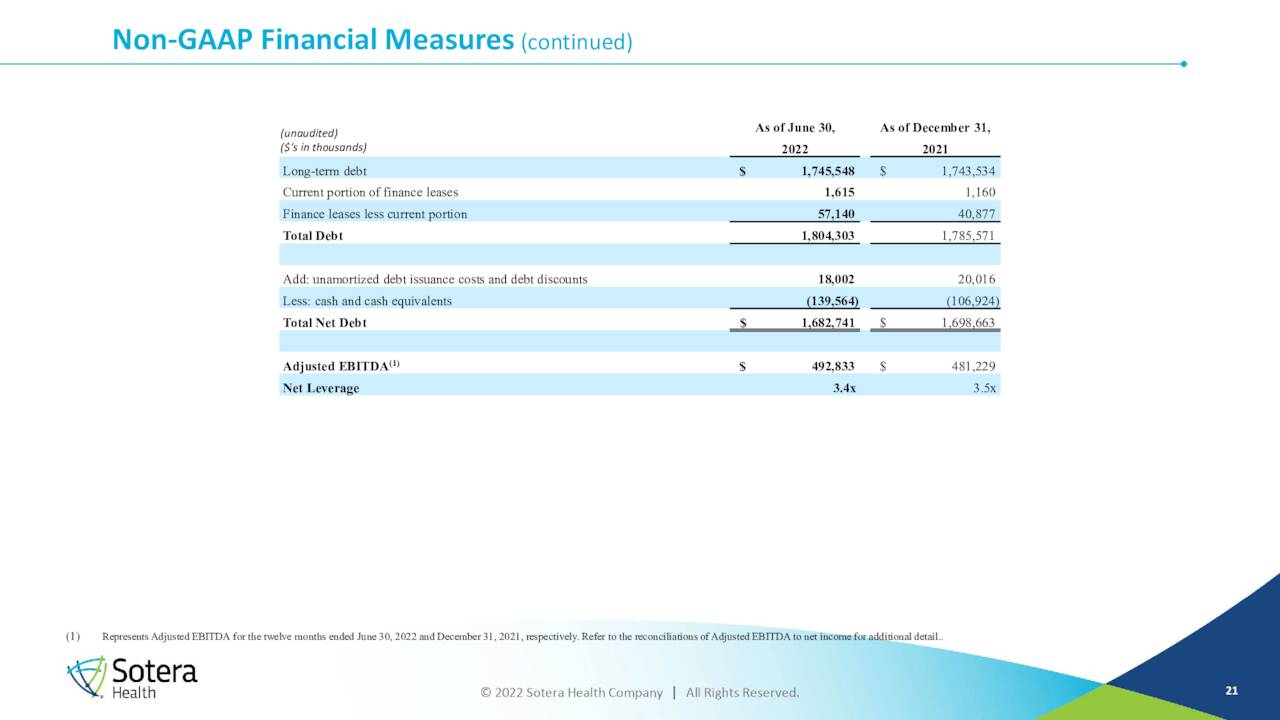

Approximately seven percent of the outstanding float in SHC is currently held short. There has been no insider activity in the stock since Sotera went public in the first quarter of 2023. The company ended the second quarter with some $140 million in cash and marketable securities against some $1.8 billion of debt. Sotera’s net leverage ratio as of the send of the quarter remained stable at 3.4x, within the Company’s stated range of 2.0x to 4.0x.

Verdict

The current analyst firm consensus has the company earning some 95 cents a share in FY2022 as revenues rise in the high single digits to just over $1 billion. Similar sales growth is expected in FY2023 when Sotera is projected to make roughly $1.10 a share.

Obviously, litigation challenges are going to remain a huge concern until they are resolved for Sotera. Now, it should be mentioned that Cook County is a perennial judicial hellhole which is known for disproportionate volumes of litigation and large verdicts. An analyst at Barclays noted the following right after the recent jury verdict:

‘We believe this is the first domino to fall, getting that much closer to global settlement and lifting of litigation overhang.’ He also estimated that the total award will come out to $100K-$200K case, which implies a total liability of $150m-$200m based on 1,000 cases.“

Now, if that comes to pass, Sotera Health Company will look like a great bargain in hindsight, selling at just over seven times this year’s projected EPS. STERIS plc (STE) which provides similar services via its Applied Sterilization Technologies unit, sells at 20 times forward earnings with similar revenue growth projections, as one comparison point. That said, in an already uncertain market; the litigation issue is too much of a risk for me to sign up for at this moment.

Until more litigation clarity is provided and/or investors see a significant wave of insider purchases, I plan to stay on the sidelines with this stock. We should get an update on litigation from Sotera’s management when they report third quarter earnings shortly. If I did take a position in SHC, I would do so via covered call orders for the additional downside protection this simple strategy would provide.

Be suspicious of the litigious.”― Stewart Stafford

Be the first to comment