Maskot

Investment Summary

We revisited our thesis on Sonida Senior Living, Inc. (NYSE:SNDA) after remaining neutral on the stock since the last publication. There is much to like about the company on face value, however this hasn’t pulled through to share price performance in FY22. Following its latest numbers last month, we’re back today to reiterate our negative findings.

Before we proceed, as a reminder, our last analysis on the company uncovered the following data points:

- GAAP measures of quarterly operating performance had fallen off on a sequential basis since FY17. Vertically down the P&L from revenue down income had narrowed substantially and had with investors then realizing a substantial negative FCF yield. This matched the erosion in shareholder value that had been exhibited during the same time.

- Investors were then expected to pay ~4x TTM sales and 129x TTM EV/EBITDA for a series of long-term operating losses, and a $366 million retained deficit (versus retained earnings).

- This also bought negative working capital of $35 million, ongoing NOPAT losses, a Q2 FY22 FCF loss of $11 million and a negative tangible book value of equity of $69 million. The loss on FCF and book value would have been acceptable and perhaps even preferred if return on investment exceeded the company’s return on investment beat the WACC hurdle, and capital was easily accessible.

- We also note it had $41.25 million in preferred equity on its balance sheet and debt of $668 million including minority interests.

Alas, and unfortunately, we retain our hold rating on SNDA.

Latest numbers not enough to get the market biting

We’d note it was a fairly tight period of growth for SNDA. For example, looking at Q3 metrics like revenue per available unit, increased by 6.3% and revenue per occupied unit increased by 2.9%, bringing in $3,682. Adjusted EBITDA increased by 41.0% YoY and by 5.0% in sequential quarters, due to continued improvement in operations. Despite this, the community net operating income decreased by $100,000.

We also observed the number of open community leadership positions decreased from 33 to 14, indicating stability in the community workforce. As a result, the company expects a wind-back in its reliance on contract labor looking ahead, and this could be a potential tailwind. As with the broad industry, average wages also increased during the quarter, and net hires increased by 7.9% since the year-end. It pulled this down to a net loss of $13.7mm, compared to a net loss of $7.4mm last year. The difference between these two time periods can be largely attributed to the $9.1mm of CARES Act income recognized during Q2 2022.

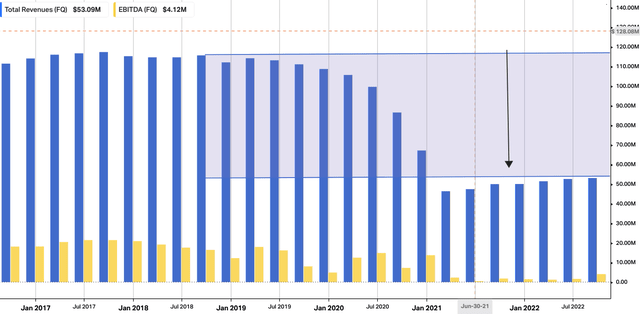

As you can see below, our findings also demonstrate the company has a large recovery period ahead of itself to return to previous revenue clips. This would explain the lack of investor attention in our opinion. We would also note that core EBITDA has note shown the growth of pre-pandemic times either.

Exhibit 1. SNDA long-term operating performance, per quarter

Data: Refinitiv, Koyfin

Deeper market analysis to guide positioning for SNDA

It was important for us to share our findings of the broad assisted living facilities market. There are differentiating factors about the space that are worth noting. When we performed our macro-deep dive on the sector, we focused on two main fragments of the market: the first being the demand for these services, the supply of facilities, and the financial aspects of the industry.

One study on the demand for assisted living facilities found that the number of Americans over the age of 85 is expected to more than double by 2050, resulting in increased demand for long-term care services such as assisted living. Another study found that seniors are increasingly preferring assisted living facilities over nursing homes, with the number of seniors choosing assisted living facilities increasing by nearly 50% from 2000 to 2010.

On the supply side, the number of assisted living facilities has also been increasing in recent years. The number of assisted living units in the United States increased by 45% from 2002 to 2012. However, the growth of the industry has not been evenly distributed across the country, with some states experiencing much faster growth than others.

In terms of the financial aspects of the assisted living facility market, recent analysis has shown that the industry is highly fragmented, with the majority of facilities being owned by small, privately-held companies. Research from the start of the millennium noted the top 25 assisted living companies in the United States only account for about 15% of the market. Additionally, the cost of assisted living varies widely depending on location, with some states having much higher median costs than others.

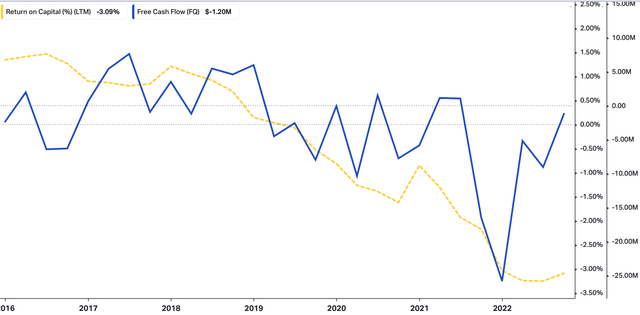

Despite the growth percentages listed above, SNDA has not been capturing any economic value added over the past 5 years. As you can see below, along with the cyclical free cash outflows, return on capital employed has drifted lower, and is now at multi-year lows. This presents a risk to the investment debate looking forward, when there are multiple names more attractive premia. Ideally, we wish to see declining free cash flow with an ascending return on capital, to justify the investment in various growth initiatives.

Exhibit 2. Free cash out flows with declining return on capital equals lack of economic value added.

Data: Refinitiv, Koyfin

Valuation and conclusion

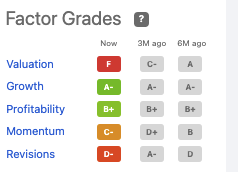

There’s not much to say in terms of valuation. Shares are richly priced at 3.4x trailing sales. Based on the findings above, and without a directional view on the market, we don’t provide a suggested price target. Our view is supported by Seeking Alpha’s factor grades on SNDA, seen below.

Exhibit 3. SNDA factor grades

Data: Seeking Alpha, SNDA

Be the first to comment