Thurtell

Solar energy stocks have outperformed the S&P 500 Index YTD with the most noticeable divergence June-August. The S&P 500 index is down 17% YTD and Nasdaq-100 index is down 26%, yet solar stocks are leading the tech industry as Enphase Energy (ENPH) is up 72%, Maxeon Solar Technologies (MAXN) is up 62%, and First Solar (FSLR) is up 56% YTD.

Similarly, we can see in the below chart that Invesco Solar ETF (TAN) is up 13% YTD and iShares Global Clean Energy ETF (ICLN) is up 7% YTD, and has outperformed other popular ETFs by a wide margin, particularly the Innovator IBD 50 ETF (FFTY) is down (39%), and Cloud Computing ETF (CLOU) is down (36%) YTD.

Solar Stocks Have Two Important Catalysts

There are two additional catalysts that may help to support the performance of solar stocks this year. The first is the Inflation Reduction Act which is expected to allocate $369 billion to energy security and climate change. Jon Hale, Global Head of Sustainability Research at Morningstar, said that the clean energy sector ETFs had a net outflow of $223 million two weeks before the July 27th announcement and the two-week subsequent, it had net inflows of $434 million.

The second catalyst is the energy crisis in Europe. The price of natural gas is rising, which will become a tailwind for alternative forms of energy. In some cases, the cost for base load energy prices in France, Spain, Italy and Germany are quadrupling or worse year-over-year with one expert saying it’s “like paying $500 for a barrel of oil.” We look at this in detail below.

The Inflation Reduction Act of 2022

The Inflation Reduction Act of 2022 aims to reduce the budget deficit, invest in domestic energy production and manufacturing, lower healthcare costs, and reduce carbon emissions. Our primary aim is to keep an eye on the clean energy industry as IRA unfolds.

According to the estimates, the Act is expected to raise $737 billion from increased corporate taxes, prescription drug reform and through IRS tax enforcement. This will be primarily allocated to energy security and climate change ($369 billion), affordable care act ($64 billion) for a total deficit reduction of $300 billion. The bill which was passed in both the Senate and the House of Representatives was finally signed by President Joe Biden on August 16th.

The revenue will be raised primarily from $265 billion by allowing Medicare and others to negotiate drug prices with drug companies, $222 billion from the new 15% corporate minimum tax for companies that earn more than $1 billion a year in profits, $124 billion from the stricter IRS tax enforcement, and $74 billion from the 1% stock buyback fee.

The highlight of the bill is investments of $369 billion in energy security and climate change with the goal of reducing carbon emissions by 40% by 2030. It also aims to expand tax credits for the purchase of Electric Vehicles. According to Morningstar analyst Brett Castelli, investors need to focus on three key takeaways:

“First, the act contains a 10-year extension of solar and wind tax credits. These credits had been scheduled to phase out over the next few years and the 10-year provision provides a significant amount of time for clean energy firms to build and benefit from new capacity.

Second, incentives have been included to support new technology that had not previously been eligible for tax credits. The two areas that we think will see the biggest benefits are hydrogen and energy storage.

Third, the act provides incentives for the domestic manufacturing of solar panels and equipment which had largely been imported previously. The provisions in this law significantly increase the incentive to manufacture solar panels and inverters domestically.”

As stated, electric vehicles are a beneficiary. The previous federal tax credits which were available to Electric Car buyers is going to change with The Inflation Reduction Act of 2022. Companies like Tesla, and General Motors which lost the $7,500 consumer income tax credit when they sold more than 200,000 electric cars, will once again be eligible since the cap of 200,000 EV sales is now removed.

Notably, there is a maximum retail price cap of $55,000 for cars and $80,000 for vans & trucks. There are also other income conditions for the buyers and critical mineral & battery component requirements. President Joe Biden said, “It also gives consumers a tax credit to buy any electric vehicle or fuel cell vehicle, new or used and a tax credit for up to $7,500, if those vehicles were made in America.”

The solar industry will benefit since Inflation Reduction Act includes the extension of Production Tax Credits (OTC:PTCS) and Investment Tax Credits (ITCs) for the construction of wind and solar projects beginning before January 1, 2025. It means a three-year extension for PTCs and a one-year extension for ITCs.

It also extends the 30% federal tax credits for installing solar panels on rooftops by another 10 years, from 2022 to 2032. Solar installations are eligible for 26% tax credit for installations in 2020 and 2021. It now extends till 2032 for 30% tax credits, and in 2033 the tax credit will be reduced to 26% and 22% in 2034. There will be no tax credit after this period unless Congress renews it. Home battery systems that store energy generated by solar systems for later use will also be eligible for a 30% tax credit.

The Inflation Reduction Act also has created a new Production Tax Credit for the domestic production and sale of solar and wind components. The tax credit is expected to phase out at a rate of 25% for components sold after 31 December 2029, and no credits will be available after the end of 2032.

European Energy Crisis

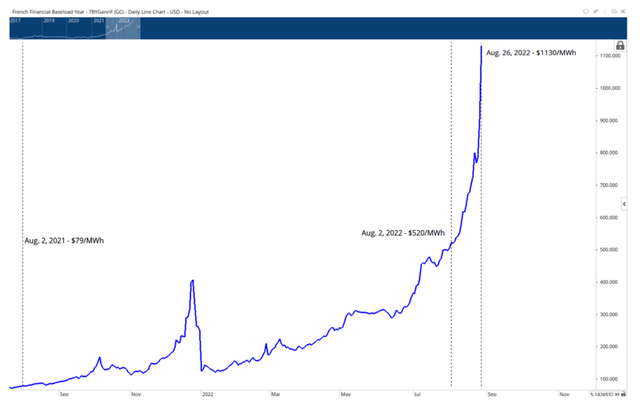

The below chart looks at the futures market for the cost for base load energy prices in France one year out. Base load refers to the minimum energy needs to support a grid, and does not include peak energy.

On August 26th, 2022 the price was $1130/MWh. Twenty Four days earlier the cost was €507/MWh. And one year ago, the same forward price was €78/MWh. Keep in mind, this is the expected cost to power the base load of the French energy grid one year out from now.

This is not just a French problem. The same contract looking at the 1-year percentage increase in the expected cost to power a country’s base load is as follows: Italy +660%, Spain +400%, Germany/Austria +1200%. Alex Munton, an expert on global gas markets at Rapidan Energy Group, said, “European natural gas is so expensive it’s like paying $500 for a barrel of oil.”

To make matters worse, the French government just bailed out Electricité de France S.A. (OTCPK:ECIFF) (‘EDF’), which is the largest supplier of nuclear energy to Europe, as well as a large supplier of natural gas in France, Belgium, Italy and the UK through its subsidiaries. The €10 billion bailout has made the company 100% nationalized, as the French government scrambles to address the EU energy crisis.

EDF is one of a string of EU energy companies applying for emergency loans as the soaring price of natural gas affects EU supply. Uniper SE (OTCPK:UNPRF), one of Germany’s largest utility companies, was just given a new bailout that allows the German government to take a 30% stake in the company. The ongoing losses are unsustainable as rapidly rising energy costs drain needed liquidity to fund daily operations.

Uniper was Europe’s largest supplier of Russian gas. They claimed the volume it has received from Russian gas this year has fallen by 80% since June, which forced them to find alternative sources of energy at elevated prices in order to meet demand.

France’s solution to the crisis was to instill price caps on energy prices to its citizens. A politically popular policy with the consequence we are seeing with EDF. The energy suppliers are being forced to buy high and sell low due to these price caps. As a result, France has had to hand over roughly €40 Billion in 2022 to keep EDF afloat this year. Ever since, energy prices have doubled as future prices are expected to increase by about 5 times into 2023. If France maintains price caps, they will be looking at an additional €200 billion to keep EDF afloat through the winter with the current price caps.

Regardless, with energy prices increasing with no end in sight, EU officials are calling for major price caps across the board. The EU is forced to choose between ongoing bailouts/nationalization of energy suppliers or face the realization that many citizens will be unable to afford energy needs for basic cooking and heating as we enter the Fall/Winter months.

How can a European utility, which has been historically safe, run into insolvency when energy demand has far exceeded supply? It goes back to standoff between Russia and the EU. Russia supplied 40% of Europe’s natural gas in 2020. In 2022, the EU has taken a stance against Russian imports due to the invasion of Ukraine.

As of July 2022, EU has seen a 60% drop in Russia natural gas deliveries, as we move into Fall/Winter. Furthermore, the Nord Stream 1 pipeline, which accounts for 1/3 of all EU’s natural gas imports from Russia, has seen around 1/5 of normal inflows this year. As a result, basic energy price throughout the EU is approaching prices that most citizens simply cannot pay.

Much like the US saw a contagion in banking in 2008, which forced a quasi-nationalization of the industry, it appears that the EU is heading in the same direction with its energy companies. With the multi-year move to shift towards a green energy grid, coupled with the sudden loss of Russian energy supply, the EU appears to have no viable option to avoid blackouts into the coming fall/winter months.

Conclusion:

The NDX is down (26%) YTD and this is one of four years in the last two decades the broader tech index has seen double-digit losses. However, there are pockets of growth even in this market and solar is the leader in this regard.

On top of this sector’s excellent performance over the past few months, we foresee its leadership position continuing due to these two catalysts which will create a new trajectory in global demand for renewable sources of energy. We publish premium deep-dive reports on individual stocks for our premium members with a focus on Solar this upcoming week.

Knox Ridley, Portfolio Manager at Tech Insider Network, and Royston Roche, Equity Analyst at Tech Insider Network contributed to this article.

Be the first to comment