Selman Keles/E+ via Getty Images

While the broad crypto market has seemingly found its footing in recent weeks, the price of Solana (SOL-USD) has really shined. After a 31% rip over the last 7 days, SOL is the best performer of any Top 30 coin according to CoinMarketCap. The last couple of days specifically have seen some pretty big moves in SOL. Price action that is almost certainly in response to some degree to NFT marketplace OpenSea planning to integrate Solana on the platform in April.

Current Solana Marketplaces

Solana already has a presence on several NFT marketplaces including Magic Eden, Solanart, and Solsea. Magic Eden has a pretty commanding share of Solana’s NFT market based on both user adoption and raw volume numbers. The table below shows the Solana NFT activity over the last 30 days broken out by top 3 marketplaces.

| Marketplace | Traders | Volume |

| Magic Eden | 95,991 | $41.05m |

| Solanart | 18,891 | $4.39m |

| Solsea | 4,994 | $657k |

Source: DappRadar.com

After Magic Eden, the level of activity falls off considerably. And all of that Solana NFT volume falls well short of what OpenSea brings to the table. According to DappRadar, OpenSea and new rival LooksRare have combined for just under $5 billion in NFT volume on Ethereum (ETH-USD) over the last 30 days. With roughly half a million traders in just the last 30 days and over 1.4 million lifetime, OpenSea will now bring Solana NFTs to a much larger user base.

The NFT Story

NFT activity on Solana has started to trend up lately. As of article submission, 4 of the top 20 NFT collections by 24-hour sales volume are on Solana according to CryptoSlam. For context, Solana doesn’t have a single collection in the top 20 over the last 30 days. Meaning interest in Solana NFT projects is experiencing a notable uptick. While a 24-hour sample is incredibly small, March 30th was the second consecutive day that NFT sales on Solana eclipsed $11 million.

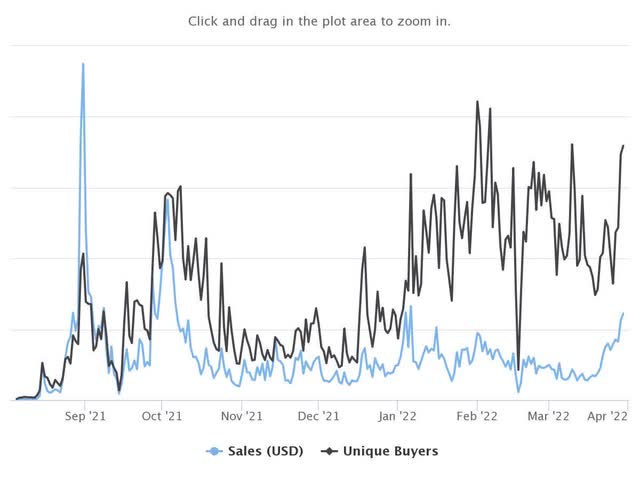

Solana NFT Sales (CryptoSlam.io)

March 29-30 was the best two-day period for NFT sales on Solana since early October. It also shouldn’t go unnoticed that unique buyers eclipsed 8,600 during that two-day period as well. The fact that daily unique buyers have held up relatively well over the last few months even when sales were low is interesting. But again, it’s a small sample size. I think we can look to the trend in average NFT sale price over the last several months and draw some conclusions.

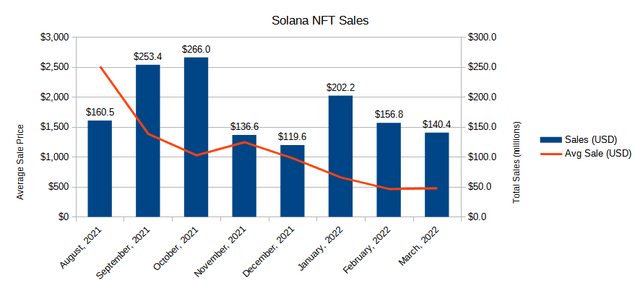

Author generated graphic (CryptoSlam.io)

While it’s no secret that Solana aims to be a lower-cost layer 1 alternative to Ethereum, it would appear in the early going that Solana is indeed appealing to the lower-cost NFT buyers and sellers. In August, the average sale price of a Solana-based NFT was over $2,500. As March nears a close, the average price of Solana NFTs is now under $500. Comparing average NFT sales data with ETH and fellow “ETH killer” Avalanche (AVAX-USD) provides interesting context.

| Month | Solana | Avalanche | Ethereum |

| August, 2021 | $2,513 | – | $4,792 |

| September, 2021 | $1,387 | – | $3,483 |

| October, 2021 | $1,031 | $580 | $2,726 |

| November, 2021 | $1,250 | $560 | $3,458 |

| December, 2021 | $980 | $868 | $2,597 |

| January, 2022 | $662 | $1,325 | $3,075 |

| February, 2022 | $469 | $1,862 | $2,215 |

| March, 2022 | $481 | $809 | $2,150 |

| vs Nov | -61.5% | 44.4% | -37.8% |

| vs Feb | 2.7% | -56.6% | -2.9% |

Source: CryptoSlam.io

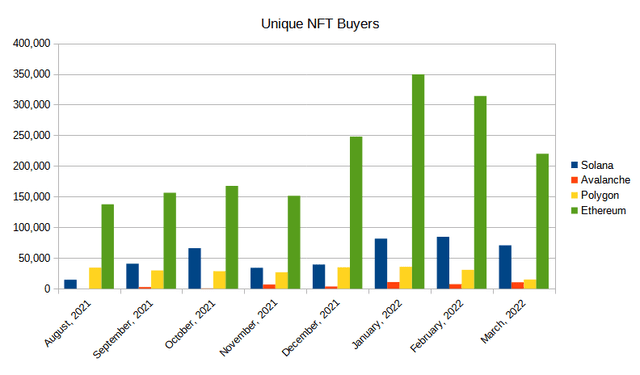

Since November when most coin prices peaked, Avalanche has seen a 44% increase in average NFT price while both Ethereum and Solana NFTs are well off highs. While those NFT average price declines have been fairly drastic, especially since August in the case of Solana, unique NFT buyers on Solana have been generally increasing.

Author generated graphic (CryptoSlam.io)

The conclusion I draw here is the average NFT price decline for Solana hasn’t been from a lack of interest in the network. It’s more of an indication that Solana does indeed offer a lower barrier to entry for NFT buyers and sellers. While Avalanche does have a positive trend overall, there has still been far more adoption of Solana as a network for viable NFT projects than that of Avalanche or Polygon (MATIC-USD).

Valuation Metrics

Still, caution is warranted. Despite the boost in NFT activity on Solana and the large move up in the price of SOL over the last week or so, the token value is likely still far ahead of what would be warranted based off other metrics. After all, NFTs are just one part of the activity for layer 1 blockchains. Even though I look at the NFT action on Solana as generally favorable, it’s important to consider all of the on-chain activity when assessing whether the performance in SOL is justified.

Solana is also home to DeFi protocols and Web3 applications. Back in late November when I compared Ethereum with a few of the newer competitors, I shared 30 Day Revenue and Price to Sales data from Token Terminal. Comparing those tokens with the same metrics now looks like this:

| 11/22/21 | 03/30/22 | |||

| 30 Day Rev | P/S | 30 Day Rev | P/S | |

| ADA | $1.4m | 4,653 | $1.2m | 3,692 |

| SOL | $7.1m | 1,329 | $3.1m | 1,587 |

| AVAX | $6.8m | 1,148 | $20.7 | 269 |

| ETH | $1.8b | 23 | $370m | 85 |

Source: Token Terminal

I’m not saying this is the best way to value any of these chains, but if we’re judging Solana purely off the P/S ratio, it has been one of the weaker performers from a valuation perspective as it is now more overvalued than it was in late-November when the token price was $100 higher.

Total Value Locked

One of the other ways we can assess if a token is overvalued or not is by looking at some of the DeFi activity valuation metrics. Specifically, Total Value Locked (TVL) and Market Cap to TVL. Generally, the lower the MC to TVL the better value the token potentially is. We can get a sense of Solana’s MC to TVL positioned against peers. According to DeFi Llama, Solana just cracks the top 5 chains measured by TVL with a little under $7.9 billion locked.

| Chain | Protocols | TVL | MC/TVL |

| Ethereum | 583 | $129.97b | 3.2 |

| Terra (LUNA) | 26 | $29.3b | 1.3 |

| BSC (BNB) | 352 | $13.15b | 5.7 |

| Avalanche | 189 | $10.51b | 2.6 |

| Solana | 63 | $7.86b | 5.1 |

Source: defillama

Of the top 5 in the table above, Solana has the highest MC/TVL and the second-fewest protocols. To me, this is another indication that the SOL token is probably overvalued.

Main Takeaways

Solana is a very interesting blockchain. As an NFT enthusiast myself, I’m very cognizant of the need for low-cost, on-chain transactions. I think we are going to witness quite a bit of partnerships and integrations as layer 1 competitors and layer 2 Ethereum solutions battle for the future. This announced integration between OpenSea and Solana figures to be mutually beneficial for both parties. I think it could ultimately bring faster adoption of Solana-based NFTs. But only time will tell. From here, I think Solana is a hold. While I am long SOL personally, I’d like to see how the OpenSea integration plays out before I chase this big move up in recent days.

Be the first to comment