Koki Nagahama

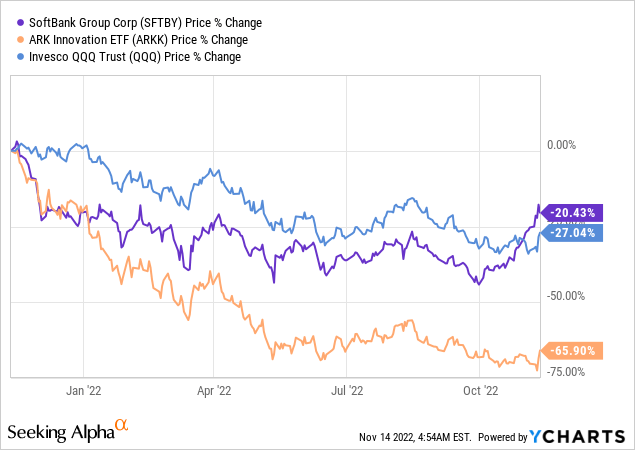

SoftBank Group (OTCPK:SFTBY) is a $73 billion conglomerate with investments in established telecommunications companies, as well as in disruptive technology plays through its Vision Funds, somewhat analogous to a techie ETF as I have explained before. Its sustained upside from the beginning of October (as per the deep blue chart below), outperforming both the Invesco QQQ Trust (NASDAQ:QQQ) and ARK Innovation ETF (ARKK) points to a change in sentiment towards the Japanese company, but its connection with Bahamas-based cryptocurrency exchange FTX also needs to be considered.

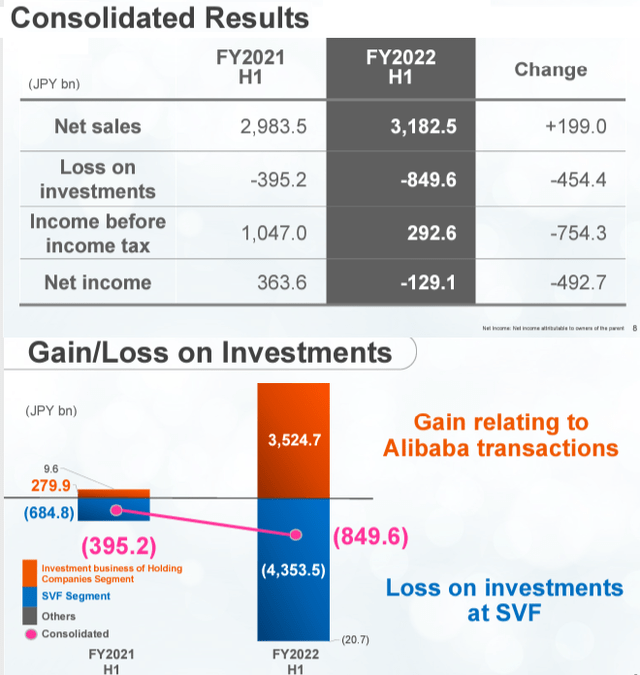

My objective with this thesis is to assess whether an investment in the Japanese conglomerate makes sense and I start with dissecting the second quarter of 2022 financial results which ended in September. At that time, revenues of ¥3,182.5 billion for the first half of 2022 (FY2022-H1) represented a 6.7% Y/Y growth.

The Results and Playing Defense

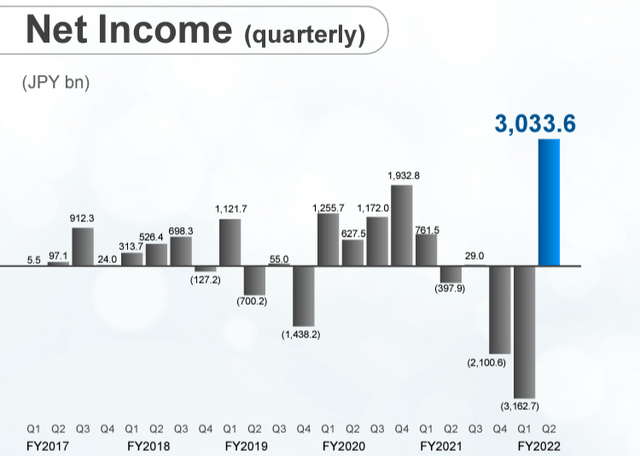

First, this topline growth as illustrated in the table below represented a breather after dark clouds had gathered over SoftBank’s finances three months earlier when it suffered from record losses against the backdrop of a global decline in technology stocks. At that time, investment losses of more than 2.8 trillion yen were recorded.

Results for the first half of FY 200, ending in September (group.SoftBank)

Looking into the rear mirror in 2017, SoftBank has been plagued by market volatility since its CEO and founder Masayoshi Son reoriented the business model towards a financial holding company specializing in tech investments, but, there were losses that gradually accumulated at the point when the CEO had to admit that these were really huge during the first quarter results which ended in June.

These losses were mainly related to its SoftBank Vision Fund 1 and 2 funds (SVF1 and SVF2), reflecting the global downward trend in tech due to growing concerns about high inflation, and economic slowdown concerns due to rising interest rates without forgetting the unending Covid restrictions in China where Alibaba (BABA) operates. There was also the fact that these funds included hundreds of private and unlisted companies whose value is difficult to estimate.

To address the situation, Mr. Son went on the “defensive”, a strategy consisting of both being selective in terms of investments, and ensuring monetization of assets. This strategy has been put into practice, namely with the reduction in Alibaba’s holdings, which resulted in a “huge gain” of ¥3,524.7 billion (as shown in the above table). This only partially offsets the losses on investment of ¥4,353.5 incurred by the Vision Funds but is a clear signal to the market that Softbank’s CEO is delivering on its monetization strategy, which had been announced back in August.

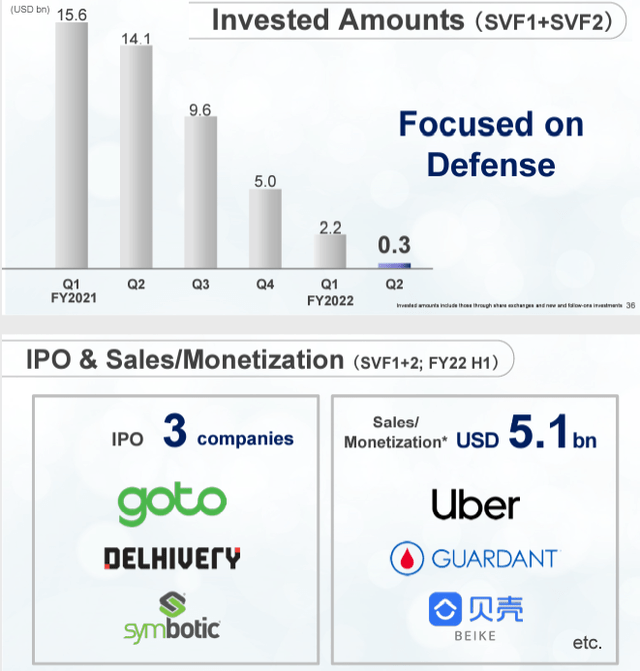

Looking deeper, there has been more evidence to show that Mr. Son has moved away from instinct-led investment whereby he would splurge money on new ventures without necessarily doing proper due diligence. Thus, the amounts invested in SVF1 and SVF2 fell to their lowest level at $0.3 billion during Q2 compared to $14.1 billion in the same quarter last year. This certainly resulted in winning the trust of the more value-oriented shareholders.

Amount Invested in Vision Funds (group.SoftBank)

At the same time, with about ¥2.4 trillion of debt having been repaid, the group remains committed to a healthy balance sheet plus the ¥400 billion in share buybacks effected as of September (out of the total of the ¥1 trillion initially announced last year) shows that the commitment to return value to shareholders remains undeterred.

However, it is also important to talk about the risks

The Risks and their Mitigation

The most important risk for SoftBank stems from its investments in startups and private companies as I briefly touched upon earlier. Here, unlike publicly listed companies whose market capitalization can be easily available from SA or other investing sites, the value of unlisted ones has to be estimated mostly based on the amount obtained during fundraising.

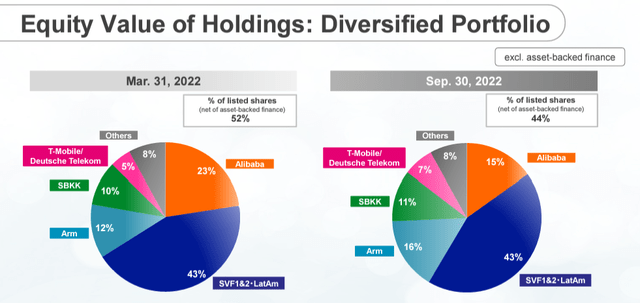

Furthermore, as shown in the pie chart below and excluding asset-backed finance, the percentage of listed shares out of the total which went down from 52% in the March quarter to 44% at the end of September, signifying that SoftBank’s portfolio is now significantly skewed towards unlisted shares.

Thus, these account for a sizable 43% of the group’s portfolio, with Alibaba accounting for only 15% compared to 30%-40% in the past. SoftBank itself or SBKK now accounts for 11% as shown below.

Change in the Value of Equity Holdings (group.SoftBank)

Therefore, while SoftBank’s monetization strategy together with paying off debts appears to be appropriate in this era of monetary tightening by most central banks throughout the world, it is not without risks as its portfolio becomes skewed toward more risky assets.

However, there are some who would welcome weighing down shares of Chinese Alibaba which is seen as being highly susceptible to China’s unpredictable tech sector regulations as well as the strict Covid-Zero policy. Also, Mr. Son has a trump card in the form of the ARM IPO. This is the company manufacturing processor chips that compete against those of Intel (NASDAQ:INTC) and, as seen in the above chart, floating of the company’s shares on the public market could significantly skew the percentage in favor of listed shares by as much as 16%.

Along the same lines, the emphasis is more on quality for the Vision Funds, namely through “trying to enhance the governance” instead of quantity, like just adding more startups. Also, the group has embarked on a cost-cutting initiative across all senior levels, junior levels, and middle management levels, encompassing all geographies.

In these circumstances, with the group playing defense, compared to an all-attacking mode in 2021, valuations should be done accordingly.

Valuations and the FTX Episode

To value SoftBank, I make a comparison with Cathie Wood’s ARKK, an actively managed ETF that invests in both U.S. and foreign equity securities of companies that are deemed to be engaged in the theme of disruptive innovation through “technologically enabled new product or service” that “potentially changes the way the world works”.

When analyzed in depth, these objectives are not so different from SoftBank’s Vision SVF 1, SVF 2, and Latin American Funds which seek to profit from “tech-enabled growth companies”, and build “transformative businesses” involved in the AI revolution.

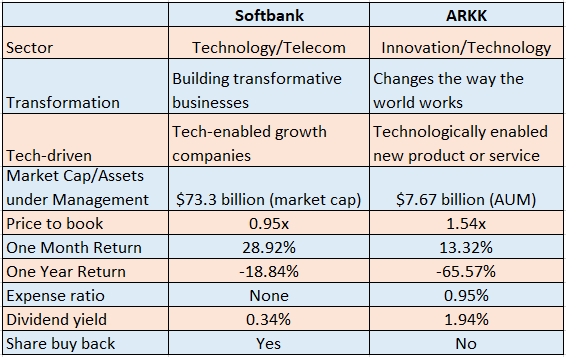

I have grouped these in the table below as well as some key value metrics.

Comparison of Objectives and Key Metrics (www.seekingalpha.com)

Thus, with its Vision funds, Softbank dwarfs ARKK by more than nine times in terms of value, as shown by the $73.3 billion market cap versus the $7.67 billion AUM. Also, while you must pay fees of 0.95% for Cathie Wood’s fund, the Japanese conglomerate charges none apart from broker fees common to all stocks.

Consequently, in case you want disruptive tech exposure, Softbank with a lower Price to Book multiple of 0.95x compared to ARKK’s 1.54x is a better option. Adjusting accordingly, I obtain a target of $35 ((21.64 x1.54)/0.95)) based on the current share price of $21.64.

Now, this is a high target and in the current highly volatile environment, do expect some turmoil, as on Monday when the company’s shares went down by more than 10%, probably due to its nearly $100 million FTX write-off.

Conclusion

This is the reason that I am not bullish on the stock as the FTX episode may prompt investors to look more attentively towards loss-making equity investments like South Korean eCommerce giant Coupang (CPNG), Chinese AI company SenseTime (OTCPK:SNTMF), and DoorDash (DASH), specializing in the delivery of meals. There is also the Swedish unicorn Klarna (KLAR), which is privately held and has also suffered.

However, putting things into perspective, the nearly $100 million FTX write-off pales with the $21.4 billion (or 3.03 trillion yen) net profit in the second quarter at SoftBank or SBKK itself, compared to a loss of 3.16 trillion yen in the first quarter.

At the same time, the group has 4.3 trillion yen in cash, a level that allows it to cover four years of debt service.

Therefore, by playing defense instead of actively buying startups, SoftBank is building the finances needed to weather any further potential turbulence relating to its loss-making investments, but its stock should stay volatile for the time being.

Finally, it is better to wait on the sidelines as the market digest the FTX episode before investing, in a conglomerate which I value at around $35.

Be the first to comment