Justin Sullivan

Thesis

We updated readers in our previous article on SoFi Technologies, Inc. (NASDAQ:SOFI), encouraging investors to add SOFI through the pullback. However, SOFI has continued to underperform the market.

Therefore, we revisited our thesis and tried to discern why the buyers have not been keen to support our conviction, even though SoFi is expected to continue its recovery through the cycle.

We noted that the selloff from our previous article suggests that the market has attempted to re-test its May/June lows. Therefore, it created an opportunity for investors who missed adding at its mid-year lows to consider adding more positions.

SOFI’s valuations remain well-battered at the current levels and its operating metrics are projected to continue growing rapidly through 2024. Moreover, its profitability remains well below the company’s targeted long-term incremental EBITDA margins of 30%. Accordingly, despite the worsening macroeconomic headwinds, it offers significant potential upside for investors with a high conviction of its medium-term growth cadence.

We also see constructive consolidation signals at the current levels as buyers returned to support SOFI at its critical support zone.

Accordingly, we reiterate our Speculative Buy rating but lower our medium-term price target (PT) to $7.2, implying a potential upside of 33%.

The Street Remains Confident Of SoFi’s Execution Through The Recession

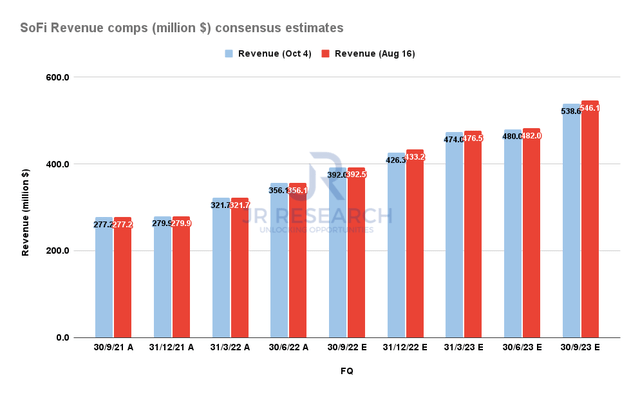

SoFi Revenue comps consensus estimates (S&P Cap IQ)

We reviewed the revised consensus estimates (bullish) to analyze whether there were significant changes since our previous article. However, we noted that the revenue estimates for SoFi’s upcoming Q3 earnings release had stayed relatively consistent, despite the increasing threat of a recession.

Furthermore, SoFi is expected to continue its sequential revenue growth through FY23, suggesting it should continue executing well through the cycle.

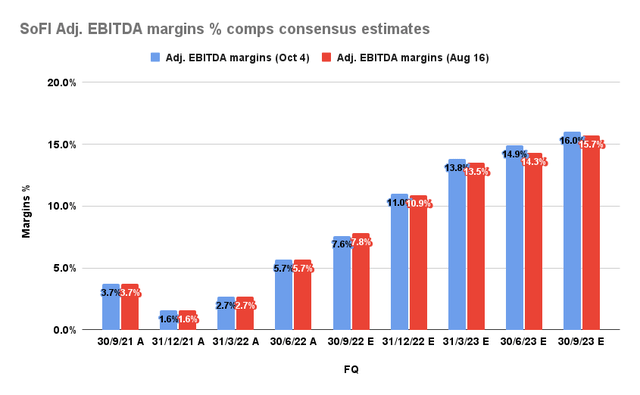

SoFi Adjusted EBITDA margins % comps consensus estimates (S&P Cap IQ)

Accordingly, SoFi’s adjusted EBITDA margins are also expected to remain stable through the coming recession, making steady progress toward its long-term model target.

Yet, the market deemed it necessary to pummel SOFI from its August highs, sending it down more than 40% through its September lows. Hence, we believe investors could have been perplexed by the market’s reaction and started to question their conviction levels of SoFi’s growth estimates.

Is the Street too optimistic about SoFi’s ability to pull through the recession, even though its members generally have higher income levels, with higher FICO scores? Is SoFi overstating its opportunity for the student loan refinancing opportunity from 2023 when the moratorium ends?

The Problem Could Lie With Its Investor Base

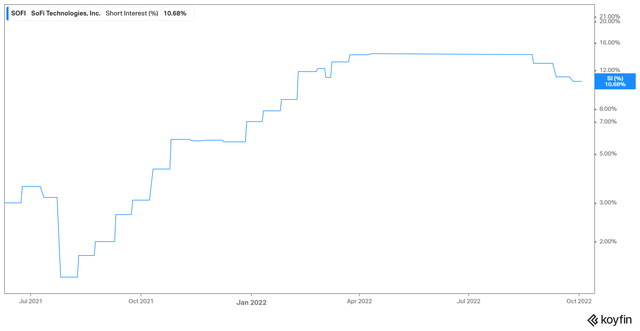

SOFI short interest % (koyfin)

It certainly didn’t help that SOFI’s short interest continued to climb through August, reaching a peak of more than 14%. However, we noted that it has since started to fall through September. Therefore, it would be constructive if investors continue to peel off their bearish bets on SOFI, allowing its short interest to continue falling from its 2022 highs.

Moreover, we also noted that SOFI has a retail investor base comprising nearly 50% of its total holdings. Accordingly, it could have contributed to the recent volatility, as the bear market continued to discourage retail investors from holding on to losing bets.

Furthermore, the media has also been fanning the flames of a potential global recession, raising the levels of pessimism to an extreme. We also analyzed that retail investors have been spooked significantly, as the retail put/call ratio spiked massively from its August lows.

Therefore, SOFI could have suffered the brunt of retail investors giving up their holdings in anticipation of a debilitating recession that could cause further pain for speculative stocks like SOFI.

But, SOFI’s Valuation Has Been Battered

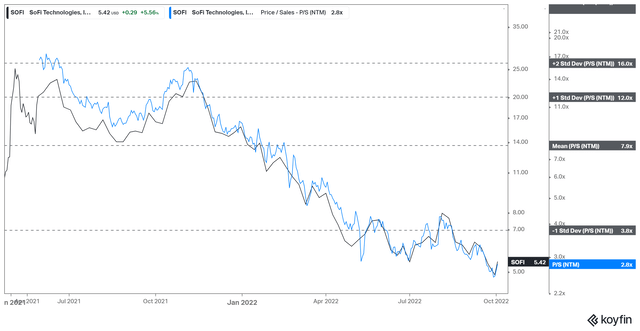

SOFI NTM P/S valuation trend (koyfin)

We concur that the P/S ratio isn’t our preferred valuation measure, given our preference for earnings multiples gauges. However, SOFI is unprofitable and doesn’t offer meaningful insights with earnings multiples.

As a result, we continue to view SOFI as a speculative opportunity, suggesting investors apply appropriate risk management strategies.

Notwithstanding, with SOFI’s NTM P/S having fallen to 2.8x, we believe its valuation has been battered significantly.

Is SOFI Stock A Buy, Sell, Or Hold?

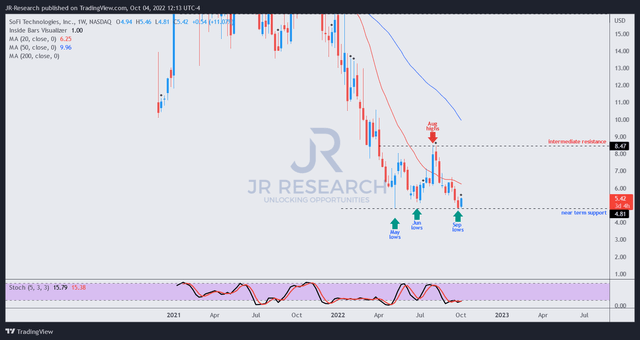

SOFI price chart (weekly) (TradingView)

As seen above, the hammering in August/September sent SOFI back to its May lows, re-testing it.

Therefore, we believe SOFI is at a critical juncture, needing buyers to demonstrate tremendous resilience to underpin its critical support level.

However, the buying sentiments among retail investors are very weak due to the high level of pessimism in the market. Therefore, SOFI would need to rely on its institutional base to lift its buying momentum, bolstering the potential return of retail investors subsequently.

We believe the price action dynamics are constructive even though we would have preferred a much more robust re-test (indicating a decisive break of May lows before staging a bullish reversal).

Accordingly, we reiterate our Speculative Buy rating on SOFI, with a medium-term PT of $7.2.

Be the first to comment