Justin Sullivan/Getty Images News

SoFi Technologies (NASDAQ:SOFI) had to cut 2022 financial targets due to the extension of the federal debt moratorium. The government move is disappointing, but not a huge shock to the market. My investment thesis remains very Bullish on the fintech stock after a massive dip to new lows following the guidance cut.

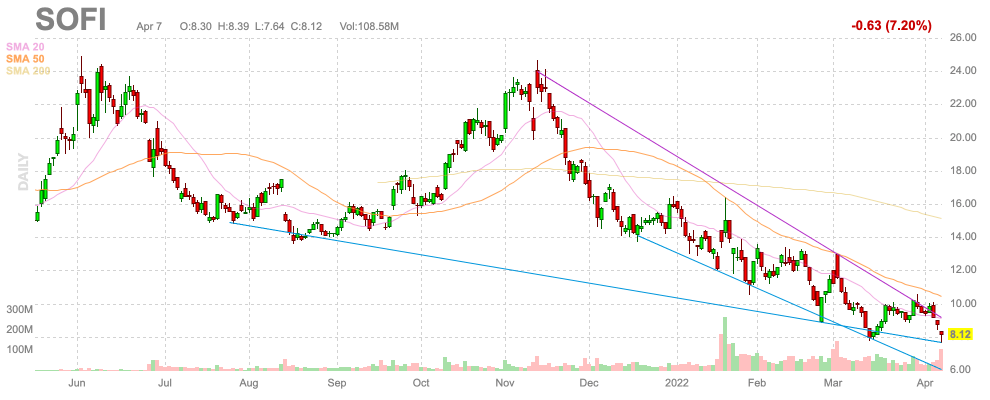

Source: FinViz

Extended, Not Cancelled

Since the start of covid, the Federal government has delayed student loan repayments to provide up to 41 million Americans time to recover from covid hardships. The Biden Administration again extended the moratorium until August 31, 2022 for another four month extension.

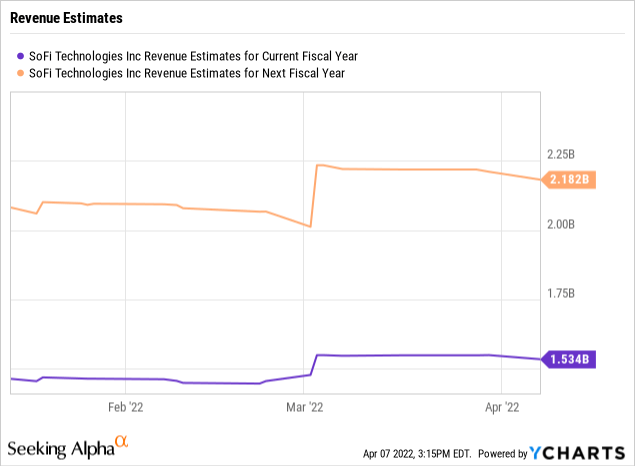

When SoFi reported Q4’21 earnings on March 1, the company provided 2022 numbers based on the current moratorium ending on May 1, 2022. The fintech guided Q1’22 revenues over $30 million below potential due to the delay in restarting student loan repayments. SoFi guided 2022 revenues to $1.57 billion based on student loan origination volumes normalizing to pre-covid levels by mid-May.

The stock falling on news of SoFi cutting 2022 guidance due to this extension is baffling. The current student loan debt levels are estimated at $1.8 trillion. No legitimate signs exist for the Biden Admin. to actually get Congress to approve the cancelling of debt despite the extension of the moratorium, especially considering this direct statement by Biden.

I’m asking all student loan borrowers to work with the Department of Education to prepare for a return to repayment, look into Public Service Loan Forgiveness, and explore other options to lower their payments.

This time, SoFi wisely just stripped the revenue for the student loan refinancings out of the business model for the whole year. The fintech is now targeting 2022 revenues of $1.47 billion for impressive 45% growth. The company cut ~$100 million off the revenue targets for the year generally in line with prior estimates assigned to the quarterly revenue impact of ~$30 million.

SoFi still plans to generate $100 million in EBITDA profits for the year. The company cut the target nearly in half from the prior $180 million estimate and will likely lead to more consternation by stock pundits unimpressed by the profit level of the fintech. Remember, SoFi guided to 30% incremental EBITDA margins on the non-Technisys business. The market will incorrectly question the valuation of the stock with a market cap not exactly representative of current profits.

No Less Valuable

As long as the student loan business isn’t expected to end, the market shouldn’t factor the extended moratorium much into the valuation equation. The government hasn’t made any valid proposals to ever allow for the cancellation of debt for a government already $30 trillion in debt.

In such a scenario, the student loan debt refinancing business will ultimately return. The consensus analysts’ estimate for 2023 revenue targets of $2.2 billion should be considered valid to evaluate the stock. The market cap is now down to only $6.5 billion providing a rare opportunity to own a stock at less than 3x sales targets with revenue growth approaching 50%.

SoFi continues to build out a suite of financial service products to move the bank beyond just lending. The company now has checking and savings accounts along with cryptocurrency trading driving the financial services revenue segment which grew 442% YoY in the December quarter.

The stock might be more risky to own, if the business was solely based on refinancing student debt. The company now originates more personal loans and home loans. Even under a scenario where student loan debt was cancelled, the target customer would likely quickly shift borrowing habits towards these alternative loan options no longer having to repay student loans.

Investors need to keep in mind SoFi once traded at $24 on multiple occasions. The market for fintechs is far different than last November, but the business model hasn’t exactly taken a different long-term outlook. Under a normal 2023 student loan scenario, the company would generate up to $400 million in adjusted EBITDA with the $650 million in incremental revenue producing somewhere close to $200 million in additional EBITDA profits based on the 30% margins.

Takeaway

The key investor takeaway is that investors need to view full student loan debt refinancing as a bonus going forward. The stock isn’t correctly priced for a company generating 45% revenue growth this year and tripling EBTIDA profits. SoFi hasn’t hit financial targets since closing the SPAC deal, but the problems are out of the control on management.

Investors should use the weakness to load up on a leading fintech trading at the all-time lows.

Be the first to comment