MichaelRLopez/iStock Editorial via Getty Images

In an odd twist, SoFi Technologies (NASDAQ:SOFI) trades back to the recent lows despite a major catalyst in student loans ahead. The fintech remains a bargain, trading nearly 80% off the highs near $25. My investment thesis is ultra-Bullish on the finance Super App following a month of extreme weakness in the stock market.

Too Much Doubt

At one point, SoFi surged to nearly $25 on the promise of fast growth for the fintech. If one had told those investors the digital bank would generate at least 50% sales growth in 2022 despite student loan moratoriums, people would’ve loaded up on the stock.

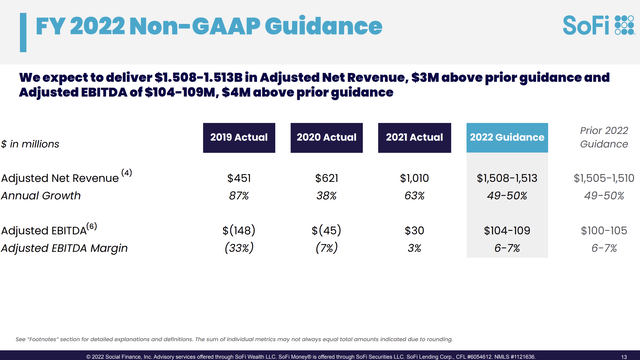

SoFi produced 2019 revenue of only $451 million, with a large EBITDA loss. The company grew those revenues to $1.0 billion in 2021, despite Covid lockdowns and the government moratorium on student loans hurting their prime customer acquisition tool. The fintech even forecasts $1.5 billion in 2022 revenues with the Biden Admin issuing a proclamation for forgiving up to $500 billion in student debt while pushing the end of the moratorium until January 1, 2023.

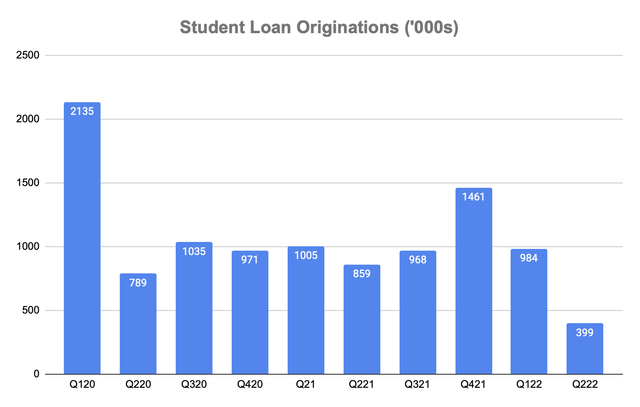

The company expects student loan financing by the prime target customer to regain momentum in Q4 to avoid higher rates from any further rate hikes by the Fed. As a reminder, the average SoFi customer has $70,000 in student loans, a 773 FICO score and annual income of $170,000.

Over the last 2.5 years, SoFi has done the following student loan originations. The 1H’22 was down over 50% from the 1H’21 levels before Covid government regulations reduced refinancing demand, though oddly the company did manage to refinance $4.3 billion worth of student loans in 2021.

The big question is how many people rush out to refinance student debt, with the current administration setting the terms that anybody refinancing debt isn’t eligible for loan forgiveness. On the flip side, SoFi average customers aren’t even eligible for the loan forgiveness under the latest attempt with the average income above the $125,000 limit for the $10,000 forgiveness, or up to $20,000 for students receiving Pell grants. The Student Debt Relief Plan restarts repayments on December 31, 2022, with payments resuming in January 2023.

In this regard, the fintech could definitely see a huge surge in student debt loan refinancing as high-income individuals realize any potential forgiveness will never cover them. Some even think lawsuits could end up blocking the forgiveness plan with the President lacking statutory authority, with the first lawsuit filed this week by the Pacific Legal Foundation.

Focus On 2023

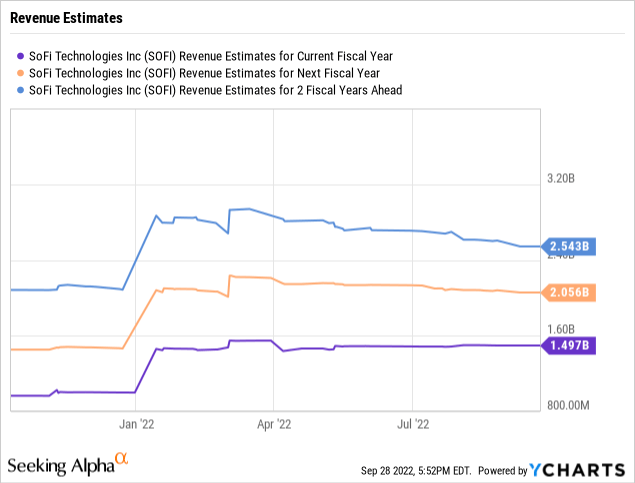

The end of the student debt moratorium sets SoFi up for full speed ahead in 2023. The market still doesn’t appear to understand the fintech will grow revenues by at least 50% this year to reach $1.5 billion.

Now, the market will start appreciating the 2023 revenue target of $2.06 billion. The market definitely doesn’t appreciate revenues are forecast to grow at a strong clip with 2024 sales targets of $2.54 billion for 24% growth based on 9 analyst estimates.

Remember, SoFi only cut 2022 revenue estimates by $100 million when finally deciding at the start of April to strip out any end of the student loan moratorium this year. The company will see this boost in 2023 now, and more importantly, the additional high-income earners added to the platform provide a strong funnel for other financial products.

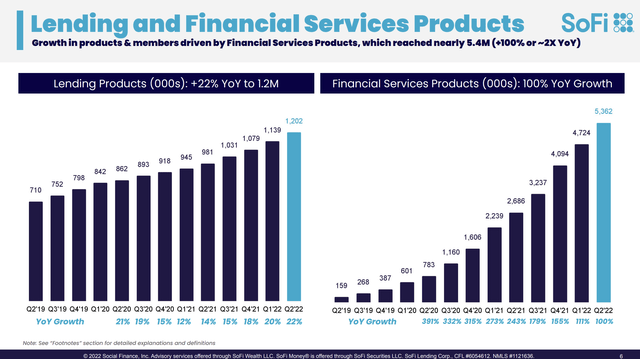

The underappreciated reason SoFi will continue growing at a fast clip is the growth in Financial Service Products. The company was still reporting 100% growth in Q2’22 with 5,362K products, up over 638K products from the prior quarter.

New Lending Products members quickly add new products such as Invest, Money and others. As all of these new products mature and student loan debt is no longer a headwind, SoFi will become far more profitable.

The fintech forecast a 10% adjusted EBITDA in 2H’22 leading to $80 million for the 2H and at least $104 million for all of 2022. The key is the company is on an annual path of $160 million with a boost to 15% margins in 2023 leading to EBITDA of over $300 million.

After all, SoFi originally guided to 2023 revenues of $2.1 billion with adjusted EBITDA of $484 million for 23% margins. The fintech even guided to a 2023 EBITDA boost of $234 million from becoming a digital bank for a total of $718 million and ~30% margins.

The stock has a $4.75 billion market cap, so even on a forward EBITDA multiple, SoFi is no longer expensive. Just looking at a more simple P/S multiple knowing the growth story isn’t geared to maximize profits, SoFi only trades at close to 2.5x sales estimates. Not many stocks with 50% growth trade at such low multiples.

Takeaway

The key investor takeaway is that SoFi is now full speed ahead on the original business plan. The fintech should become very profitable in the year ahead as student loan refinancings are no longer a headwind.

Investors should use this incredibly cheap price to load up on SoFi.

Be the first to comment