Sundry Photography/iStock Editorial via Getty Images

In this analysis, we looked into the triple-digit growth (3-yr average of 135.2%) software company, Snowflake Inc. (SNOW). We analyzed its cloud data warehouse business and expect it to benefit as companies shift towards cloud-based solutions and the growth of data volumes in companies to drive its revenue growth. Moreover, we highlighted the study by GigaOM which compares the performance and cost of selected cloud data warehouse solutions including Amazon Redshift (AMZN), Microsoft Synapse (MSFT), Google BigQuery (GOOG), and Avalanche. Lastly, while the company has improving margins, we see the company remaining unprofitable in the near future while facing intense competition and high bargaining power of suppliers as it depends on the major cloud service providers who are also its competitors as headwinds for it to reach profitability.

Benefiting From Shift to Cloud and Rising Data Volumes

Based on its annual report, the company describes its warehouse database as a “cloud-native architecture that leverages the massive scalability and performance of the public cloud”. In terms of customer base, its number of customers grew rapidly by 112.7% on average from 2019 to 2021. According to 7Park Data Research, the company has an estimated market share of 16% in Q2 2021.

We believe that the company stands to benefit as companies spend on and adopt cloud-based data warehouse software. According to a survey by New Vantage Partners in 2022, it indicated that 97% of organizations are investing in data initiatives. Moreover, by 2022, 35.8% of respondents expect to migrate 60% of analytical workloads to cloud-based warehouses according to Intelligent Business Strategies. Additionally, the IDC forecasts 50% of data and analytics software revenue to be derived from the cloud by 2023. The following quote by the IDC highlights the shift towards cloud-based deployments for data warehouses.

The data warehouse market is on the cusp of switching from traditional deployment methods to being majority cloud based, – Dan Vesset, Group VP of Analytics and Information Management at IDC.

Furthermore, according to TRUE Global Intelligence, it was found based on a study of 2,259 business and IT managers that 67% expect their data to grow 5 times by 2025. We believe that the company stands to benefit from data growth and be positive for its revenue per customer with its pay-to-use model which depends on its customers’ consumption of its platform services.

We projected Snowflake’s customers in FY2022 based on prorated Q1 to Q3 customer growth and we assumed its customer base to grow beyond 2022 at an average rate of 1,639 customer additions per average based on a 3-year average from 2020 to 2022. We believe this is appropriate to forecast its customer base growth as its customer additions per year grew at a stable rate and its customer base growth shows a decelerating trend. Further, we forecasted its revenue per customer to grow based on a 3-year average rate of 28.2% from 2020 to 2022 tapering down by 5% per year as a conservative estimate.

|

Revenue Forecasts ($’000s) |

2019 |

2020 |

2021F |

2022F |

2023F |

2024F |

|

Revenue per Customer (‘a’) |

110.68 |

143.04 |

210.05 |

269.31 |

331.82 |

392.25 |

|

Growth % |

8.5% |

29.2% |

46.8% |

28.2% |

23.2% |

18.2% |

|

Total Customers (‘b’) |

2392 |

4139 |

5,865 |

7,504 |

9,144 |

10,783 |

|

Growth % |

152.3% |

73.0% |

41.7% |

27.9% |

21.8% |

17.9% |

|

Total Revenue (‘c’) |

264,748 |

592,049 |

1,232,042 |

2,021,038 |

3,034,020 |

4,229,461 |

|

Growth % |

173.9% |

123.6% |

108.1% |

64.0% |

50.1% |

39.4% |

*c = a x b

Source: Snowflake, Khaveen Investments

As companies are expected to shift towards cloud-based data warehousing solutions, we anticipate the company to benefit by attracting and growing its customer base. However, we see the company’s customer base growth rate decelerating as it grows from a higher base. Also, we believe that the company’s pay-to-use business model could allow it to benefit as the data volumes in organizations are expected to rise in the coming years. Notwithstanding, we conservatively projected its revenue at a decreasing rate through 2024.

Cost to Performance Disadvantage to Key Competitors

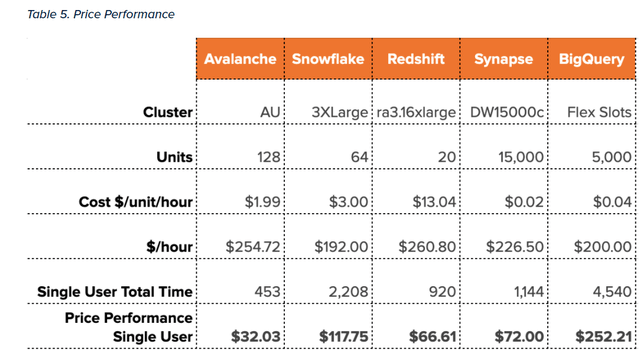

The company competes against several competitors in the cloud data warehouse market. In a study by GigaOM of a comparison between Avalanche, Snowflake, Amazon Redshift, Microsoft Synapse and Google BigQuery’s data warehouse, the study compared the performance and costs of each company’s cluster which consists of units. The difference is both Snowflake and Amazon Redshift units are its compute nodes of its clusters, Avalanche Units (‘AU’) for Avalanche, Data Warehouse Units for Microsoft Synapse and slots for Google BigQuery.

Based on the study, its results found that based on 66 queries for 22 data types, Snowflake was ranked as the second-lowest in terms of performance by taking the longest time in the different tests trailing behind Google BigQuery. Positively, the test found that Snowflake was the best in terms of having the lowest cost per hour. However, we focused on the price-per-performance instead which considers the performance results as we believe both cost and performance would be key factors for customers when deciding which provider to pick from. Snowflake has the second-highest price-per-performance behind Google BigQuery.

GigaOM

Overall, in our opinion, the study indicates the disadvantage of Snowflake in the performance test to its fierce competitors including Amazon Redshift and Google BigQuery. That said, the results also indicate that it is better than Google BigQuery while Avalanche’s data warehouse appears to be the most attractive from a price-per-performance standpoint.

To sum it up, based on the comparison of the data warehouses study, we believe that the results highlight a performance advantage that its competitors have over the company as well as a better price-per-performance which we believe could be a risk affecting its future growth outlook in the competitive market.

Dependency Risk on Cloud Service Providers Suppliers

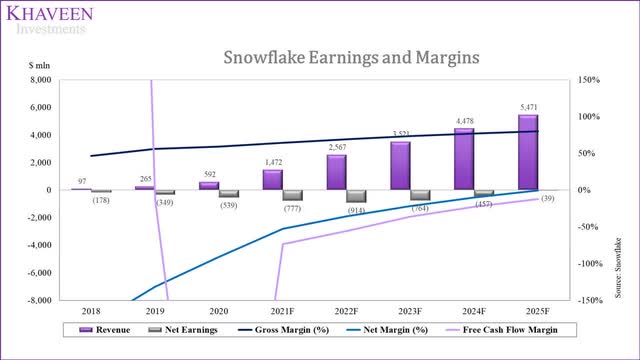

In terms of profitability, the company’s gross margins have improved from 46.4% in FY2018 to 59% in FY2020 and its net margins improved from -184.1% in FY2018 to -91% in FY2020. We believe that its rising profitability in the past 3 years indicates business scalability as its COGS, R&D and SG&A has declined as a % of revenue from 2019 to 2021.

One stark contrasting difference between Snowflake and its competitors including Amazon, Google and Microsoft, is that it relies on their cloud infrastructure services to host its software based on its annual report. Whereas competitors like Amazon, Google and Microsoft could rely on their own cloud infrastructure. These 3 companies are also the top cloud service providers in the world with a combined market share of 61% of the cloud infrastructure market share in Q1 2021 according to Statista.

Due to these factors, we believe that the company has a high bargaining power of suppliers and we see its gross margin upside being limited by its risk associated with the high bargaining power of suppliers. While we believe that this may be beneficial for its customers are they could get to choose which cloud service to store their data on, however, we view its reliance on its cloud service providers as a negative as the company is competing against its suppliers which are also major competitors. According to 7Park Data, Amazon (Redshift & EMR) and Google Big Query have an estimated combined market share of 61.1% in Q2 2021.

Snowflake, Khaveen Investments

While the company’s profitability has improved in the past 3 years in both gross and net margins, we expect the company to remain unprofitable for the foreseeable future despite improving economies of scale, as we see its bargaining power of suppliers being very high as it depends on and competes against its suppliers who are the leading cloud infrastructure providers and combined hold a large share of the data warehouse market which we believe could lead to a margin squeeze risk in the future.

Risk: Increasing Competition from Cloud Providers

The company competes against Amazon, Google and Microsoft. We believe that the company could face greater competition from these competitors. Compared to Snowflake, its competitors are much larger in market cap and revenue which we believe indicates their greater scale.

Source: Seeking Alpha

An example of competition intensifying is AWS which recently released its new hardware-accelerated cached called AQUA (Advanced Query Accelerator) which it claims allows Redshift queries to be able to run 10 times faster than competitors.

Hence, we see the competitive rivalry between the company and its competitors to be very high as it competes against large competitors including Amazon, Google and Microsoft with superior scale and greater resources which we believe could see the competition intensify in this market and may affect its growth.

Valuation

As we expect the company to continue focusing on growth, we see it remaining unprofitable in the foreseeable future. We therefore valued the company with a P/S comparable valuation. We forecasted its revenues based on its customer growth and revenue per customer growth and obtained an average total revenue growth of 51.2% from 2021 through 2025.

|

Revenue Projections ($000’s) |

2019 |

2020 |

2021F |

2022F |

2023F |

2024F |

|

Total Customers (‘a’) |

2392 |

4139 |

5,865 |

7,504 |

9,144 |

10,783 |

|

Growth % |

152.3% |

73.0% |

41.7% |

27.9% |

21.8% |

17.9% |

|

Revenue/Customer (‘b’) |

110.68 |

143.04 |

210.05 |

269.31 |

331.82 |

392.25 |

|

Growth % |

8.5% |

29.2% |

46.8% |

28.2% |

23.2% |

18.2% |

|

Total Revenue (‘c’) |

264,748 |

592,049 |

1,232,042 |

2,021,038 |

3,034,020 |

4,229,461 |

|

Growth % |

173.9% |

123.6% |

108.1% |

64.0% |

50.1% |

39.4% |

* c = a x b

Source: Khaveen Investments

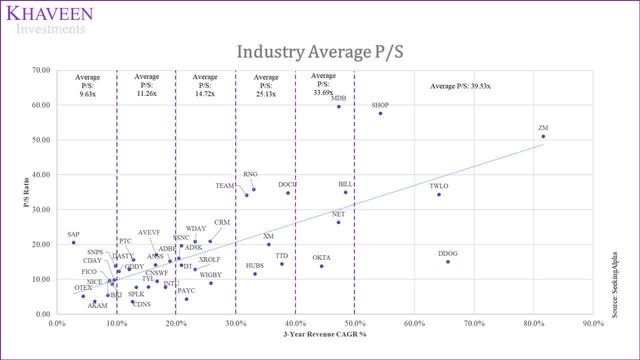

For the comparable companies, we selected 41 software companies and obtained an average P/S according to their 3-year revenue CAGR, segmented into 6 revenue CAGR groups. Snowflake’s triple-digit 3-year revenue CAGR is so high, it does not even fit on our chart below.

Seeking Alpha, Khaveen Investments

| 3-yr CAGR | 0%-10% | 10%-2% | 20%-30% | 30%-40% | 40%-50% | >50% |

| Average P/S | 9.61x | 11.26x | 14.72x | 25.13x | 33.69x | 39.53x |

Based on a P/S ratio of 25.13x (corresponding to our expected growth rate of 39.4% for Snowflake in 2024), we obtained a valuation of $353.26 in 2024.

|

P/S Valuation |

2024F |

|

Revenue ($ mln) (‘a’) |

4,229 |

|

P/S ratio (‘b’) |

25.13x |

|

Valuation ($ mln) (‘c’) |

106,297 |

|

Shares Outstanding (‘mln’) (‘d’) |

300.90 |

|

Target Price (‘e’) |

$353.26 |

|

Current Price |

$253.52 |

|

Upside |

39.3% |

* c = a x b

e = c/d

Source: Khaveen Investments

Based on the price target of $353.26 in 2024, we derived the upside for 2022 and 2023.

|

Snowflake Price Target |

Price Targets |

Upside |

|

Current Price |

$253.52 |

|

|

Price Target (2022) |

$283.17 |

11.7% |

|

Price Target (2023) |

$316.28 |

24.8% |

|

Price Target (2024) |

$353.26 |

39.3% |

Source: Khaveen Investments

Verdict

In conclusion, we analyzed the company’s data warehouse software business and expect it to stand to benefit as more companies shift towards cloud-based data warehouse solutions which we believe could bode well for its customer growth as well as its revenue per customer to benefit from rising data volumes as we expect its customers’ consumption of its services to increase. However, we highlight its competitive disadvantage with a poor cost-to-performance compared to key competitors based on the study. Lastly, we see the company remaining unprofitable in the near future despite improving scale and believe its high bargaining power of suppliers relying on major cloud service providers could be a potential headwind for it to reach profitability. Overall, we rate the company as a Buy with a price target of $283.17.

Be the first to comment