TothGaborGyula

Snowflake (NYSE:SNOW) is a cloud-native software that allows companies to store and analyze their data. The company continues to be a phenomenal growth story in 2022 as most tech companies face difficulty delivering meaningful growth rates in a post-Covid environment.

Recent performance

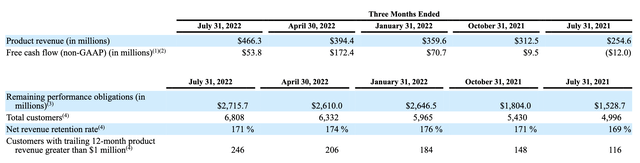

In 2Q22, Snowflake saw revenue increase by 83% driven by strong consumption. The company added 40 customers with contract values over $1 million which was a step up against the trailing 4 quarter average of 26. RPO (remaining performance obligations) of $2.7 billion increased 78% YoY, of which 57% is expected to be recognized as revenue over the next 12 months.

Total customers increased 7.5% sequentially from 6,332 to 6,808, while customers with over $1 million TTM product revenue increased from 206 in Q1 to 246 in Q2. NRR (net revenue retention) was again a healthy 171% vs. 174% in Q1. Snowflake only has around 25% of companies that belong to the Global 2000, indicating a long growth runway.

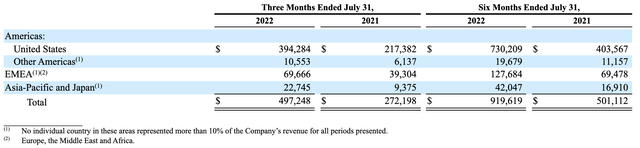

Average product revenue per customer grew 33% vs. +30% in 1Q22, driven by strong performance in the Financial Services vertical which made up roughly 20% of total revenue. Looking at Snowflake’s revenue by geographic regions, the 77% YoY growth in EMEA revenue was particularly encouraging despite serious macroeconomic concerns in the region. In fact, management highlighted that 4 of the 10 top deals secured during the quarter came from EMEA. Big picture, corporate spending on data and analytics remained relatively resilient compared to other types of corporate IT budgets.

Outlook

For 3Q22, Snowflake guided product revenue of $500-$505 million, indicating another strong quarter of growth (+60-62% YoY). Non-GAAP operating margin is expected to come in at 2%.

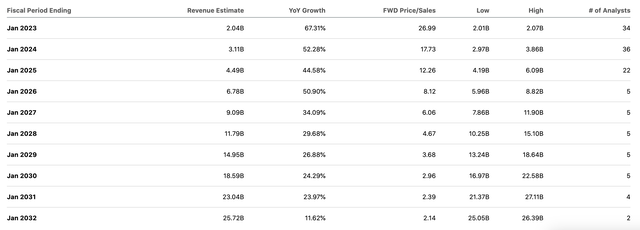

For full year 2022, management sees product revenue growth of 67-68% YoY to reach $1,91 billion at the midpoint, while non-GAAP product gross margin/operating margin/FCF margin are expected to be 75%/2%/17%. The Street now expects 2022 total revenue of roughly $2 billion, up 67% on a strong 2021 with 106% growth. Long term, management is targeting product revenue of $10 billion in FY2029/C2028, non-GAAP operating margin of 10% and non-GAAP FCF of 15%. This implies a 6-year revenue CAGR of ~39% from C2022 to C2028.

Earnings are a problem

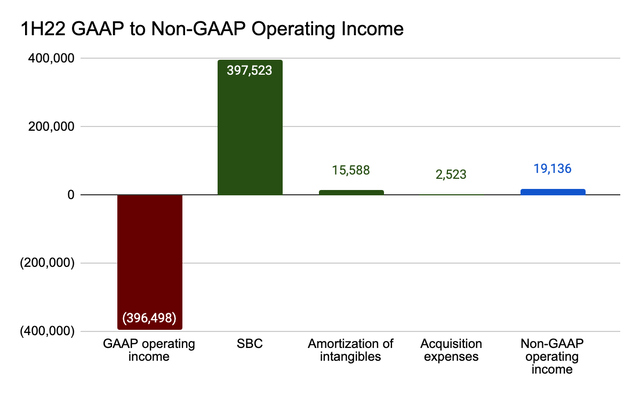

The problem, however, is that Snowflake doesn’t really generate profits from such aggressive growth on the top line. While the company touts metrics such as non-GAAP operating income and free cash flow, it’s important to understand that the delta between GAAP and non-GAAP figures primarily comes from stock-based compensation. In 1H22, Snowflake generated revenue of ~$920 million and GAAP operating income of -$396 million. The idea is that if we add back ~$398 million in stock-based compensation (40% of total revenue) along with ~$16 million in amortization and $2.5 million in acquisition expense, Snowflake is actually profitable with $19 million in adjusted operating income for a 2% margin vs. -43% on a GAAP basis.

The wide discrepancy between GAAP and non-GAAP operating income is also reflected in the calculation of adjusted free cash flow. In 1H22, Snowflake reported adj. FCF of $240 million, which represented 26% of total revenue. Digging further into the cash flow from operations (CFO), we can see that the $249 million CFO generated was mostly a result of adding back stock-based compensation to -$389 million in net income.

The takeaway here is that investors should treat Snowflake’s earnings quality with skepticism as the company’s operating income shows a massive gap between what’s reported per general accounting standards and what management wants the market to focus on. If stock-based compensation is not being treated as an expense item in measuring profitability, what is it anyway and why is it on the income statement in the first place? For this reason, I’m concerned that markets will eventually being to question whether Snowflake has a viable path to profitability when revenue growth eventually slows.

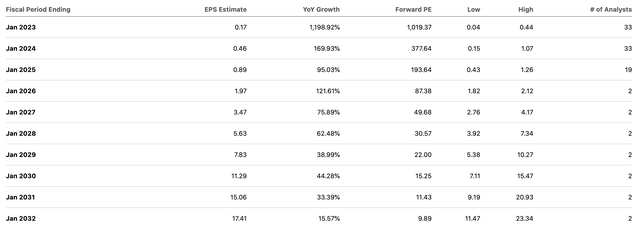

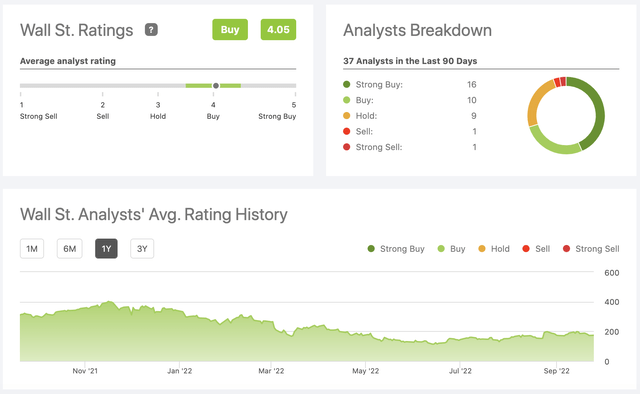

For now, the Street has come up with a very optimistic growth trajectory for Snowflake’s bottom line as 33 analysts think the company can deliver positive EPS (on a non-GAAP basis) in the current year and grow its earnings 46x by 2028. Despite the luxurious valuation that makes someone with a Birkin bag look like she’s on welfare, the Street continues to churn out Buy ratings with an average price target of $220 at ~23x 2023 revenue. Of course, if you’re willing to look further out to 2031, the stock is only trading at <10x earnings

Risks

Of course, the fact that Snowflake is an unprofitable business is a well understood phenomenon so someone on the short end of the trade may face significant downside should the macro narrative take a different spin. Interest rates are rising in response to 40-year high inflation and it’s conceivable that the prospects of better-than-expected inflation may trigger a sudden wave of animal spirits in the market. On the long end of the trade, IT budgets are not entirely immune to a slowing economy, while Snowflake’s reliance on cloud service providers including AWS, Azure and GCP may be a potential source of trouble. Additionally, competition from Databricks is something to monitor going forward.

Conclusion

Snowflake is a growth company that doesn’t turn a profit so investors will likely rely on the P/S ratio as a key valuation metric. The stock currently trades at 27x and 18x 2022 and 2023 sales, respectively. Evidently, these are highly demanding multiples in a rising interest rate environment where the TINA (there is no alternative) narrative no longer applies as one can purchase the 2-year US Treasury today and get a 4% yield virtually risk-free. Of course, investors don’t own Snowflake for the dividends and comparing the stock to the risk-free rate may seem outrageous at first, but the higher the discount rate goes, the more investors will begin to question whether they paid a fair price for the stock.

Be the first to comment