Eoneren

Price Action Thesis

We present a timely update on Snowflake Inc. (NYSE:SNOW) after our post-FQ1 article as we urged investors to be cautious. SNOW has rallied 15% since we published and outperformed the SPDR S&P 500 ETF (SPY).

Although it’s not strictly a SaaS model, it has leveraged the broad recovery in Software stocks holding their May bottoms resiliently.

Notwithstanding, we remain on the sidelines even after its June Investor Day. While SNOW is oversold on its long-term technicals, we don’t encourage investors to buy this dip. Moreover, our valuation model indicates that SNOW will likely underperform the market at its current valuation through FY24.

Therefore, we reiterate our Hold rating on SNOW. Investors looking to layer out should wait for another bull trap to form on its medium- or long-term chart, as its short-term rally could continue.

Snowflake Expects To Lift Its Operating Leverage Markedly

Snowflake used its Investor Day to share more insights on how it expects to improve its operating leverage, given the market’s renewed focus on free cash flow (FCF) profitability.

Notably, CFO Michael Scarpelli accentuated that Snowflake’s strategy is “not growth at all cost.” He added: “Yes, growth is the #1 thing, but it’s being responsible growth and only spending where you think you can get a true payback for that.”

Accordingly, Scarpelli shared how its traction with the largest customers has been robust, as its Global 2000 customer count reached 506 in FQ1’23, up from 299 in FQ1’21. He accentuated (edited):

Our price per credit has increased with the adoption of higher-priced product editions and discounting discipline. Enterprise and business-critical editions carry the highest margin profile as we have started to focus on the largest customers in the world. And I think you’re going to continue to see that upward trend in the higher editions for Snowflake. As we mature as an organization, large customer relationships provide an important source of leverage. Increased scale lends additional yield to R&D and G&A investments and our mature accounts are less sales intensive. We believe we are just getting started in scaling these accounts and reaching our full margin potential. (Snowflake Investor Day 2022)

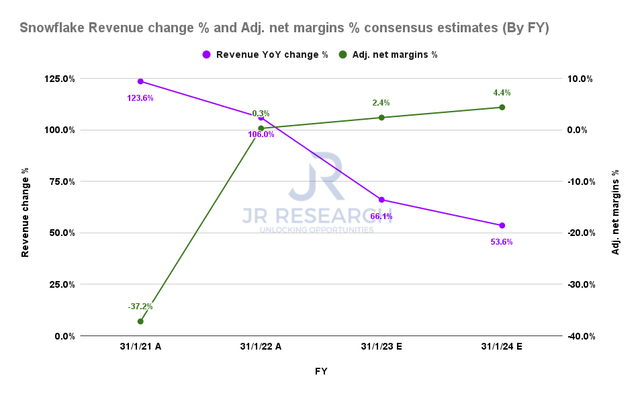

Snowflake revenue change % and adjusted net margins % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) also generally concur with management. Notably, the Street modeled for decelerating revenue growth. However, it also expects Snowflake’s adjusted net margins to improve significantly from 0.3% in FY22 to 4.4% by FY24.

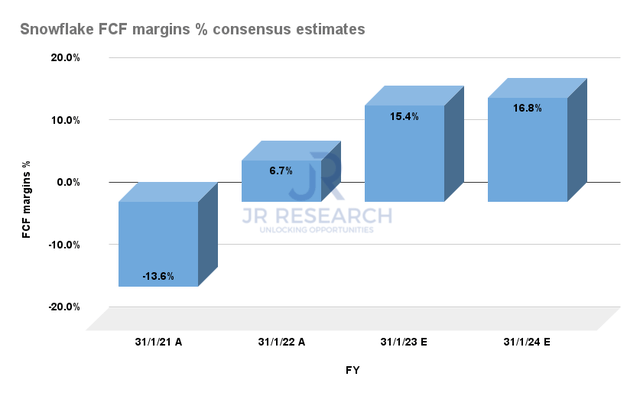

Snowflake FCF margins % consensus estimates (S&P Cap IQ)

Consequently, Snowflake’s FCF margins are also estimated to benefit from the flow-through of its operating leverage gains. As a result, Snowflake’s FCF margins are expected to reach 16.8% by FY24. Investors should note that Snowflake’s preferred adjusted FCF metric differs from the abovementioned FCF metrics. Therefore, investors are urged to consider the differences as they could impact their valuation models.

But, We Don’t Think It’s Enough To Justify SNOW Stock’s Valuation

| Stock | SNOW |

| Current market cap | $47.59B |

| Hurdle rate [CAGR] | 25% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 2% |

| Assumed TTM FCF margin in CQ4’26 | 15% |

| Implied TTM revenue by CQ4’26 | $17.2B |

SNOW reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-outperform hurdle rate of 25% in our model, with a required FCF yield of 2%. We think our yield assumption for a “high-growth” play like SNOW is appropriate. Furthermore, SNOW last traded at an FY24 FCF yield of 3.05%.

Assuming a blended TTM FCF margin of 15% (more conservative than the Street’s consensus), we need Snowflake to post a TTM revenue of $17.2B by CQ4’26. In addition, management guided for $10B in annualized product revenue by FY29 (quarter ending 31 January 2029). Therefore, Snowflake seems well-overvalued at the current levels.

Even if we adjust our FCF margins to 25% (in line with management’s FY29 guidance), we still need Snowflake to post a TTM revenue of $10.52B by CQ4’26. Therefore, we couldn’t justify how investors can expect Snowflake to help them outperform at the current levels, even with much improved operating leverage.

Is SNOW Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on SNOW.

SNOW is currently well-oversold on long-term technicals. Therefore, a short-term rally to draw in dip buyers, coupled with the covering of directionally-bearish bets, is expected.

But, our valuation analysis indicates that SNOW is still overvalued at the current levels.

Be the first to comment