Just_Super

Snowflake flew too close to the sun

Snowflake (NYSE:SNOW) has been one of the hottest stocks since its IPO in September 2020, where even Warren Buffett’s Berkshire Hathaway (BRK.A)(BRK.B), the legendary value investor known for making conservative stock picks, invested in the company. The company rose up to 60% to almost $400, before crashing 56% in line with other growth stocks since November 2021. The stock is down 28% since its IPO, but has shown relative strength compared to some of its high-growth peers like Teladoc (TDOC), Cloudflare (NET) and Twilio (TWLO) who all dropped 75% and more in the same period. In this article, I’ll run Snowflake through my SaaS Checklist to find out why it has shown relative strength in this market. I’ll use numbers from the last earnings release, their Q2 2023.

Snowflake stock performance (google )

Industry Tailwinds

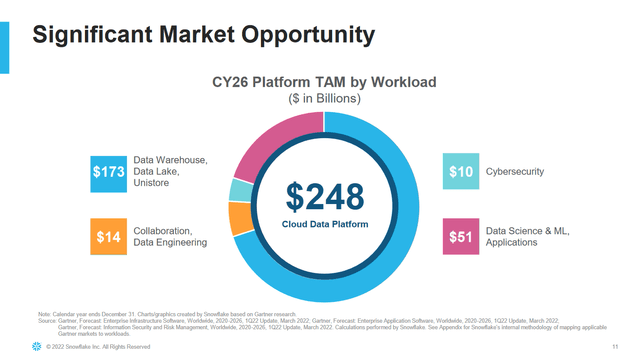

According to IndustryARC, the cloud data warehouse market (which represents the largest business opportunity for Snowflake) is expected to grow at a 31% CAGR between 2021 and 2026 to a size of $39 billion. I find this more realistic than the $173 billion 2026 TAM management projects for 2026 based on Gartner (IT) research. Regardless of the ultimate size of the TAM, what’s important is how much of it you can serve and how fast the market is growing. Be it $39 or $173 billion, at a $1.6 billion revenue run rate Snowflake has a lot of room to grow in this fast-growing market. The other opportunities are also large and will complement the primary product offering.

Snowflake 2026 TAM (Snowflake investor relations)

Running Snowflake through My SaaS Checklist

I have a checklist of factors to look at for SaaS companies. Even though Snowflake is not a classical Software as a Service company, but rather works with a consumption-based model (customers aren’t billed based on the product package they use, but instead on the amount of usage they have with the used products), so let’s take a look at the last earnings report and see how Snowflake is performing regarding:

- Retention rates

- Number of big customers

- Gartner Magic Quadrant positioning

- Margins

- Rule of 40

Best in class retention rates

Software as a Service or SaaS has been one of the hottest markets in recent years. The companies appeal to investors due to their easy scalability and potential for high profitability down the road. One key part of any successful SaaS company is to retain its customers. Customer acquisition costs are high (S&M spend for Snowflake was 43% of revenue in Q2 23, down from 63% in FY21), so you better be able to keep those customers and ideally charge them more money every year.

Net dollar retention (NDR) is a metric that shows how much an existing customer will spend this year compared to last year. This doesn’t factor in new customers and just represents growth per existing customer. Since going public Snowflake has maintained an NDR of around 170%, which is spectacular. I look for SaaS companies with NDRs above 120%, so that is easily achieved for Snowflake. The reason for this high NDR is the consumption-based model, which allows for fast scaling in revenue per customer if they use the product extensively. Gross dollar retention (GDR) describes the churn, so how many customers are left in a given year? Snowflake doesn’t talk about it much, but in a recent conference at the Deutsche Bank Technology Conference, they mentioned a 97% GDR, another fantastic value.

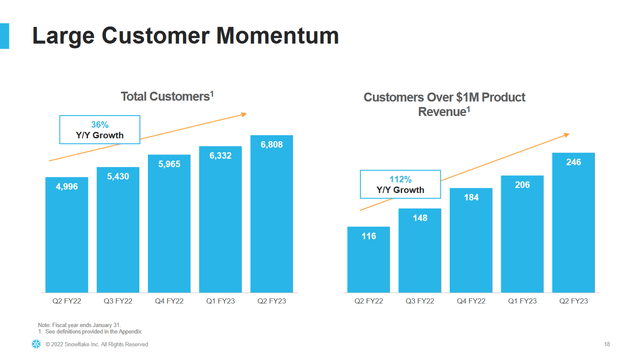

Number of big customers

Snowflake has a fast 36% Y/Y growth in total customers, over 6800 in the last quarter, but only 3.6% of them generate more than $1 million in revenue for Snowflake. This number is rising fast and is the main driver of their growth. Snowflake claims to have 510 Forbes 2000 customers (growing modestly at 15% Y/O), so that means that not even half of these large corporations generate over $1 million in revenues. This leaves large opportunities for Snowflake to grow revenues through its existing customer base, and with the industry-leading NDR of 170%, it should be able to leverage this.

Number of big customers (Snowflake investor relations)

Gartner magic quadrant positioning

Gartner’s magic quadrants are a great resource to get a view of a competitive landscape. Sadly the only quadrant including Snowflake I found was from 2019. It shows Snowflake as a leader in data management solutions for the analytics segment. The data also shows that this is a highly competitive field with 10 niche players, one visionary and 7 other leaders (5 of them with better placement in the leader quadrant than Snowflake). Unfortunately, the data is 3 years old, but it underlines that Snowflake won’t be able to create a monopoly in this market most likely.

Gartner magic quadrant cloud data management for analytics (Gartner)

Margins are improving

A big part of any SaaS scaler is an improving margin profile, with the most important ones being the gross margin and the free cash flow margin. Snowflake reports adjusted gross margins in its earnings report, which I do not agree with. Margins shouldn’t be adjusted for stock-based compensation or SBC (Snowflake does a lot of it), in my opinion. In the following table, I’ll calculate my margin profile for Snowflake. You can see that FCF is highly volatile due to the payment cycle and also far from positive if we look at a trailing twelve-month basis, where FCF margin excluding SBC is at -21%. The margins are improving, but they are still far from great! Investors are being diluted heavily to appear profitable.

| Quarter | Q2 23 | Q1 23 | Q4 22 | Q3 22 | Q2 22 |

| Total revenues (millions) | $497 | $422 | $383 | $334 | $272 |

| Gross profit (millions) | $324 | $274 | $249 | $213 | $166 |

| Gross profit margin | 65% | 65% | 65% | 64% | 61% |

| Free Cash Flow (millions) | $60 | $177 | $75 | $13 | -$10 |

| SBC cost (millions) | $209 | $172 | $145 | $144 | $164 |

| FCF ex SBC | -$149 | $5 | -$70 | -$131 | -$174 |

| FCF ex SBC margin | -30% | 1% | -18% | -39% |

-64% |

Rule of 40

The Rule of 40 is a metric to see if a SaaS company is growing healthily. The rule is calculated by adding the growth rate to the profit margin. There are different versions of the Rule of 40, depending on the type of profit margin used. I will use the FCF margin excluding SBC I calculated above. That leaves us with -21% + 83% revenue growth = 62. Based on the rule of 40 Snowflake is growing at a healthy mix between growth and profitability.

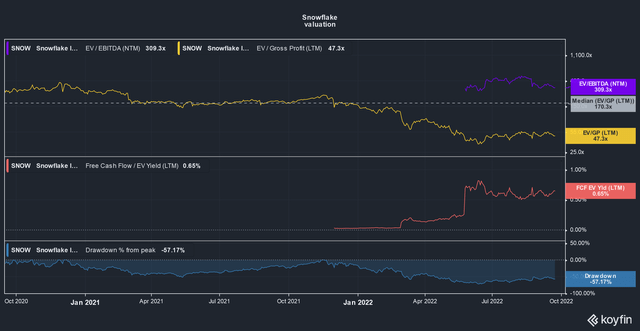

Valuation

It’s hard to value Snowflake due to the absence of profits. That leaves us with the gross profit multiple, I use EV/GP to account for the good balance sheet with $3.9 billion in cash and only $250 million in debt. We can see that Snowflake came down a lot from its past valuation. The median EV/GP has been a staggering 170 times, which came down to 47 times. This still is an extremely high valuation and I personally wouldn’t feel comfortable paying above 40 times, even though considering the high-quality and the fast growth of the company.

Snowflake valuation (koyfin)

Conclusion

Snowflake is a great business with best-in-class growth and retention rates, but the valuation and continued dilution keep me away from the stock. Snowflake has shown relative strength because it managed to remain a very fast-growing company with 170% NDRs, but in this environment, investors will want to see real profits (no SBC-adjusted profitability) on the horizon.

Be the first to comment