Peach_iStock

Elevator Pitch

I rate Snowflake Inc.’s (NYSE:SNOW) stock as a Hold.

I analyzed SNOW’s full-year FY 2022 outlook in an earlier update for the stock published on December 16, 2021. In my current article, the focus is on previewing Snowflake’s earnings for the second quarter of fiscal 2023 (YE January 31).

There are a number of things to focus on before Snowflake’s upcoming financial results such as consensus market expectations, changes in the consensus estimates, sell-side commentary, and the company’s metrics (e.g. net revenue retention rate). My prediction is that Snowflake will deliver in-line results when it reports its earnings for Q2 FY 2023. Also, SNOW’s current valuations are fair but uncompelling. As a result, I retain a Hold rating for Snowflake.

Date Of SNOW’s Q2 FY 2023 Earnings Announcement

Snowflake will release the company’s Q2 FY 2023 financial results on August 24, 2022 after the end of trading, and this is based on SNOW’s disclosures in its prior August 1, 2022 media release.

Expectations For Snowflake’s Second-Quarter Results Are Low

As a start, it is necessary to assess the market’s current expectations of SNOW’s financial performance for the second quarter of fiscal 2023. In my view, investors have reasonably low expectations of Snowflake’s Q2 FY 2023 results based on three key indicators.

The first indicator is that the sell-side’s consensus estimates point to a more moderate pace of top line expansion and continued losses for Snowflake.

According to the market’s consensus financial projections taken from S&P Capital IQ, Wall Street expects SNOW’s revenue growth to slow from +101.5% YoY in Q4 FY 2022 and +84.5% YoY in Q1 FY 2023 to +71.8% for Q2 FY 2023. Also, Snowflake is forecasted to stay in a loss-making position for Q2 FY 2023 with an estimated normalized net loss per share of -$0.01. SNOW was also unprofitable in Q1 FY 2023, but the company previously achieved positive non-GAAP adjusted earnings for both Q3 FY 2022 and Q4 FY 2022.

The second indicator is that analysts have become less optimistic about Snowflake’s Q2 FY 2023 performance in recent months as seen with the revisions to SNOW’s financial forecasts.

In the last three months, 24 of the 36 sell-side analysts covering Snowflake’s stock have lowered their respective bottom line estimates for the company. Specifically, the sell-side’s consensus bottom line projections for SNOW were cut by -11% and -20% in the past one and three months, respectively.

The third indicator is bearish sell-side commentary on the near-term prospects of SNOW.

An August 2, 2022 Seeking Alpha News article cited a BTIG research report noting that “a downtick in recent field checks and the fact that cloud hyperscalers started to decelerate” had prompted a reduction in FY 2023 product revenue estimates by the analyst. Seeking Alpha News also published another article on August 16, 2022, highlighting that the analyst from UBS (UBS) also cut his or her top line forecast for fiscal 2023 on the basis that “more customers” are “flagging efforts to curtail discretionary data analytics spend.”

SNOW Should Meet Market Expectations With Upcoming Quarterly Earnings

I don’t expect a significant earnings miss for Snowflake when it reports its Q2 FY 2023 results on August 24, 2022. Instead, my view is that SNOW’s actual financial performance for the second quarter of fiscal 2023 should be roughly in line with the investors’ expectations.

There are three key reasons supporting my view.

Firstly, the expectations for Snowflake’s Q2 FY 2023 results are already quite low as discussed in detail in the previous section. This implies that SNOW has a much lower hurdle to cross in terms of delivering financial numbers that are close to the current consensus forecasts.

Secondly, a key operating metric for SNOW, net revenue retention rate, has remained high in the recent quarters, and the company thinks that its net revenue retention rate should decline at a very moderate pace in the near future. I previously touched on Snowflake’s definition and calculation of net retention rate in my previous July 20, 2021 article for the company.

In its most recent quarterly earnings presentation slides, Snowflake disclosed that its net revenue retention rates were 171%, 177%, and 174% for Q3 FY 2022, Q4 FY 2022, and Q1 FY 2023, respectively. At its recent Investor Day on June 14, 2022, SNOW guided that its net revenue retention rate should “stay above 160 this year (FY 2023)” which is just slightly lower than its 170+% net revenue retention rates for the past few quarters. Snowflake also emphasized at its earlier Q1 FY 2023 earnings call on May 25, 2022 that its net revenue retention rate “will come down gradually over time.”

In other words, Snowflake’s revenue growth for Q2 FY 2023 shouldn’t be much worse than what the market currently expects, taking into account the future expectations of the company’s net revenue retention metric.

Thirdly, SNOW’s costs shouldn’t be that much higher than what investors anticipate. Snowflake has been cautious about over-investing, and the effects of positive operating leverage are starting to kick in as the company’s scale expands.

Snowflake stressed that it “is not a ‘growth at all cost’ company”, and noted that “we evaluate investments based on yield.” This reduces the probability of SNOW engaging in value-destructive investments that lead to a negative earnings surprise.

The Impact Of Positive Operating Leverage For SNOW

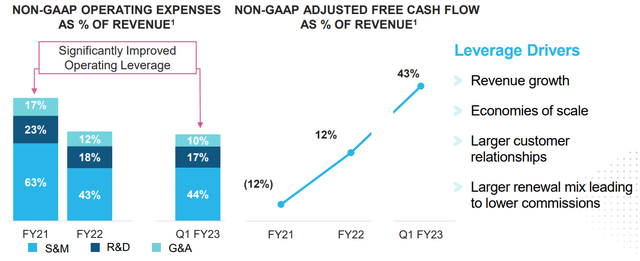

SNOW’s Q1 FY 2023 Earnings Presentation

Also, as per the chart presented above, there are signs that Snowflake has been improving its profitability and free cash flow over time thanks to the positive impact of operating leverage.

As such, there is a lower risk of SNOW’s actual Q2 FY 2023 bottom line coming in substantially below expectations, as the company is benefiting from positive operating leverage and it is mindful of maintaining a balance between growth and profitability.

Valuations And Long-Term Expectations For SNOW

Snowflake’s shares aren’t cheap, but the stock does deserve a valuation premium for its solid growth prospects in the long run.

The market currently values SNOW at a consensus forward next twelve months’ Enterprise Value-to-Revenue multiple of 20.7 times as per S&P Capital IQ data. In comparison, Snowflake has traded at an average consensus forward Enterprise Value-to-Revenue multiple of 56.2 times since its listing on the NYSE on September 16, 2020.

The company guided at its 2022 Investor Day in mid-June that it is targeting to achieve a revenue of $10 billion for FY 2029. This translates into an impressive top line CAGR of +35% as compared to SNOW’s FY 2022 revenue of $1,219 million. The robust revenue growth expectations are supported by Snowflake’s estimated TAM (Total Addressable Market) of $248 billion; SNOW’s most recent fiscal year top line is slightly under 0.5% of its TAM.

Also, Snowflake’s current premium valuations reflect investors’ expectations of a substantial improvement in SNOW’s profitability in the long-term as the company realizes the positive effects associated with operating leverage. It has set a target of delivering an operating profit margin of 20% in fiscal 2029, which will represent a meaningful expansion as compared to the FY 2023 consensus EBIT margin of 1.1% for Snowflake.

In summary, I think that SNOW is fairly valued in consideration of the company’s long-term growth and profitability expectations.

Closing Thoughts

Snowflake remains a Hold-rated stock based on my analysis. SNOW’s shares shouldn’t perform badly after releasing Q2 earnings, as I don’t expect negative surprises. But SNOW’s valuations aren’t cheap on an absolute basis, and the market is unlikely to see beyond the next few quarters (as opposed to taking a long-term view) in assessing Snowflake’s prospects. Therefore, a Neutral view and Hold rating is warranted for SNOW, rather than a Sell or a Buy.

Be the first to comment