Hispanolistic/E+ via Getty Images

A Quick Take On Snap One Holdings

Snap One Holdings (NASDAQ:SNPO) went public in July 2021, raising approximately $249 million in gross proceeds from an IPO that was priced at $18.00 per share.

The firm provides a range of smart home products, software and services to professional integration companies.

We’re in a period where it is difficult to ascertain which direction the economy will take as well as whether the recent cost of capital rises will taper off.

Until we have greater clarity on these issues, my outlook on SNPO is on Hold for now.

Snap One Holdings Overview

Draper, Utah-based Snap One was founded to develop a large network of system integrators who sell and install home technology and smart living offerings.

Management is headed by Chief Executive Officer, John Heyman, who has been with the firm since January 2015 and was previously CEO of Radiant Systems, a technology provider to hospitality and retail companies.

The company has over 2,800 proprietary SKUs and a curated set of third-party products, such as:

-

Home entertainment

-

Audio systems

-

Home security

-

Smart lighting

-

Networking products

-

Control solutions

The firm seeks relationships with systems resellers, integrators and end consumers for certain products.

The company also offers a subscription service to consumers that enables them to control and monitor their homes remotely.

Snap One’s Market & Competition

According to a 2021 market research report by Mordor Intelligence, the global smart home market was valued at an estimated $79 billion in 2020 and is expected to grow to $314 billion by 2026.

This represents a forecast CAGR of 25.3% from 2021 to 2026.

The main drivers for this expected growth are an increasing interoperability between products and systems and a growing use of the home for multiple purposes by consumers.

Also, a continued drop in the price of Internet of Things products will incentivize users to purchase a greater variety of products over time.

Major competitive or other industry participants include:

-

Alarm.com

-

Google

-

Amazon

-

Apple

-

Crestron

-

Logitech

-

Savant

-

Sonos

-

Ubiquiti

-

Others

Snap One’s Recent Financial Performance

-

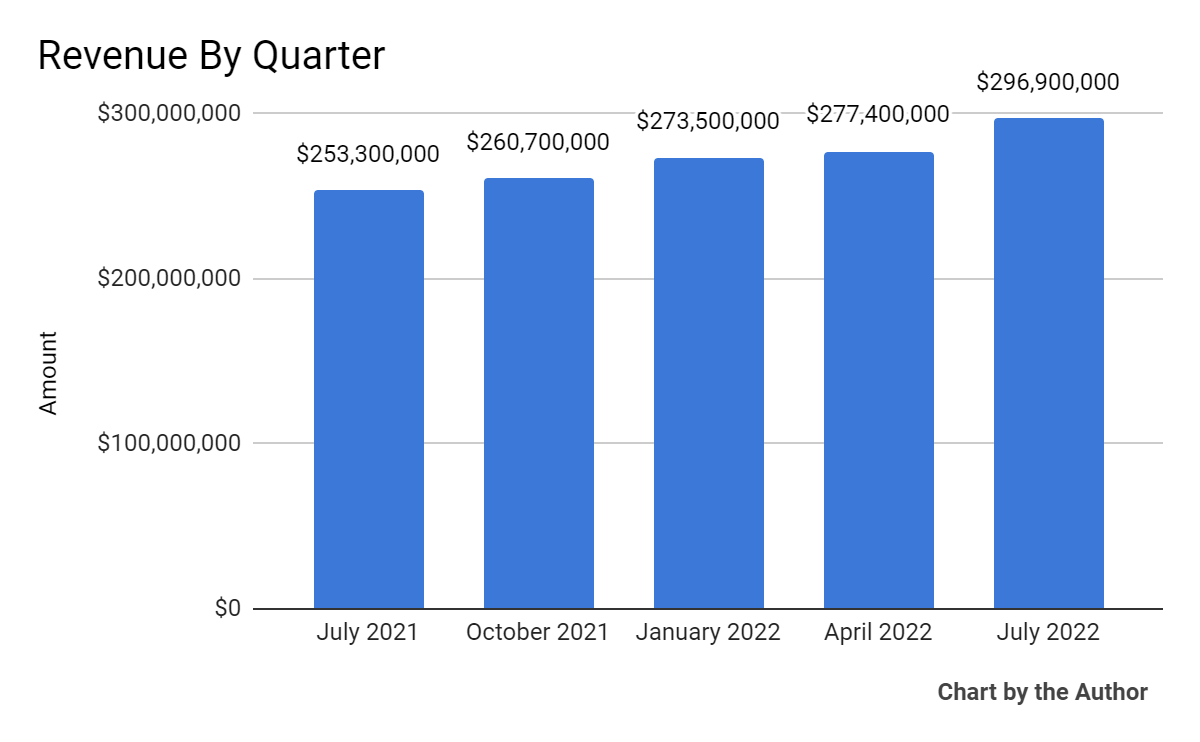

Total revenue by quarter has grown over the past five quarters, as the chart shows here:

5 Quarter Total Revenue (Seeking Alpha)

-

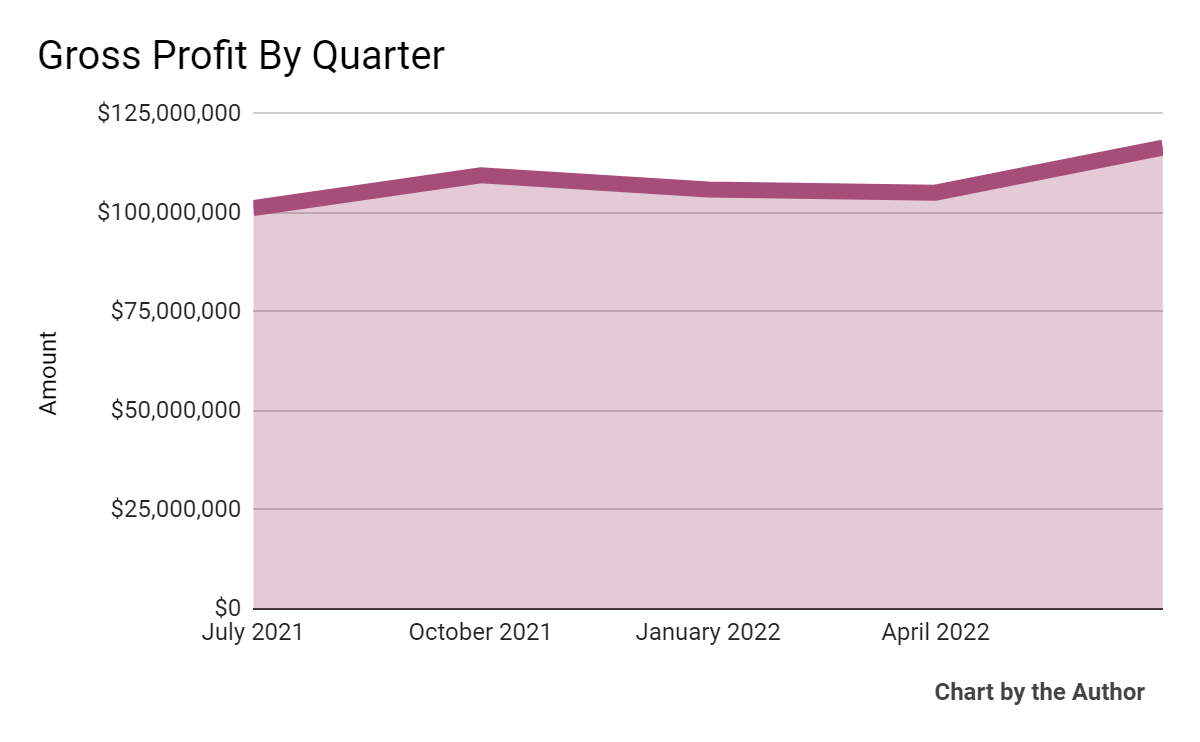

Gross profit by quarter has recently started growing again:

5 Quarter Gross Profit (Seeking Alpha)

-

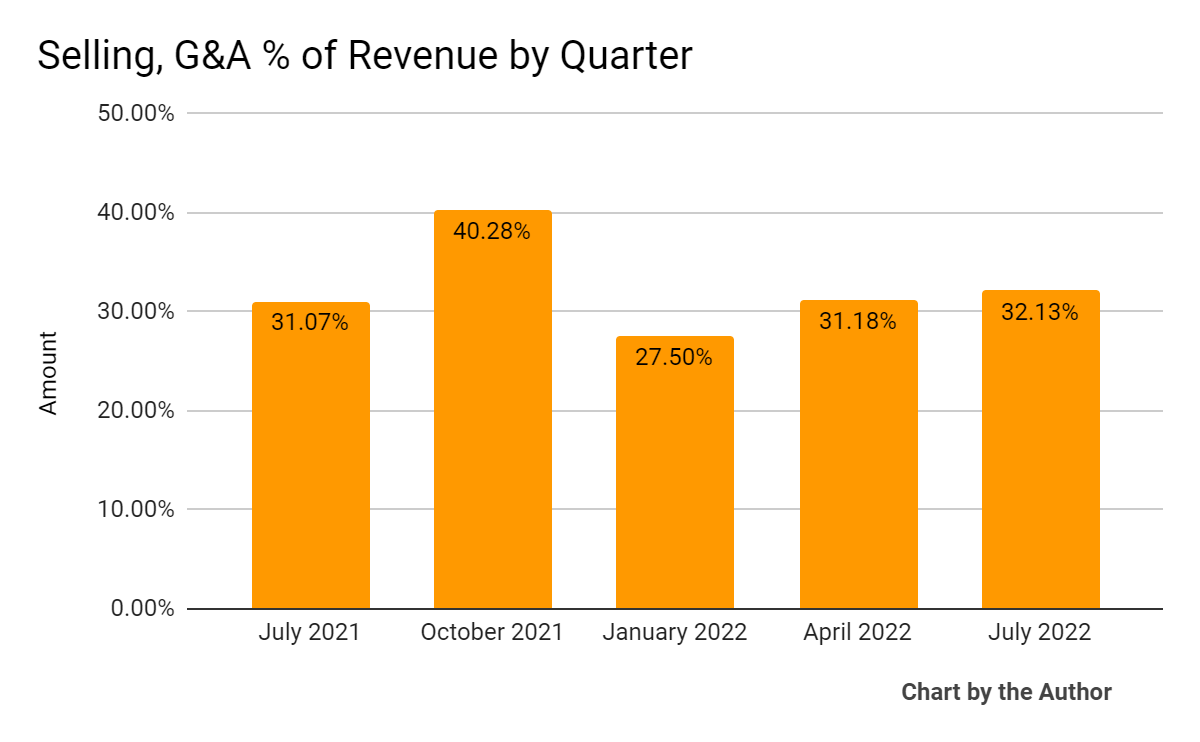

Selling, G&A expenses as a percentage of total revenue by quarter have varied as follows:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

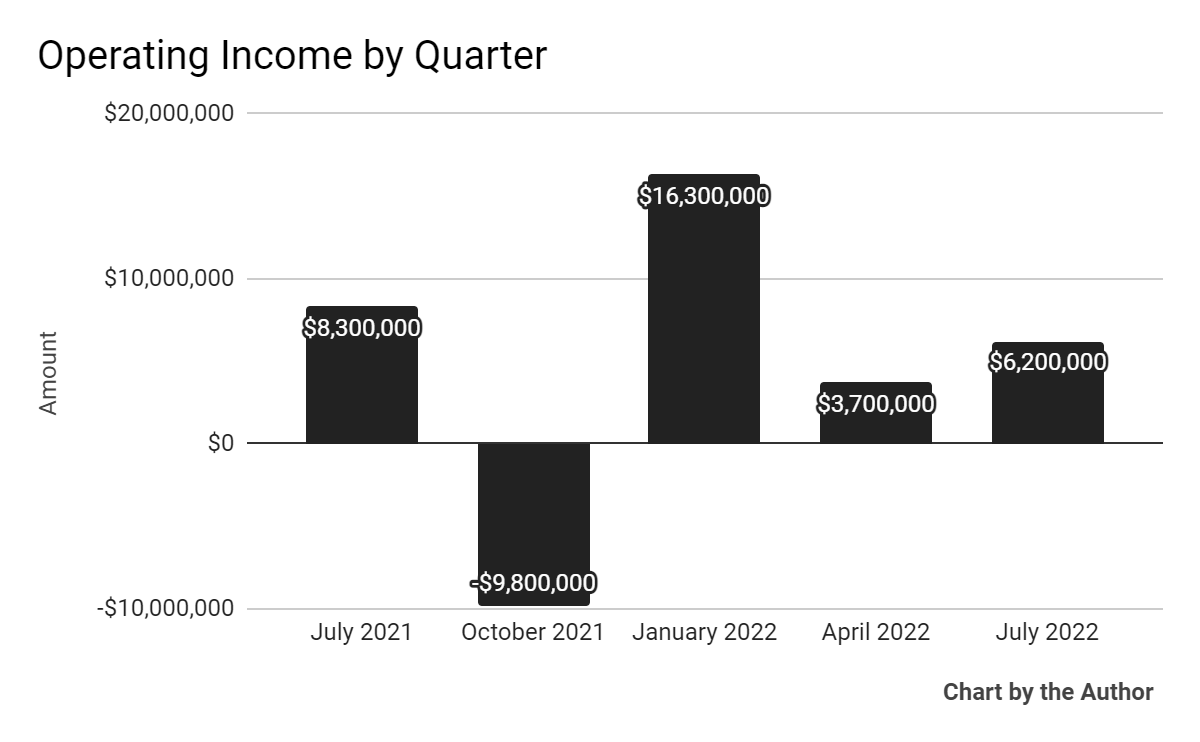

Operating income by quarter has been positive in four of the past five quarters:

5 Quarter Operating Income (Seeking Alpha)

-

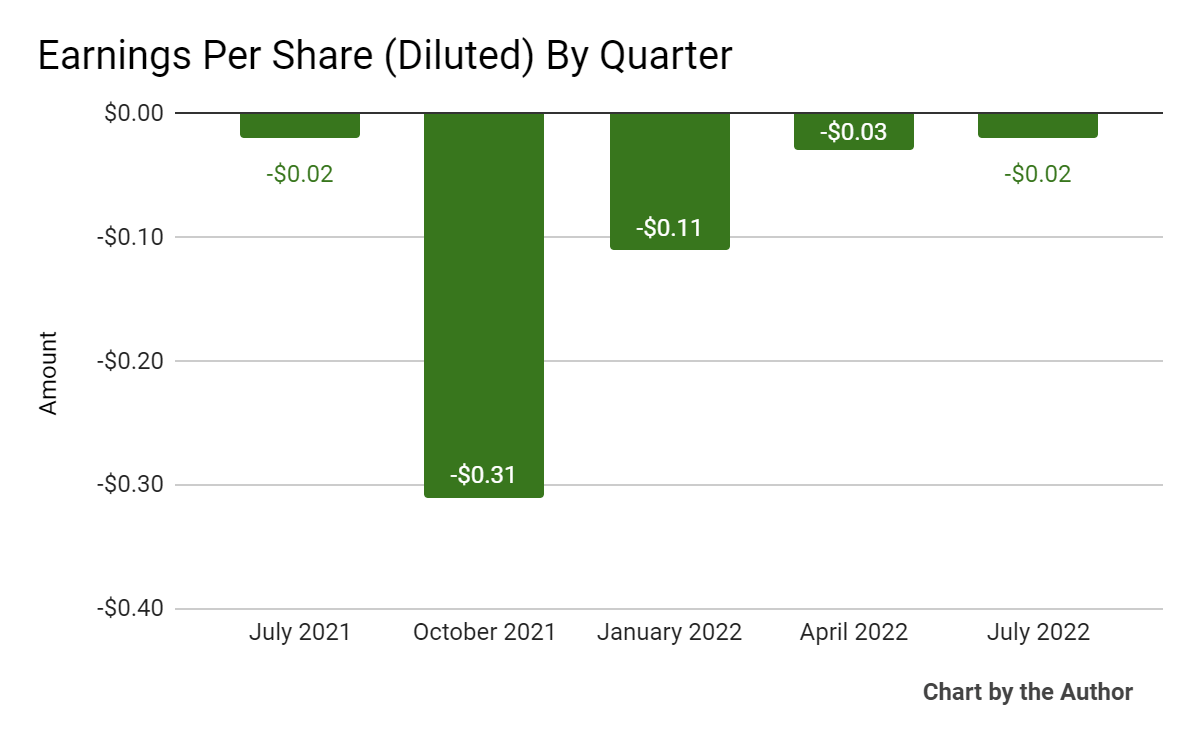

Earnings per share (Diluted) have remained negative in recent reporting periods:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

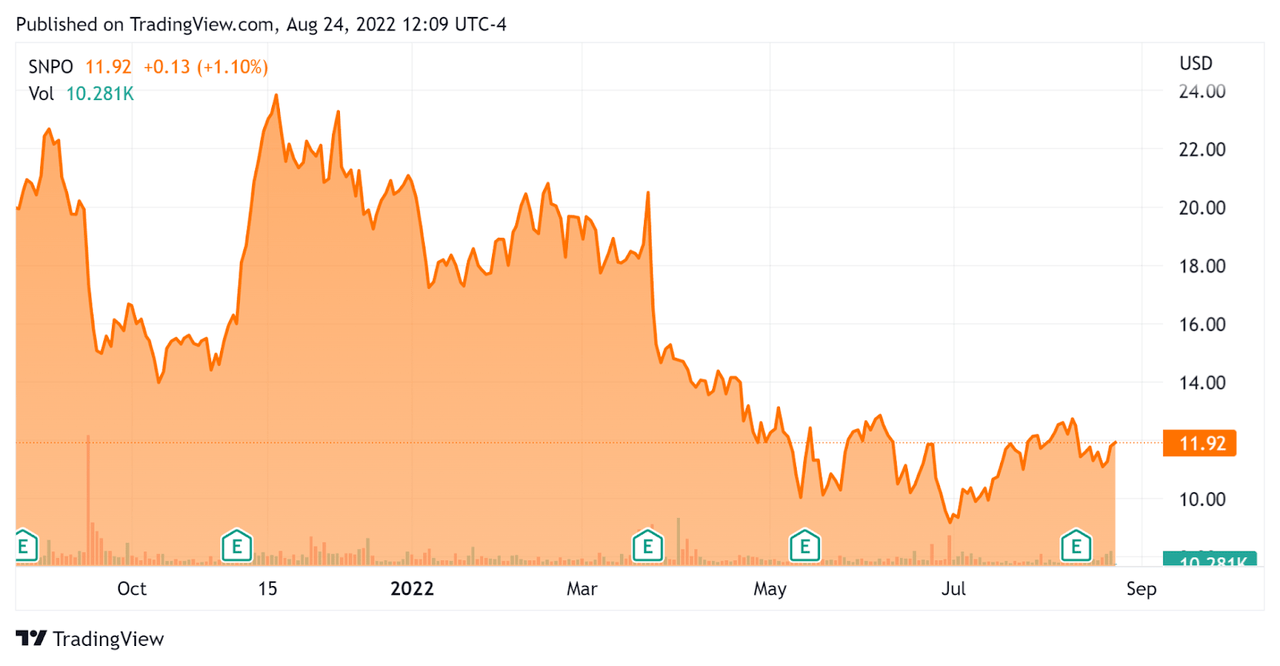

In the past 12 months, SNPO’s stock price has dropped 40.8% vs. the U.S. S&P 500 Index’s drop of around 7.4%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Snap One Holdings

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.27 |

|

Revenue Growth Rate |

19.7% |

|

Net Income Margin |

-3.0% |

|

GAAP EBITDA % |

6.8% |

|

Market Capitalization |

$894,320,000 |

|

Enterprise Value |

$1,400,000 |

|

Operating Cash Flow |

-$45,350,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.47 |

(Source – Seeking Alpha)

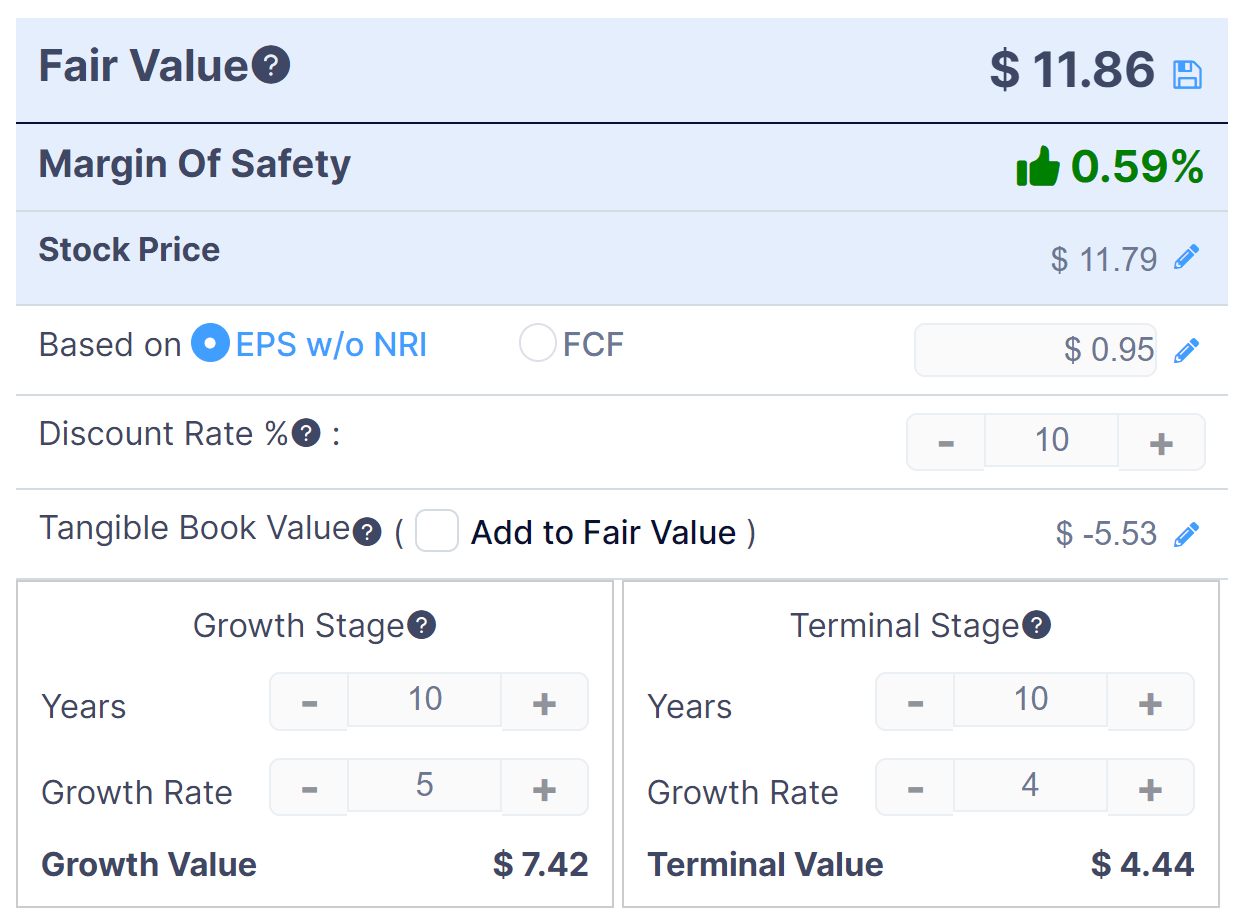

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

SNPO DCF (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $11.86 versus the current price of $11.79, indicating they are potentially currently fully valued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On Snap One Holdings

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its network of approximately 20,000 integrators for distribution of its products and proprietary software to residential and commercial customers.

However, the company has seen the negative impacts of supply chain disruption and inflation on its inventory and cost structure, although the company was able to pass through a price increase in June.

Management has expanded its efforts in adjacent growth markets such as commercial and security and continues to grow its omnichannel coverage by investing in its local branch network, which reached 32 locations at the end of the quarter.

The company also acquired Clare Controls after the quarter, seeking to bring in-house a previous distribution agreement for the ClareOne smart home and security solution for entry to mid-level applications.

As to its financial results, net sales rose by 17% year-over-year and adjusted EBITDA grew by 8% on an as-reported basis. Revenue grew, in part, due to the acquisitions of Access Networks and Staub Electronics.

The company raised its minimum wage and paid a one-time stipend to some employees to defray the negative effects of inflation and to improve retention and attract new employees.

SG&A expenses rose 21.3% and were driven by a ‘$5.9 million provision for credit losses and notes receivable’.

For the balance sheet, the firm finished the quarter with cash and equivalents of $31.3 million while it used free cash flow of $26 million for the first half of the year, due to operating cash use for inventory growth to compensate for supply chain risks and higher capital expenditures.

Looking ahead, management reiterated its previous full year guidance for revenue growth of 16% at the midpoint as-reported, of which 13% is expected to be organic growth. Adjusted EBITDA is expected to rise by 7% at the midpoint of the range.

Regarding valuation, the market is valuing SNPO at an EV/Revenue multiple of around 1.3x trailing twelve-month revenue.

My discounted cash flow analysis, which used conservative (i.e., low) growth estimates, indicates that the stock may be fully valued at its current level.

The primary risk to the company’s outlook is a macroeconomic slowdown, which may slow sales cycles, lowering revenue growth in the process.

Potential upside catalysts to the stock could include a ‘short and shallow’ economic pullback and a pause to the rise in the cost of capital, which may increase the valuation multiple for the stock.

We’re in a period where it is difficult to ascertain which direction the economy will take as well as the cost of capital.

Until we have greater clarity on these issues, my outlook on SNPO is on Hold for now.

Be the first to comment