Wachiwit

No mercy for another underwhelming quarter

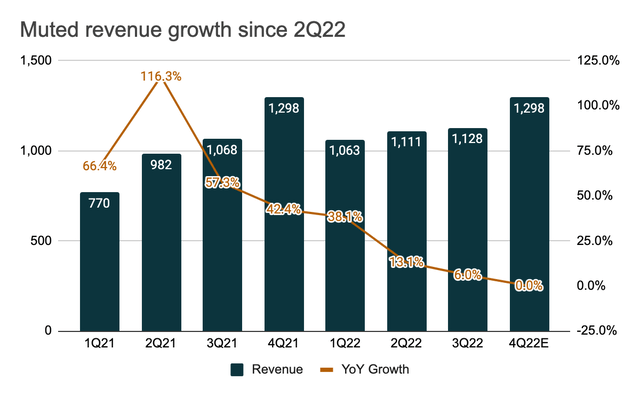

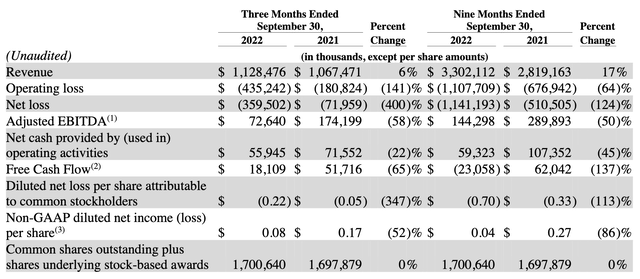

Markets are showing no mercy for Snap Inc. (NYSE:SNAP) as shares are down 27% after the social media company reported underwhelming 3Q22 revenue that came in below the Street’s already lowered expectations. Following a disastrous Q2, where sales grew 13% (vs. 15.5% consensus) with management also pointing to flat Q3 growth back in July, analysts were quick to lower the bar and expected just 6.4% in top-line growth going into the report. Unfortunately, Snap’s 3Q22 revenue of $1.13 billion was up just 6% due to weak DR (direct response) and brand advertising, and management again provided no guidance for Q4 given “uncertainties related to the operating environment.”

Operating loss swelled 141%, from $181 million in 3Q21 to $435 million in 3Q22, while total loss for the first 9 months of 2022 came in at $1.1 billion vs. $677 million in 2021. Adjusted EBITDA, mostly a result of adding back stock-based compensation, also contracted by 58% in Q3 and 50% in 1Q-3Q22. Given earnings are non-existent (or negative), it’s difficult for investors to find any valuation support considering top-line growth has slowed materially.

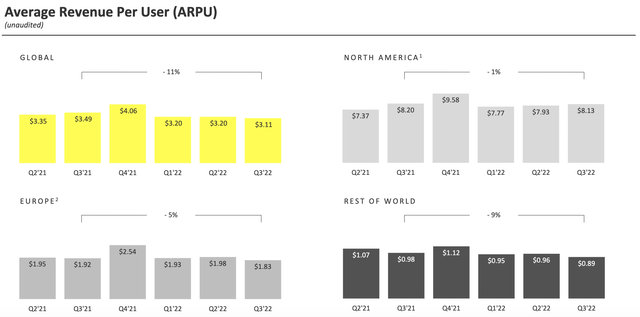

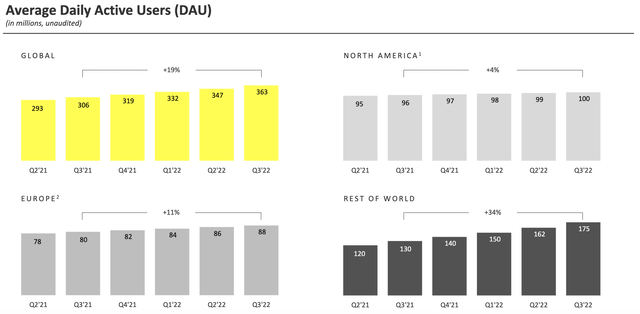

While average DAUs increased 19% YoY/4.6% QoQ to 363 million thanks to 34% YoY growth in Rest of World, global ARPU was down 11% YoY/2.8% QoQ driven mostly by weak ARPU in Europe and RoW. North America remained the most meaningful revenue contributor (>70% of total revenue) with Q3 ARPU of $8.13 (-1% YoY/2.5% QoQ) vs. $1.83 Europe and $0.89 RoW, but it’s unlikely for Snap to further expand the user base in this region since DAUs have been growing at just 1% sequentially over the last 5 quarters. If one must find a silver lining in the dark clouds, it would be that the total time spent watching Spotlight (short-form videos) increased 55% YoY, potentially reducing fears of competition from TikTok.

Snap has likely reached full penetration in the North American market and will likely start to see declining users at some point. While other regions are still growing users, the much lower ARPU profiles suggest there won’t be meaningful contribution to the top-line. Though Snapchat+ ($3.99/month, $21.99/6 months, $39.99/year) may be a way to diversify the revenue stream, the subscription service reached just 1.5 million paying customers in Q3. Assuming this number doubles to 3 million, Snapchat+ will contribute just $120 million in annual sales, or 2.6% of 2022E revenue.

Outlook

Management provided no guidance for the current quarter and pointed to a worsening macro (inflation, war, rate hikes) that clouded the company’s visibility. Additionally, weakness in brand advertising is also expected to continue. Nevertheless, Snap saw growth re-accelerate a bit (at ~9%) in the early weeks of Q4 and would still expect revenue to grow 15% sequentially. This implies a flat Q4 with revenue of $1.3 billion and full year 2022 revenue of $4.6 billion, up 12% YoY.

In September, a leaked internal memo by Snap showed that CEO Evan Spiegel wanted to grow Snapchat’s user base to 450 million (+30%) and revenue to $6 billion (+30%) by 2023. These numbers look quite aspirational considering revenue growth would likely enter negative territory should the current weakness stretch into 1H23. Snap saw 38% revenue growth in 1Q22, which puts 1Q23 growth in question considering the strong comp.

Thoughts on the stock

The read-through from Snap’s results and outlook are largely negative for the digital advertising sector in general. But it’s important to recognize that Snap belongs to the top-of-funnel and experimental part of the marketing budget, so social media behemoth Meta (META) could potentially fare better in the current down cycle, though the company is dealing with a metaverse problem (analysis here). Outside social media, Google’s (GOOG, GOOGL) search business will likely be more resilient (here), and The Trade Desk’s (TTD) exposure to CTV is a more structural story (here).

From a valuation perspective, many would consider Snap cheap at just 2.4x 2023 sales, but markets are unlikely to find the P/S multiple helpful given there’s not much revenue growth. Some investors may want to turn to profits to find valuation support, but Snap has none, and figures like adjusted EBITDA are largely driven by artificially adding back stock-based compensation.

All in all, Snap belongs to the speculative growth sector of the stock market, except there’s no longer any growth to speculate on. While the stock may see a short-term bounce given the dramatic price movement, I see any rally being met with heavy selling pressure and would advise investors to stay away from this name.

Be the first to comment