Ethan Miller/Getty Images News

Thesis

Smith & Wesson Brands Inc. (NASDAQ:SWBI) is an American manufacturer and marketer of firearms. After a strong fiscal year in 2021, depressed expectations and political uncertainty have led the stock to a bear market. As the company’s financial health remains promising and the industry is expected to see moderate growth for the foreseeable future, Smith & Wesson’s value proposition is examined in this analysis.

Smith & Wesson Product Offerings

The Smith & Wesson brand is well-recognized and known for its high-quality products, over its 160+ year history. From its iconic revolvers to modern sporting and hunting rifles the company’s firearms serve many different purposes while upholding the reputation for reliability and performance. Apart from individual customers, ranging from collectors, hunters, sportsmen, and enthusiasts, the company also provides firearms for numerous law enforcement agencies and military organizations around the world. S&W sells its products under the Smith & Wesson, M&P, Thompson/Center Arms, and Gemtech brands, while manufacturing primarily occurs in the Springfield, Massachusetts, Houlton, Maine, and Deep River, Connecticut facilities.

Financial Performance & Prospects

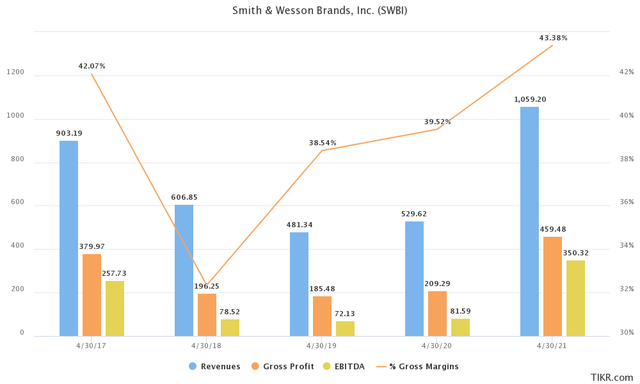

The fiscal year 2021 (ending in April 2021) marked record performance for Smith & Wesson. Revenue surpassed $1B for the first time in the company’s history, propelled by accelerated firearm sales after the Covid-19 pandemic hit in early 2020. SWBI generated $1.1B in sales, shipping 2.6M of firearms. The company also upgraded its website, significantly increasing web traffic. Outpacing the increases in the number of National Instant Criminal Background Checks, a proxy for tracking gun sales growth, Smith & Wesson maintains popularity among first-time and regular buyers. Over the past 10 and 3-year periods, Revenue has grown at 10% and 16% CAGRs, even though recent growth is heavily influenced by the massive uptick in sales recorded in the Covid-influenced 2020.

When taking a closer look at the company’s balance sheet, S&W’s solid financial position is reaffirmed. With a 2.8 current ratio and a 1.7 quick ratio, there should be no short-term liquidity concerns. The company carries a very small balance of long-term debt at $25M, with its cash stockpile, amounting to $107M able to pay down all debt 4 times over. Share count has also been decreasing, from 65M in 2012 to 45M as of the last quarterly filing, increasing shareholder value progressively over time.

Despite strong growth for the fiscal year 2021, analysts are not as optimistic for the next couple of years. Expecting negative double-digit growth, Smith & Wesson is expected to bring in revenue of 870M in 2022 and $630M in 2023. Firearms sales, however, remain highly susceptible to changes in the political and social environment, with estimates often missing the mark. Even during a broader recession that leads to more sociopolitical turmoil, gun manufacturers often increase sales and outperform the market.

As management mentioned during the Q3 2022 earnings call, the firearms market, while still remaining healthy and welcoming new entrants, has significantly cooled off compared to the pandemic heights. For the foreseeable future, management sees a return to the pre-pandemic historical demand patterns. Maintaining strong margins and versatile production capacity will set S&W apart from the competition during surges and pullbacks in demand. Throughout the upcoming fourth quarter, the company also expects to build inventory and continue to restock after last year’s depletion of finished goods.

Industry Prospects

Smith & Wesson estimates that the total addressable market for the company has grown at a 20-year 5.2% CAGR since the early 2000s. In 2021 the company estimates the handgun market at $2.9B and the long-gun market at $2.3B, with approximately 66M gun owners in the United States. According to research by fortunebusinessindights.com:

The global guns and accessories market size was USD 6.14 billion in 2019 and is projected to reach USD 9.33 billion by 2027, exhibiting a CAGR of 6.15% during the forecast period.

While growth prospects are not too exciting, still, at a 6% CAGR, the industry is expected to outpace the broader economy giving the main competitors room to increase their revenue and protect profit margins. On that note, even though, revenue is set to decrease over the next two fiscal years, the overall trend is not adversarial to Smith & Wesson’s long-term strategy.

Gun sales should experience a rebound after displaying very weak numbers in January 2022, driving the stock lower. Future growth will also stem from a changing gun demographic, as more women and minority groups become first-time gun owners. A lot of effort on the part of the company is focused on attracting first-time buyers that are rather unfamiliar with the business to trust the brand’s quality and reliability.

Profitability & Valuation

S&W maintains an impressive profitability capacity. Gross and Net income margins of 45% and 25% provide comfort, while handily beating sector averages. Currently, gross margins and at record high levels, while for the last decade the company has averaged around 35-40% in gross and 8-12% net income margins. On a P/E and P/S basis, SWBI trades at forward 4x and 0.85x multiples, significantly lower than longer-term averages.

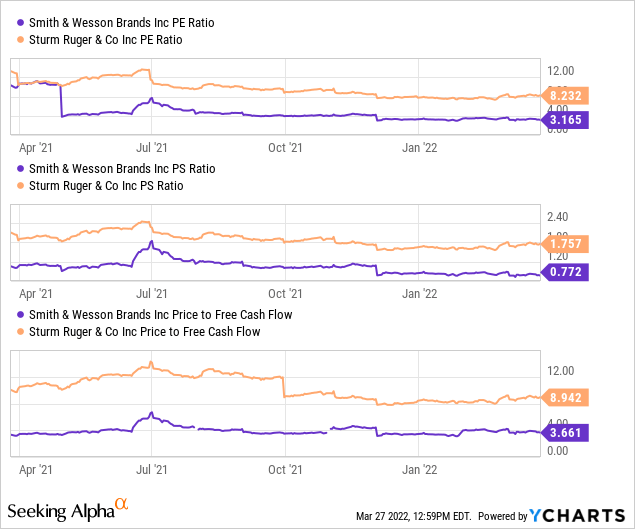

On a relative valuation basis, SWBI is compared against one of its largest competitors in the firearms industry, Ruger (RGR). On all three metrics selected SWBI is significantly less expensive, although it could be argued that Ruger offers a more attractive growth proposition, building on its more modernized product range. That said, in the case that the industry as whole gains some ground over the short-run Smith & Wesson currently offers the better-investing proposition.

Risks

Supply chain disruptions: As COVID-19 continues to impact worldwide economic activity, significant disruptions are caused to the global economy, as well as businesses and capital markets. Disruptions to the supply chain are persisting, causing materials shortages and increased production costs.

Regulation: Financial performance is heavily influenced by a variety of political, legislative, and regulatory factors. Policy shifts looking to retract second amendment protections could have an adverse effect on the company’s business operations. The firearms business is subject to extensive regulation bearing significant costs for manufacturers.

Demand fluctuations: With consumer demand exhibiting tremendous volatility, affected by external factors, the company might struggle to align our capacity with our demand. That would lead to sizable shortages or excessive amounts of inventory incurring additional operational expenses.

Final Thoughts

After all things are considered, despite high uncertainty levels, related to the nature of Smith & Wesson’s business, I believe the value proposition is too good to ignore. The stock trades at cheap multiples while a healthy balance sheet and a 160-year reputation for product quality ensure long-term sustainability. Despite political and broader-market risks, SWBI is attractive, especially if management shows over the next couple of quarters that short-term depressed expectations are overblown. I would rate the stock as a buy.

Be the first to comment