Jae Young Ju/iStock via Getty Images

Smith Micro Software, Inc. (NASDAQ:SMSI) is expected to benefit from growth in the internet of things market. Besides, the company is reporting acquisition of software from large software companies, and may soon deliver new partnerships with large telecom operators. Even considering the risks from cyber-attacks or concentration of clients, in my view, the stock appears undervalued. My discounted cash flow models with conservative assumptions indicated large upside potential in SMSI’s stock valuation.

Smith Micro: Software For Family Safety And Assets Acquired From Large Conglomerates

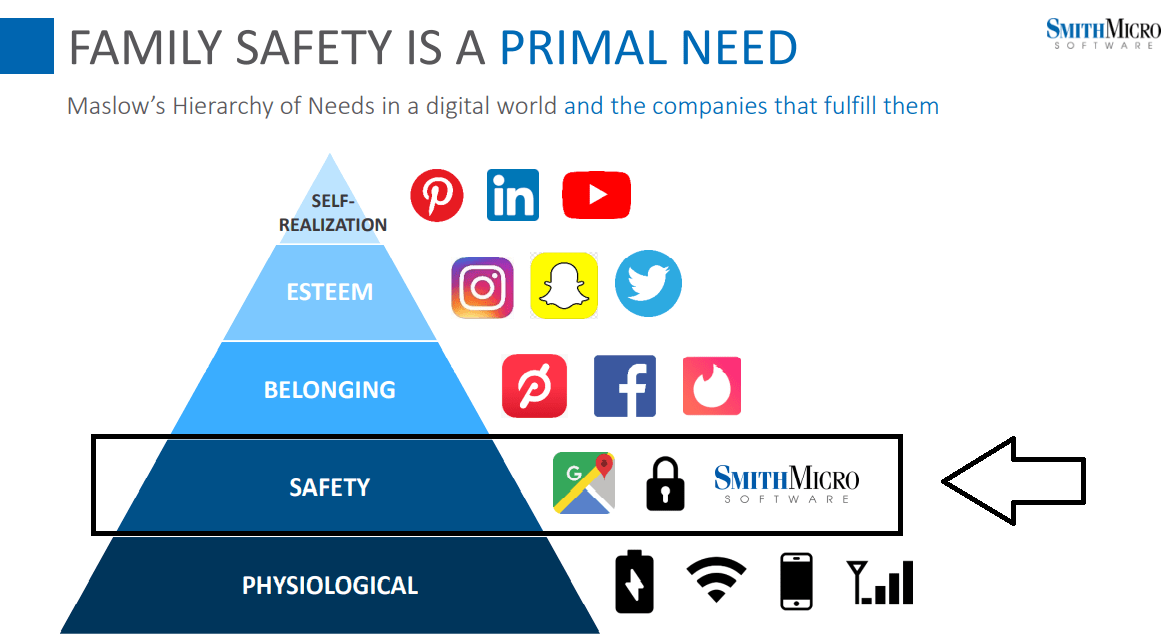

Smith Micro offers software that interacts with smartphones and Internet of Things devices for customers to protect the family digital lifestyle. The products offered by Smith Micro appear to be essential for the safety of families out there:

Source: Investor Presentation

Even though Smith Micro is a small business, management presents its portfolio as the most white-label robust safety platform in the market:

We believe our portfolio includes the most robust white-label family safety platform on the market, and a wide range of products for creating, sharing, and monetizing rich content, such as visual voice messaging, and retail display management. Source: 10-K

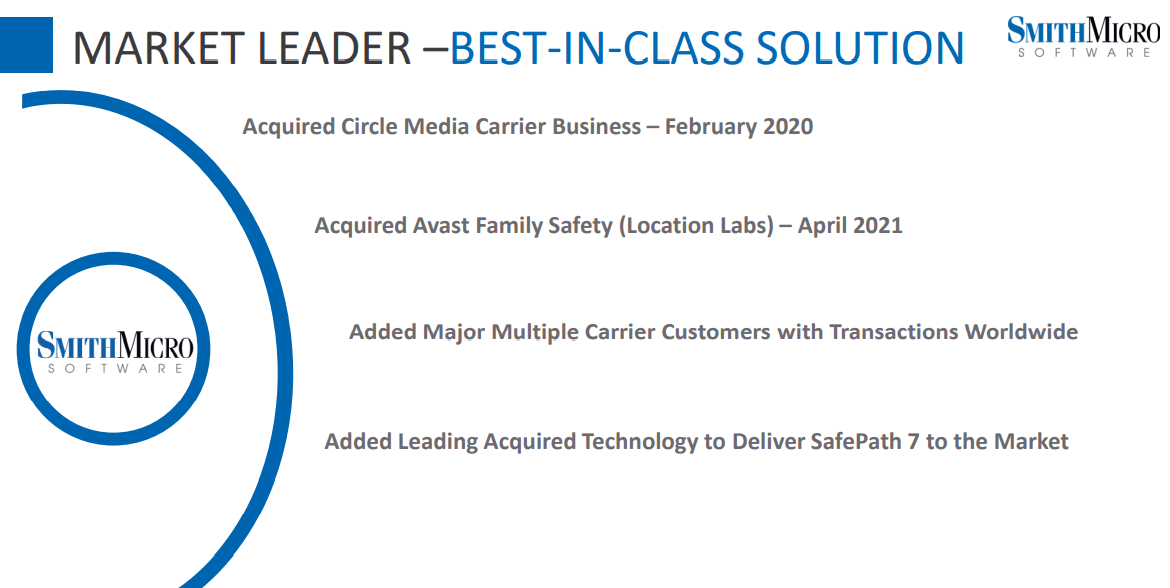

I believe that Smith Micro is an interesting business model, and not only because of the words of management about its solutions. In my view, the most interesting fact is that Smith Micro is operating in a growing market, the internet of things. Besides, management acquired assets from large software conglomerates like Avast (AVST). So, Smith Micro’s financial ratios could look like that of other large corporations. Keep in mind that Smith Micro’s products may show as much quality as that of AVST.

Source: Investor Presentation

More Agreements With Network Operators

Smith Micro claims strong relationships with mobile network operators, which offer the company distribution to millions of end-users. Considering this information, as the market and mobile network operators increase their customers, Smith Micro’s customer base will likely increase:

We continue to capitalize on our strong relationships with the world’s leading mobile network operators and multiple system operators. These customers serve as our primary distribution channel, providing access to hundreds of millions of end-users around the world. Source: 10-K

Under this case scenario, I believe that Smith Micro will likely sign new contracts with other network operators, which could lead to larger revenue growth. In my view, new partnerships are also quite likely because the company already noted large agreements with large operators. I think foreign players in the IoT industry could also be interested once their managers know about the agreements signed by Smith Micro.

In addition to growing our business with current customers, we look to expand our MNO and MSO customers worldwide, as well as to expand into new partnerships as we extend the reach of our product platforms within the connected lifestyle ecosystem. Source: 10-K

In line with my previous commentary, let’s note that management is working towards partnership agreements with DISH and Boost, which will likely bring revenue growth.

A portion of our solutions sales to Sprint/T-Mobile (TMUS) has historically included sales to Boost. We are working toward expanding our strategic relationship with DISH and will aim to grow the number of subscribers – both at Boost and at DISH – using Smith Micro-powered value-added services. Source: 10-K

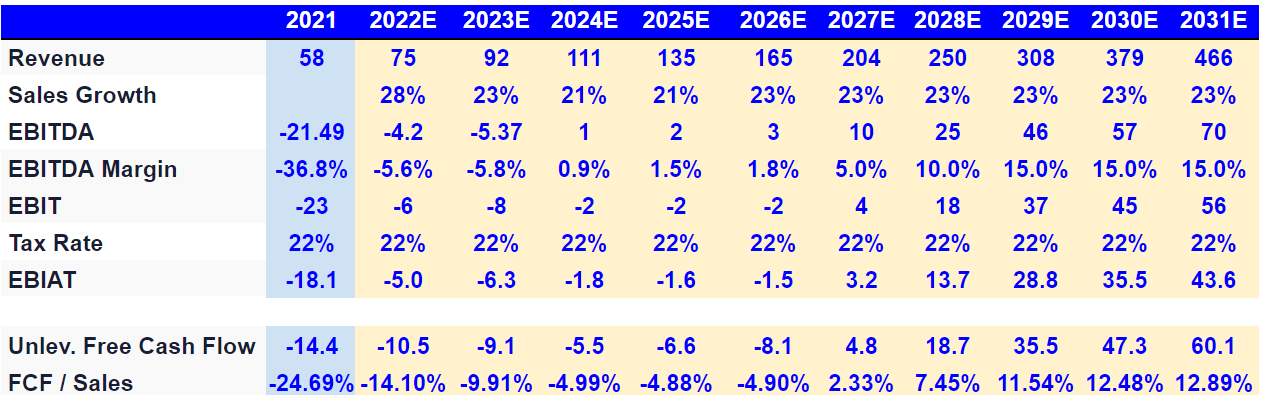

Market experts believe that the IoT market size could grow at close to 15.9% in the next four to five years. Smith Micro is a small entity, so growing larger than the market may be easy. With that, under this case scenario, I assumed that from 2027 to 2031, sales growth would stay close to 15.9%.

The Global Consumer IoT Market size is expected to reach $204.8 billion by 2027, rising at a market growth of 15.9% CAGR during the forecast period. Source: The Worldwide Consumer IoT Industry is Expected to Reach

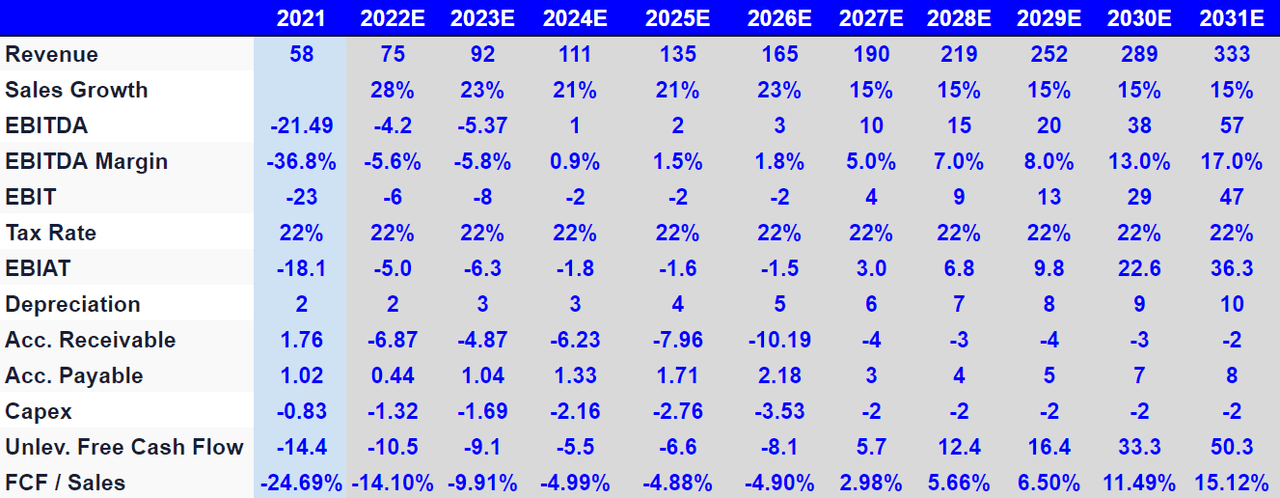

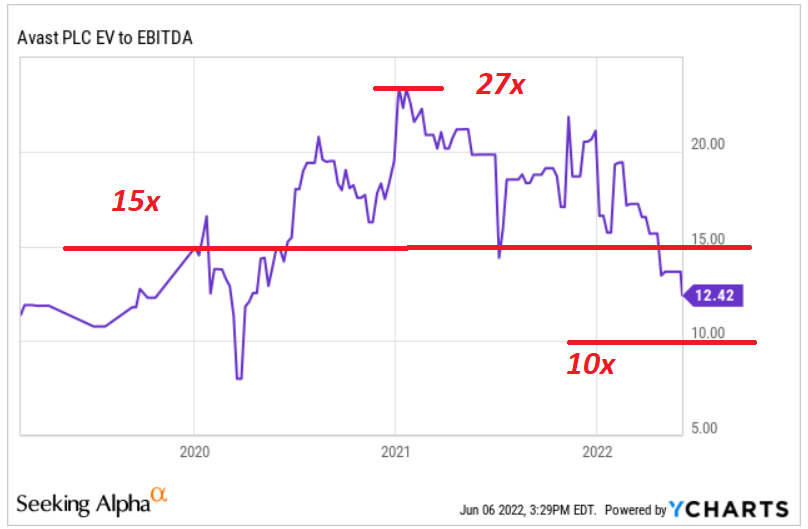

As Smith Micro grows larger, I believe that its financial figures will look pretty much like that of large corporations. SMSI competes with Avast plc, and recently acquired assets from this corporation. With this in mind, I decided to have a look at Avast’s EBITDA margin and FCF/Sales margin.

2021 was a historic year for Smith Micro as we completed the largest acquisition in company history by acquiring substantially all of the assets of the Family Safety Mobile Software business of Avast plc, and its subsidiaries, together with all of the outstanding membership interests of its then subsidiary, Location Labs LLC (the “Family Safety Mobile Business acquisition” or “Family Safety Mobile Business”) for a base purchase price of $66 million. Source: 10-K

In the past three years, Avast’s EBITDA margin was close to 56%, and the FCF/Sales ratio stood at 48%. Considering these figures, I believe that SMSI could achieve an EBITDA margin of 17% in 2031.

I also included a tax rate of 22% and capital expenditures close to $2 million, which implied an unlevered free cash flow of $33-$50 million from 2030 to 2031.

Arie Investment Management

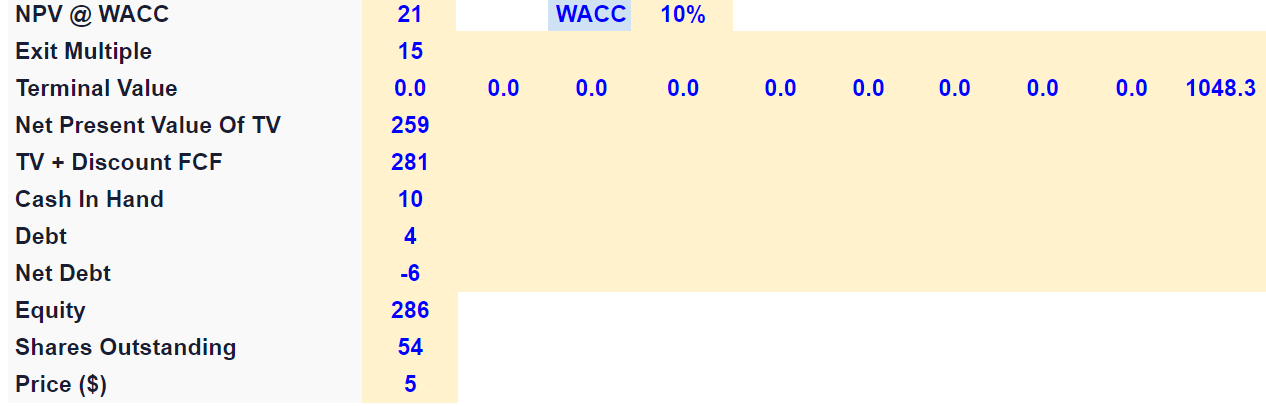

Avast traded in the past between 10x and 27x EBITDA, and the median is also close to 12x EBITDA. Considering these figures, in my view, we could use an exit multiple of 7x.

Ycharts

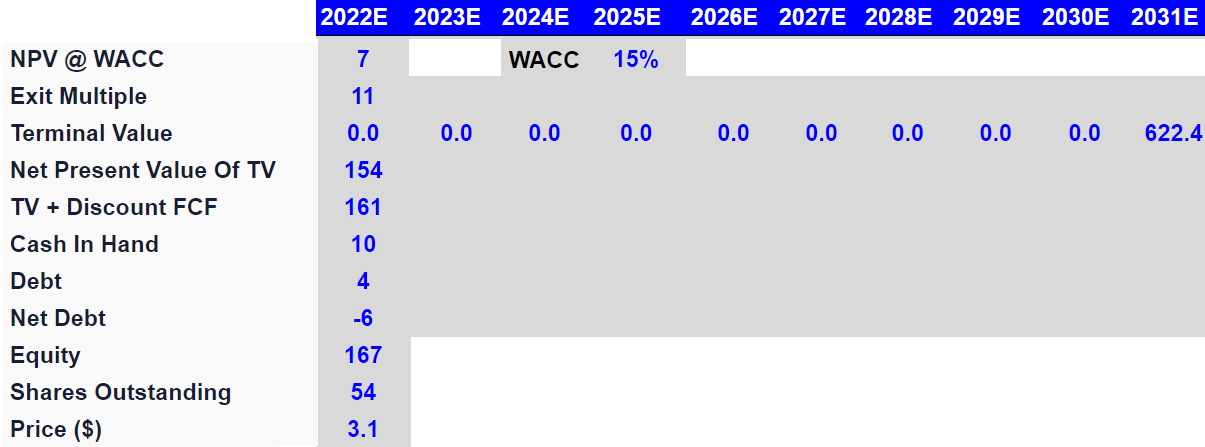

Finally, with a discount of 15%, which I believe is conservative, I obtained an implied valuation of $167 million or $3.1 per share.

Arie Investment Management

Worst-Case Scenario

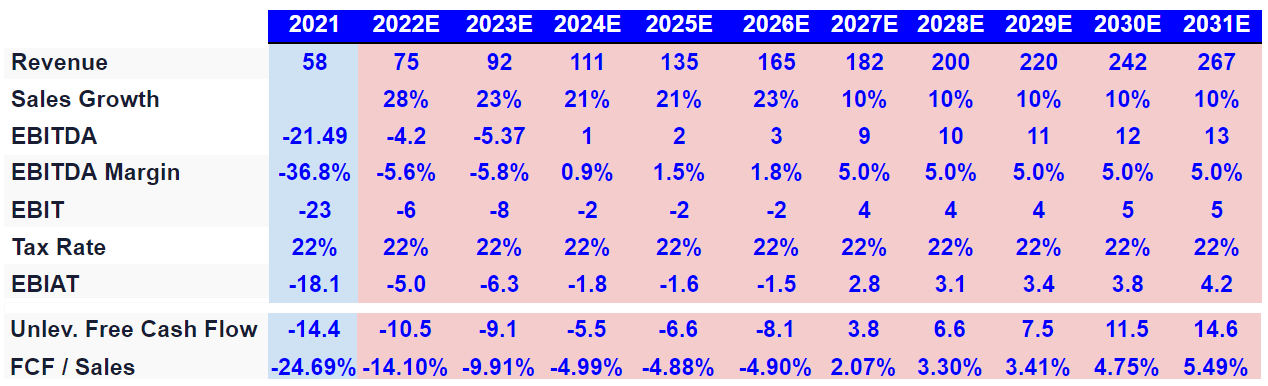

Let’s note that the company reports significant customer concentration. Smith Micro would suffer a significant decline in revenue if the company loses an agreement with a large wireless carrier. Under this scenario, I assumed that sales growth could decline because any of the clients would decide to work a bit less with Smith Micro.

We sell our wireless products and solutions primarily to large wireless carriers, so there are a limited number of actual and potential customers for our products, resulting in significant customer concentration. For the year ended December 31, 2021, sales to our two largest customers comprised 80% of our revenues. Source: 10-K

Smith Micro may also suffer significant revenue growth decline if new products or services are not delivered when wireless carrier customers require them. Smith Micro’s reputation could be affected, which may compromise potential new agreements.

In the event that we are unable to complete the necessary contract processes, or that our wireless carrier customers withhold or delay the commitment of resources or the completion of necessary internal processes or approvals, we may not be able to launch our new or updated products or services within the timeframes that we expected or at all, and our revenue and financial performance may be adversely affected. Source: 10-K

Finally, considering the number of cyber-attacks currently going on, mentioning about security breaches appears relevant. Let’s also remind investors that Smith Micro handles sensitive information about consumers. If Smith Micro loses information and the media notices, sales growth could diminish. Besides, the company may have to pay fines, which could lower future free cash flow margins.

Any failure to prevent or mitigate security breaches and improper access to or disclosure of our data or our customers’ data or their users’ data, including personal information from users, or of the other third party information and materials in our possession or control, including pre-release mobile devices in our custody, could result in the loss, modification, disclosure, destruction, or other misuse of such data or materials, which could harm our business and reputation, subject us to material liability and diminish our competitive position. In addition, computer malware, viruses, and general hacking have become more prevalent and may occur on our systems or on the third-party systems that we use. Source: 10-Q

Under detrimental circumstances, I believe that sales growth of about 10% from 2027 to 2031 would be lower than expected. In my view, shareholders wouldn’t be happy considering that market sales growth is larger than 15%. An EBITDA margin of 5% and FCF sales close to 4.75% may not be celebrated either.

Arie Investment Management

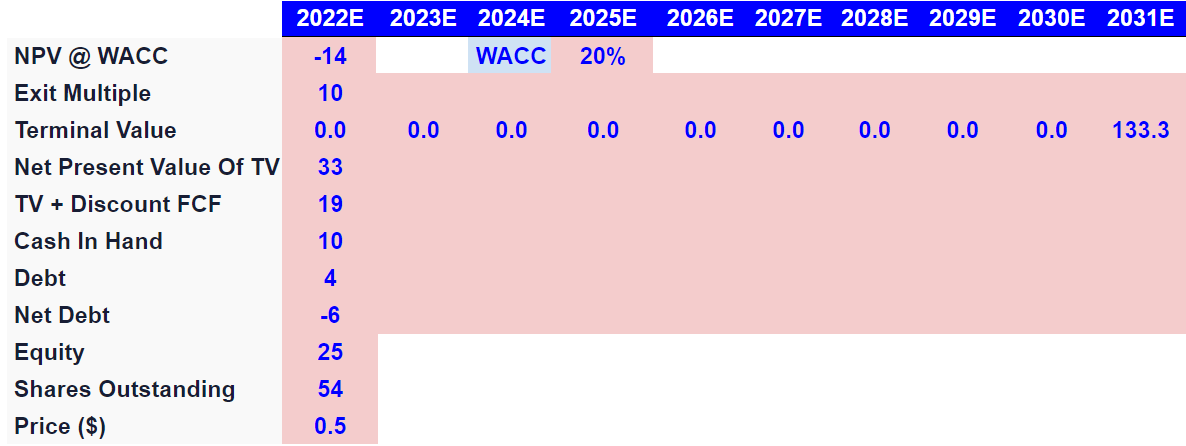

Putting previous assumptions together with a discount of 20%, an exit multiple of 10x implies an equity valuation of $25 million and a fair price of $0.5.

Arie Investment Management

With An Increase In The Amount Of Inorganic Growth, The Stock Price Could Increase Significantly

Under very extraordinary circumstances, Smith Micro would finance new aggressive M&A operations. As management stated in the last annual report, new acquisitions could be financed with debt or equity. In my view, new synergies generated and revenue growth could help the company grow more than the target market.

We may also have to incur debt or issue equity securities to finance future acquisitions. Source: 10-K

Under extraordinary events, I believe that we could see sales growth of 23%, until 2031, and an EBITDA margin of 15%. It means that the EBIAT could stand close to $45 million in 2031. 2031 Free cash flow would also stay close to $60 million.

Arie Investment Management

With an exit multiple of 15x and a discount of 10%, the implied equity valuation would be $286 million. The fair price implied would be $5.

Arie Investment Management

Balance Sheet

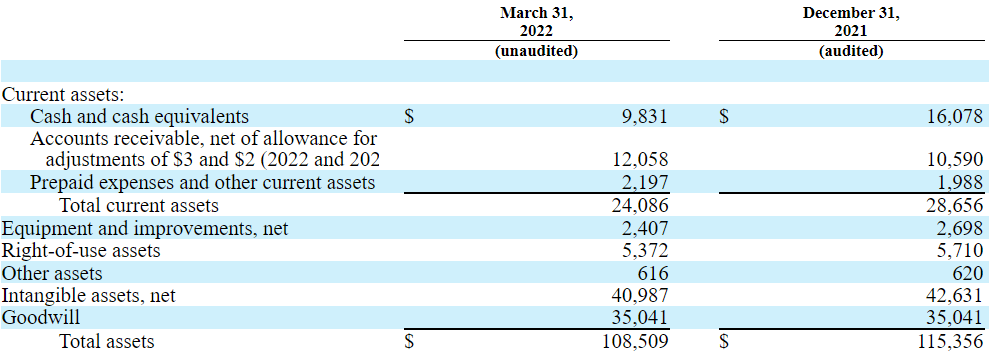

As of March 31, 2022, the company reported $9 million in cash, so I believe that sale of equity would be necessary for the further acquisition of targets.

10-Q

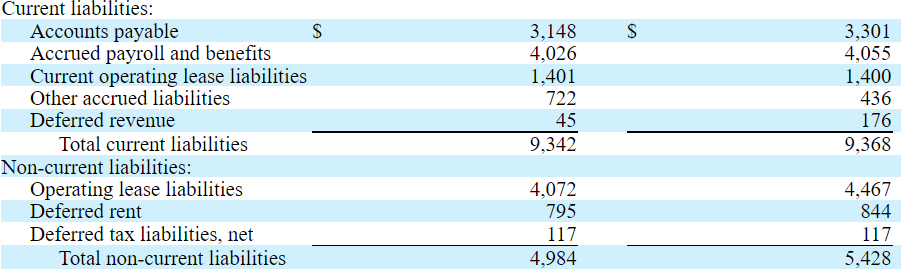

With regards to the total amount of liabilities, I wouldn’t worry much. The amount of liabilities is small, and the total amount of debt is very small. Smith Micro could finance future acquisitions with debt if bankers like the new transactions proposed.

10-Q

My Takeaway

Smith Micro is a small company, so I believe that the stock may not be for very conservative investors. There are also risks from customer concentration and cyber-attacks. With all that being said, I believe that the growth in the IoT market, more acquisitions, and partnerships could justify a small position in the stock. My discounted cash flow models indicated significant upside potential in Smith Micro’s stock valuation.

Be the first to comment