Yakobchuk/iStock via Getty Images

The U.S. government seems to be leading from behind when it comes to imposing sanctions on Chinese foundry Semiconductor Manufacturing International Corporation (SMIIC) (OTCQX:SMICY). For example,

- On July 17, 2020, prior to the U.S. sanctions, I published a Semiconductor Deep Dive Marketplace subscription article entitled “China: Who Needs TSMC When They Have SMIC?” Six weeks later on Sept. 4, 2020, Reuters reported the Trump administration was considering whether to add China’s top chipmaker SMIC to a trade blacklist, as the U.S. escalated its crackdown on Chinese companies.

The result? China was the leading region for semiconductor equipment revenues in 2020.

- On Aug. 11, 2021 I wrote a Seeking Alpha article entitled “SMIC Is Closing The Gap With Industry Leaders Despite U.S. Sanctions.” Less than three months later, on Dec. 15, 2021, an article was published in Fortune with the title “Shares of China’s largest chipmaker sink to lowest close in nearly a year as Biden team considers tougher sanctions.”

The result? China was the leading region for semiconductor equipment revenues in 2021.

Coincidence? I don’t know. Further sanctions would hurt U.S. suppliers Applied Materials (AMAT) and Lam Research (LRCX), as it did ASML (ASML) with a blockade on its EUV lithography exports to China.

Three months after this Dec. 15 article, nothing has been done on further sanctions, except for U.S. Commerce appeasing ASML by adding 33 Chinese entities to its Unverified List on Feb. 8, 2022. One of these companies is SMEE, the China home-grown company that’s developing advanced lithography systems, particularly DUV immersion, that will enable 7nm production. SMEE is the company I was referring to in my last bullet of my Aug. 15, 2021, article noted above.

Are Sanctions Working?

Despite the intentions of sanctions, we need to consider the comment by President Joe Biden on the Russian sanctions imposed after their invasion of Ukraine:

“Sanctions never deter,” Biden said during a Thursday press conference at a NATO summit in Brussels, Belgium.

According to the Newsweek article, this comment was counter to comments by the White House Security Advisor and the U.S. Secretary of State that sanctions were intended to deter. Biden was right about Russia because sanctions didn’t deter, and it appears that this comment has resonated with China.

In an earnings release, SMIC reported that:

- Revenue was $5,443 million, record high – Compared to $3,907 million in 2020

- Gross margin was 30.8%, record high – Compared to 23.6% in 2020

- Profit from operations was $1,393 million – Compared to $312 million in 2020

- Profit attributable to SMIC was $1,702 million – Compared to $716 million in 2020

SMIC’s guidance was strong, and the company has earmarked US$5 billion for capital expenditure this year, up from US$4.5 billion in 2021. The investment could boost its monthly capacity by 130,000 to 150,000 8-inch equivalent wafers.

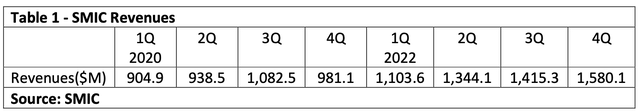

SMIC’s revenues have increased consistently since the sanctions, which may have had a minor impact in Q4 2020 after the July 2020 imposition, as shown in Table 1.

SMIC

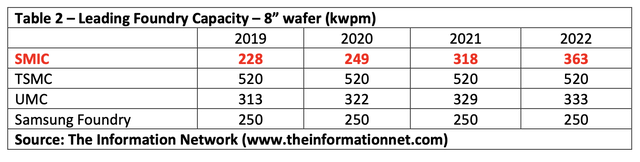

SMIC plans to increase capex spend to $5 billion increasing overall capacity by 130-150 kwpm (8″ equivalent) in 2022.

SMIC is the only leading foundry that plans to increase 8-inch wafer capacity, as shown in Table 2.

SMIC

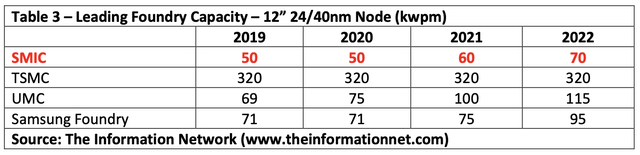

In addition, SMIC intends to construct three mega fabs that will 240 kwpm total capacity addition at the 28/40nm nodes, as shown in Table 3.

SMIC

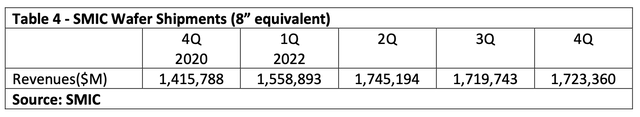

Table 4 shows total wafer shipments between 4Q 2020 and 4Q 2021 for SMIC, again showing expansion despite sanctions.

SMIC

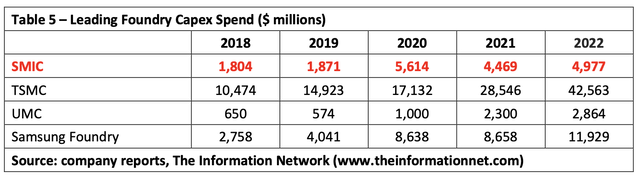

Table 5 shows capex spend for the leading foundries. SMIC cut capex spend in 2020 following U.S. sanctions, but after recognizing their ineffectiveness, will increase spend in 2022, according to the report entitled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends.”

The Information Network

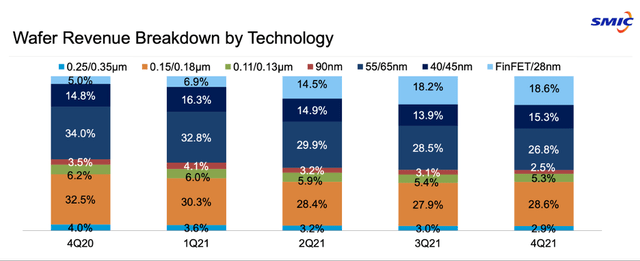

One of the contributing factors in the increase in QoQ revenues shown above in Table 1 is an increase in output by smaller nodes, which command higher chip prices. Chart 1 shows that at the smallest dimensions (top of each column), SMIC increased output consistently over the past five quarters while decreasing output at the largest nodes (bottom of each column).

SMIC

Chart 1

Investor Takeaway

Because of U.S. sanctions, SMIC is blocked from purchasing EUV systems. Does it matter? SMIC has exhibited strong growth since sanctions were imposed, and YoY revenue growth of 39.3% was more than twice that of leading foundry TSMC’s (TSM) 12.5%.

Equipment sales to China are another thing. In 2021, China maintained the top position of equipment purchases, as it did in 2020. However, according to the report entitled “Global Semiconductor Equipment: Markets, Market Share, Market Forecasts,” Taiwan is expected to regain the top position in the sector in 2022 and 2023. But China will be a strong third behind South Korea, as Taiwan and S. Korea ramp up capex spend for <7nm chips using EUV lithography.

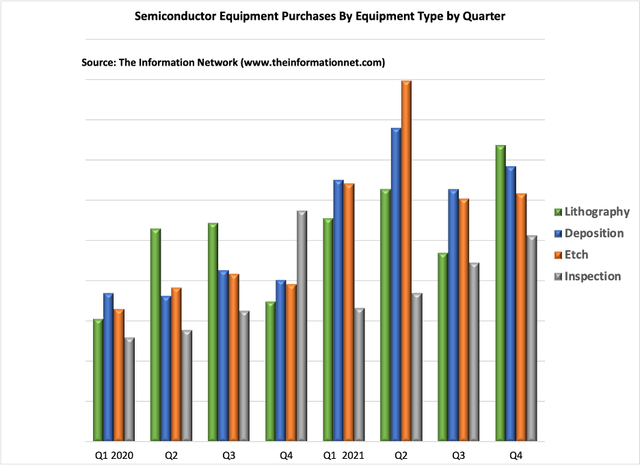

Chart 2 shows equipment sales to China by type by quarter for 2020 and 2021. The chart shows that the trend on a QoQ basis does not reflect any negative impact of sanctions on equipment purchases by China.

The Information Network

Chart 2

SMIC isn’t the only Chinese foundry that has grown strongly. Another Chinese foundry, Hua Hong, also has its most advanced technology with a mature 28-nm process and it is working on advanced 14-nm technology – an area where SMIC has already achieved scaled production.

According to its latest financial figures, the company’s revenue in the fourth quarter increased 88.6% from a year ago to an all-time high of $528.3 million while its net profit surged 212.8% to $88.2 million.

In 2021, Hua Hong’s revenue grew by 70% YoY to $1.63 billion, while its net profit for the year reached a record high of $182 million.

In short, as with the Russian sanctions, where Biden strongly stated “Sanctions never deter,” questions are raised about the impact of these sanctions on Chinese semiconductor equipment other than the blockage of EUV lithography systems limiting nodes to 7nm.

Be the first to comment