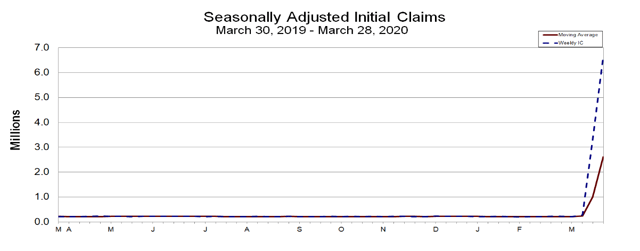

For the second week in a row, the Department of Labor issued a blowout initial unemployment claims number:

In the week ending March 28, the advance figure for seasonally adjusted initial claims was 6,648,000, an increase of 3,341,000 from the previous week’s revised level. This marks the highest level of seasonally adjusted initial claims in the history of the seasonally adjusted series. The previous week’s level was revised up by 24,000 from 3,283,000 to 3,307,000. The 4-week moving average was 2,612,000, an increase of 1,607,750 from the previous week’s revised average. The previous week’s average was revised up by 6,000 from 998,250 to 1,004,250.

Here’s a chart of the data from the report:

These numbers are going to be extraordinarily bad for at least the next few weeks.

These numbers are going to be extraordinarily bad for at least the next few weeks.

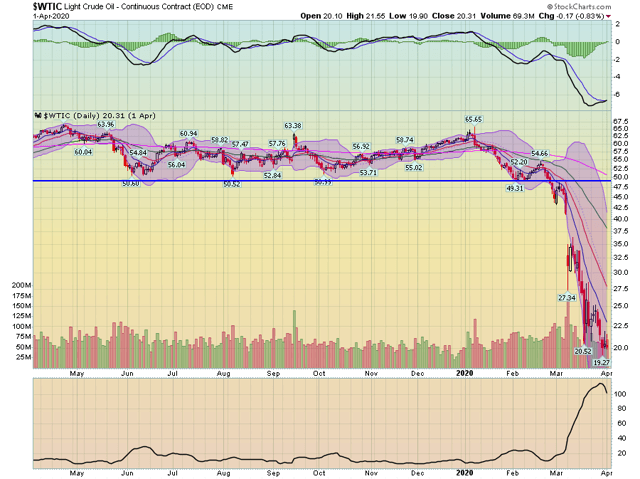

Is there a deal to be had in the oil markets (emphasis added)?

Saudi Arabia called on Thursday for an urgent meeting of the Organization of the Petroleum Exporting Countries and other oil producing countries with the “aim of reaching a fair agreement to restore” balance in the oil markets, according to a statement carried by the official Saudi press agency on Thursday. The statement said that the Saudis were acting to support the global economy and in “appreciation” of Mr. Trump’s request.

Here’s a chart of oil prices: After Saudi Arabia decided to flood the oil market at the end of February, prices crashed. They broke through support in the upper 40s/lower 50s and are now down over 50% from those levels.

After Saudi Arabia decided to flood the oil market at the end of February, prices crashed. They broke through support in the upper 40s/lower 50s and are now down over 50% from those levels.

Bank of America is arguing the coming recession will be the worst ever (emphasis added).

The BofA team forecast three consecutive quarters of contraction in gross domestic product, “with the US economy shrinking 7% (annualized) in 1Q, 30% in 2Q and 1% in 3Q.”

On the bright side, the economists estimate that the fourth quarter of 2020 will see a sizable pop in business activity as the measures put in place to slow the deadly contagion are slowly unwound.

The size of the coming contraction is anybody’s guess. As I’ve noted, I’m not viewing this as a formal recession; instead, I’m using the “National Pandemic Adjustment Period” concept advanced by St. Louis Fed President James Bullard. I think 2Q20 should be viewed as a period out of economic time

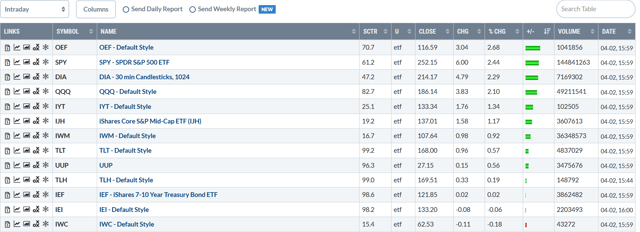

Let’s look at today’s performance tables: Overall, not a bad day for the market, especially considering the blow-out initial unemployment claims number. The larger averages were higher; small-caps were up but to a lesser degree. Note that micro-caps were off marginally and that the Treasury market was also higher.

Overall, not a bad day for the market, especially considering the blow-out initial unemployment claims number. The larger averages were higher; small-caps were up but to a lesser degree. Note that micro-caps were off marginally and that the Treasury market was also higher.

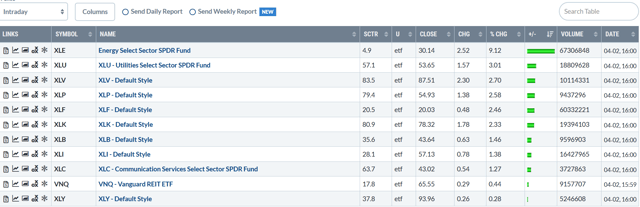

The energy sector was up strongly on news of a possible oil market deal. After that come the three defensive sectors — utilities, health care, and consumer staples. This, combined with the higher move in the Treasury market, indicates there is still a strong safety bid in the market.

The energy sector was up strongly on news of a possible oil market deal. After that come the three defensive sectors — utilities, health care, and consumer staples. This, combined with the higher move in the Treasury market, indicates there is still a strong safety bid in the market.

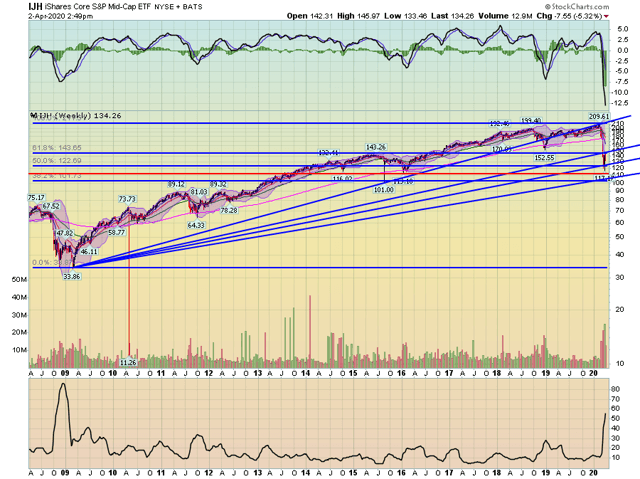

Today let’s take a look at the very long weekly charts for mid, small, and micro-cap indexes. Like other indexes, mid-caps have dropped sharply over the last month and a half on very strong volume. They are currently at levels from 2015-2016. They are also at key Fibonacci levels. They’re right at the 50% retracement for the levels that connect the low from 2009 and the recent high while also being in the middle of the Fibonacci fans that connect the same points.

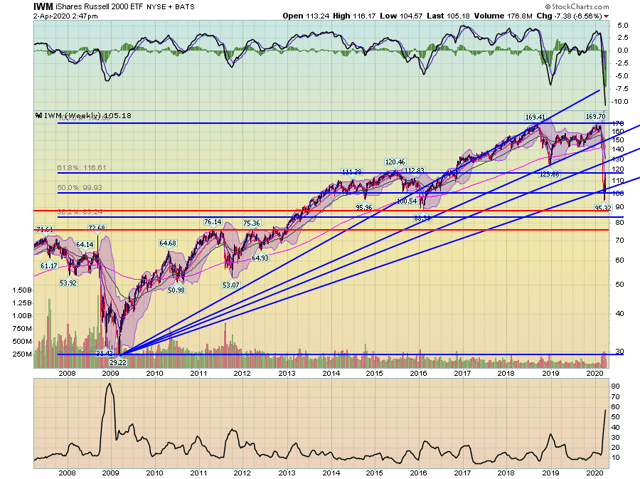

Like other indexes, mid-caps have dropped sharply over the last month and a half on very strong volume. They are currently at levels from 2015-2016. They are also at key Fibonacci levels. They’re right at the 50% retracement for the levels that connect the low from 2009 and the recent high while also being in the middle of the Fibonacci fans that connect the same points.  While being at the same key Fibonacci levels as the mid-cap index, small-caps are also right above two old price levels: the low from early 2016 and the highs from 2011-2012.

While being at the same key Fibonacci levels as the mid-cap index, small-caps are also right above two old price levels: the low from early 2016 and the highs from 2011-2012.

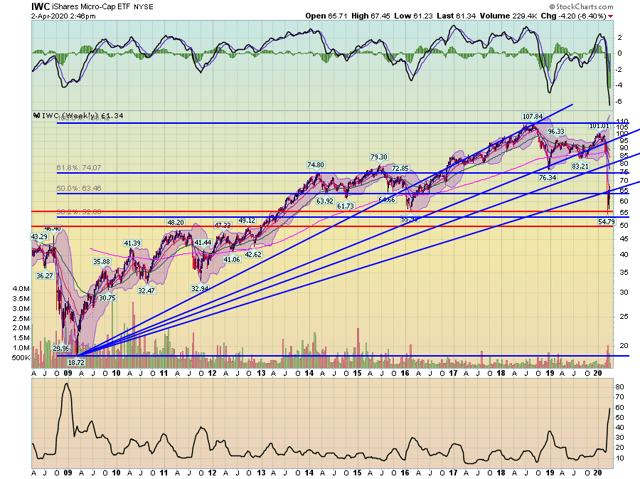

Micro-caps are at the lowest Fibonacci fan level after bouncing off the price level from the lows of early 2016.

Micro-caps are at the lowest Fibonacci fan level after bouncing off the price level from the lows of early 2016.

The smaller-cap indexes have already moved lower. The question is now will the larger-caps follow suit? Or, will the smaller-caps catch a bid and move higher?

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment