imaginima/E+ via Getty Images

SM Energy (NYSE:SM) expects its oil production to decrease in 2022 as it allocates more capital towards its Austin Chalk wells and anticipates a significant number of planned Midland Basin wells (from its 2022 capex budget) not starting production until early 2023.

Despite the lower oil production and potential hedging losses of nearly $700 million, SM should still be able to generate over $1 billion in positive cash flow in 2022 at $95 WTI oil. This would allow it to call its 2025 notes and reduce its net debt to under $800 million, while saving around $70 million in annual interest costs compared to the end of 2021.

I now estimate that SM is worth around $45 in a long-term (after 2022) $70 WTI oil and $3.50 NYMEX gas environment.

Production Growth

SM’s production growth forecast for 2022 was less than I previously expected. It anticipates growing total production by around 2% during 2022 (compared to 2021). As well, it anticipates its oil cut to fall to around 46% to 47% in 2022 compared to 54% in 2021. This results in a roughly -12% decline in its oil production compared to 2021.

This appears to be partly caused by increased capital allocation to its South Texas assets, which have a lower oil cut. New Austin Chalk wells are reportedly 42% oil and 30% NGLs and 28% natural gas, and oil percentages tend to decline over time. The payback on these wells should be quite quick though, as SM mentioned that its 2021 wells had an average payback time of 9 months, and 2022 commodity prices are even stronger.

SM also noted that part of its 2022 capex is going towards 20 Midland Basin wells that won’t start producing until early 2023.

2022 Outlook At $95 WTI Oil

At $95 WTI oil (around current strip), SM may be able to generate $3.341 billion in revenues before hedges. It is also helped by strong prices for NGLs and natural gas, as those commodities account for around 53% to 54% of its total production.

SM has hedged around 50% of its oil production and approximately 42% of its natural gas production, and this contributes to estimated hedging losses of $691 million for the year.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Oil | 24,412,500 | $93.50 | $2,283 |

| NGLs | 6,600,563 | $44.00 | $290 |

| Gas | 128,921,625 | $5.75 | $741 |

| Hedge Value | -$691 | ||

| Total | $2,623 |

SM is expected to generate $1.038 billion in positive cash flow in 2022 at current strip ($95 WTI oil) before dividends. SM’s dividend currently remains minimal at around $2 million per year, but it should have room to increase this after its calls some of its outstanding notes.

| $ Million | |

| Lease Operating | $243 |

| Transportation | $158 |

| Production and Ad Valorem Taxes | $192 |

| Cash G&A | $95 |

| Cash Interest | $147 |

| Capex | $750 |

| Dividends | $2 |

| Total | $1,587 |

Debt Maturities

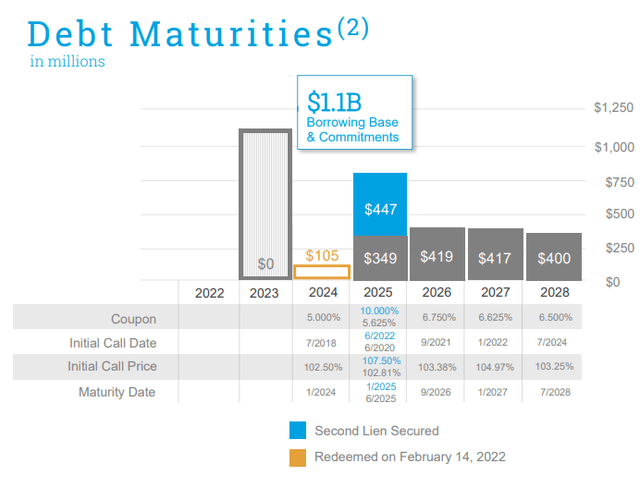

SM ended 2021 with $1.804 billion in net debt, and the positive cash flow it generates in 2022 could reduce its net debt below $800 million. It has already redeemed its $105 million in 5% unsecured notes due 2024, and with its positive cash flow seem likely to call its $447 million in 10% second-lien notes due 2025 and its $349 million in 5.625% unsecured notes due 2025.

SM’s Debt Maturities (sm-energy.com)

After that, its annual cash interest costs would be reduced to approximately $82 million per year, with an effect on cash flow (compared to its interest costs at the beginning of 2022) equivalent to an increase in oil prices of approximately $3 per barrel.

Notes On Valuation

Due to the reduced near-term production expectations (particularly for oil), I am trimming SM’s estimated value to approximately $45 per share in a long-term (after 2022) $70 WTI oil and $3.50 NYMEX gas scenario.

A $5 change in long-term oil prices (combined with a $0.25 change in long-term gas prices) affects SM’s value by approximately $5 per share.

SM may also be able to increase its value by delivering more oil production, which may occur in 2023 as more of its Midland Basin wells come online again.

Conclusion

SM’s oil production guidance for 2022 was lower than expected due to a combination of timing with its higher-oil Midland Basin wells and a decision to devote more capex to its Austin Chalk development.

With $6+ near-term natural gas prices (and strong prices for NGLs), the Austin Chalk wells should have outstanding economics. The lower near-term oil production is leading me to trim SM’s estimated one-year target price to $45 in a long-term $70 WTI oil and $3.50 NYMEX gas scenario. However, I believe that SM’s prospects beyond 2022 look strong as it will have fewer negative value hedges and its interest costs and leverage should be substantially reduced.

Be the first to comment