jamesteohart/iStock via Getty Images

Skyworks (NASDAQ:SWKS) has once again fallen to bargain levels thanks to the broad market volatility that has brought growth stocks to their knees. The company became popular with investors when what is billed as the next great pivot to 5G started shaping out. It soared when the semiconductor shortage boosted gross margins across the industry and lifted stocks through elevated levels in the space, but things have since cooled, and the stock has seen a precipitous fall from grace. Despite all this, there are signs that the company’s business is operating just fine and that long-term hopes about the 5G buildout are happening despite signs of a looming recession. I have covered Skyworks in the past. For a more detailed company profile, search here.

Company Outlook

Skyworks has direct exposure to key industries that will likely shape the world of the future. Top OEMs rely heavily on Skyworks, Sky5 architecture, and 5G is only just beginning. Perhaps the most interesting segment is automotive. The automotive segment seems promising as we have only just begun widespread electrification of vehicles, and the runway seems long as is, never mind the opportunity for more complex features in everyday vehicles that tie in with this Skyworks business product catalog. Encouragingly, the company is coming off of all-time record revenues for the automotive segment, which is probably expected as we are navigating through some exciting times for electric vehicle manufacturers.

The company is expecting global wireless data traffic to grow at a 27% annual rate over the next five years, lifted heavily by machine-to-machine connections, which may soon hit the 15 billion user mark. The company also expects 650 million connected cars by 2030, with each vehicle consuming 25 times the data of a smartphone. Interestingly, these are not overly aggressive targets. The world is on the cusp of a major paradigm shift, and there is a healthy appetite from large companies to increase device complexity and the role technology plays in our daily lives. That pivot will likely rely heavily on data consumption, and Skyworks ties in heavily on that front.

Stellar Q3 Earnings

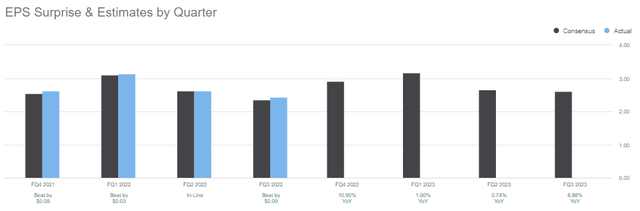

The main concern whenever there are signs of an economic slowdown is earnings figures. In many circles, the expectation this quarter was that we would see growth stocks like Skyworks start to miss estimates and guide lower. Skyworks did exactly the opposite. The company posted record revenue of $1.23 billion for the quarter, which beat estimates and was up 10% year-over-year. The company had stellar gross margins at 51.2%. In the past, anything over 40% gross margins on a semiconductor stock was considered great. They also had strong showings across their automotive, data center, and network infrastructure segments, which will be crucial in the future. Management has highlighted these segments as a key driver for growth long term in the past.

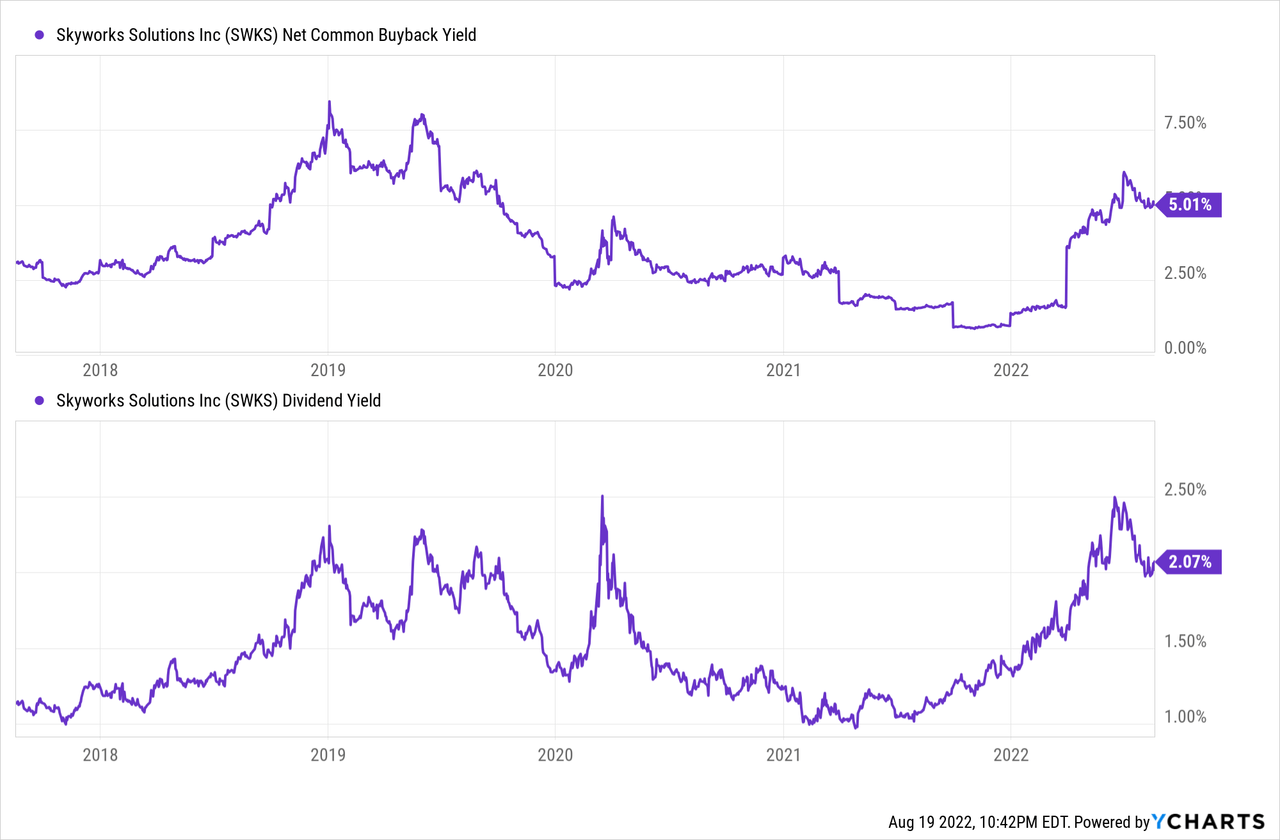

The company also authorized more than $1 billion in dividends and repurchases, which is a great sign for investors as the business sought fit to return cash despite a possible economic downturn, and the repurchases will have happened at advantageous prices for shareholders in the long term.

Interestingly for a large semiconductor company, Skyworks has a great record of returning cash to shareholders. We can see that the recent sell-off in the stock has done wonders for buyback figures. The company is also hiking distributions into the weaker stock price, which is ideal.

The one criticism of Skyworks that never seems to go away is its reliance on one major company, generally understood to be Apple (AAPL). The revenue reliance on Apple continued this quarter. This time the customer provided approximately 55% of total revenue compared to 53% year over year.

Normally we hold customer dependence against companies, but that customer is Apple, they are one of the most stable companies in the world, and quite frankly, there are a plethora of semiconductor companies who only dream of doing business with them. The risk is always there that Apple will decide to switch to another provider, but so far, things have been going well.

Valuation And Forward-Looking Commentary

As one might expect, the leadership team is fairly confident in its ability to deliver strong regional revenue performance through the end of the calendar year 2022. Management is guiding between $1.375 billion and $1.425 billion for Q4 revenue.

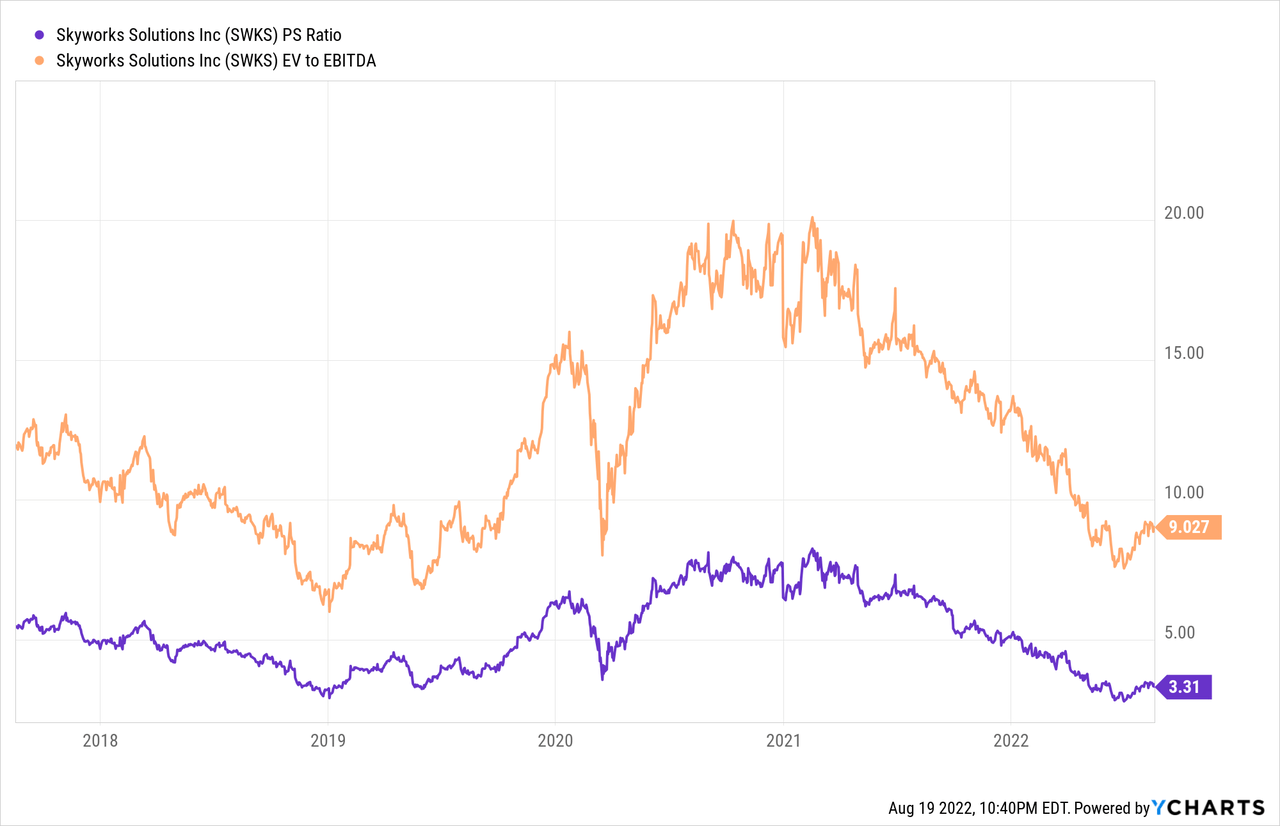

The strong performances imply that the company should easily come in north of the $5.48 billion revenue estimate, which is good for a forward PS ratio of just 3.16. We can see from the chart below that this is on the low end of the historical ranges for the company.

We can also see that management has been doing a very good job of living up to earnings expectations. The company has beaten or hit expectations for each of the last four quarters, which is always a good sign.

Seeking Alpha

As the Fed completes its tightening cycle, I expect conditions to begin to improve for growth stocks like Skyworks. The stock is currently trading at a 3.3 price-to-sales ratio, and if it can rebound to a price-to-sales ratio of 6, that is good for a stock price of roughly $205. Taking a 20% margin of safety, we get a target of $164, which represents a 52% upside from current levels.

The Takeaway

It can’t be overstated that Skyworks Solutions is a fantastic company at an amazing price. The company is already doing aggressive buybacks and paying investors to wait with a reasonable dividend. Its core markets have just about every tailwind imaginable, apart from the support of the Fed right now. After this stellar quarter, I see no pressing concerns with their business model. I rate Skyworks solutions as a long-term buy.

Be the first to comment