sutlafk/iStock via Getty Images

Skyworks Solutions (NASDAQ:SWKS) is currently trading at cheap multiples, despite reporting a good operating momentum and growth prospects being positive over the next few years.

Background

As I’ve covered in previous articles, I invest mainly in secular growth trends, including 5G and the Internet of Things (IoT), and in this investing theme, one of my long-term positions is Skyworks Solutions. The company is well positioned to benefit from industry-secular growth trends in this investment theme, especially following the acquisition of the Infrastructure & Automotive business from Silicon Labs (SLAB) last year.

This deal increased Skyworks’ exposure to broad markets, while at the same time, reduced its exposure to the mobile segment and its key customer Apple (AAPL), which account for about half of Skyworks’ annual revenue.

As I’ve not covered Skyworks for some time and the company has released very recently its most recent quarterly figures, I decided to take a look again to see how its business has progressed in recent months and to see if its investment case remains compelling for long-term investors or not.

Earnings Analysis

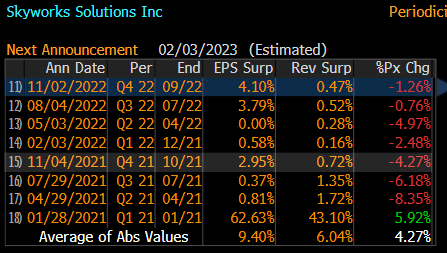

Skyworks has released its earnings related to Q4 and full fiscal year 2022 (FY 2022) at the end of last week, beating slightly revenue and earnings estimates, as shown in the next graph. Note that its top and bottom line beats were quite small, in line with the past seven quarters. Not surprisingly, its share price reaction was muted, as key financial figures were practically very close to expectations.

Earnings surprise (Bloomberg)

Skyworks’ revenues amounted to $1.4 billion in the fourth quarter of FY 2022, up 7% YoY, and reaching a new record for Q4. For the full year, its revenue was close to $5.5 billion, also up 7% YoY, driven by both Mobile and Broad Markets. While this is not particularly impressive for a growth company, it’s much better than compared to its peer Qorvo (QRVO), which as I’ve analyzed in a recent article, has reported a revenue decline of close to 8% YoY in the last quarter, due to weakness in the mobile segment.

Broad markets were particularly strong in recent month, reporting revenue growth of 30% YoY in the last quarter, and account now for some 36% of total revenue. In this segment, Skyworks has very good long-term growth prospects, coming from IoT, automotive connectivity, or industrial automation which are strong revenue tailwinds over the next decade.

Its gross margin in Q4 was 51.3% (non-GAAP), also higher than its peer, and above its level in the same quarter of last year, while Qorvo’s gross margin declined due to inventory reductions. Skyworks’ operating expenses were $129 million, leading to an operating income margin in the quarter of 37.6%.

Its quarterly net income (non-GAAP) amounted to $486 million and its EPS was $3.02 (+15% YoY), above the company’s own guidance and street expectations.

Regarding its cash flow generation, cash from operations was $236 million and capital expenditures were $142 million. Due to the company’s good cash flow generation and solid financial position, Skyworks returned $179 million to shareholders during the quarter, both through dividends and share buybacks.

For the full year, revenue amounted to $5.5 billion (vs. $5.1 billion in FY 2021), gross margin was 51.2%, and operating income margin was 37.3%. Its net income was $1.8 billion, leading to diluted EPS of $11.24, up 7% YoY, and reaching a new record high. Its cash flow from operations was $1.4 billion, and the company returned $1.3 billion of capital to shareholders, $373 million through dividends, and the rest through share buybacks.

Despite these strong financial figures, Skyworks is a company that’s heavily exposed to consumer electronic markets in an indirect way, due to its position of being a key supplier to Apple for instance, and is therefore not immune to weakness in end-markets.

Indeed, due to broad demand weakness, its guidance for the current quarter was quite weak given that Skyworks expects revenue to decline sequentially. It expects revenue in Q1 FY 2023 to be between $1.3-1.35 billion, a decline of about 5.4% at the midpoint of its guidance compared to the last quarter, while its gross margin is expected to remain broadly flat at about 51.5% in the middle of its range.

Nevertheless, although this guidance can be considered to be soft, it’s much better than compared to Qorvo, showing that Skyworks’ strategy to diversify away from mobile was the right one and the company continues to be well positioned to benefit from growth opportunities in the multi-year 5G ramp up and the rise of IoT.

Regarding its dividend, its quarterly dividend is unchanged at $0.62 per share, or $2.48 per year, payable next month. Due to a lower share price over the past few months, Skyworks is currently offering a dividend yield of about 2.85%, which is quite attractive within the technology sector even though it is not a high-dividend yield. Moreover, its peer Qorvo does not distribute dividends, being this factor another positive point for Skyworks over its peer.

Medium-Term Estimates and Valuation

Skyworks operating momentum has remained relatively good in recent quarters, and this trend is expected to continue in the coming years, as growth prospects are good over the next three years even though Skyworks is not expected to be a high-growth company.

Indeed, according to analysts’ estimates, its revenue is expected to grow at mid-single digits over the coming years, and reach about $6.28 billion in FY 2026. Its net income is expected to be close to $1.7 billion by FY 2026 (GAAP basis), compared to just $1.27 billion in FY 2022. This is justified by higher margins, as net profit margin should reach close to 26% in FY 2026, compared to 23.2% in FY 2022.

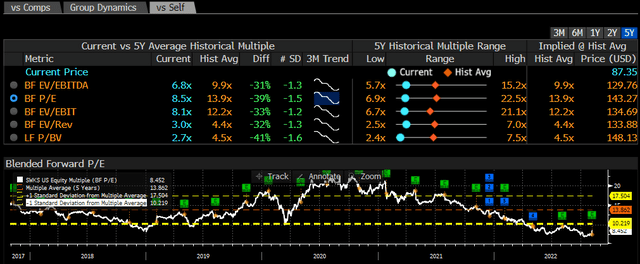

Despite these growth prospects, Skyworks’ current valuation is currently relatively low, both in absolute and relative terms. As shown in the next graph, Skyworks is currently trading at only 8.5x forward earnings, a significant to its historical average over the past five years, and close to the bottom of its historical trading range.

Moreover, this valuation also is much cheaper than Qorvo, which is trading at more than 13x forward earnings despite having reported weaker fundamentals in recent quarters, showing that Skyworks’ valuation is too depressed right now.

Conclusion

Skyworks has delivered a robust quarter during a thorough period for semiconductor companies, showing that its strategy to grow in broad markets was the right one. Despite its good fundamentals and resilient business model, Skyworks is currently trading at a relatively depressed multiple, which doesn’t seem to be justified. Thus, Skyworks is an undervalued play in the 5G/IoT investing theme and a good pick for long-term investors.

Be the first to comment