Sundry Photography/iStock Editorial via Getty Images

Thesis

SiTime Corporation (SITM) should continue to grow at an accelerated rate over the next few quarters and years. Current trends show growth is here to stay for the semiconductor industry. Specifically, advancements in 5G, datacenters, automotive industry, and even aerospace have seen increased demands for semiconductors and associated timing products. MEMS timing devices, as an addressable market, are projected to grow from $0.24B in 2021 to closer to $1B by 2024. This represents a potential compound annual growth rate of 62%. At the time of writing this, SiTime trades around 13.77 forward price to sales, and a P/E ratio over 128. SiTime is expensive on nearly every other metric, but I am willing to pay up for the future growth potential. Current leadership noted 2022 revenue growth is expected to grow by at least 35%. The most compelling part of the story for me is that SiTime has $559.46 million cash on hand and zero debts. I believe SiTime is a buy and will grow into valuation.

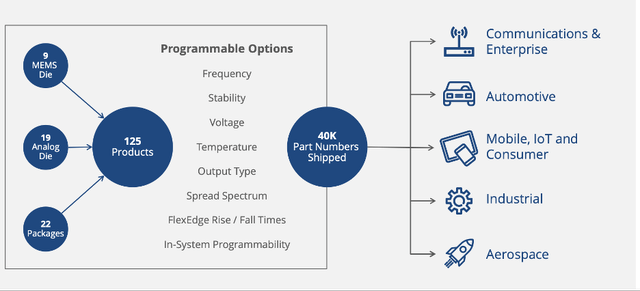

Product Chart (SiTime Investor Overview Presentation – Feb 2022)

Background

SiTime is a provider of silicon timing solutions, in which these solutions are set apart from competitors by performance, reliability, small size with low power consumption, and product programmability. SiTime is comprised of a fabless business model. This allows SiTime to focus on sales, design, marketing, and product scalability. SiTime sells its products through distributors and resellers. They then in turn sell to end customers. Although this is its primary method, it also sells products directly to end customers. SiTime’s product offerings include communications, enterprise, industrial, automotive, mobile, consumer, and aerospace consumer. The key building blocks of SiTime’s timing product solutions are Resonators, Oscillators, and Integrated Circuits. SiTime’s all-silicon products are based with three main focuses in mind: micro-electro-mechanical systems (MEMS), analog mixed signal design capabilities, and advanced system-level integration. MEMS is a process used to create tiny integrated systems and devices that combine mechanical and electrical components. This is what separates SiTime. One of the key points of SiTime is that the MEMS resonators are silicon based, while quartz suppliers utilize quartz crystal technologies.

XCalibur (SiTime Introduces XCalibur)

Innovation

SiTime is the creator of the mentioned silicon MEMS timing devices within the industry. Notably, they created two manufacturing processes called EpiSeal and TempFlat, which have allowed the sealed resonators to be placed in industry-standard low-cost packages. The innovation is continuing to advance. On February 1st of 2022, SiTime landed the new XCalibur active resonator. This product solves supply chain constraints by utilizing programmable semiconductors to deliver drop-in replacements for traditional non-MEMS quartz crystal resonators. In addition, the XCalibur product provides a higher performance, reliability and reduces development time in automotive, enterprise and industrial products applications by up to 8 weeks. Additional benefits from the new MEMS resonators extend into communications, networking, consumer electronics, mobile products as well.

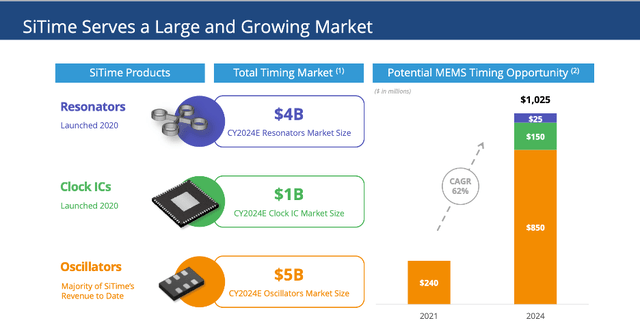

Total Addressable Market (SiTime Investor Overview Presentation – Feb 2022)

Opportunity

Analyst estimates, future forecasts, and SiTime estimates state the base case for the “timing market” is expected to grow into a $10.1 billion market by 2024. Dedalus Consulting’s Frequency Control Components Market Research, Competitive Analysis estimates oscillators to represent a $5B TAM and standalone resonators at nearly $4B TAM in the year 2024. Based on SiTime’s 10-K internal estimates, clock ICs currently stand near a $1B addressable market. MEMS timing devices, an addressable market, are now projected to grow from around $0.24B at the end of 2021 to close to $1B by 2024, representing a compound annual growth of 62%. If SiTime can keep carving away at the quartz products, I believe the TAM could improve more over the next three to five years as the increase in electric vehicles takes hold. Additionally, I believe continued innovation will keep SiTime relevant moving forward.

Risks

As a result of the COVID-19 pandemic, the company has experienced both delays and disruptions in the manufacturing processes, shipping processes, and even product sales. Additionally, over 2021, suppliers have also seen similar effects with increased supply chain issues and rising cost of goods. Moreover, the semiconductor industry-wide supply constraints have had adverse effects on certain manufacturers and foundries, one of which is Taiwan Semiconductor Manufacturing Company (TSM). With the pandemic slowly fading in the rear-view mirror, this risk could soon get back on track closing out 2022.

One of the biggest risks in my opinion is concentration risk. For the full year 2021, three companies accounted for more than 10% or more of the company’s revenue. SiTime typically sells its products to distributors and other resellers. They then make the sells to end customers. Of these, Pernas Electronics, QANTEK Technology Corporation, and Arrow Electronics make up the 3 previously mentioned. SiTime’s Form 10-K identifies that sell-through information provided by distributors shows that most of the total products sold to Pernas and QANTEK are then in turn incorporated into Apple (NASDAQ:AAPL) products.

For the full year ending 2021, research and development expenses increased by 65% or $20.5M. This large jump is primarily due to higher personnel costs due to increased headcount, which accounted for $10M. Stock-based compensation expense of $6.1 million came in higher in 2021 also. SiTime expenses also went towards a new product, which correlated to $6.9M which went towards supplies and consulting. SiTime has a research and development team which conducts the respective activities in the United States, the Netherlands, Japan, Taiwan, and Ukraine. Around 30% of the workforce is made up of research and development personnel. With current world affairs, this does pose a potential threat to research. Time will tell if SiTime plans to limit operations in Ukraine.

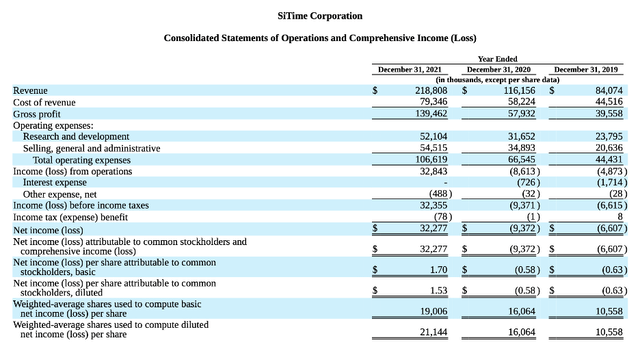

Financials

Q4 2021 net revenue increased by 88.1% coming in at $75.7M, up from $40.3M in the fourth quarter of 2020. This is nearly a double. Net revenue for the full year 2021 came in at $218.8M, an 88.4% increase from 2020 which came in at $116.2M. Q4 21 non-GAAP gross margins were $52.6M, representing 69.4% of revenue. Non-GAAP operating expenses were $23.0M, representing 30.4% of revenue. Non-GAAP net income was $29.2M, which resulted in $1.32 per share on a diluted basis. For full year 2021, non-GAAP gross margins were $141.2M, or 64.5% of revenue, while non-GAAP operating expenses were $76.1M, representing just over 34% of revenue. Non-GAAP income from operations was $65.2 million or 29.8% of revenue, and non-GAAP net income was $64.6M or $3.05 per share on a diluted basis.

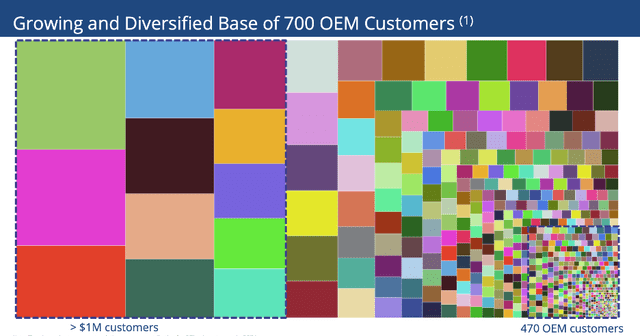

Since 2021, they have raised $406.6M through the two stock offerings. Current cash and cash equivalents total $559.5M with total assets amounting to $678.2M. SiTime has $45.7M in liabilities and zero debt. For a company under a $4B market cap, zero debt is one of the most exciting things for me to see personally. For 2022 outlook, the earnings call provided some insight. SiTime expects 2022 to be another great year. Advanced bookings have provided SiTime with visibility for 2022. Market trends that require precision timing are stronger than ever which includes 5G, datacenters, auto industry, medical, and aerospace. Revenue is currently expected to grow by at least 35% which, based on the previous 6 quarters, I feel is highly conservative guidance from management. Lastly, SiTime has 12 customers currently who spend over $1M. This excludes SiTime’s largest customers which had accounted for 20% of Q3 21 revenue.

Customer Chart (SiTime Investor Overview Presentation – Feb 2022)

Closing Thoughts

Continuation of strong market trends, advancements in current and new product rollouts, and conservative guidance all serve as reasons to buy in my opinion. 2022 should provide another year of net returns for investors. SiTime now has 12 customers who spend over $1M and has zero debt, making it well positioned going into FY2022. With oscillators outlook to be a $5B TAM and standalone resonators at nearly $4B TAM, by 2024, combined with MEMS timing devices growth expected to reach $1B from $.24B by 2024, SiTime is a great company to own. I am excited to see how the next two earnings reports go with another six months of performance. I rate SiTime as a Buy.

Be the first to comment