contrastaddict

SITE Centers’ (NYSE:SITC) share price has declined 28% year-to-date – a casualty of the dramatic 2022 REIT sell-off. While the share price has tanked, fundamentals remain robust as SITE continues to execute on maximizing the value of its curated portfolio of shopping centers featuring creditworthy national tenants (52% of rent comes from publicly traded tenants) in high income areas of the United States. As we sit today, SITE Centers trades at a significant discount to my estimate of NAV per share and represents an attractive entry point for long-term, conservative investors.

A Focused Shopping Center Portfolio

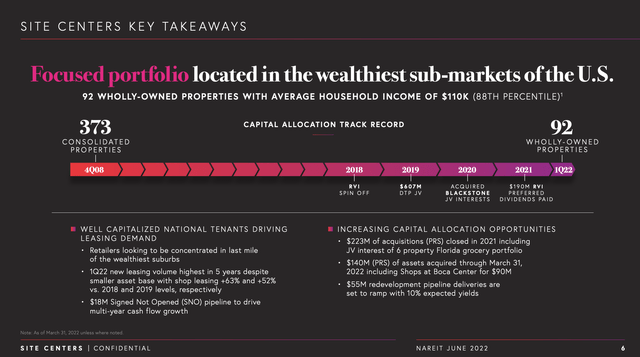

Portfolio Transformation (SITE Centers Investor Presentation)

Formerly known as DDR, through asset sales and spin-offs, SITE Centers dramatically shrunk its portfolio of shopping centers, reducing its footprint by ~75% (shown above). In doing so, the company has retained market leading shopping centers located in neighborhoods with average household income greater than $110k. It has shed secondary properties and those located in less affluent areas.

A Robust Leasing Environment for Shopping Centers

The environment for retail leasing remains very strong – after several years of where retailers closed more stores than they opened, 2021-22 has seen a reversal of this trend with a dramatic increase in openings. This is driving increases in occupancy (all major shopping center operators are now mid 90s occupied vs. low 90s pre-COVID) and driving increased rental spreads which will positively impact NOI going forward.

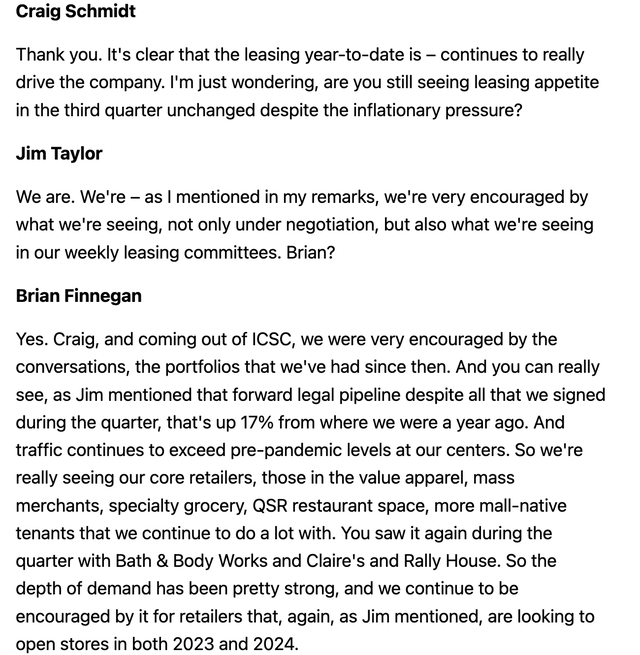

Here is some recent commentary from Brixmor (BRX) management:

Brixmor management 2Q22 commentary on leasing environment (Seeking Alpha Transcripts)

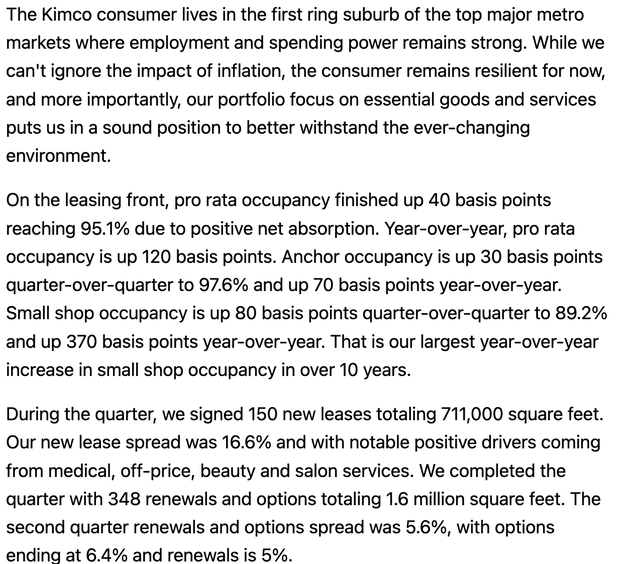

Similarly, on its 2Q conference call, Kimco (KIM) management noted strong demand for its space:

Kimco 2Q22 conference call leasing commentary (Seeking Alpha Transcripts )

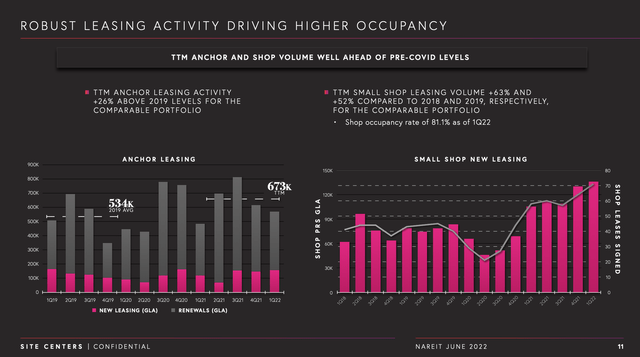

The strong leasing environment has shown up in increased occupancy numbers for SITE Centers. As we sit today, the overall portfolio is nearly 95% leased (up from 91-94% pre-pandemic) with small shop occupancy (small shops have the highest rent per square foot in shopping centers) at a multi-year high.

Leasing (SITE Centers Investor Presentation)

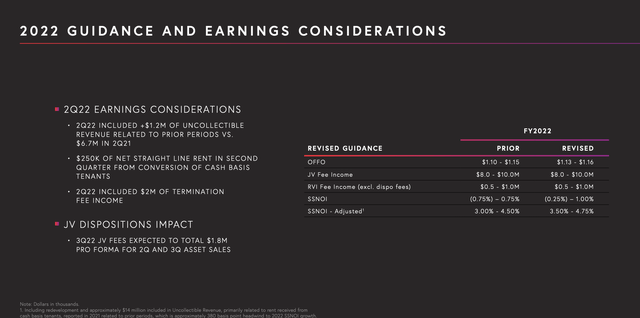

The strength of the leasing environment and high occupancy has allowed SITE Centers to increase rents and the company increased 2022 NOI growth guidance to 3.5-4.75% (midpoint increased 0.5% as shown below) upon releasing 2Q22 results.

Revised 2022 Guidance (SITE Centers Investor Presentation)

Valuation & Conclusion

Here is my valuation of SITE Centers:

|

Share Price |

11.5 |

A |

|

Shares o/s |

215 |

B |

|

Market Cap |

2472.5 |

C=A*B |

|

Debt |

1980 |

D |

|

Pref |

175 |

E |

|

Total Cap |

4627.5 |

F=C+D+E |

|

NOI |

400 |

G |

|

Implied Cap |

8.6% |

H=G/F |

Trading at an implied cap rate of 8.6% and P/FFO of just 10.2x, SITE Centers is about 50-80 basis points cheaper on a cap rate basis versus peers like Kimco and Brixmor which trade at mid 7s/low 8s cap rates. While Brixmor expects to see higher same store NOI growth in 2022 than SITE Centers, over the medium term Brixmor is expected to achieve similar (3-4%) same store NOI growth as SITE Centers. Ultimately I think the fair cap rate for these types of assets is somewhere around 6.5-7% which implies 40-50% upside in SITC shares.

I believe SITE Centers is overlooked by investors given its small size (sub $2.5 billion market cap) relative to Brixmor and Kimco which have market caps of $6 and $12 billion, respectively.

With a focused portfolio of shopping centers targeting high income consumers and trading at an 8-10% discount to peers, I believe SITE Centers is an attractive investment for long-term, conservative investors.

Risks

1. A sharper economic downturn could lead retailers to curb expansion plans. A severe downturn could lead to retailer bankruptcies and store closures.

2. Continued interest rate increases may lead to further near-term declines in REIT prices.

Be the first to comment