SusanneB/E+ via Getty Images

Introduction

After Sisecam Resources (NYSE:SIRE), formerly known as Ciner Resources, suspended their distributions during 2020 amidst the severe Covid-19-inspired downturn, they were reinstated at the end of 2021 but still saw risks remain from the Omicron Covid-19 variant threatening the economic recovery, as my previous article discussed. Thankfully, these fears largely subsided with only minimal economic impacts and thus subsequently saw them starting 2022 with record distributions that if continued would place their yield at a very high 12.74%. Despite being a welcome surprise for their unitholders, they appear unlikely to last, as discussed within this follow-up article that also reviews their subsequently released fourth quarter of 2021 results.

Executive Summary & Ratings

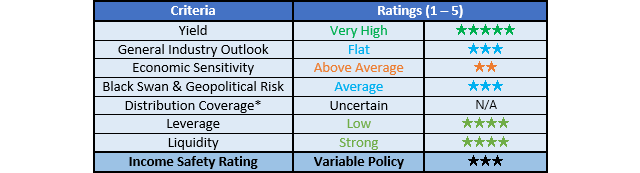

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

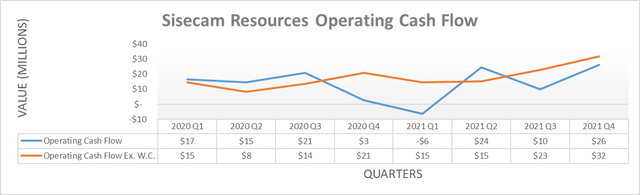

It was positive to see their cash flow performance continue improving throughout the fourth quarter of 2021 after seeing their recovery begin earlier in the year, which saw the year ending with operating cash flow of $54m and thus almost twice its earlier result of $28m during the first nine months. Whilst it was still essentially unchanged versus their previous result of $55m during 2020, this was due to temporary working capital movements resulting in a large $30m build. If removed along with their equivalent $2m build during 2020, it sees their underlying operating cash flow actually 47.37% higher year-on-year thanks to the fourth quarter of 2021 posting their best result in years, as the graph included below displays.

It can be seen that regardless of whether their working capital movements are included or excluded from their results, the fourth quarter of 2021 saw their highest quarterly operating cash flow since at least the start of 2020 when they began to battle the severe downturn. When looking ahead, the outlook appears favorable for 2022 as the global economy roars back to life following trillions of dollars of fiscal stimulus in the preceding years and the release of most lockdowns now that the Omicron Covid-19 variant proved less problematic than originally thought.

Even though soda ash prices have moderated back from their rapid rise during late 2021, they have still started trading at far higher year-on-year during early 2022 and should continue given its uses in a wide array of economically-sensitive industries, such as construction, automotive, and energy to name a few, which stand to benefit as the global economy runs hot. Although there are no free lunches in economics, and sadly, since the economy can give, it can also take away once again, hence the pain they felt during 2020 may return in 2023 if the economy slows, which is not out of the question given the ominous warning from an inverted yield curve. There are no perfect ways to predict future economic conditions but the current high inflation and prospects for upwards of seven rate hikes during 2022 certainly support an outlook for a slowdown during 2023, if not even a downturn.

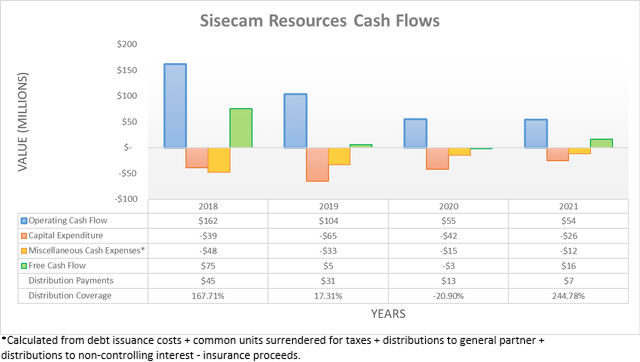

Regardless of this variable, the costs to sustain their now record distributions make them unlikely to grow materially higher in the short term nor be sustained into the medium term. Given their latest outstanding unit count is 19,788,208 or 20,187,208 once including their general partner units, it means that funding a quarterly distribution of $0.65 per unit would cost $52.5m per annum. Although due to the non-controlling interests relating to the 49% ownership stake in their Ciner Wyoming operations held by Natural Resource Partners (NRP), the true cost levied upon their operating cash flow should be circa $105m as they too should receive comparable distributions. When considering their average capital expenditure of $43m across 2018-2021, they would likely need to generate around $150m to remain cash flow neutral and thus provide adequate distribution coverage.

Whether they can reach this point remains to be seen, although even their strong underlying operating cash flow of $32m during the fourth quarter of 2021 only annualizes to $128m, thereby making it seem rather unlikely for these distributions to be sustained well into the future. At least, they should not hurt their financial position with management appearing to take a variable approach to their distributions, as per the quote included below.

“Further, due to market tightness that persisted through the end of the fourth quarter, we are optimistic around supportive pricing levels and free cash flow in 2022; however, our Board of Directors will continue to evaluate distributable cash flow coverage and distributions on a quarter-by-quarter basis.”

-Sisecam Resources Q4 2021 8-K.

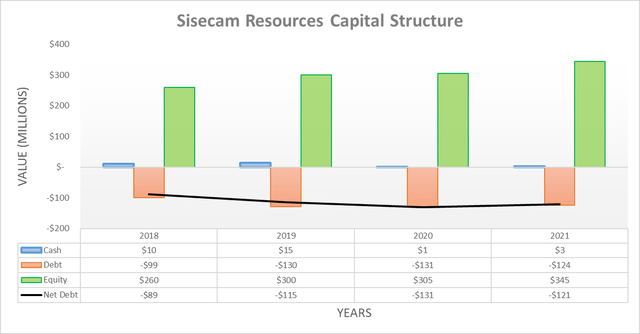

Despite restarting distribution payments and seeing their working capital build, their net debt still edged slightly lower during the fourth quarter of 2021 to end the year at $121m and thus a slight $6m lower than when conducting the previous analysis following the third quarter. Whilst it remains to be seen where 2022 leads, at least if nothing else, the prospects to see their $30m working capital build makes lower net debt likely even if they continue declaring relatively massive distributions.

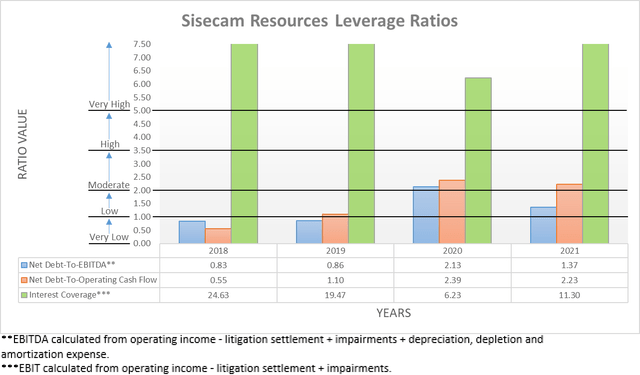

Quite unsurprisingly, the strong end to 2021 saw their leverage decrease with their net debt-to-EBITDA now down to only 1.37, which is the lowest point since the end of 2019 before the severe Covid-19-inspired downturn and resides within the low territory of between 1.01 and 2.00. Whilst their net debt-to-operating cash flow of 2.23 sits above this range and thus into the moderate territory, this obviously stems from their working capital build that if removed, would have seen a result of only 1.43 and thus within the low territory, thereby making for a healthy financial position when combined with their strong liquidity.

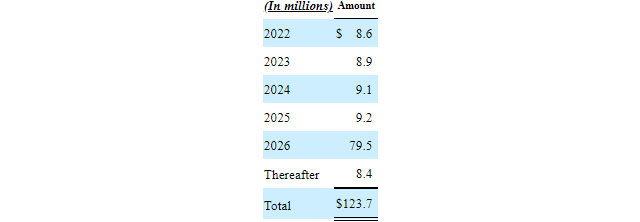

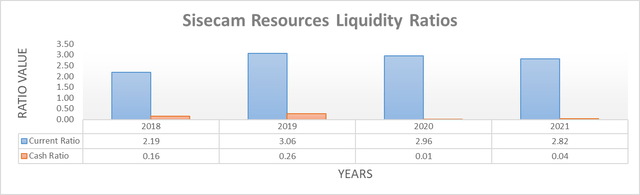

Despite their respective current and cash ratios dipping to 2.82 and 0.04 versus their respective results of 3.42 and 0.05 when conducting the previous analysis following the third quarter of 2021, thankfully, they easily remain strong. A larger cash balance than their mere $3m would have been preferable but at least they retain a further $155m available within their credit facility that itself was refinanced during 2021 to extend its maturity from 2022 until 2026, thereby leaving no material maturities until 2026, as the table included below displays.

Sisecam Resources 2021 10-K

Conclusion

Whilst their healthy financial position means that they can return the entirety of their free cash flow to their unitholders risk-free, it does not solve the associated issue with their distributions to non-controlling interests nor the inherent economic sensitivity of their financial performance. Even though this should see further strong results in 2022 after a strong end to 2021, the prospects for an economic slowdown during 2023 make for a less positive overall outlook, and thus as a result, I only believe that maintaining my hold rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Sisecam Resources’ SEC Filings, all calculated figures were performed by the author.

Be the first to comment