Drazen_

Investment Thesis

Simpson Manufacturing Co., Inc. (NYSE:SSD) is a leading wood and concrete construction product manufacturer headquartered in Pleasanton, California. In this thesis, I will primarily analyze SSD’s Q2 2022 results and its future growth prospects. I will also analyze the key risk faced by the company. The company has shown significant growth in revenue and income parameters, and I believe it will maintain this growth trajectory in the future. I assign a buy rating for SSD after taking into consideration all these factors.

Company Overview

Simpson Manufacturing designs and manufactures wood and concrete construction products. It is one of the leading manufacturers of wood construction products in the United States. The company’s concrete products include adhesives, chemicals, mechanical anchors, carbide drill bits, powder-actuated tools, and fiber reinforced materials, which are utilized in concrete, masonry, and steel construction. Its wood construction products include fastening systems, connectors, truss plates, fasteners, and pre-fabricated lateral resistive systems, which are utilized in light-frame construction. SSD also provides engineering services in support of some of its products. The company uses several channels for sales and product distribution, which include distributors, home centers, and dealers. The company primarily operates in three regions North America, Europe, and the Asia Pacific. The North American region contributes majority of the revenue at 77% of the total revenue, followed by Europe at 22.5% and the Asia Pacific at 0.5%.

Q2 2022 Results

SSD posted strong Q2 2022 results with improvement across all segments. The company beat the market estimates both in terms of EPS and revenue. It beat the EPS estimates by 15% and revenue estimates by 2.5%. The company has shown significant improvement on all parameters YOY basis.

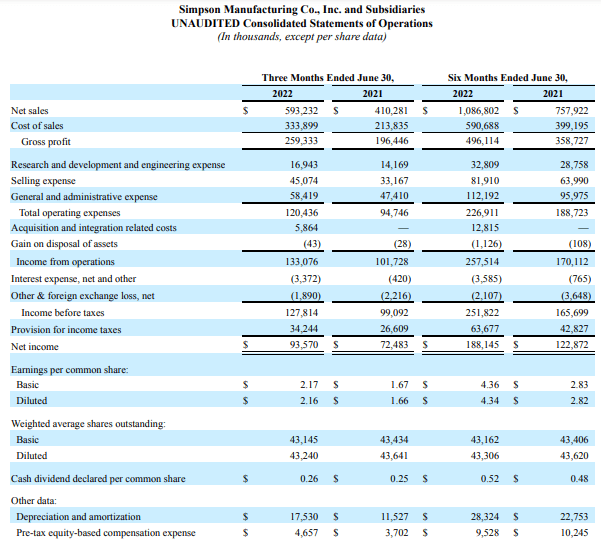

SEC:10Q SSD

SSD reported net sales of $456.4 million from the North American region, a 30.2% increase compared to Q2 2021 net sales of $350.6 million. As per my analysis, the primary revenue driver for the North American region was the hike in the average product price. The net sales from the European region were reported at $133.2 million, a jump of 136.1% compared to $56.4 million in the corresponding quarter last year.

I believe the acquisition of ETANCO was the major revenue driver in the European region, with a contribution of $80.3 million to net sales. The total net sales were reported at $593.2 million, a significant 44.6% improvement from $410.3 million in the same quarter last year. The company gross profit of $259.3 million compared to $196.4 million in the year-ago period, an effective 32% increase. However, SSD witnessed a decline in the gross margin from 47.9% to 43.7%, primarily due to increased cost of sales given the higher raw material costs. The company reported a net income of $93.5 million, a 29% increase from $72.5 million in Q2 2021. The diluted EPS increased 30% to $2.16 compared to $1.66 in Q2 2021. SSD announced a dividend per share of $0.26 and a share repurchase of $25 million in Q2 2022.

Karen Colonias, Chief Executive Officer of Simpson Manufacturing, stated,

We made progress on our key growth initiatives during the second quarter within each of our five end use markets including Residential, Commercial, OEM, National Retail and Building Technology, which gives us confidence we can continue our above market growth relative to U.S. housing starts in fiscal 2022 and beyond. In conjunction with the integration of ETANCO, we identified facility expansions in the U.S. that will improve our overall service, production efficiencies and safety in the workplace, as well as reduce our reliance on certain outsourced finished goods and component products, and ensure we have ample capacity to meet our customers’ needs. Investments in these expansions have already started this year and will continue into 2024.

Overall, the company posted stellar quarterly results with a solid future outlook. However, I believe the company can beat its future guidance given its growth trajectory and the improvement across segments and geographies. I estimate the FY22 EPS at $8.1 against the market estimates of $7.2. I believe SSD is a great investment buying opportunity at the current price level, given its growth potential and recent performance.

Risk Factor

Rising Raw Material Prices: The company’s complete product portfolio depends on steel, and SSD has no control over steel prices. The steel prices are cyclical and influenced by various factors such as import tariffs, demand, supply, currency exchange, etc. The company’s products are also dependent on the price of energy. The increased cost of energy and raw materials could have a materially negative impact on a company’s financial health and operational outcomes. The company has managed to mitigate this risk by passing on this cost to the customer by product price hikes, but it is important for the company to address this issue for better financial performance.

Valuation and Quant Rating

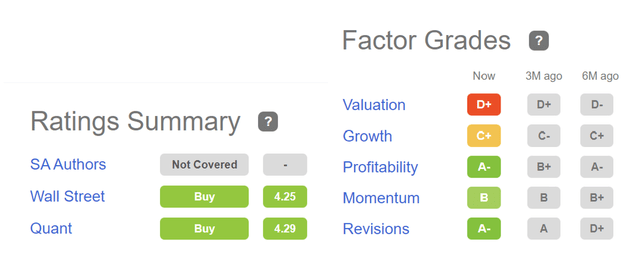

According to the quant ratings, the company has a buy recommendation. The company has A- in profitability, B in momentum, and A- in revisions. The company has D+ in valuation and C+ in growth, and I believe both the ratings are not a correct representation of the current financial condition and growth prospect and the grades are expected improve in coming quarters.

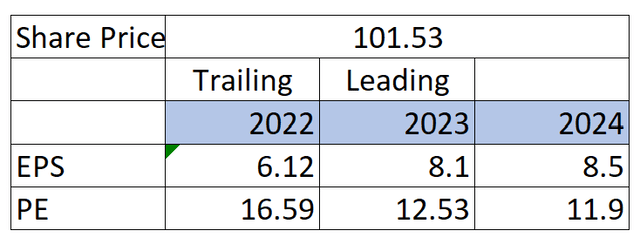

The company currently trades at $101.53 with a market capitalization of $4.38 billion. It is currently trading at a P/E multiple of 13.29x. I think the company’s updated outlook is conservative, and the FY22 EPS could be $8.1, which gives the leading P/E multiple of 12.53x. I believe the company will trade at higher multiples due to the continuous outperforming of the estimates and strongly growing financials, which tell us that the company is undervalued. I estimate the company to trade at a P/E multiple of 17x, which gives the target price of $137.7, representing a 35.7% upside from the current share price level.

Seeking Alpha

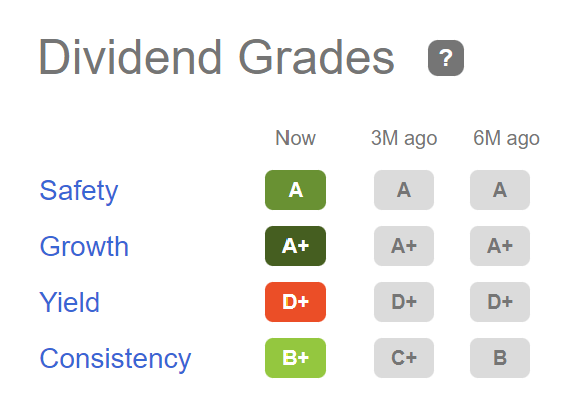

The company also has a dividend yield of 1.02% at the current share price. The dividend payment can be considered safe and growing with the dividend grade of A in safety and growth. Currently, the company has a low dividend yield. That’s why according to dividend grade, the yield has D+, but the dividend is growing consistently.

Conclusion

The company has delivered a strong quarterly result and has beaten the EPS expectations of the market by 15%. After considering the integration of ETANCO and the strong financials, the company turns out as trading below its fair valuation. The company is currently trading at a leading P/E multiple of 12.5x, with a safe and growing dividend yield. After considering all these factors, I assign a buy rating for SSD.

Be the first to comment